1️⃣ Macro Pressure & Liquidity Shift

Bitcoin’s drop wasn’t random. It came during a period of:

Aggressive profit-taking in gold and silver

Liquidity rotation from crypto into metals

Broad weakness across U.S. equity markets

Rising geopolitical tension (U.S. – Iran uncertainty)

Tariff and political headlines triggering risk-off sentiment

When global markets shift to defensive assets, crypto usually reacts first and faster.

2️⃣ Liquidity Drought

This move was amplified by:

Weak ETF inflows

Reduced institutional demand

Miner distribution pressure

Low spot demand during breakdown

Bitcoin doesn’t usually collapse this fast unless liquidity is thin.

This was a liquidity-driven flush, not just technical weakness.

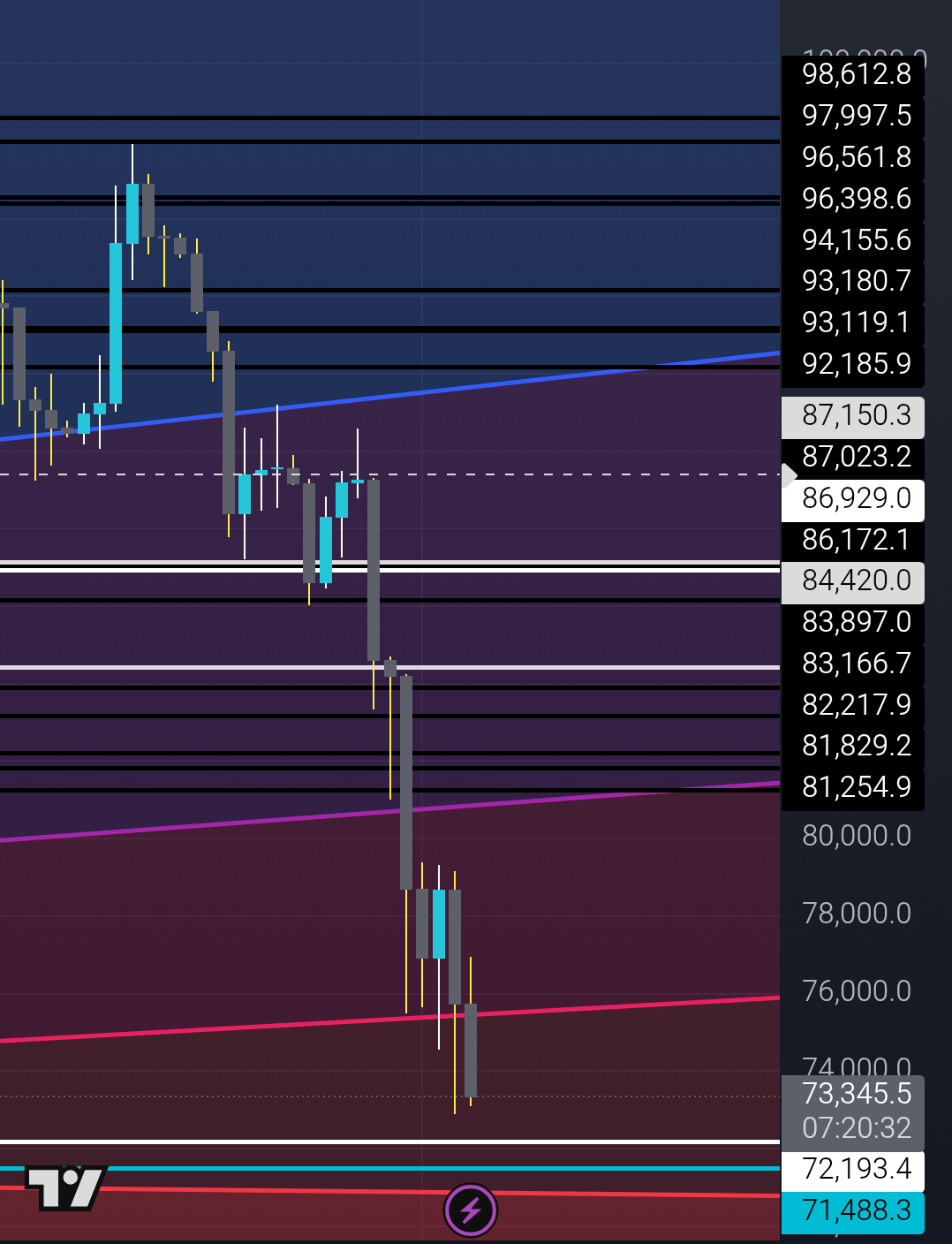

3️⃣ Market Structure Breakdown

The range between 85,000 – 92,000 was a compression zone.

