Imagine a world where sending money feels like sending a message on WhatsApp. No fees eating your balance, no waiting for confirmations, no switching tokens just to pay gas, no worrying about network congestion or failed transactions. Just tap, send, done. That’s the world Plasma is trying to build, and if it succeeds, it might completely redefine how the global economy moves money

Plasma is not a regular blockchain. It isn’t trying to be the next Ethereum or the next Solana. It is built for one purpose only: to become the global highway for stablecoins. It wants to be the place where USDT, USDC, and other digital dollars flow instantly, smoothly, and without friction. In a crypto world filled with experiments, Plasma is building something that feels almost boring in the best possible way: reliable digital cash rails for billions of people.

What makes Plasma stand apart is how deeply it understands the real problem. Today, stablecoins are everywhere, but they live on blockchains designed for everything except payments. When you send stablecoins on most networks, you still have to hold the native token just to pay transaction fees. Ethereum fees can spike. Solana can stall. Tron is cheap but limited. None of them were built with stablecoins as the core ingredient. Plasma flips this completely. It is a chain where stablecoins are the main character, not a side actor. You want to send USDT? It’s free. You don’t need special tokens. You don’t need to care about gas. The network itself covers the cost. It feels like magic, but it’s actually clever engineering and a stablecoin-first approach.

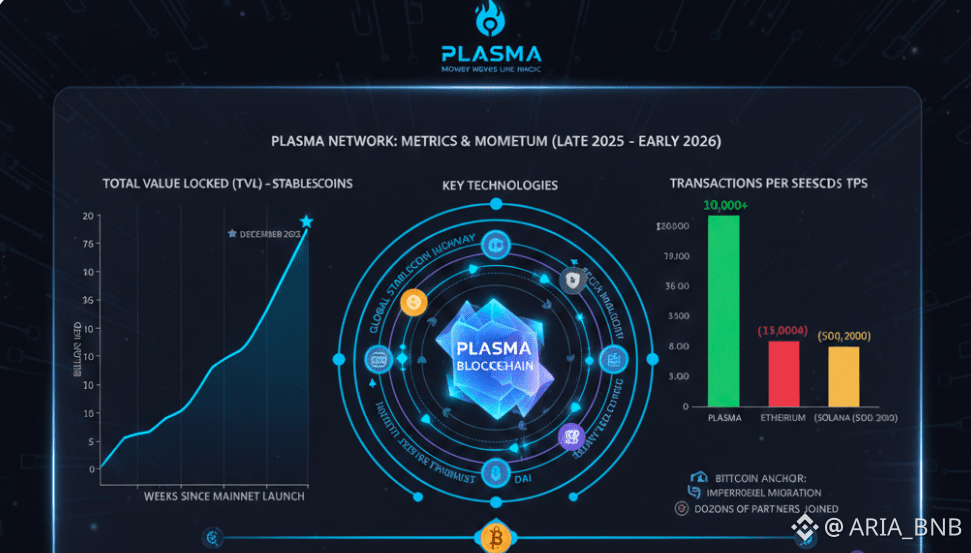

The technology under the hood pushes this vision forward with surprising power. Plasma uses PlasmaBFT, a super fast consensus system that finalizes transactions in less than a second. When you hit send, the transaction is done almost instantly. The network can handle thousands of transactions per second without breaking a sweat. And because it’s fully compatible with Ethereum, developers can bring over smart contracts, apps, and tools without rewriting a single line. Plasma basically says: if your app works on Ethereum, it works herebut faster, smoother, cheaper.

One of its boldest ideas is anchoring its security to Bitcoin. Every so often, the state of the Plasma chain is stamped onto the Bitcoin blockchain. That means even if someone tried to attack Plasma, the proof of its correct history lives forever in the most secure chain ever created. It’s like giving Plasma a shield made from Bitcoin’s armor. In a crypto world that often talks about decentralization but rarely delivers it, this design adds an extra layer of trust and neutrality.

Plasma launched its mainnet beta in late 2025, and the response was electric. Billions of dollars in stablecoins moved onto the network within days. Dozens of DeFi protocols integrated it. Wallets and exchanges added support. Payment companies and trading firms became partners. You could feel a shift in the air, as if the market had been waiting for something like this for a long time. A chain that finally treats stablecoins like real moneysimple, instant, and dependable.

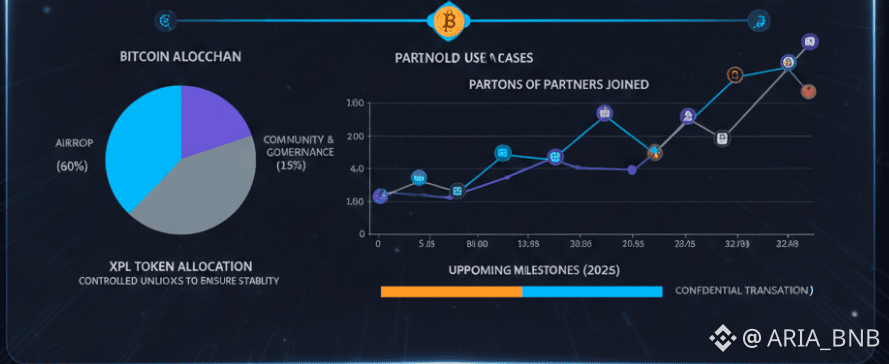

The builders behind Plasma designed the token economics to be practical rather than flashy. The native token XPL helps with governance, security, and premium transactions, but the average user can live entirely in stablecoins without touching it. A massive airdrop helped spread XPL to thousands of early users, and the controlled unlocks aim to avoid the chaotic token dumps seen in many other projects. The long-term focus is clear: build a stable, sustainable settlement layer for global finance.

But the true power of Plasma appears when you imagine the real-world use cases. Think about people sending money across borders with zero fees. Think about gig workers getting paid instantly after every job. Think about merchants settling payments in seconds instead of waiting days for bank transfers. Think about fintechs and banks plugging into a blockchain that is as fast as modern payment processors but as open as the internet. This isn’t science fictionPlasma is explicitly designed to make all of this possible.

Of course, no project is perfect, and Plasma faces real challenges. Stablecoins are becoming a favorite topic for regulators, and rules differ by country. Competing chains will try to imitate or outpace Plasma’s strategy. And supporting zero-fee stablecoin transfers at global scale requires constant refinement. But the Plasma team seems aware of these obstacles, treating them as engineering and policy problemsnot roadblocks.

What comes next might be the most exciting part. Plasma is preparing to activate its native Bitcoin bridge, allowing BTC to flow into the ecosystem in a trust-minimized way. Confidential transactions are on the horizon, giving users optional privacy without compromising compliance. More partners from payments, DeFi, and global commerce are joining every month. The network is shaping up not just as a blockchain, but as the backbone for a new kind of financial internet.

In a digital world that is slowly waking up to the idea of programmable money, Plasma feels like an inevitable evolution. A chain where money behaves the way people expect it to. Quick. Cheap. Reliable. Simple. A chain that doesn’t force users to learn crypto culture just to move value. A chain that finally understands that stablecoins are not just tokensthey are the future of money.

Plasma is building something deceptively powerful: a settlement layer where billions of dollars can move every day without friction. If it keeps growing at this pace, the way we send and receive digital money may change forever. Not with noise. Not with hype. But with quiet, efficient, unstoppable movementlike magic