Most blockchain founders come from engineering backgrounds where technical elegance drives decision-making and probabilistic thinking remains abstract concept discussed in whitepapers. Paul Faecks arrived at building Plasma through completely different path where years sitting at poker tables taught him visceral understanding of making optimal decisions under uncertainty, accepting that correct choice doesn’t guarantee favorable outcome, and managing psychological pressure when enormous stakes ride on single moments. This unusual foundation shaped project that rejected conventional wisdom about what blockchain should be, instead making singular focused bet that stablecoins deserve infrastructure purpose-built exclusively for their needs rather than adapting to general-purpose chains designed before anyone understood how digital dollars would actually get used.

The February afternoon in London when Plasma opened deposits for public token sale should have felt triumphant. Instead, it became one of most terrifying experiences of Faecks’ career. At one fifty-eight PM he stood watching countdown timer approach zero while running through every catastrophic scenario his paranoid mind could conjure. The frontend could get exploited. The smart contracts might contain undiscovered vulnerabilities. The infrastructure could collapse under unexpected load. Ninety seconds after deposits opened, one billion dollars had poured into system. What should have been celebration became moment of existential dread where single error could destroy everything they built and betray trust of thousands of people who believed in vision.

The Institutional Infrastructure Detour Teaching Critical Lessons

The journey to Plasma began years earlier when Faecks co-founded Alloy in August twenty twenty-one as B2B crypto infrastructure platform helping institutions access digital asset operations. The experience provided front-row seat to endless frustrations of bringing crypto into traditional finance where compliance procedures stretched for months, procurement decisions moved through byzantine approval chains, and corporate politics determined outcomes more than technical merit. Every integration required navigating lawyers, risk committees, and executives who fundamentally didn’t understand why blockchain mattered but needed convince themselves they weren’t exposing organization to unacceptable risks.

The Alloy acquisition that eventually came felt fine but not incredible in Faecks’ assessment. The company solved real problems for institutions wanting crypto exposure without building everything themselves, but something essential was missing. The compromises required to work within traditional finance constraints meant never building pure vision of what crypto could be. Every feature got watered down by regulatory concerns. Every timeline stretched to accommodate institutional decision-making processes. The bureaucracy that made institutional clients comfortable simultaneously killed innovation velocity that made crypto exciting in first place.

The poker background influenced how Faecks processed this experience. Professional players learn distinguishing between making correct decision and achieving desired outcome because randomness ensures even optimal plays sometimes fail. Alloy represented correct decision for that moment in his career, providing stability, learning opportunities, and eventually financial exit. But poker also teaches recognizing when game conditions change enough that previously correct strategy becomes suboptimal. The institutional crypto infrastructure space had become crowded with competitors all solving similar problems for same clients using comparable approaches. Winning required either accepting smaller slice of established pie or finding entirely different game to play.

