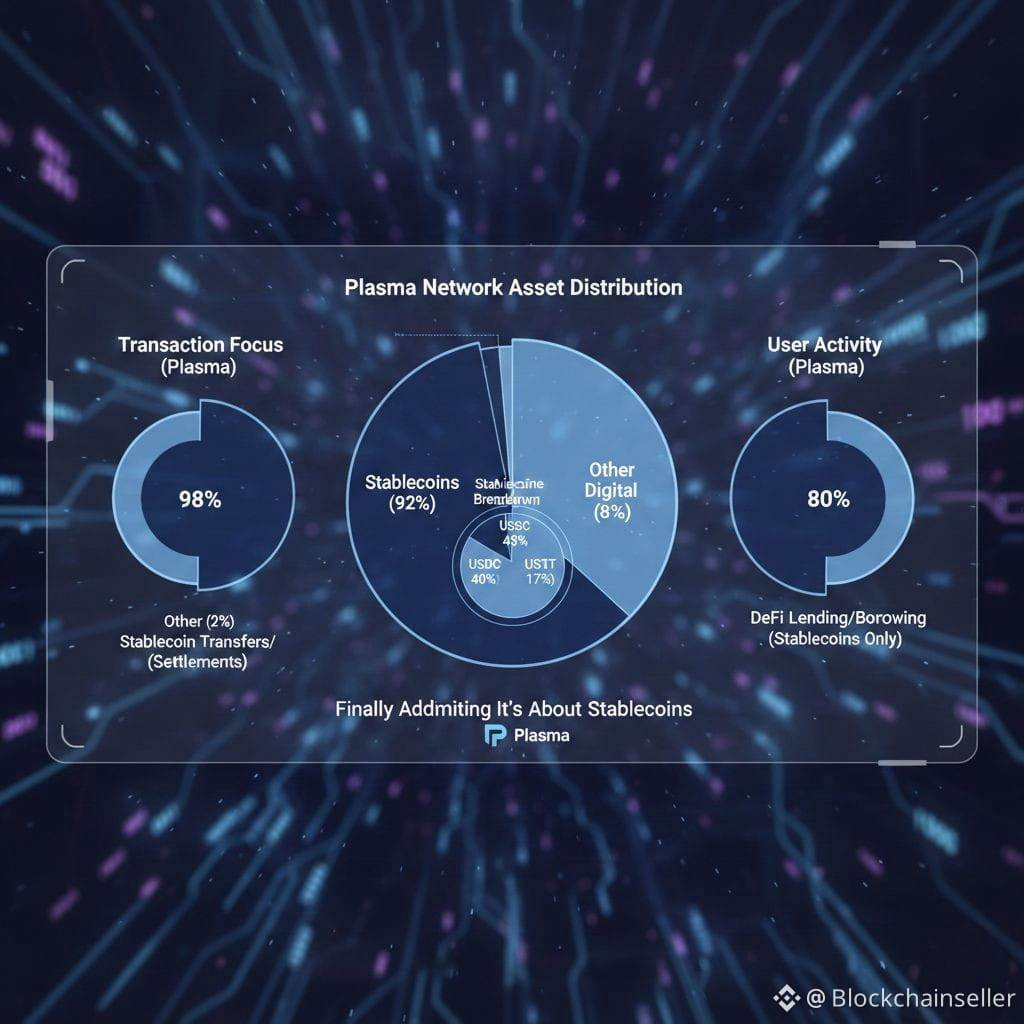

I have been around crypto long enough to be deeply suspicious of anything that calls itself a Layer 1 because most of the time that phrase really means we could not fit our idea anywhere else so we spun up a chain and hoped vibes would carry us Plasma walks right up to that trap looks into it and then does something mildly refreshing it stops pretending it is here to reinvent money and just focuses on how people already use it Dollars on chain mostly stablecoins That is the whole obsession and honestly about time

Most blockchains still act like their native token is the star of the show Fees paid in it security justified by it governance warped around it In the real world nobody wants to think about some volatile asset just to send twenty bucks to a cousin or settle an invoice They want the thing to move quickly cheaply and without a lecture Plasma whole pitch starts there not at ideology but at usage which already puts it ahead of half the ecosystem that is still shadowboxing with theory

