#Plasma is built so it can help stablecoins move.

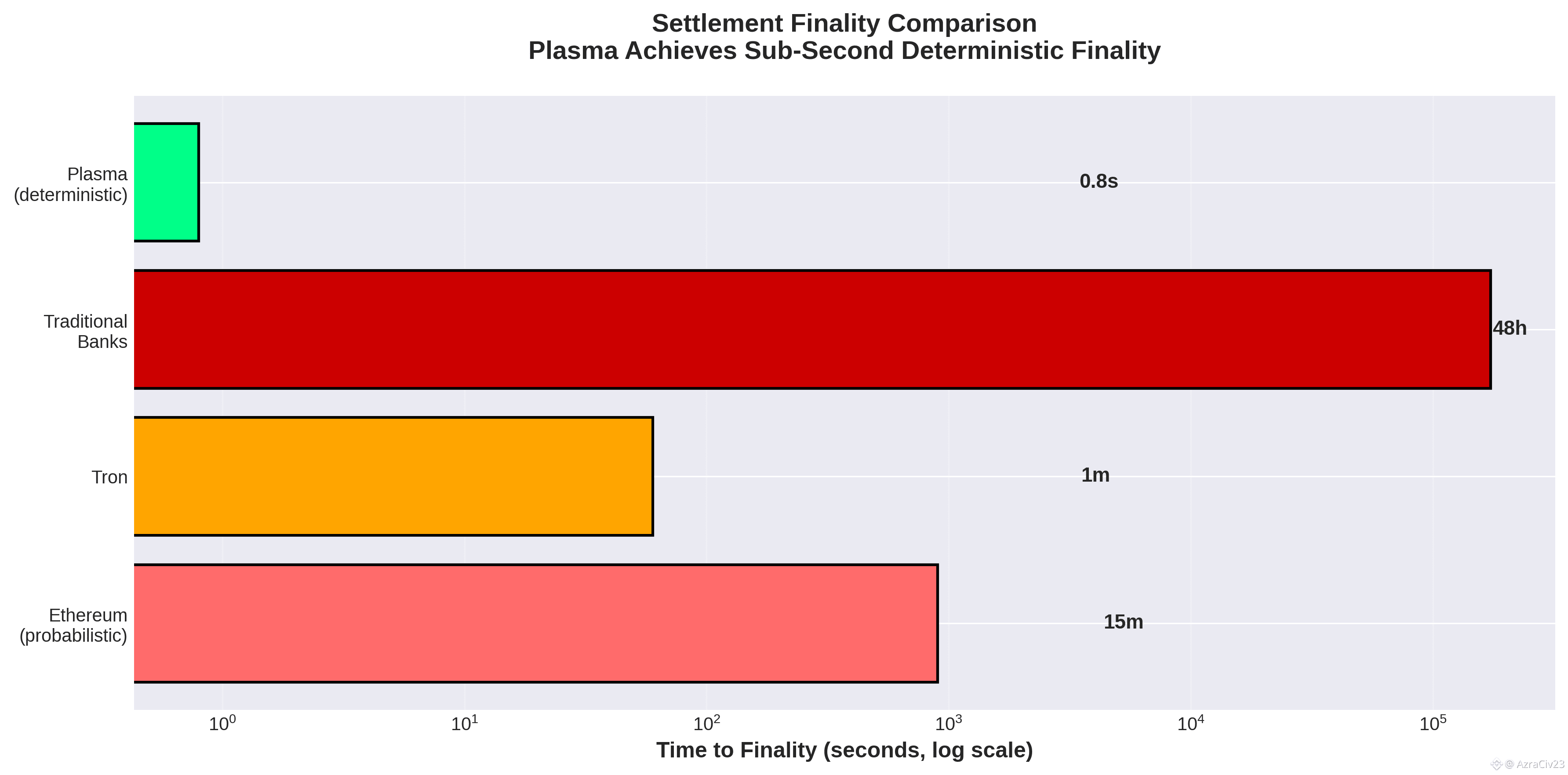

Sending USDT on most blockchains feels unreliable. Fees fluctuate, confirmations take time, and finality is probabilistic. For institutions, this settlement risk — the uncertainty between initiating a transfer and knowing it’s irreversible — is a dealbreaker. @Plasma was built to solve exactly this problem. Its entire architecture is designed so stablecoins settle like real money: instantly, cheaply, and with certainty.

