Not a hype spike, not a one-week incentive mirage—but a structural migration of capital. Across Aave, Fluid, and Pendle, Plasma is no longer a peripheral deployment. It is becoming a primary venue where stablecoin liquidity is supplied, borrowed, and actively used.

This is not about raw TVL numbers alone. It’s about composition, behavior, and intent. When you look closely at how liquidity behaves on Plasma versus Ethereum and other L2s, you start to see why sophisticated capital is moving—not chasing yields, but optimizing for efficiency.

Aave on Plasma: Small Share of TVL, Outsized Strategic Importance

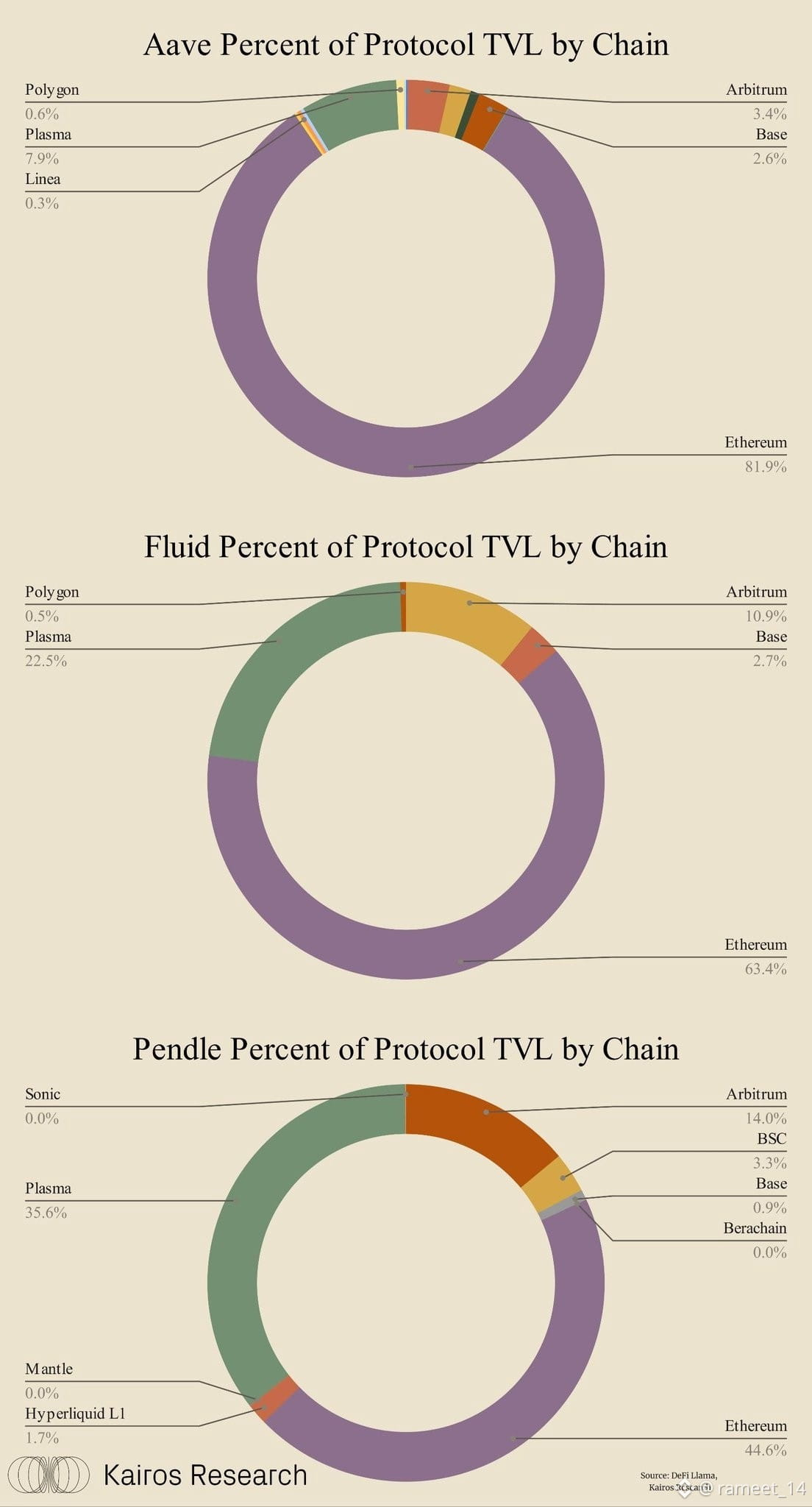

Aave appears Ethereum-centric—and that’s true in aggregate. Roughly 81.9% of Aave’s total TVL still resides on Ethereum, dwarfing other chains. Plasma accounts for ~7.9% of Aave’s protocol TVL, a modest slice relative to the L1 giant.

But raw percentage masks the quality of that liquidity.

On Aave V3 Plasma, stablecoins dominate the market in a way that’s almost unprecedented:

92.22% of supplied assets are stables

97.75% of borrowed assets are stables

By contrast, Ethereum V3 sits at 31.13% stable supply and 52.23% stable borrowing.

This matters. Plasma’s Aave market isn’t being used as a passive parking lot for volatile collateral. It’s functioning as a pure credit layer: capital-efficient, stable-denominated, and actively borrowed. That’s exactly what professional DeFi users want when they’re deploying leverage, running arbitrage, or managing delta-neutral strategies.

In short, Plasma isn’t competing with Ethereum’s scale—it’s specializing where Ethereum is structurally less efficient.

Fluid: Plasma as a High-Velocity Liquidity Engine

While Ethereum still holds the majority of Fluid’s TVL (63.4%), Plasma already commands 22.5%—a striking share for a relatively new venue. Arbitrum, long considered the go-to L2 for DeFi liquidity, sits behind at 10.9%.

