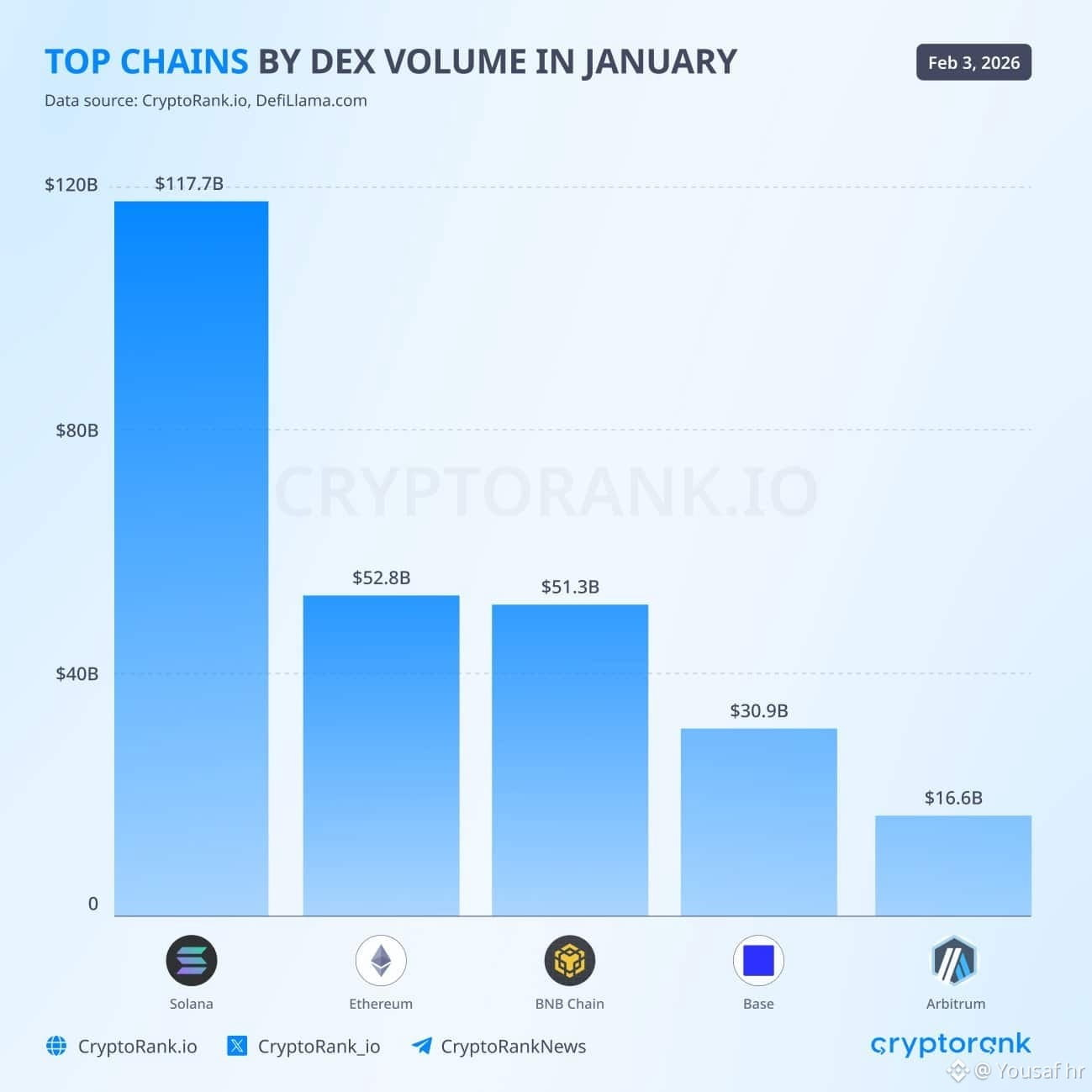

In January, Solana ($SOL )was the top network for trading volume on decentralized exchanges. Its transactions and activity hit record highs.

Key Facts:

· It processed $117.7 billion in trades for the month, 35% of the entire market.

· It left major competitors like Ethereum ($ETH )and BNB Chain ($BNB ) far behind.

· The number of successful transactions is improving.

The Price Puzzle:

Despite this strong performance, SOL's price has fallen recently.

· In the past week, it dropped about 20% to near $100.

· This drop was due to overall market weakness, not a loss of faith in Solana.

· Right now, the price is moving opposite to its network growth.

The Future Outlook:

Analysts at Standard Chartered Bank see this gap between activity and price as a long-term opportunity. They believe Solana is growing beyond just meme coin trading and will become dominant in stablecoin transfers and small payments.

Their Price Forecast: End of 2027: $400

They note that Solana's speed and efficiency, especially for stablecoins, could unlock new uses like AI-driven micropayments, even if it takes time to fully develop.