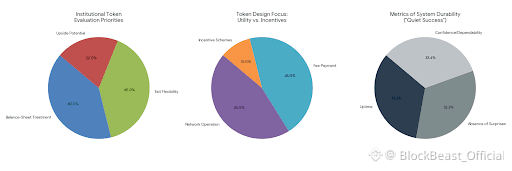

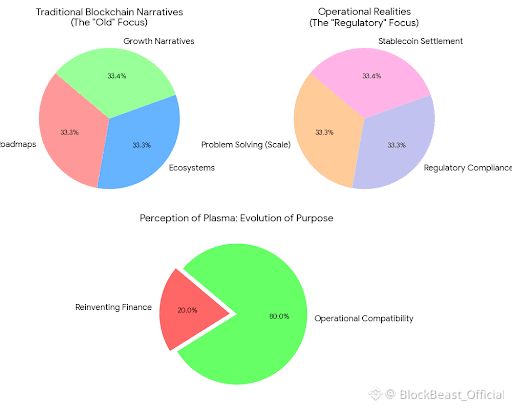

When assessing a system like , it helps to step away from the usual language of roadmaps, ecosystems, and growth narratives. A more revealing question is simpler: what problem does this infrastructure solve for actors who already move money at scale, under regulatory regimes they cannot opt out of? Viewed from that angle, Plasma reads less like a bid to reinvent finance and more like an attempt to make blockchain compatible with the operational realities of stablecoin-based settlement.

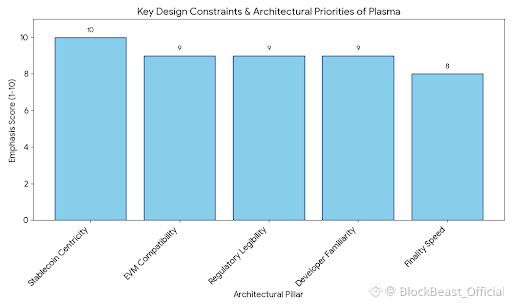

Plasma’s decision to treat stablecoins as a first-order design constraint is telling. In many regions, stablecoins already function as practical digital dollars, embedded in everyday commerce and intermediary workflows. They are not experimental assets; they come with issuer controls, compliance obligations, and expectations around traceability. Designing a Layer 1 around this reality signals acceptance that the system will be evaluated not only for technical soundness, but for how it behaves during audits, freezes, reversals, and regulatory reporting. Gasless USDT transfers and stablecoin-denominated fees are therefore less about user convenience than about aligning costs with the fiat mental models that dominate real payment environments.

Architecturally, Plasma’s reliance on a familiar EVM execution environment via Reth reflects a deliberate avoidance of novelty. Full EVM compatibility is rarely exciting, but it is predictable. It lowers friction for developers porting existing contracts, for auditors reviewing execution semantics they already understand, and for compliance teams tasked with risk assessment. The separation of execution and consensus, alongside the introduction of PlasmaBFT for sub-second finality, further emphasizes modularity. This does not remove risk, but it makes it more legible—and in regulated settings, legibility often outweighs raw performance.

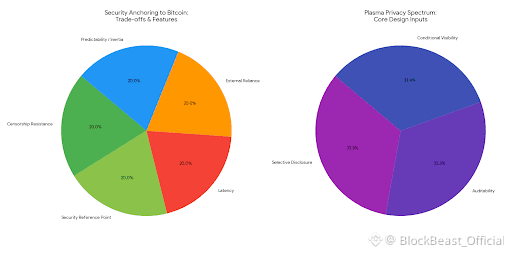

Security anchoring to Bitcoin introduces another conservative trade-off. While often framed as a neutrality guarantee, anchoring is better understood as a choice in favor of predictability. It can enhance censorship resistance and provide a widely recognized security reference point, but it also brings latency and reliance on an external system. For institutional settlement use cases, that inertia may be a feature rather than a flaw. Bitcoin’s slow, well-understood behavior can be preferable to faster systems with less established operational norms.

Privacy within Plasma’s design appears to be treated as a spectrum rather than an absolute. This mirrors how financial systems function in practice. Total opacity is rarely compatible with regulated money flows, while complete transparency is operationally impractical. Selective disclosure, auditability, and conditional visibility for regulators are not compromises; they are design inputs. Systems that acknowledge this from the outset tend to integrate more smoothly into existing compliance processes, even if they lack ideological appeal.

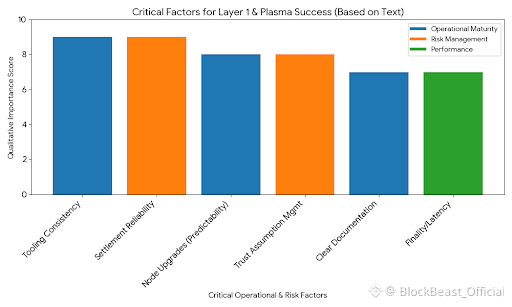

Equally important are the unglamorous aspects of running a Layer 1. Sub-second finality matters only if node software upgrades are predictable, documentation is clear, and tooling behaves consistently. Many networks fail not because of flawed concepts, but because of operational brittleness—misconfigured nodes, unclear upgrade paths, ambiguous failure modes. Plasma’s emphasis on mature tooling and predictable behavior suggests an understanding that production systems usually break in mundane ways.

Bridges and migrations remain unavoidable sources of risk. Plasma is no exception. Any mechanism that moves value across chains introduces trust assumptions and latency. Acknowledging and constraining these assumptions is more credible than claiming to eliminate them. For institutions, settlement delays can affect liquidity management and intraday risk—central considerations rather than edge cases.

From an institutional perspective, token design is evaluated less for upside and more for balance-sheet treatment and exit flexibility. A token primarily focused on network operation and fee payment, without aggressive incentive schemes, is easier to model and justify internally. Predictable fee markets and conservative monetary policy often matter more than complex reward structures that obscure long-term costs.

Ultimately, Plasma presents itself as infrastructure that expects scrutiny. Its design choices suggest anticipation of audits, regulatory questions, and the slow cadence of institutional adoption. This is not a system built to win attention cycles; it is built to endure them. If Plasma succeeds, it will likely do so quietly—measured by uptime, by the absence of surprises, and by the confidence of users who rely on it not because it is novel, but because it is dependable. Durability here is not a slogan; it is the cumulative result of many restrained decisions that keep a system usable long after initial enthusiasm fades.