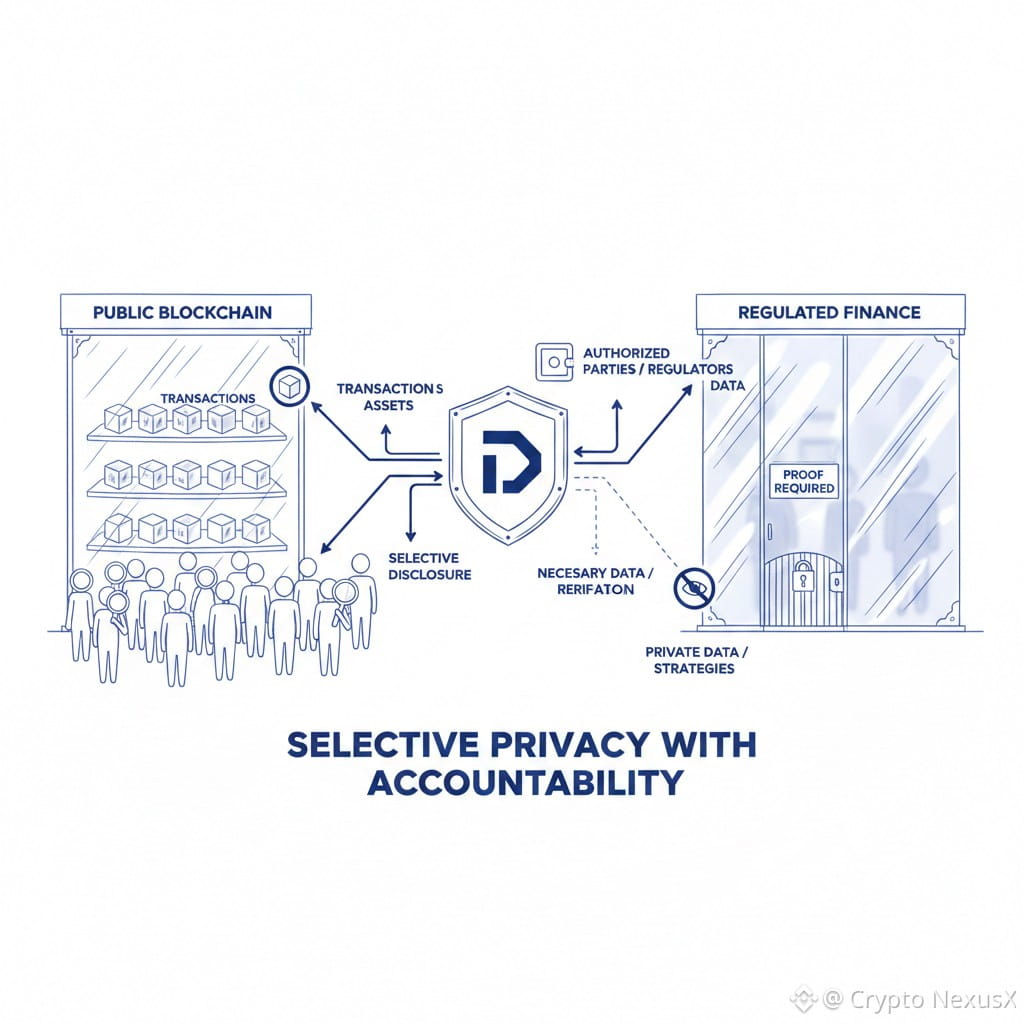

When I think about most blockchains, I picture a glass storefront: bright lights, everything visible, nothing hidden. That kind of transparency is perfect for open markets and public experimentation. But regulated finance does not work like that. In real financial systems, you are expected to prove what happened, but you are not expected to broadcast every position, strategy, counterparty, and workflow to the entire world.

That is where Dusk feels different. It is not trying to be a mystery box chain where nothing can be verified, and it is not trying to be a fully public ledger where every move becomes permanent public data. It is aiming for something more realistic: selective privacy with accountability. The simple idea is this: reveal what is necessary to the right party at the right time, and keep the rest from becoming public exhaust that competitors and attackers can harvest.

