Plasma makes more sense if you stop looking at it as “another chain” and instead look at the one thing it’s clearly obsessed with fixing: how unnatural stablecoin payments still feel on crypto rails.

Most people who hold USDT don’t want to learn anything new. They don’t want to acquire a second token just to move the first one. They don’t want to guess fees or wait to see if a transaction “sticks.” They want money to behave like money. Plasma is built around that very ordinary expectation, and that’s why it feels different from most Layer 1s. It’s not chasing novelty; it’s chasing normality.

That choice explains almost everything else. Plasma doesn’t try to reinvent execution. EVM compatibility via Reth is the least controversial decision it could make, and that’s intentional. Developers don’t need another environment to learn. Infrastructure teams don’t need another stack to maintain. Plasma is saying, quietly, that execution is a solved problem and that the real pain is at the settlement layer—finality, reliability, and fee behavior under real-world conditions.

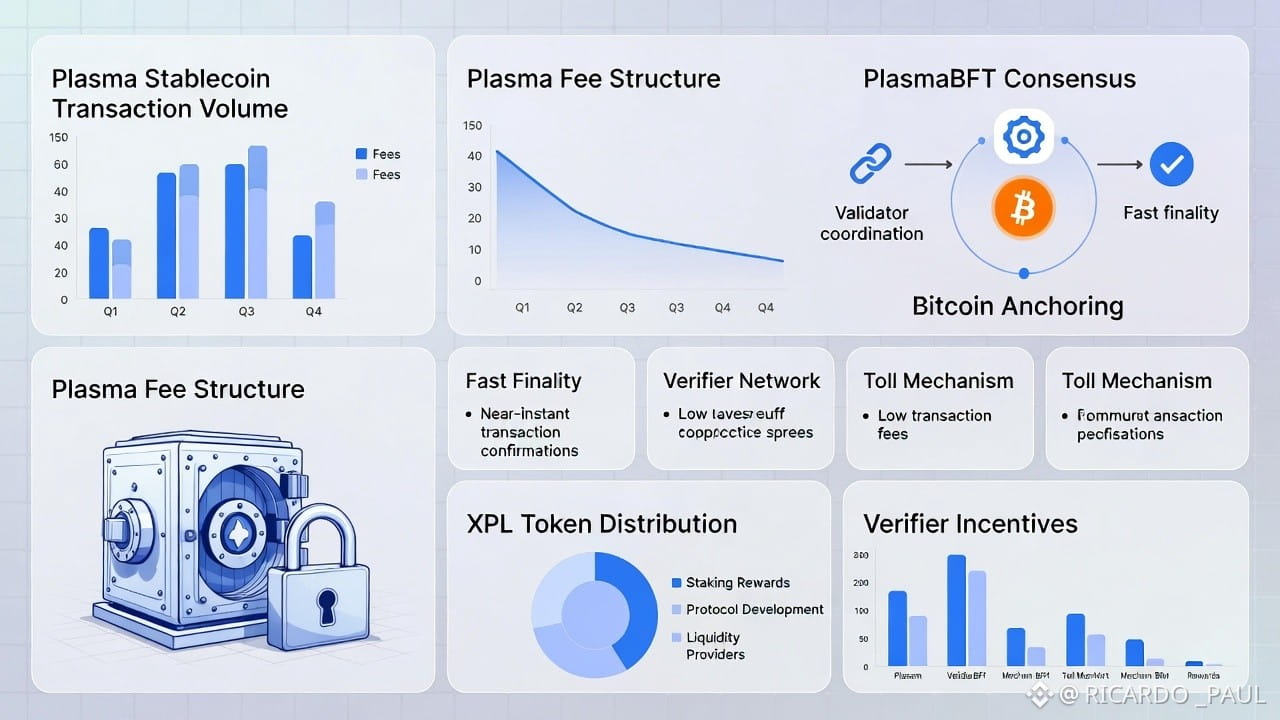

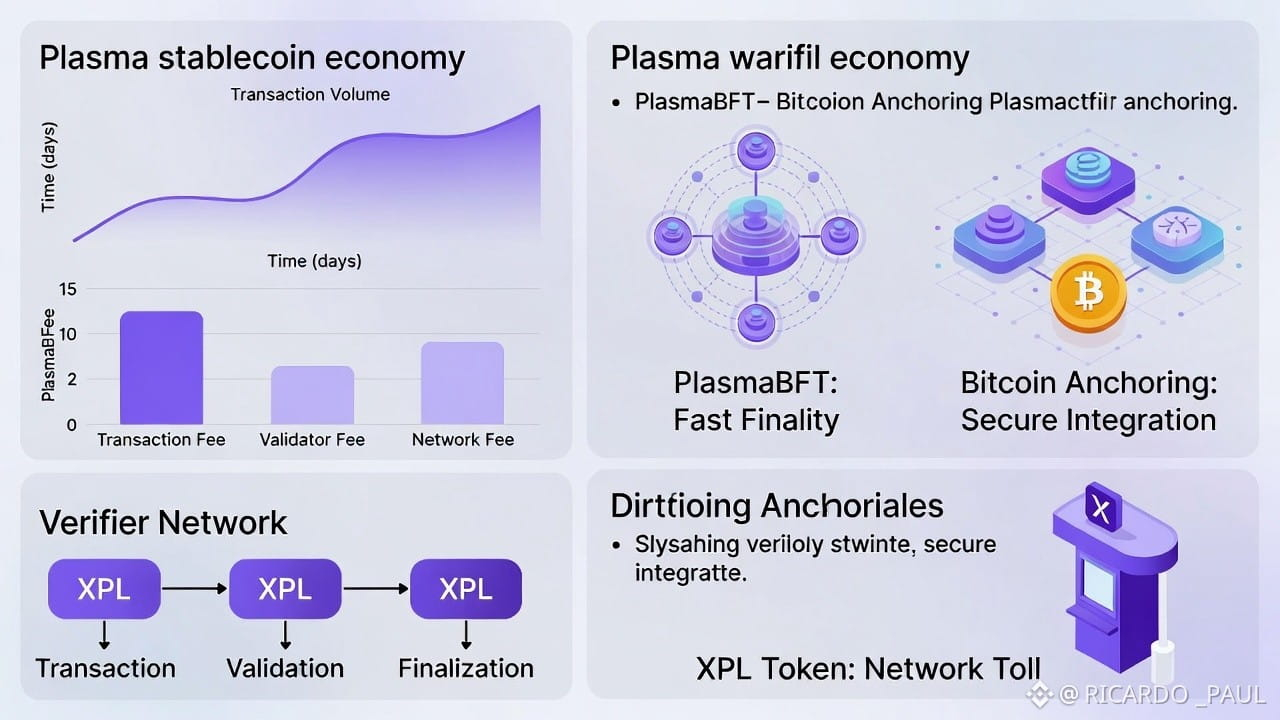

Fast finality is where Plasma starts to show its priorities. Payments don’t work if finality is probabilistic or delayed. PlasmaBFT aims to make “confirmed” actually mean something, and that comes with trade-offs Plasma doesn’t hide. Fast BFT systems usually require tighter coordination and cleaner validator operations. Plasma’s phased approach—starting with a more managed validator set and expanding later—isn’t ideological decentralization, but it is operationally honest. Reliability comes first because payments break when infrastructure behaves unpredictably.

That honesty also shows up in how Plasma treats validators. There’s less appetite for harsh stake slashing and more emphasis on reward-based incentives. That’s a concession to institutional realities. Large operators do not tolerate unpredictable capital loss. But it also means Plasma’s security model leans more on operator quality, incentives, and governance than on brute-force economic punishment. That can work, but only if validator diversity becomes real and not cosmetic.

The Bitcoin angle fits into this same pattern. Plasma talks about Bitcoin anchoring and neutrality, but what exists today is better understood as an integration pathway than a security inheritance. Verifier networks, attestations, and MPC-style controls can expand liquidity and narrative alignment, but they also introduce their own trust surfaces. Bitcoin doesn’t magically make a system neutral. People and processes still sit in the middle, and the real test will be how much power any single group has over withdrawals, pauses, or censorship when things get stressful.

Where things get genuinely tricky is the token.

Plasma’s user experience is designed to make XPL disappear. Gasless USDT transfers mean users don’t need it. Stablecoin-paid gas means users still don’t need it. From a human perspective, that’s fantastic. From a token economics perspective, it’s dangerous.