Unlike general-purpose chains, Plasma treats stablecoins as first-class primitives. PlasmaBFT consensus achieves sub-second deterministic finality, meaning transactions are irreversible the moment they appear. No waiting for multiple confirmations, no reorg risk, and no hidden exposure to MEV.

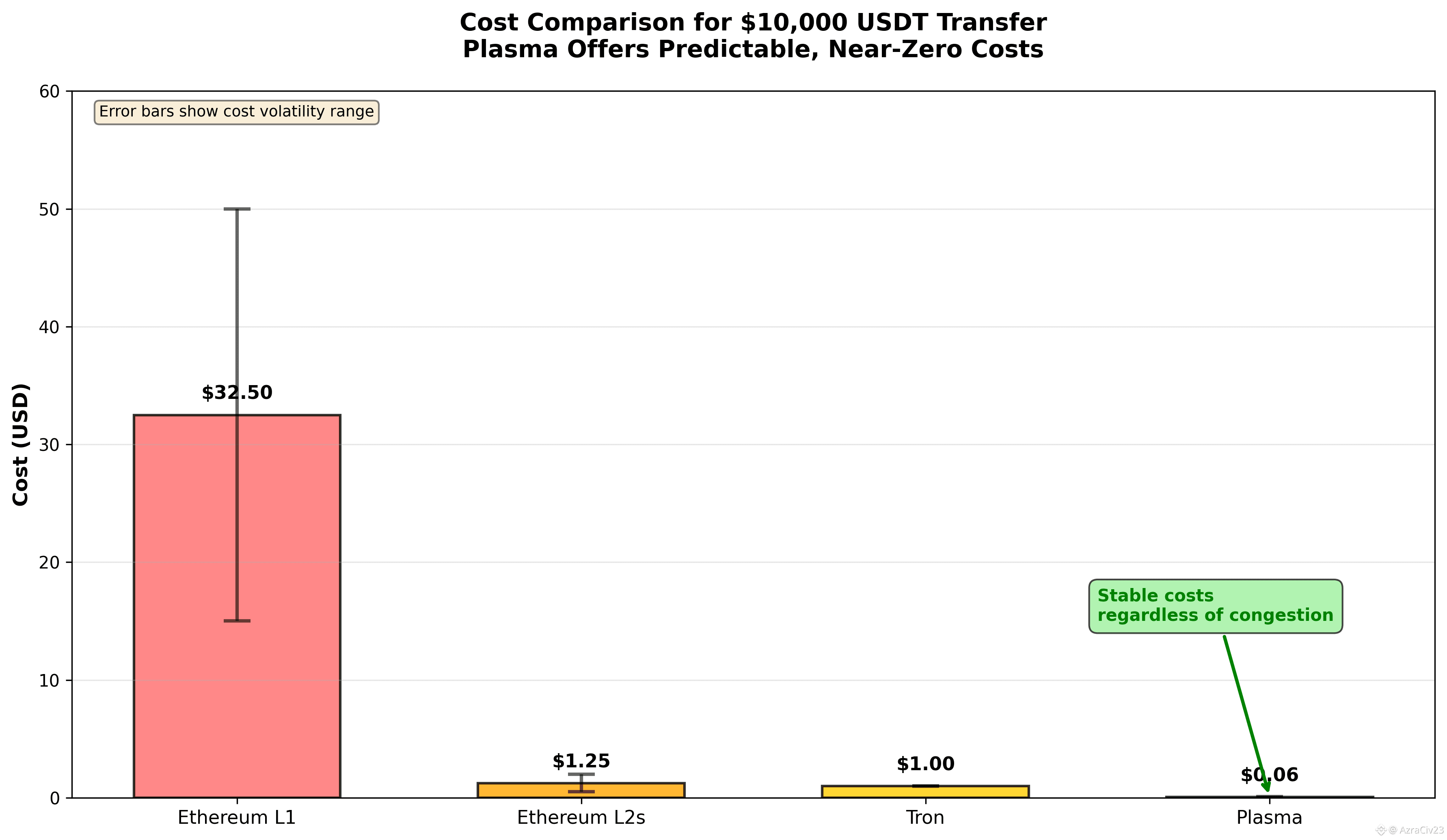

Economics matter too. Paying gas in volatile tokens complicates treasury operations and adds operational friction. Plasma introduces a stablecoin-first gas model, letting fees be paid in USDT or waived entirely for time-critical transactions. Transfers are not only fast but predictable and near-zero in cost, whether moving $10 or $50 million.

