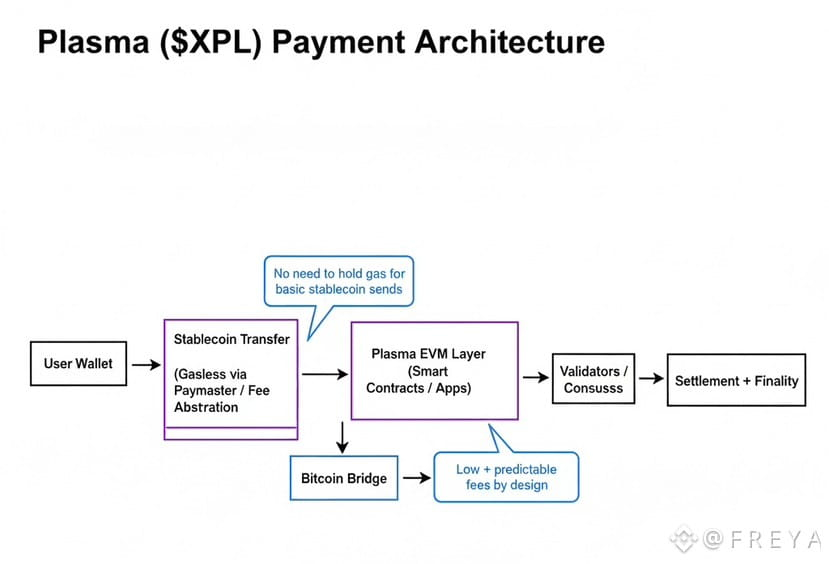

Most blockchain projects start with whitepaper promises then spend years debugging why performance doesn’t match specifications. Plasma engineering team made series of counterintuitive technical decisions that individually seem incremental but collectively transform how stablecoin infrastructure operates at scale. The choice to implement Fast HotStuff consensus variant optimized for two-phase commits rather than traditional three-phase approach, the decision to anchor state roots directly to Bitcoin blockchain while maintaining independent consensus, and the protocol-level paymaster enabling zero-fee USDT transfers each required rejecting conventional wisdom about what blockchains should prioritize. I’m examining how these architectural choices interconnect creating system where technical constraints actively reinforce design goals rather than fighting against them.

The March twenty-sixth twenty twenty-five technical reveal explained PlasmaBFT as pipelined implementation of Fast HotStuff consensus algorithm distinguishing itself through parallelization of proposal, vote, and commit processes into concurrent pipelines. Traditional Byzantine Fault Tolerant systems require every validator node send multiple back-and-forth confirmations creating communication overhead that scales quadratically with network size. They’re discovering that HotStuff’s leadership-based approach where single validator proposes block and others vote in single step dramatically reduces message complexity from quadratic to linear. The innovation enabling Plasma’s sub-second finality involves recognizing that HotStuff’s third confirmation phase frequently proves unnecessary when leader behaves honestly and network remains responsive, allowing consensus to complete in just two communication rounds during normal operation while maintaining safety guarantees when conditions deteriorate.

The Mathematical Foundation Behind Rapid Consensus Achievement

The security assumptions underlying PlasmaBFT follow classic Byzantine Fault Tolerance mathematics where total number of replicas must satisfy n greater than or equal to three f plus one, required quorum size equals two f plus one, and maximum Byzantine nodes equals floor of n minus one divided by three. This mathematical relationship means network tolerates up to one-third of validators acting maliciously or failing completely while remaining operational. The practical implementation written in Rust for performance optimization achieves deterministic finality typically within seconds rather than probabilistic confirmations gradually strengthening over time. The distinction matters enormously for payment systems where merchants need absolute certainty that transaction cannot reverse before releasing goods or services.

The Quorum Certificate mechanism plays central role in high-performance consensus by aggregating individual validator votes into single cryptographic proof that sufficient validators endorsed specific block. When leader proposes new block, validators independently verify transactions and sign approval if block passes validation. Once enough signatures accumulate to reach quorum threshold, they’re combined into QC providing mathematical proof that consensus was achieved without requiring anyone verify individual signatures from each validator. The aggregation transforms potentially hundreds of signatures into single compact proof that anyone can verify efficiently, enabling light clients and applications to confirm finality without processing full validator set communications. If it becomes standard that applications can verify finality through lightweight proofs rather than monitoring entire validator network, the scalability improvements enable consumer applications that current blockchain infrastructure cannot support.