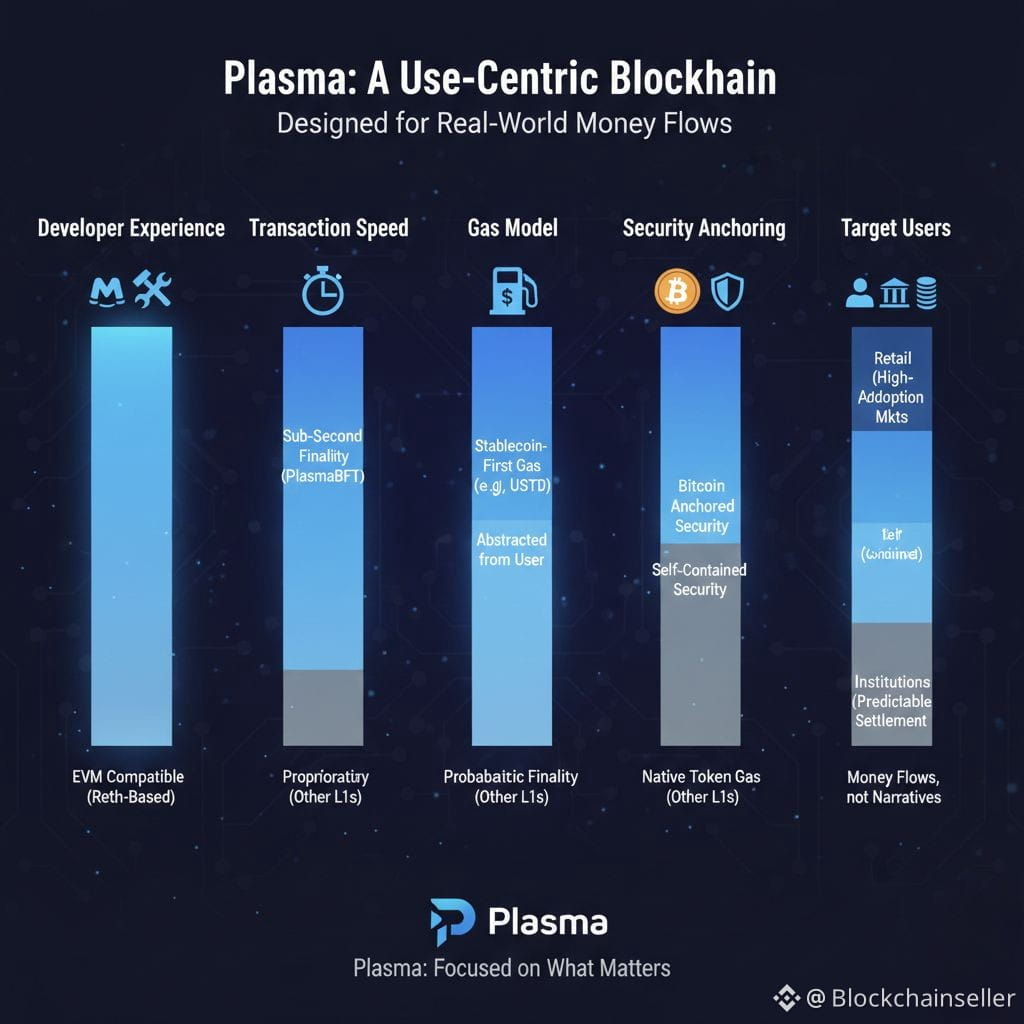

So yes it is fully EVM compatible Reth based That line exists mostly so developers do not panic People say new chain and devs hear rewrite everything debug for months and explain to your boss why timelines slipped Plasma does not try to be clever here Same tools same mental model same contracts And that is fine Boring is good when you are dealing with money Excitement is for marketing decks not settlement systems

Where Plasma actually starts to show its teeth is finality Sub second finality specifically using its own PlasmaBFT consensus Payments do not care about probabilistic assurances Nobody paying for groceries wants to hear it is basically confirmed unless something weird happens Weird things always happen Sub second finality is not a flex it is table stakes if you want to touch real commerce And yes BFT systems come with coordination assumptions and trade offs and no that does not magically disappear because the whitepaper says so But at least the design goal matches the use case instead of dancing around it

Then there is the stablecoin first gas model which is one of those ideas that seems obvious only after someone actually builds it If all anyone wants to move is USDT why force them to juggle another asset just to pay fees Gasless USDT transfers sound almost suspiciously nice because someone always pays in the end Validators do not run on goodwill The interesting part is not that fees disappear it is how they are abstracted away from users who should not have to care That is real product thinking even if it opens a whole new set of questions about incentives and sustainability that will absolutely matter later

And then of course Bitcoin enters the room Bitcoin anchored security neutrality censorship resistance I have heard these words enough times to instinctively brace myself Bitcoin is not a magic shield you tape onto your chain and suddenly become immune to politics or pressure Anchoring is not inheriting Still using Bitcoin as a settlement anchor does signal something important Plasma is borrowing credibility from the most stubborn least flexible social consensus in crypto Bitcoin does not change easily does not care about your roadmap and does not bend for app specific drama If your goal is neutrality that is not the worst place to anchor your guarantees even if it is not the silver bullet people will inevitably claim it is

What really frames Plasma though is who it is for Retail users in places where stablecoins are not a speculative asset but a survival tool High adoption markets where people already trust USDT more than local banks Institutions that do not want narratives or communities they want predictable settlement clean accounting and something that will not implode during compliance review Plasma is not chasing everyone It is chasing money flows That focus is rare and also dangerous because it leaves very little room to hide if things break

And things always break Stablecoins are centralized whether anyone likes it or not Issuers freeze addresses Regulators apply pressure Validators have jurisdictions You can design the most elegant system in the world and still run face first into off chain reality Plasma does not erase those problems It builds around them which is more honest but honesty does not make them go away The tension between censorship resistance and issuer control is not a bug here it is the core unresolved problem and anyone pretending otherwise is either new or lying

Still I cannot help but respect a chain that stops pretending it is building a new financial universe and just tries to make the existing one less stupid on chain Plasma feels less like a revolution and more like a begrudging acceptance of how money actually moves in 2026 which might be why it makes so many maximalists uncomfortable And if this ends up being another well engineered system that works beautifully right up until the first serious stress test well that would not be new either just familiar in a way crypto never seems to learn from