The Singular Conviction Around Stablecoin-Native Infrastructure

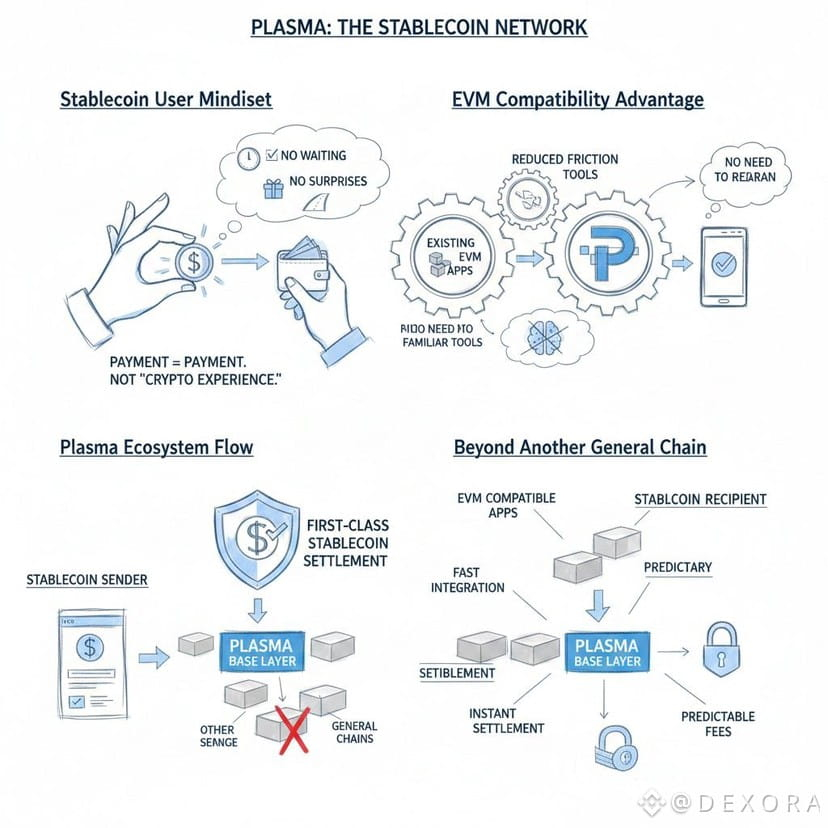

The insight that became Plasma emerged from observing how stablecoins actually got used versus how blockchains treated them. Every major chain from Ethereum to Solana to Tron designed architecture for general purposes, then stablecoins adapted to constraints of systems never built with their specific needs in mind. They’re treated as second-class citizens in Faecks’ words, forced to pay transaction fees in native tokens users don’t want, navigate congestion from unrelated applications, and accept performance limitations optimized for different use cases entirely. This made as much sense as requiring every car on highway to carry bicycle in trunk because road was originally designed for mixed traffic.

The conviction crystalized around USDT specifically rather than stablecoins generally. Tether dominates nearly seventy percent of stablecoin market with supply exceeding one hundred twenty billion dollars, yet most blockchain developers treated all stablecoins as interchangeable rather than recognizing market had clearly chosen winner. Building infrastructure specifically optimized for USDT meant aligning with what users actually wanted rather than what developers thought they should want. This focus contradicted prevailing wisdom that successful blockchain must remain neutral substrate for infinite applications, but poker teaches making contrarian bets when probability calculation suggests everyone else is wrong.

The decision to build as Bitcoin sidechain rather than Layer Two on Ethereum or independent chain reflected similar willingness to prioritize specific conviction over flexibility. Faecks believed Bitcoin’s fundamental protocol won’t change, making it stable security layer that won’t introduce breaking changes requiring constant adaptation. The team explicitly rejected enthusiasm for experiments bringing native smart contract functionality to Bitcoin through opcodes or covenants, instead building on assumption Bitcoin Core remains essentially unchanged while enabling powerful USD-denominated payment flows that settle back onto Bitcoin. This created architecture optimized for single purpose rather than attempting everything for everyone.

The Strategic Funding Journey Building Institutional Credibility

The initial three point five million dollar seed round in October twenty twenty-four brought together unusual combination of crypto natives and traditional finance heavyweights. Bitfinex led investment providing both capital and strategic alignment with Tether ecosystem through sister company relationship. Paolo Ardoino joined both as investor and advisor bringing perspective from running largest stablecoin issuer in world. The inclusion of prominent crypto traders Cobie and Zaheer Ebtikar from Split Capital added operational expertise from people who actually moved large volumes daily and understood friction points intimately.

The February twenty twenty-five Series A round totaling twenty-four million dollars marked major expansion in institutional support. Framework Ventures co-led alongside Bitfinex with participation from established players including DRW Cumberland, Bybit, Flow Traders, IMC, and Nomura. These weren’t speculative crypto investors chasing next narrative but serious market makers and trading firms whose business models depended on efficient infrastructure for moving assets. Their participation validated thesis that stablecoin-specific blockchain addressed genuine market need rather than solving theoretical problem.

The addition of Peter Thiel through Founders Fund investment carried significance beyond capital amount. Thiel co-founded PayPal where he gained firsthand understanding of how payment networks actually work, what drives adoption, and which technical details matter versus which are merely impressive engineering. His willingness to back Plasma suggested someone with deep payments expertise believed specialized stablecoin infrastructure represented genuine innovation rather than unnecessary complexity. If it becomes that Thiel’s pattern recognition around financial infrastructure proves correct again, Plasma positioning could mirror how PayPal captured payment flows by making transactions dramatically easier than alternatives.

The Team Assembly Reflecting Diverse Expertise Requirements

Building stablecoin infrastructure required different skill combination than typical blockchain project. Pure protocol engineers could design consensus mechanisms and optimize throughput, but understanding how payments actually work required people with operational experience moving real money through real systems. The recruitment of Adam Jacobs as Global Head of Payments brought perspective from roles at FTX and Canadian fintech firm Nuvei where he dealt with complexities of international money movement, regulatory compliance across jurisdictions, and merchant relationships that determine adoption regardless of technical capabilities.

