I know how exciting yet volatile the market can be, especially with the February dips we're seeing right now. With Bitcoin hovering around $77,500 as of early February 2026, and the overall market cap pushing towards new highs, it's a perfect time to dive deep into what 2026 might hold. Drawing from the latest industry reports, expert analyses, and on-chain data, this long-form article explores key trends, price predictions, and emerging technologies shaping the crypto landscape. I'll break it down section by section, backed by data from sources like CNBC, Coinbase, and Pantera Capital, to help you navigate investments wisely.

Introduction: The State of Crypto Entering 2026

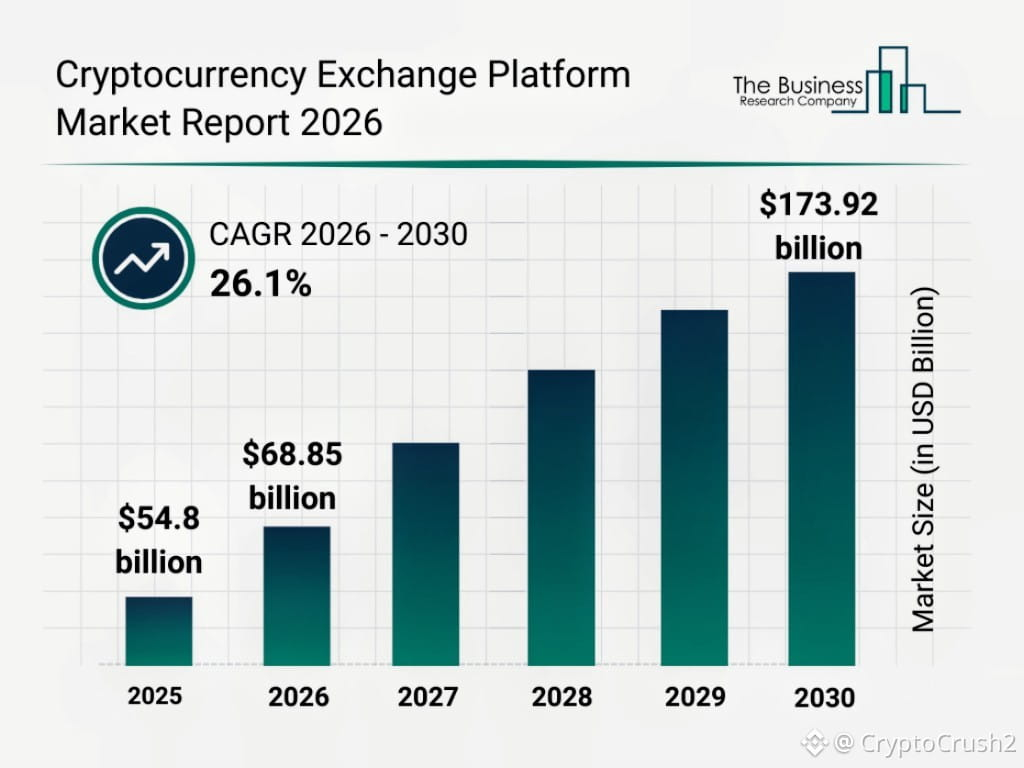

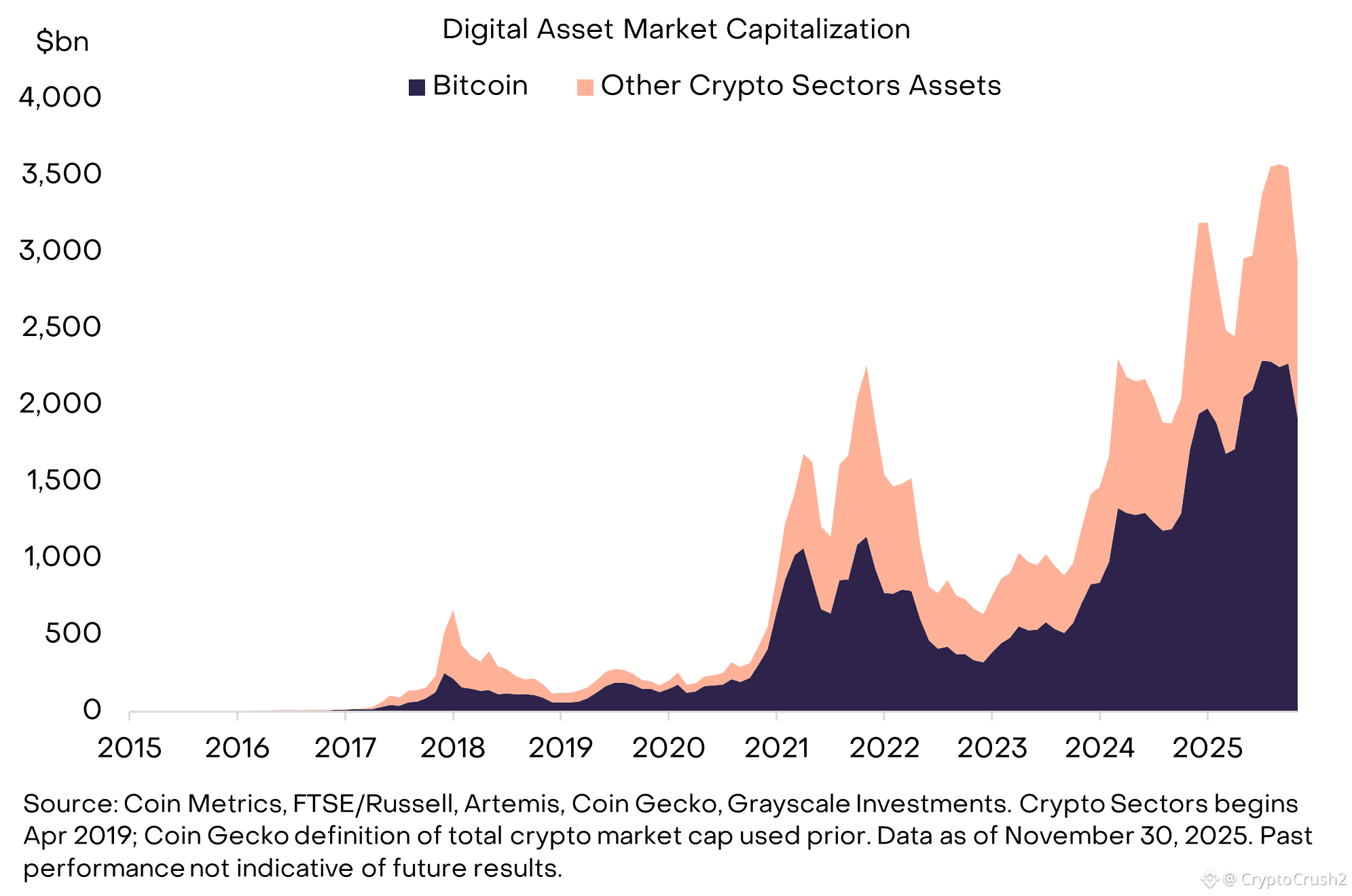

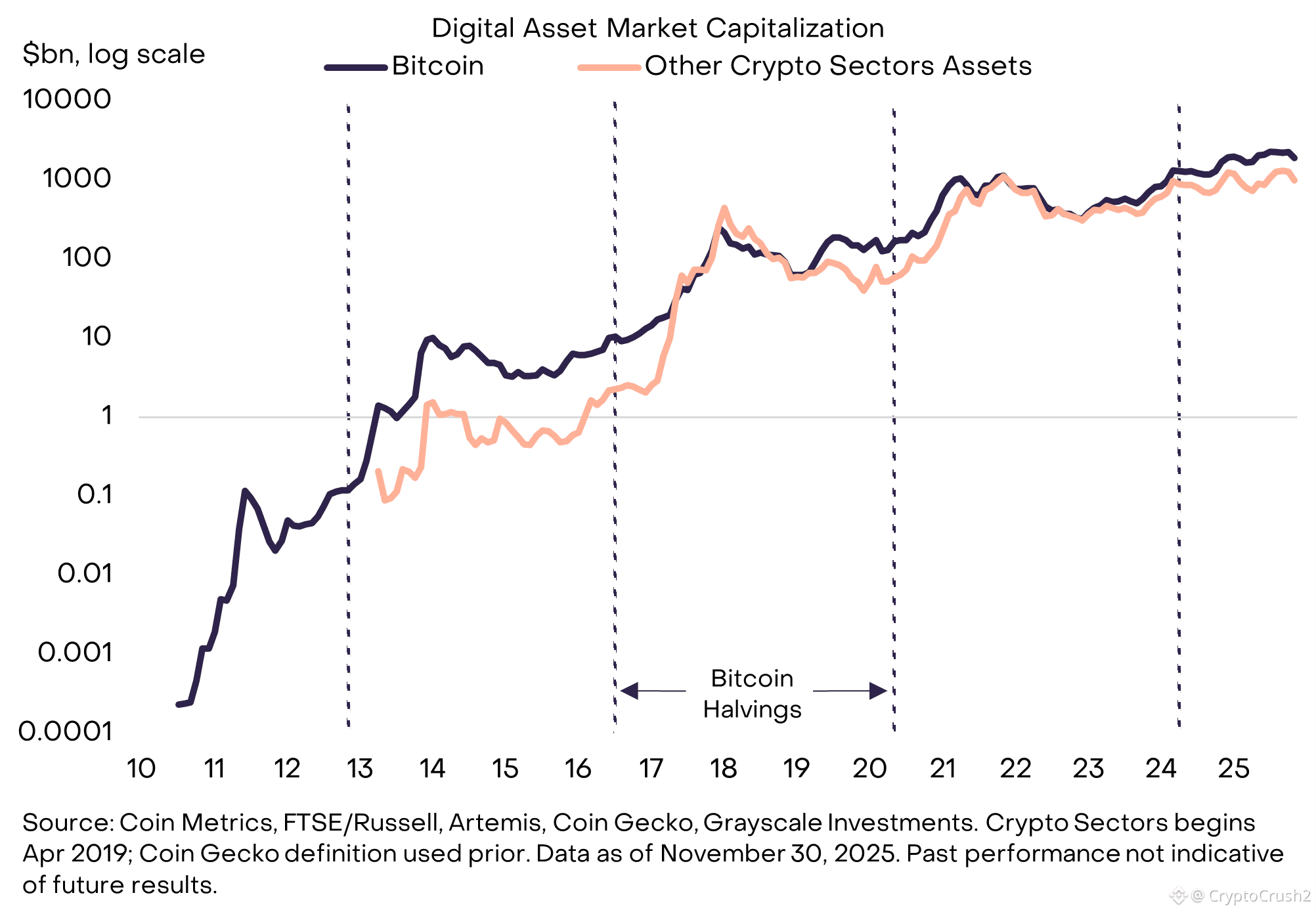

As we step into 2026, the cryptocurrency market is maturing rapidly. The total market capitalization has surged past $3 trillion in late 2025, driven by institutional inflows and regulatory clarity. Unlike the speculative frenzy of 2021, this year's growth is rooted in utility: from tokenized real-world assets (RWAs) unlocking trillions in value to AI integrations enhancing DeFi efficiency. However, challenges like macroeconomic uncertainty—sticky inflation and potential Fed rate adjustments—could introduce volatility.

According to Grayscale's 2026 Digital Asset Outlook, crypto is entering the "Dawn of the Institutional Era," where traditional finance (TradFi) fully embraces blockchain. This shift is evident in spot ETFs absorbing over 100% of new Bitcoin supply, signaling a move from retail hype to institutional stability.

Bitcoin Predictions: Breaking the Cycle or More Volatility?