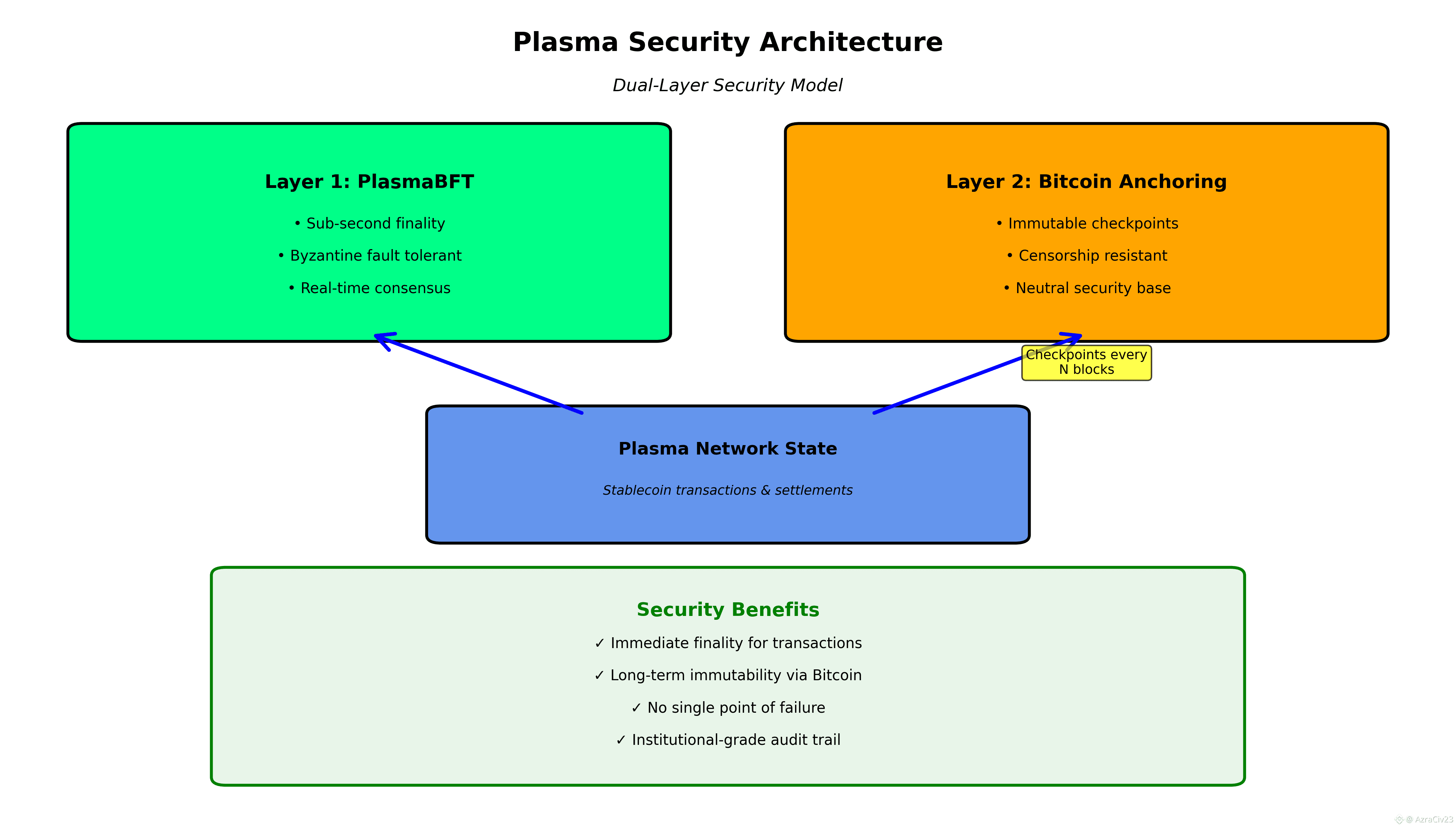

Security is another differentiator. Plasma anchors its state to Bitcoin, providing immutability and censorship resistance while maintaining sub-second settlement. Periodic checkpoints create a verifiable audit trail: if validators attempt to rewrite history, the Bitcoin-anchored ledger proves the fraud. This combination ensures neutrality and reliability for institutional use.