The addition of Murat Fırat as head of product reflected similar emphasis on practical experience. Fırat founded BiLira, Turkish crypto exchange and Lira-pegged stablecoin issuer, giving him direct knowledge of running stablecoin operations in emerging market where currency instability drives genuine user need for dollar access. This wasn’t theoretical understanding from studying market dynamics but lived experience building products for people who genuinely needed stablecoins for wealth preservation rather than speculation. The perspective from operating in Turkey where local banking system creates friction for dollar access informed product decisions impossible to make from purely Western vantage point.

The hiring of Jacob Wittman as general counsel recognized that regulatory navigation would determine success as much as technical excellence. We’re seeing increasingly that blockchain projects fail not because technology doesn’t work but because they can’t operate legally in jurisdictions where users actually exist. Having legal expertise integrated from beginning rather than retrofitted after problems emerge allows building compliance into architecture instead of bolting it on afterward. This reflected learning from Alloy experience where institutional clients demanded legal clarity before they would trust any infrastructure regardless of how technically impressive it appeared.

The Mainnet Launch Exceeding Expectations While Creating New Pressures

The September twenty-fifth twenty twenty-five mainnet beta launch with over two billion dollars in initial liquidity represented validation that market agreed with thesis. More than fifty DeFi protocols launched on Plasma from day one including major names like Aave, Ethena, and Curve who had no obligation to support yet another blockchain unless they believed it solved real problem for their users. The XPL token debuted with market capitalization exceeding two point four billion dollars, opening around one dollar twenty cents before quickly reaching one dollar eighty-eight then settling around one dollar thirty after initial volatility subsided.

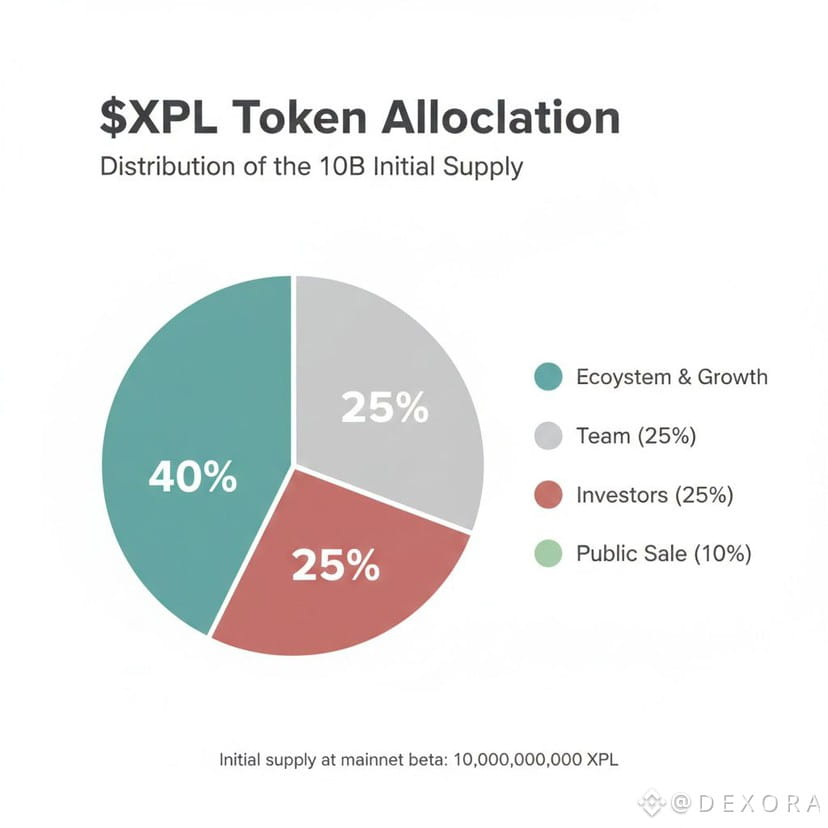

The airdrop distribution where even small contributors received over nine thousand XPL tokens created immediate community with skin in game. Token holders had financial incentive to support ecosystem growth while also serving as distributed marketing force explaining Plasma’s value proposition to their networks. The allocation approach avoided concentrating ownership too heavily in early investors and team who faced three-year lockups with one-year cliff, creating alignment where token price matters to builders but can’t be manipulated through early dumping that plagued other projects.

The rapid growth to five point six billion dollars in Total Value Locked within first week nearly matched Tron’s six point one billion dollar TVL despite Tron’s years of established operation. This suggested market had been waiting for stablecoin-specific infrastructure and was willing to try alternative once credible option existed. However, the speed of growth also created new pressures around maintaining uptime, supporting increasing transaction volumes, and ensuring security as value at risk multiplied beyond anything testnet prepared them for. The paranoia Faecks felt watching that ninety-second deposit window never fully disappears when billions of dollars depend on systems continuing to function perfectly.