Once that structure failed:

90,000 (major breakout level) failed

88,000–90,000 rejection confirmed weakness

87,000 lost multiple times

84,000 → 80,000 cascade followed

Repeated retests weaken support.

The final break below 87K triggered acceleration toward 72K.

Technical Structure Analysis

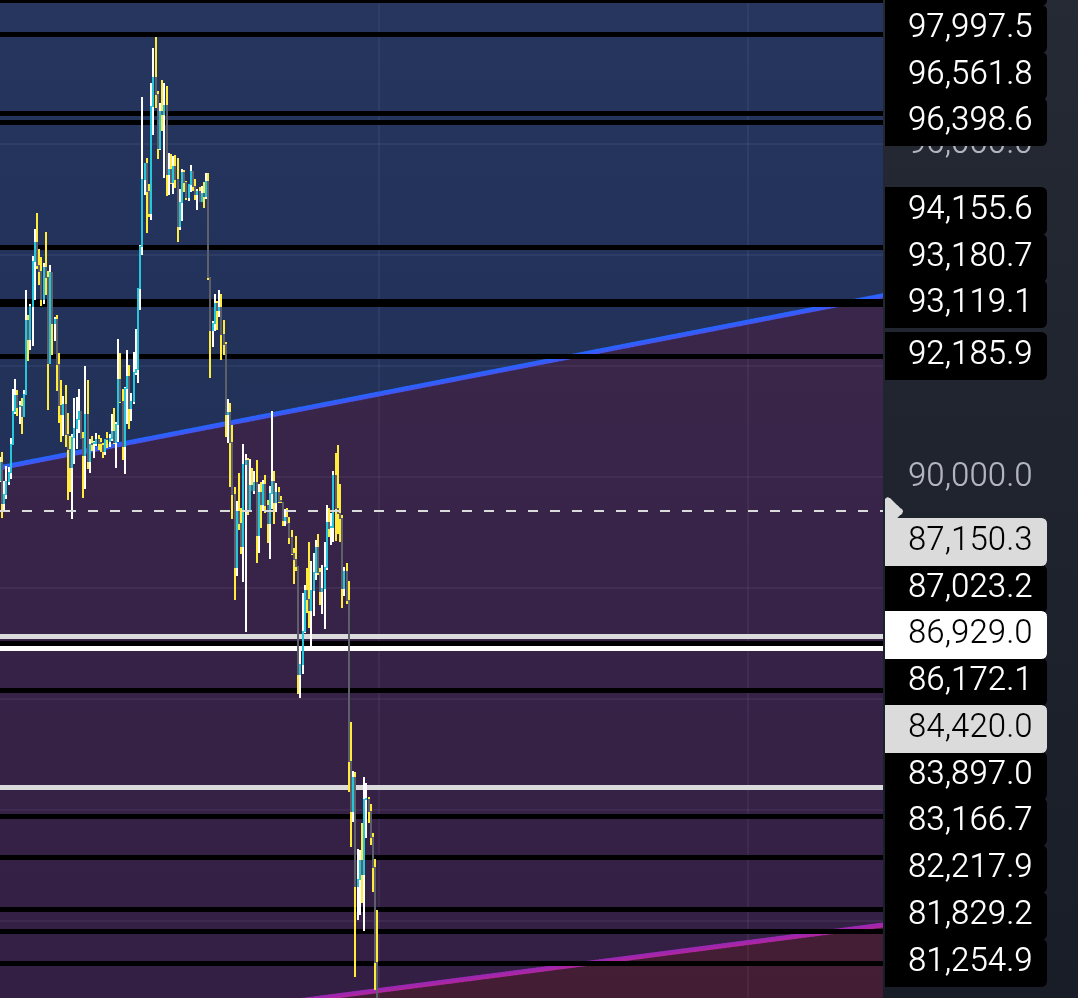