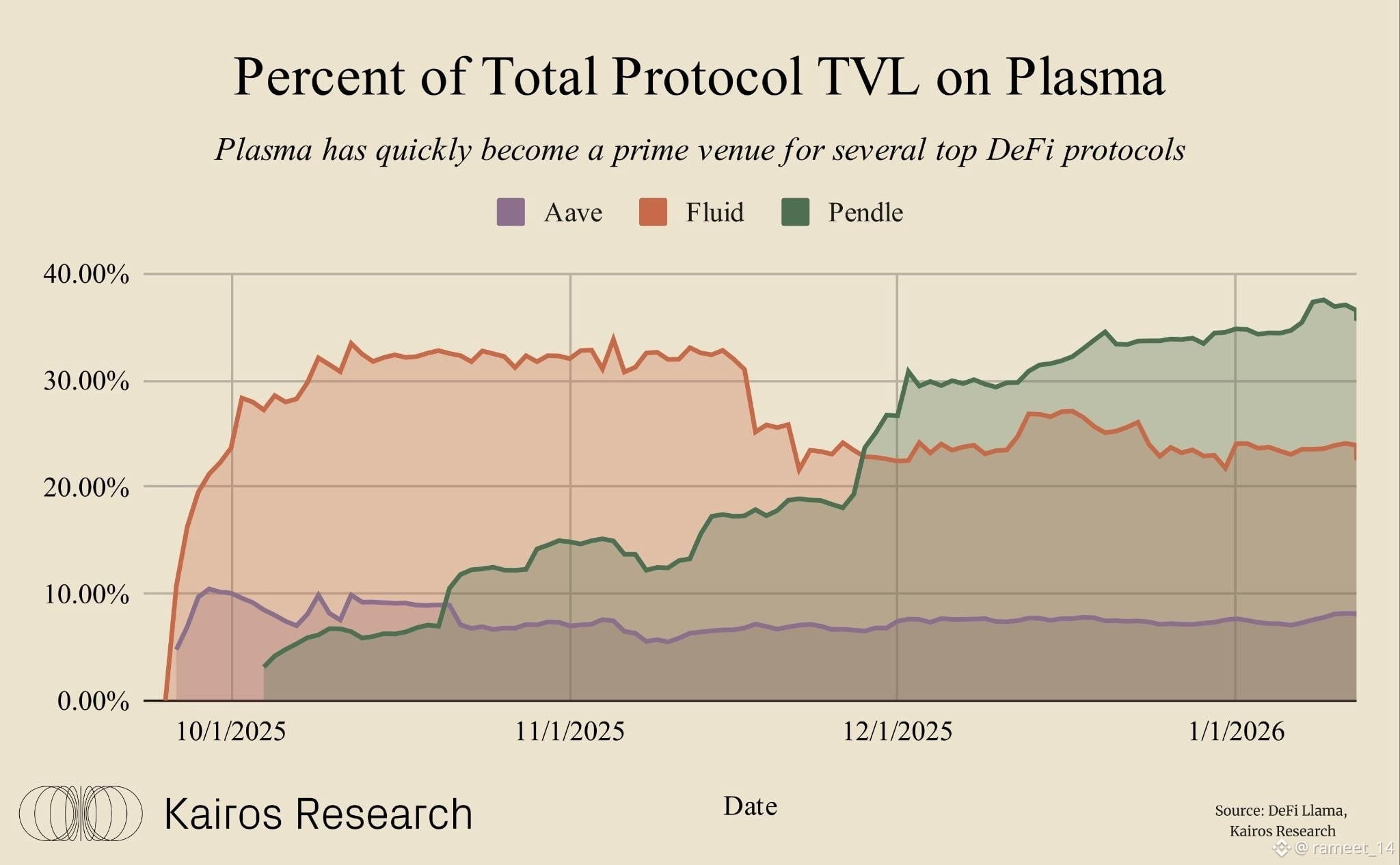

What’s more telling is how this share evolved. The time-series chart shows Fluid’s Plasma allocation ramping rapidly in October, stabilizing around the low-30% range, then settling into a durable ~22–25% band. This wasn’t a flash incentive spike followed by capital flight. It was discovery, followed by retention.

Fluid users appear to be making a clear judgment: Plasma offers execution conditions—cost, speed, and composability—that justify meaningful balance sheet exposure.

Pendle: Plasma Becomes a Core Yield Venue

Pendle now allocates 35.6% of its total protocol TVL to Plasma, second only to Ethereum at 44.6%. Arbitrum follows at 14%, with other chains barely registering.

This is remarkable for two reasons.

First, Pendle users are not casual participants. They are yield engineers—splitting principal and yield tokens, expressing duration views, and managing interest-rate risk. These users are highly sensitive to liquidity depth, execution reliability, and fee drag.

Second, the trendline is decisive. Pendle’s Plasma share climbs steadily from single digits in early October to the mid-30% range by January. No sharp reversals. No instability. Just consistent inflow.

That kind of curve doesn’t come from marketing. It comes from product-market fit.

The Plasma Pattern: Stablecoins First, Everything Else Follows

Across all three protocols, a common pattern emerges:

Plasma attracts stablecoin-heavy liquidity

That liquidity is actively used, not passively parked

Share growth is persistent, not incentive-dependent

This suggests Plasma is functioning as a settlement layer optimized for stable value transfer and credit, rather than a general-purpose chain trying to host everything at once.

Ethereum remains the ultimate balance sheet—deep, secure, and indispensable. But Plasma is carving out a complementary role: a place where capital works harder per dollar deployed.

In traditional finance terms, Ethereum looks like the global reserve system. Plasma looks like the high-throughput money market where balance sheets are actually run.

Why This Shift Matters

DeFi doesn’t move all at once. It moves by use case. First comes stablecoins. Then lending. Then structured yield. Then everything else.

The data shows Plasma is already winning the first three.

If this trajectory continues, future protocol launches won’t ask, “Should we deploy on Plasma?” They’ll ask, “How much should we allocate there on day one?”

Liquidity follows efficiency. Efficiency compounds. And right now, Plasma is quietly compounding faster than most of the market realizes.