If users never touch XPL, then XPL must justify itself somewhere else. Security is the obvious answer—validators and delegators need it. But security alone isn’t enough if the system’s economic center of gravity lives entirely in stablecoins. The hard question isn’t whether XPL is “used,” but whether real activity on Plasma creates unavoidable demand for it.

Right now, a lot of Plasma’s activity can exist without ever pulling on the token. That means XPL’s long-term value has to come from deliberate design, not from assumption. Either staking must matter at scale and stay meaningfully decentralized, or stablecoin flows must be converted into token scarcity or yield through fees, burns, or monetized infrastructure layers. Without that conversion, XPL risks becoming a token that secures a network whose users never need it.

Tokenomics doesn’t rescue this story by itself. The supply schedule is clear enough to make one thing obvious: unlocks and distributions matter far more in the near term than inflation mechanics. Ecosystem tokens flow, incentives get paid, and that creates constant selling pressure unless there’s organic demand pushing back. That demand can’t be subsidized forever. Eventually, the network has to pay for itself.

This is why raw activity metrics are less impressive than they look. A chain can process a huge number of transactions and still capture very little economic value if fees are abstracted away or subsidized. For Plasma, that’s not a failure—it’s a design choice. But it raises the bar for what must come next. If fees remain tiny and the paymaster remains a cost center rather than a revenue engine, the security budget stays external rather than endogenous.

Plasma’s real competitive position isn’t technical novelty. It’s whether it can become boringly reliable for stablecoin settlement while everyone else optimizes for speculation, throughput charts, or developer slogans. That’s a legitimate niche. It’s also a niche that can be copied by anyone with enough capital and patience. Plasma’s defensibility will come from execution quality, institutional trust, and distribution—not from clever cryptography.

The uncomfortable truth is that Plasma can absolutely succeed as a payments rail and still leave XPL in a fragile position. That outcome is common in systems where the product is human-friendly but the token is economically optional.

For XPL to become durable, Plasma has to do something subtle but essential: build a toll into the system that users don’t feel, but the economy does. Stablecoin movement must eventually strengthen the security asset, either by reducing its supply or by increasing the rewards for holding and staking it in a way that cannot be bypassed.

If Plasma closes that loop, XPL becomes the quiet backbone of a real settlement network. If it doesn’t, Plasma may still work—but the token will always be chasing the economy rather than anchoring it.