In the evolving landscape of blockchain infrastructure, specialization is becoming a defining theme of 2025–26 innovation cycles. Among the most notable of these, Plasma has emerged not as another generic Layer-1, but as a purpose-built stablecoin settlement layer designed to make digital dollars behave like real money — transferable, low-friction, and infrastructure-grade.

Vision & Core Infrastructure

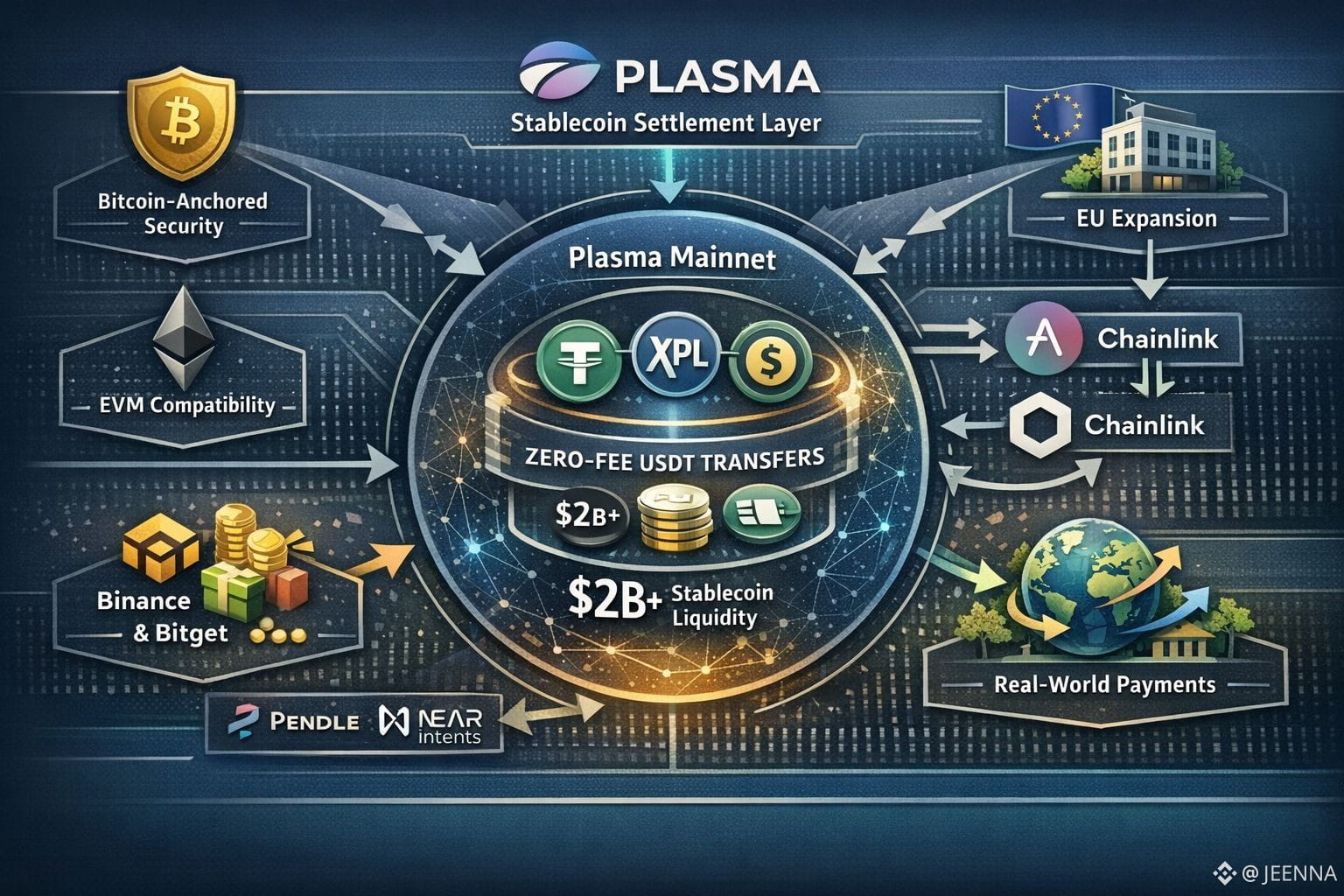

Plasma’s architecture centers around a simple yet profound idea: stablecoins are the primary money of Web3 — and they need rails that are native, efficient, and scalable. Unlike general-purpose chains that treat money as just one of many use cases, Plasma positions stablecoin movement as the foundational economic activity of the network.

