The crypto market is back in the red after a brief bounce, dropping 2.3% in the past 24 hours to a total market cap of $2.66 trillion. Selling pressure spread across the board, with 64 of the top 100 coins posting losses.

📉 Market Snapshot

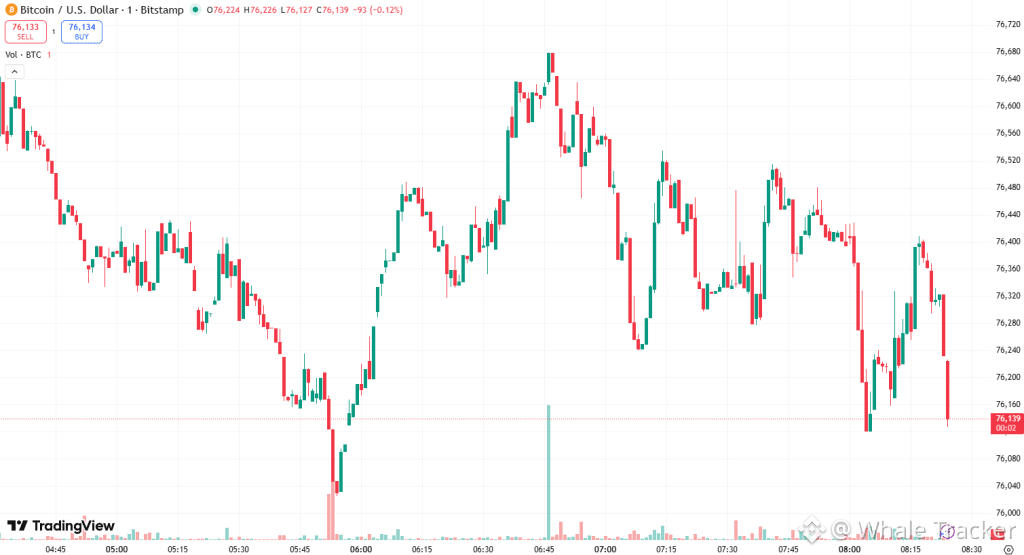

Bitcoin (BTC): down 2.9% to ~$76,400

Ethereum (ETH): down 1.7% to ~$2,280

Solana (SOL): hit hardest among majors, falling 6.5%

Only 3 of the top 10 coins managed to stay green

Trading volume remains elevated at $160 billion, showing that this move isn’t happening quietly.

🧠 What’s Really Going On?

According to YouHodler analyst Tony Severino, markets aren’t choosing a direction yet — they’re compressing.

Bitcoin is trading in one of the tightest volatility ranges in its history, with monthly Bollinger Bands squeezed more than ever before. Historically, this kind of setup doesn’t last — and when it breaks, the move tends to be decisive.

⚠️ Rising Fear, Fragile Sentiment

Crypto Fear & Greed Index dropped to 14, the lowest level since November 2025

US spot BTC ETFs saw $272M in outflows, while ETH ETFs quietly pulled in $14M

Speculation flared after GameStop moved 4,710 BTC to an exchange (no confirmed sale — but enough to shake nerves)

Meanwhile, Michael Burry warned that continued BTC weakness could trigger up to $1B in gold and silver liquidations, highlighting growing cross-market stress.

🔍 Altcoins Lag, Rotation Begins

Most altcoins remain range-bound with declining volatility — a sign of caution, not panic. That said, early rotation is showing up in higher-quality Layer 1s, Layer 2s, and infrastructure tokens, quietly gaining relative strength.

📌 Key Levels to Watch

BTC support: $73,000 → $71,200 → $70,000

ETH support: $2,100 → $2,030 → $1,950

A failure to hold current levels could open the door to another leg down.

🧭 Bottom Line

This isn’t a breakout — yet. It’s a pressure cooker.

For now, the market is rewarding patience, discipline, and risk management, not bold predictions. Volatility is being compressed, not erased — and when it finally expands, history suggests it won’t be subtle.