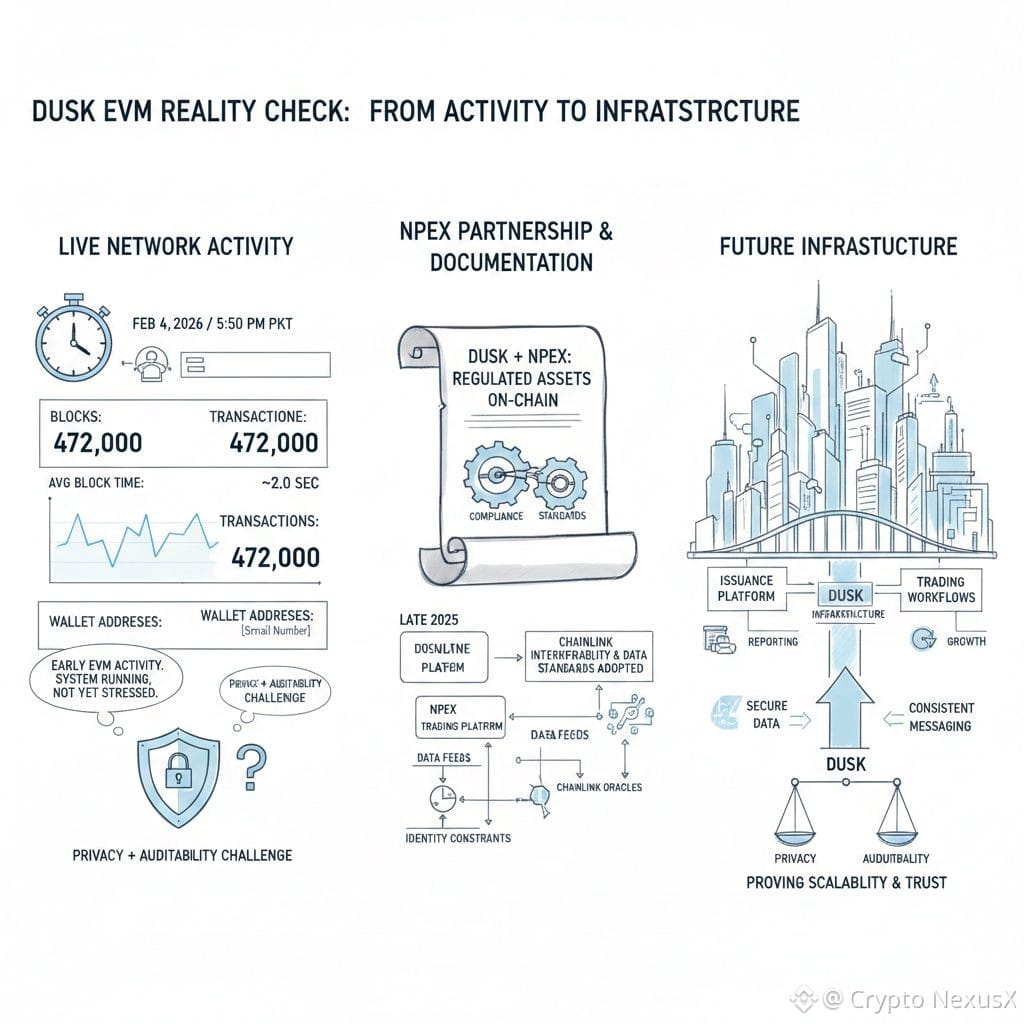

The way Dusk approaches that goal is not mainly through slogans. It is built into the structure. Dusk describes its network as modular, with a base settlement layer and an execution layer that can support familiar smart contract development. Their own framing explains a foundation that focuses on consensus, data availability, and settlement, with DuskEVM sitting above it to support Solidity style building without making teams abandon existing tools. That separation matters because regulated finance is allergic to systems where the rules of settlement shift every time an app upgrades. If settlement is the spine, you want it stable. Then you let apps evolve on top.