At the technical core:

Stablecoin-First Design: Transfer mechanics prioritise zero-fee USD₮ (USDT) transactions through chain-native logic, eliminating traditional gas token requirements for basic money flows. This removes a key pain point keeping stablecoin transfers from feeling like “real money.”

Full EVM Compatibility: Developers familiar with Ethereum tooling (Hardhat, Foundry, MetaMask, etc.) can deploy, test, and migrate smart contracts without relearning new paradigms — lowering friction for adoption.

Sub-Second Finality: Fast transaction settlement ensures predictable outcomes for payments and settlements, critical for real-world merchant use, cross-border flows, and high-frequency transfers.

Bitcoin-Anchored Security: Plasma inherits security properties from the Bitcoin ecosystem while offering modern programmability — a hybrid aimed at trust and neutrality.

Collectively, these design choices position Plasma less as “another blockchain” and more as infrastructure for actual money movement.

Mainnet Beta & Liquidity Foundations

Plasma achieved one of 2025’s most significant mainnet launches when it deployed its mainnet beta on September 25, 2025, alongside the introduction of its native XPL token.

Key achievements at launch included:

$2 + billion in stablecoin liquidity on day one, distributed across a broad swath of DeFi protocols such as Aave, Ethena, Fluid, and Euler.

Zero-fee USDT transfers enabled directly through the Plasma dashboard — reflecting the core settlement-rail design.

Integration with 100 + DeFi partners providing lending, trading, and liquidity infusion from the outset.

This depth of stablecoin liquidity from day one is rare among nascent networks and was a strategic foundation for Plasma’s market positioning as a stablecoin settlement hub rather than a speculative Layer-1 novel chain.

Ecosystem Evolution & 2026 Strategic Developments

Cross-Chain Integrations

In January 2026, Plasma announced integration with NEAR Intents, a cross-chain liquidity protocol that connects Plasma’s assets including XPL and its stablecoin USDT0 to a pool representing over 125 assets across 25 + blockchains. This integration reduces traditional bridging friction and expands stablecoin reach into multiple ecosystems.

DeFi Partnerships

DeFi protocols are layering on Plasma’s settlement logic. Notably, Pendle Finance expanded its yield products through a Plasma integration, launching new staking and governance token utility aligned to fixed-yield frameworks.

Community & Incentive Programs

To stimulate engagement, Binance’s CreatorPad launched a campaign focused on Plasma content — driving educational incentives and network awareness through token distribution mechanics.

Tokenomics & Native Utility

The XPL token serves several pivotal roles within Plasma’s economy:

Gas & Settlement Token: While fees for basic USD₮ transfers are abstracted, XPL remains essential for sophisticated operations and welfare incentives.

Staking & Consensus Security: Validators stake XPL to secure the network and earn rewards, underpinning the network’s decentralised security model.

Governance & Economic Alignment: Token holders participate in protocol upgrades, fee model determinations, and treasury considerations.

Market data suggests XPL continues trading with consistent institutional interest, with notable market capitalisation and trading volumes reflecting real utility adoption rather than pure speculation.

Challenges & Forward Momentum

Despite its technical and liquidity foundations, Plasma’s journey isn’t without headwinds:

Real-world deployment requires sustained stablecoin flows that transcend high-yield farming incentives — i.e., merchants, payment processors, and enterprise rails.

Regulatory clarity — particularly in jurisdictions applying stablecoin controls — remains an industry barometer for adoption.

Competition from established chains with entrenched stablecoin volumes continues to test Plasma’s differentiation.

However, strategic integrations, cross-chain accessibility, and a settlement-first architectural ethos position Plasma to translate infrastructure utility into real usage over mere speculative interest.

Conclusion

Plasma’s evolution in late 2025 and early 2026 reflects a deliberate shift from narrative to infrastructure. Its stablecoin-native design makes USD-pegged assets easy and predictable to move — a fundamental requirement for any money rail. With deep initial liquidity, expanding cross-chain connectivity, and growing DeFi integrations, Plasma stands at a crossroads between on-chain experimentation and practical, high-frequency money movement infrastructure.

Whether Plasma’s vision fully matures will depend less on headlines and more on consistent flows of stablecoins into real payment and settlement use cases — the true test of any money rail in the digital age.