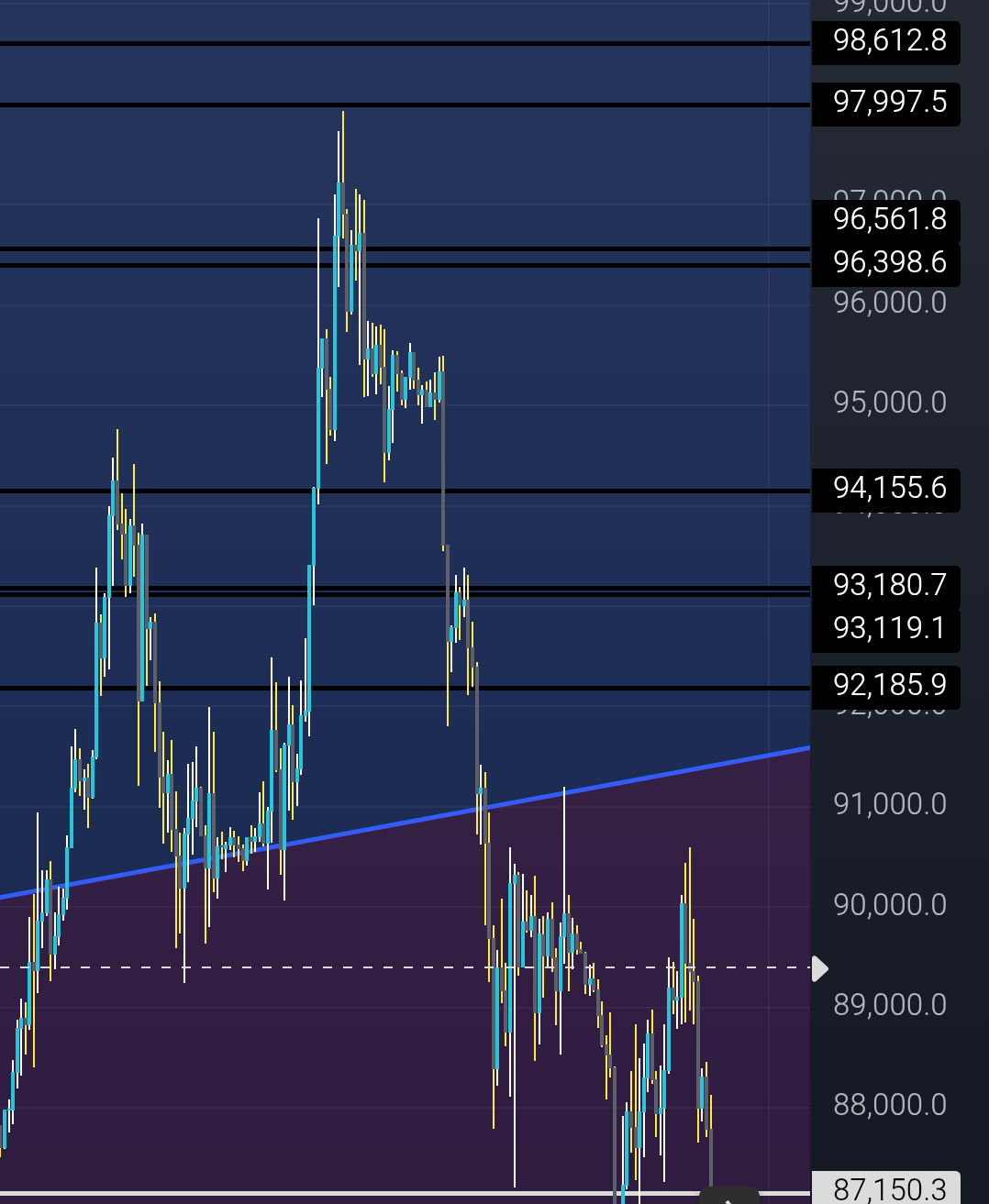

🔹 Zone 1: 97,800 – 90,000

97,000–98,200 → Failed breakout zone

96,000–94,000 → Neutral transition range

94,100 / 93,200 / 92,250 → High volatility cluster

91,500 → First reaction support

90,000 → Psychological & structural level

Failure at 90K shifted control to sellers.