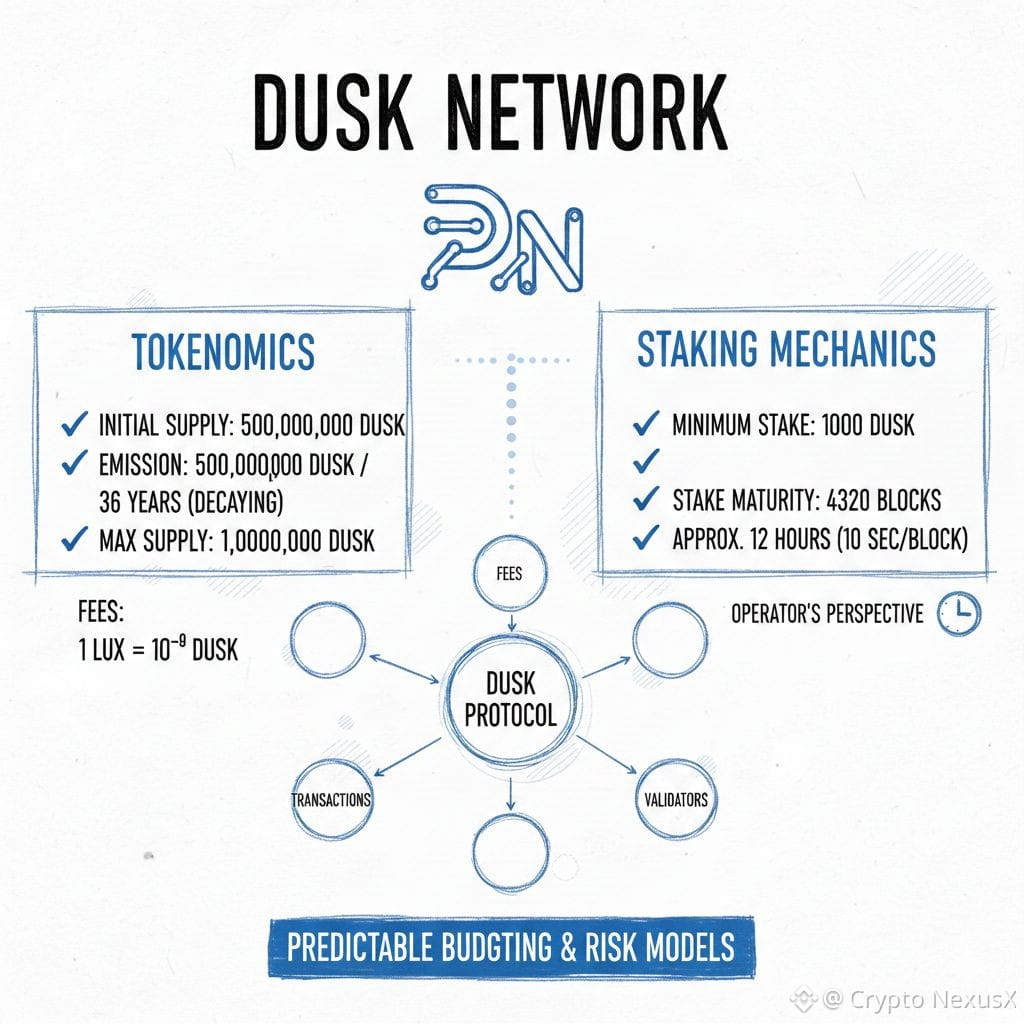

What also stands out is how Dusk treats the token and staking mechanics like operational infrastructure, not just a community feature. Their tokenomics documentation is unusually direct: an initial supply of 500 million DUSK, another 500 million emitted over 36 years with a decaying schedule, and a max supply of 1 billion. Fees use LUX as a subunit, where 1 LUX equals 10 to the minus 9 DUSK. These are the kinds of details institutions actually care about because they translate into predictable budgeting and risk models.

Staking is also described in practical terms. The docs mention a minimum stake of 1000 DUSK and explain stake maturity as 4320 blocks, which their staking guide translates to roughly 12 hours assuming about 10 second blocks. Whether someone loves or hates staking, the point here is that Dusk is documenting how the system behaves like an operator would document a service, not like a hype thread would.

If you want an honest reality check, you look at live network activity, not just design. On the DuskEVM explorer, the public stats show the chain is producing blocks at around a 2.0 second average block time, with roughly 472 thousand blocks and 472 thousand transactions listed at the time of viewing, and a small wallet address count displayed. I am not going to twist that into a victory speech. It reads like a system that is running and being used, but still early in visible EVM activity. In an institutional context, early and controlled is not always a weakness, but it does raise the bar for what comes next: proving the rails can handle real issuance, trading workflows, reporting requirements, and growth without losing the privacy and auditability balance.

This is where the ecosystem story becomes more meaningful than generic partnership noise. The NPEX track is interesting because it pulls Dusk toward regulated market reality, where compliance and standards are not optional add ons. In late 2025, there was a release describing Dusk and NPEX adopting Chainlink interoperability and data standards in the context of regulated institutional assets on chain. Whether people like press releases or not, the practical takeaway is that standards and interoperability are what turn a chain into infrastructure, because assets need data, identity constraints, and consistent messaging to move safely between systems.

And then there is the unglamorous part that matters most if you are serious about financial infrastructure: incident handling and operational discipline. Dusk published a bridge incident notice describing unusual activity involving a team managed wallet used in bridge operations and stated that bridge services were closed pending review. That is not the fun part of building, but it is the real part. Systems that want to host regulated value have to show they can detect problems, contain them, communicate clearly, and fix processes. No serious institution is evaluating only the sunny day scenario.

So my human take on Dusk is this: it is trying to build a chain that behaves like one way glass. From the outside, the system can be inspected and verified. From the inside, participants are not forced to turn their entire financial life into public data. That is why the modular design matters, why the token and staking rules are written like operational documentation, why standards focused integrations are a serious signal, and why the network metrics and incident response are the parts to watch instead of slogans.

If Dusk succeeds, it probably will not be because it becomes the loudest chain. It will be because it becomes the quiet place where complicated institutions can do simple things reliably: issue, trade, settle, and audit, without leaking everything to the public internet. And if it fails, it likely will not be because the idea is wrong. It will be because the hard part is not the concept of privacy plus auditability, it is the grind of execution, integrations, and real workflows at scale.