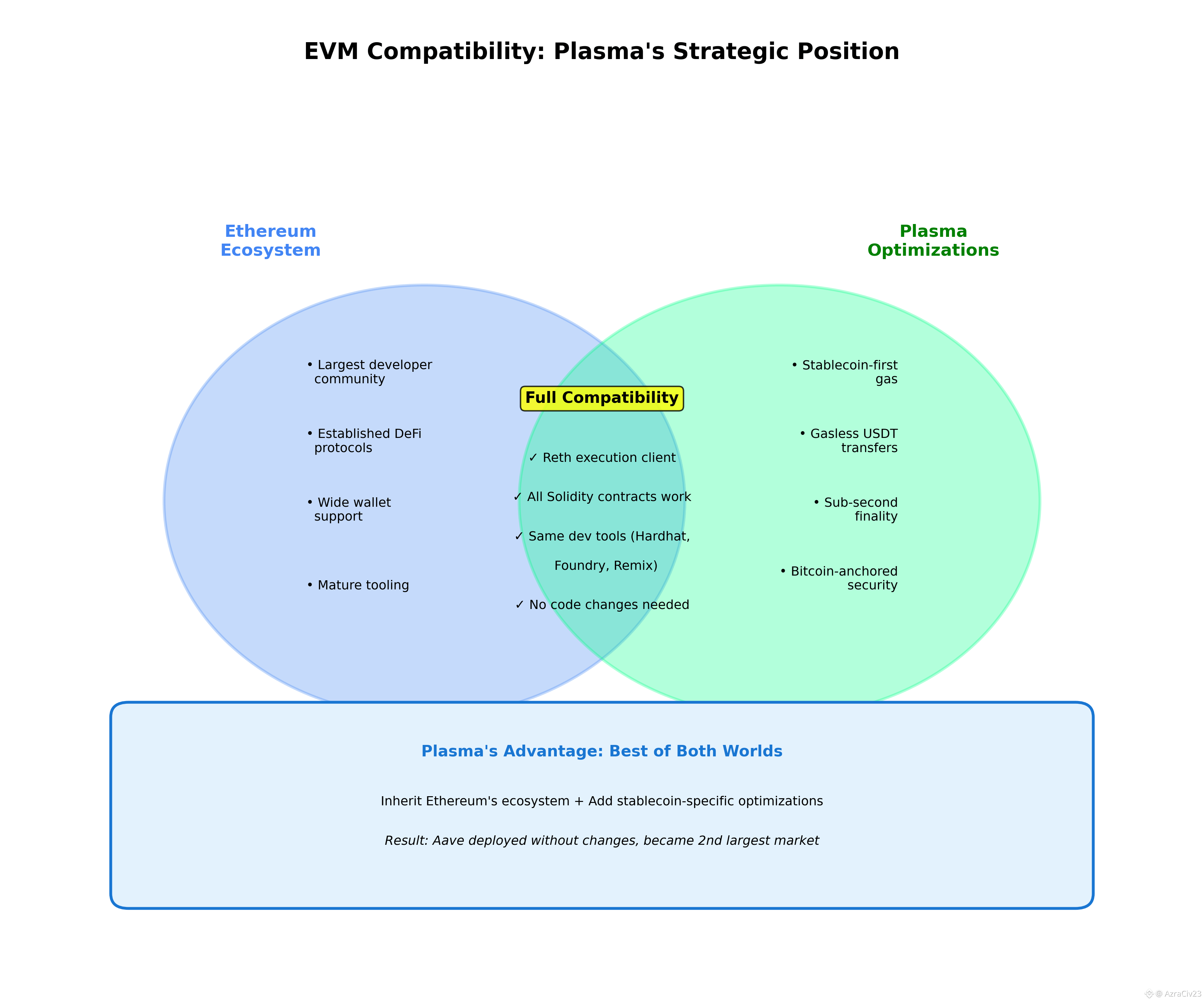

Plasma also fully supports the Ethereum ecosystem via its Reth client. Every Solidity contract, wallet, and analytics tool works out-of-the-box. This compatibility allowed Aave to deploy directly on Plasma and grow into its second-largest market, showing that real institutional adoption doesn’t require sacrificing ecosystem leverage.