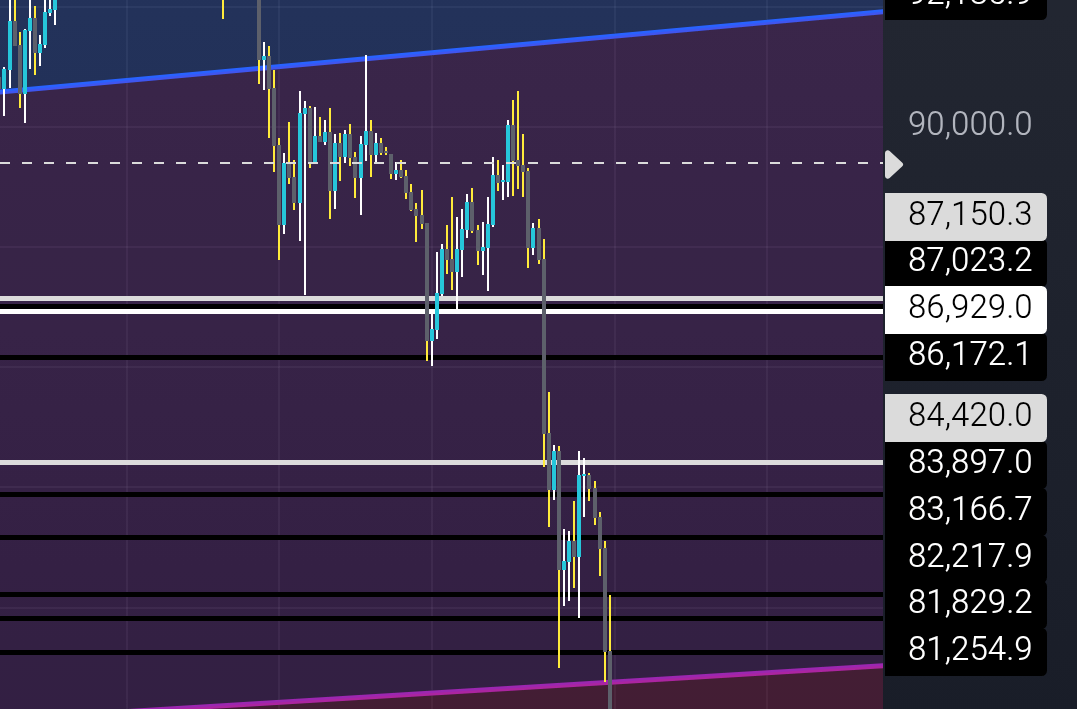

🔹 Zone 2: 90,000 – 80,000

88,000–90,000 → Major rejection band

87,000 → Multiple rebounds (5–6 times)

Final breakdown → 84,000

80,000 → Temporary bounce

Fourth retest failure → Acceleration below 80K

Repeated support tests = structural exhaustion.

🔹 Zone 3: 74,400 – 70,000

This zone is structurally interesting because:

It was previously a base for the breakout toward 100K

Liquidity pockets remain thin

No strong trend lines currently visible

Violent drop increases probability of relief bounce

Potential reaction range: 70,000 – 79,000

Current Market Psychology

Extreme fear phase

Altcoins heavily compressed

ETH near 2,000

SOL below 100

XRP below 1.6

When majors compress this hard, market enters high-volatility expansion phase.

Forward Outlook

Two scenarios:

Scenario A – Relief Bounce

If liquidity returns and macro stabilizes:

80K reclaim

85K retest

90K possible again

Scenario B – Continued Risk-Off

If geopolitical or macro stress increases:

70K retest

Temporary liquidity sweep

Deeper consolidation before recovery

Final

This wasn’t just a technical drop.

It was a liquidity-driven macro reaction amplified by structural weakness.

However, sharp drops often create sharp rebounds.

The next move depends heavily on liquidity return and macro stability.