The Market Positioning Challenging Established Dominance

The explicit targeting of TRON’s position as dominant stablecoin settlement layer represented bold strategic choice. TRON spent years building network effects where users, developers, and protocols all chose it specifically for stablecoin operations despite other chains offering superior technology in various dimensions. Displacing established leader requires not just being better but being dramatically better in dimensions that actually matter to users willing to overcome switching costs. Plasma’s zero-fee USDT transfers addressed most obvious pain point where TRON charged small fees that accumulated significantly at scale.

The challenge involves more than just cheaper transactions. TRON developed entire ecosystem of applications, wallets, on-ramps, and integrations all built around expectation that stablecoin activity happens there. Moving to Plasma means rebuilding portions of this infrastructure, retraining users on new interfaces, and convincing developers to deploy on less-established chain. The EVM compatibility helps by allowing Ethereum developers to port applications without learning new languages, but technical compatibility doesn’t automatically create social infrastructure that makes ecosystem feel alive and supported.

The emphasis on winning stablecoin settlement globally rather than becoming general-purpose platform reflects strategic discipline. Many blockchain projects suffer from identity crisis where they start focused then gradually expand scope until they’re competing with everyone on everything. Poker teaches value of knowing your edge and playing games where you have advantage rather than entering every pot hoping to get lucky. Plasma’s edge comes from purpose-built architecture for specific use case, and maintaining that focus means accepting limitations elsewhere rather than attempting to serve every possible application.

The Trillion-Dollar Vision Requiring Sustained Execution

Looking forward several years, success would mean Plasma becoming invisible plumbing layer where trillions of dollars in stablecoin transactions flow through infrastructure most users never know exists. The typical person buying coffee with stablecoin-linked debit card or receiving remittance from overseas wouldn’t think about whether payment settled on Plasma versus TRON versus Ethereum, they would simply experience transaction working instantly and costing nothing. This invisibility represents ultimate validation where infrastructure achieves such high reliability and integration that conscious thought about it disappears entirely.

The path to trillion-dollar opportunity requires maintaining execution discipline while competition inevitably emerges. If Plasma proves stablecoin-specific infrastructure creates genuine advantage, other well-funded teams will launch similar projects attempting to capture portions of market. The window where Plasma enjoys first-mover advantage in this specific category won’t last forever. Converting early adoption into durable network effects means signing exclusive partnerships, building ecosystem dependencies, and establishing brand associations where people automatically think Plasma when they think stablecoin infrastructure.

The alternative trajectory involves discovering that stablecoin-specific optimization doesn’t actually matter enough to justify separate infrastructure. Perhaps general-purpose chains improve sufficiently that specialized infrastructure advantage evaporates. Perhaps users actually prefer flexibility of chains that support diverse applications even if stablecoin operations cost slightly more. Perhaps regulatory pressure forces standardization across infrastructure providers eliminating differentiation. These scenarios don’t make Plasma wrong in any absolute sense, they would simply mean the specific bet on specialization timing proved incorrect or market conditions shifted unexpectedly.

Reflecting On Bets Made Under Uncertainty

The story of Plasma reveals how conviction-driven projects succeed or fail based on handful of crucial bets made with incomplete information. The bet that stablecoins need purpose-built infrastructure. The bet that USDT specifically rather than stablecoins generally represents optimal focus. The bet that Bitcoin sidechain architecture provides right security versus decentralization tradeoffs. The bet that zero-fee transactions matter enough to users that they’ll overcome switching costs from established alternatives. The bet that Paul Faecks and assembled team can execute vision at speed required before window closes.

Poker teaches that making correct decision under uncertainty doesn’t guarantee winning hand because randomness determines outcomes in individual cases. Over many hands though, players who consistently make optimal decisions based on available information accumulate advantage that eventually manifests in results. Blockchain operates under similar principles where single project might fail despite making all right choices, but focused conviction repeatedly applied across sustained period increases probability of eventual success. The ninety seconds when one billion dollars flooded into Plasma deposits represented single hand where everything worked. Winning the game requires thousands more hands executed with same precision over years ahead.

Whether Plasma ultimately captures significant portion of stablecoin settlement depends on variables still unfolding. The regulatory environment around stablecoins remains fluid. The competitive landscape will evolve as others recognize same opportunity. The team’s ability to maintain focus and execution velocity under pressure of managing billions gets tested daily. But the willingness to make focused bet on specific conviction rather than hedging across multiple possibilities at least gives Plasma chance at category-defining outcome. In poker as in blockchain, you can’t win meaningful pots without risking meaningful chips.