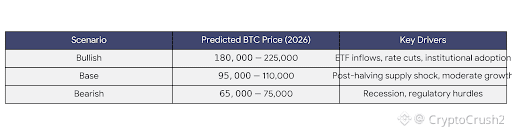

Bitcoin remains the king of crypto, often dictating market sentiment. Experts are bullish for 2026, with predictions ranging from $75,000 to $225,000. Carol Alexander from the University of Sussex forecasts a volatile range of $75,000-$150,000, centering around $110,000, citing post-halving effects and institutional demand.

More optimistic views come from Bitcoin Suisse, projecting BTC approaching $180,000 if the Fed's rate cuts accelerate economic growth. This aligns with Bitwise's prediction that Bitcoin will break its traditional four-year cycle and set new all-time highs, potentially surpassing $100,000 early in the year.

However, not all are rosy. In a bear case, YouHodler estimates BTC at $65,000 if recession hits, while the base case is $95,000. On-chain data from Glassnode supports accumulation trends, with long-term holders increasing positions despite recent dips.

Volatility might decrease, with Bitwise predicting Bitcoin will be less volatile than Nvidia stock due to maturing markets.

Ethereum and Altcoins: The Rise of Utility-Driven Assets

Ethereum (ETH) is expected to shine in 2026, with predictions from $8,000 (Bitcoin Suisse) to more conservative $5,000 in base cases. Upgrades like Dencun have reduced fees, making ETH a hub for DeFi and NFTs. YouHodler forecasts ETH at $4,000-$6,000, emphasizing its role in layer-2 scaling.

Altcoins will see selective growth. Undervalued gems like Render (RNDR) for AI, Injective (INJ) for DeFi, and Arweave (AR) for data storage could 10x, per Mercuryo and SVB analyses. Solana might challenge ETH in the layer-1 battle, with ETFs boosting its TVL.

Pantera Capital warns of "brutal pruning," where only 1-2 players dominate each category, leading to M&A surges.

Institutional Adoption: The Institutional Era Dawns

2026 marks the "Institutional Era," with Coinbase predicting deeper integration into core finance. ETFs for BTC, ETH, and SOL will absorb excess supply, per Bitwise. Wall Street giants like BlackRock are expanding into tokenization, with SVB forecasting vertical institutional capital flows.

Digital asset treasuries (DATs) will become standard, and 39% of US merchants accepting crypto signals mainstream adoption.

Regulatory Progress: Clarity Fuels Growth

Regulatory tailwinds are key. The US SEC's approvals for DTCC tokenization and potential rulemaking for DeFi will unlock trillions. Global frameworks like EU's MiCA boost stablecoins, while Asia's restrictions might ease.

Coinbase sees 2026 as a year of progress, changing institutional strategies.

AI Integration: Revolutionizing Crypto Operations

AI is a top trend, per Mercuryo. Decentralized AI chatbots, advanced aggregators, and on-chain security tools will dominate. Pantera predicts AI revolutionizing audits and governance.

Projects like ChainGPT on BNB Chain exemplify this fusion.

Tokenization and RWAs: Unlocking Trillions

RWAs will explode, with TVL hitting $16.6B in 2025 and projected to $10T by 2030. Forbes highlights accelerated tokenization, with SEC approvals paving the way.

Top projects: Polymesh, Ondo Finance.

Stablecoins: The Internet's Dollar

Stablecoins like USDT and USDC will dominate payments, becoming "the internet's dollar". With market caps soaring, they're key for cross-border transfers.

Prediction Markets and Emerging Trends

Kraken notes shifting liquidity and on-chain innovation. Motley Fool predicts regulation, AI advances, and Wall Street entry for prediction markets.

Other trends: Privacy coins revival, robotics-blockchain merge.

Conclusion: Navigating 2026 with Caution and Optimism

2026 promises growth, with BTC potentially at $100K+ and altcoins thriving in utility niches. However, volatility remains—focus on fundamentals, diversify, and stay informed. As Pantera says, this is a year of "pruning" where winners emerge.

What are your 2026 predictions? Drop a comment! 👇