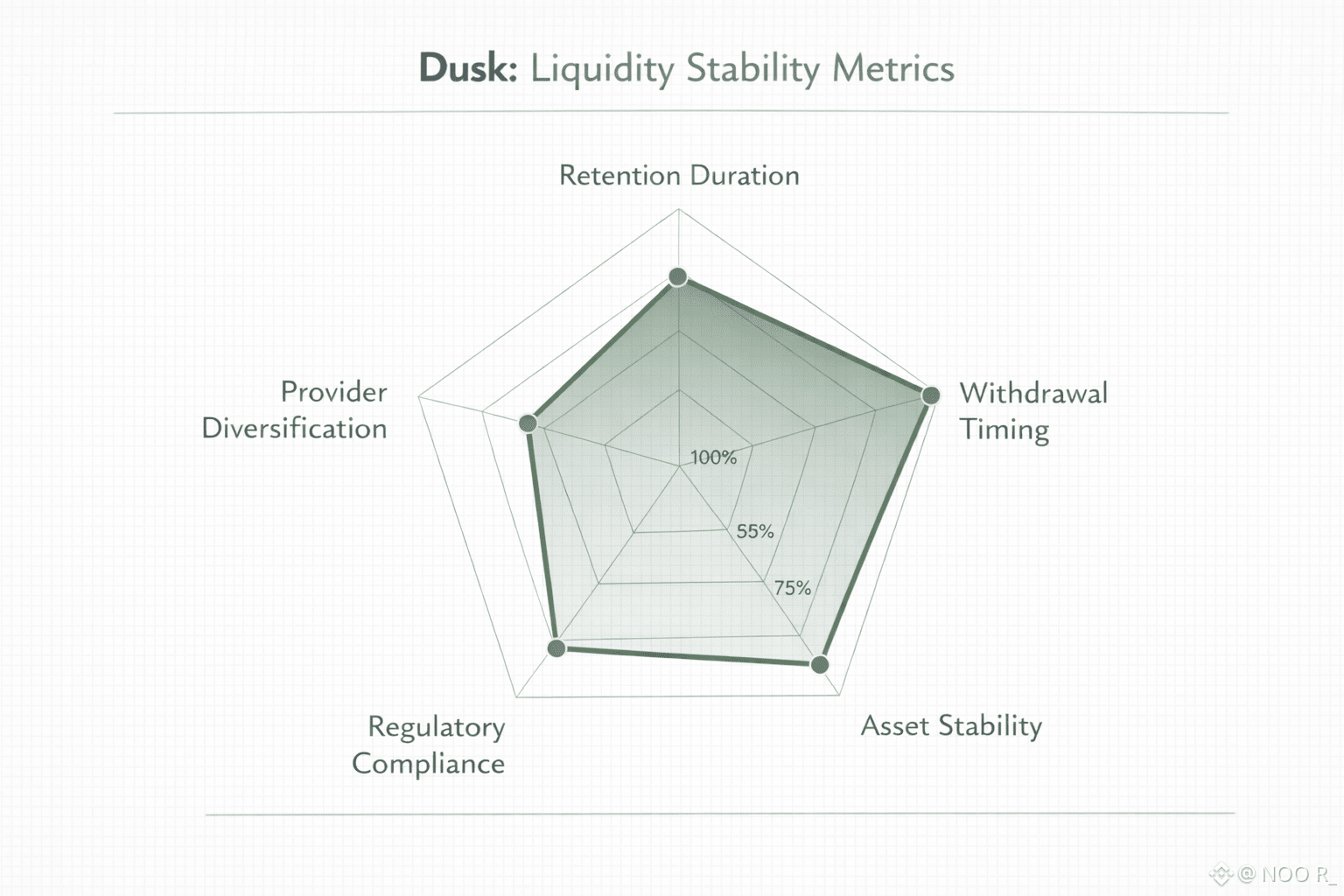

Sometimes, the most telling signals in a blockchain ecosystem aren't the flashy announcements but the subtle shifts in liquidity behavior. On @Dusk , there's been a noticeable change: liquidity isn't just moving in and out rapidly; it's settling in, becoming more stable and predictable. This isn't about sudden spikes or drops; it's about a maturation of the network's financial dynamics, indicating a deeper trust and utility being established.

A significant factor in this shift is the integration of EURQ, a MiCA-compliant digital euro, into the Dusk Network. Unlike typical stablecoins, EURQ is issued by regulated entities and functions as actual legal tender, not just a digital asset. This means that liquidity on Dusk isn't just abundant; it's compliant, stable, and aligned with traditional financial systems. Such integration reduces the fragmentation often seen in other networks and provides a solid foundation for institutional participation. This raises an important question: how will this enhanced liquidity stability influence the behavior of institutional participants and the broader adoption of compliant blockchain solutions?

For participants in the Dusk ecosystem, this evolution presents both opportunities and responsibilities. The presence of regulated liquidity means that participants can engage with the network with greater confidence and clarity. However, it also necessitates a deeper understanding of compliance requirements and a commitment to maintaining the integrity of the network's financial operations. As Dusk continues to bridge the gap between traditional finance and blockchain technology, it's crucial for all stakeholders to align with these emerging standards to fully realize the benefits of this new financial paradigm.