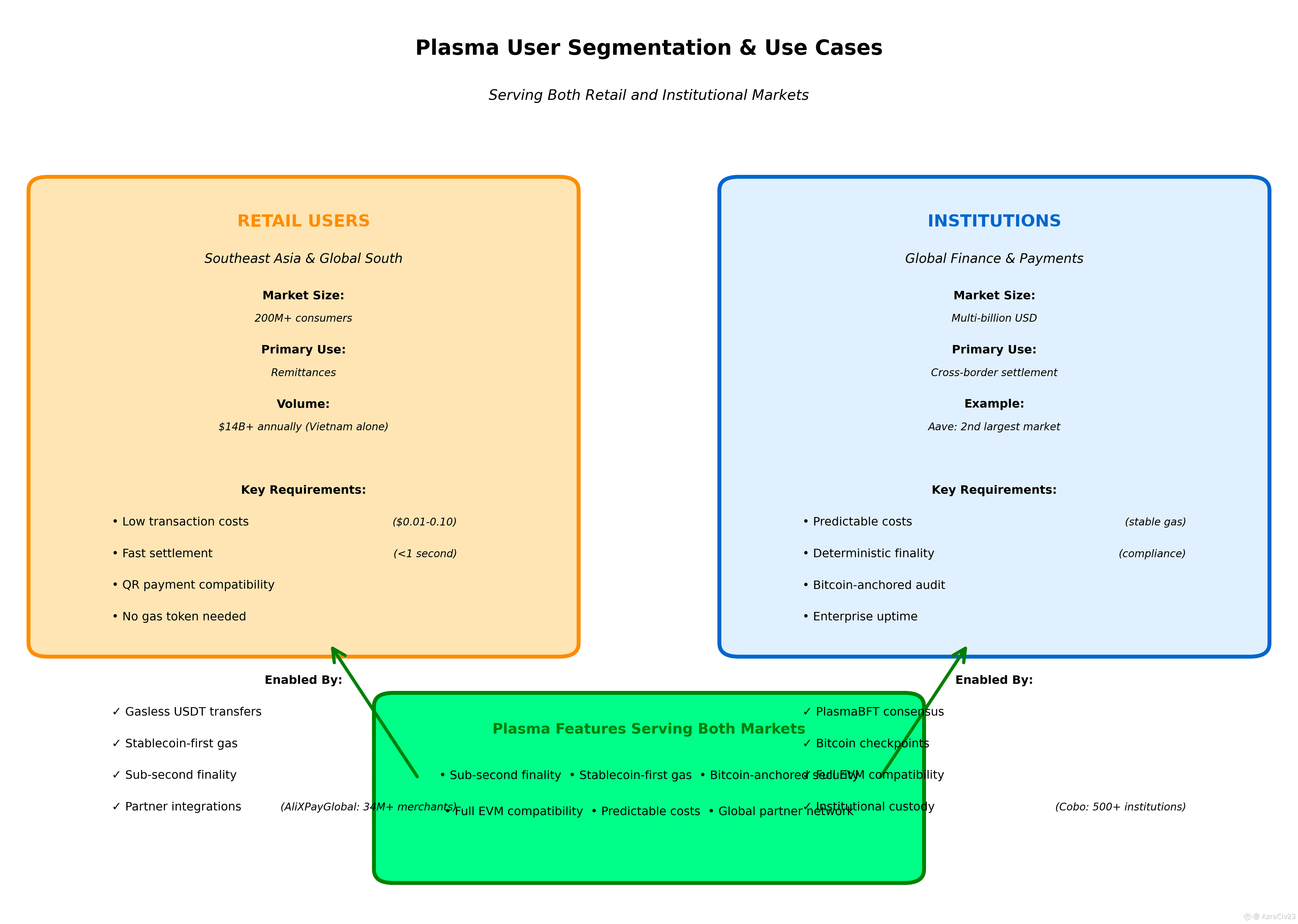

The network serves both retail and institutions. Southeast Asia merchants and consumers can send and spend USDT instantly and cheaply, while global treasury teams benefit from deterministic finality, predictable fees, and Bitcoin-backed audit trails. Plasma’s infrastructure scales with adoption rather than breaking under it.

The use of Plasma in South Asia is something we have talked about in more detail in a previous article :

🔗 Plasma 2026: The Next Layer of Real-World Money

By designing stablecoin settlement as the core primitive, Plasma changes the game. Transfers are fast, costs are predictable, and security is uncompromised. Traditional banks solved these problems through intermediaries; Plasma achieves it on-chain, for everyone. This is not theoretical — it’s operational reality. With Aave, AliXPayGlobal, Cobo, and other partners actively using the network, Plasma proves that stablecoins can finally behave like money, today.