The view change handling through Aggregated Quorum Certificates addresses scenario where current leader fails or behaves maliciously requiring replacement. When validators detect leader problem, they forward their most recent QC to newly elected leader who combines these into AggQC certifying highest block state observed across network. This aggregation prevents new leader from equivocating about blockchain state by providing cryptographic proof of what previous leader accomplished before failure. The approach differs from threshold signatures used in original HotStuff because only two signatures require validation under normal case rather than verifying threshold reconstruction, reducing computational overhead during leader transitions. The optimization matters because frequent leader changes would otherwise degrade performance significantly, but efficient handling means protocol can rotate leadership proactively for fairness without sacrificing throughput.

The Bitcoin Sidechain Architecture Creating Security Foundation

The decision to build as Bitcoin sidechain rather than independent chain or Ethereum Layer Two solution reflected conviction that Bitcoin’s proof-of-work consensus provides unmatched settlement finality for high-value transactions. Plasma periodically anchors state roots summarizing its transaction history directly to Bitcoin blockchain through op_return transactions. Once this data embeds in Bitcoin block that achieves sufficient confirmations, Plasma’s history inherits security and finality guarantees of Bitcoin’s accumulated proof-of-work representing billions of dollars in capital expenditure on mining hardware. The inheritance means reversing Plasma transactions requires attacking Bitcoin network itself, practically impossible given economic incentives protecting world’s most secure blockchain.

The verification network for Bitcoin bridge consists of independent entities including stablecoin issuers and infrastructure providers each running full Bitcoin node and indexer monitoring blockchain for deposit transactions. When user sends BTC to Plasma-controlled address, verifiers independently detect transaction, confirm sufficient confirmations occurred, and attest to deposit validity. The distributed observation means no single entity controls bridge security, eliminating central points of failure that plagued earlier wrapped Bitcoin implementations where custodian bankruptcy or misconduct could trap user funds. The LayerZero Omnichain Fungible Token standard used for pBTC issuance enables single token instance to move across multiple chains without being rewrapped into synthetic variants, maintaining liquidity unity rather than fragmenting across isolated pools on different networks.

The withdrawal process demonstrates careful attention to security where users burn pBTC on Plasma and submit withdrawal request specifying destination Bitcoin address. Verifiers confirm burn transaction occurred legitimately then employ threshold signature scheme using multi-party computation or threshold Schnorr signatures enabled by Bitcoin’s Taproot upgrade. The cryptographic construction ensures no single verifier ever holds complete private key necessary to release locked Bitcoin, distributing trust across entire verifier set. The circuit breakers and rate limits provide additional safeguards responding to edge cases where abnormal withdrawal patterns might indicate compromise, automatically throttling operations until human review can occur. They’re building defense-in-depth where multiple independent security layers must simultaneously fail before user funds face risk.

The roadmap includes potential migration toward BitVM-style verification enabling deeper trust minimization through onchain verification circuits. The research teams at Alpen Labs and Citrea pioneering BitVM approaches demonstrate that Bitcoin scripts can verify complex computations despite language’s intentional limitations. If Bitcoin Core eventually enables OP_CAT opcode currently under consideration, the expanded scripting capabilities would enable more sophisticated verification logic directly in Bitcoin. Plasma documentation explicitly states they’re monitoring these developments and positioned to upgrade bridge design as techniques mature and demonstrate battle-testing in production environments. We’re seeing recognition that trust minimization exists on spectrum rather than binary choice, with pragmatic selection of best available approach at each development stage while maintaining upgrade path toward stronger security assumptions.

The Protocol-Level Paymaster Eliminating User Friction

The zero-fee USDT transfer capability represents more than marketing differentiator but fundamental architectural choice embedding payment sponsorship directly into protocol rather than relying on external services. The ERC-20 paymaster system uses trusted oracles to compute gas prices and perform internal conversion from whitelisted tokens like USDT or pBTC into native XPL required for validator compensation. The conversion happens transparently without markup fees or trust requirements typical of third-party gas abstraction services where users must accept additional counterparty risk and potential surveillance. The protocol-level implementation means mechanism operates reliably regardless of external service availability, eliminating dependency on centralized providers whose business interests might misalign with user needs.

The practical user experience means person receiving USDT can immediately send portion to someone else without first acquiring XPL from exchange, configuring wallet to hold multiple tokens, or understanding gas fee mechanics. The elimination of “prepare gas first” step removes barrier that prevents mainstream adoption by audiences unfamiliar with blockchain mechanics who simply want to transact in stablecoins without learning technical implementation details. The design philosophy recognizes that successful payment infrastructure should feel invisible to users, similar to how person using credit card doesn’t need understand interchange fee networks, settlement systems, or fraud detection algorithms operating behind scenes. If it becomes reality that billion users transact with stablecoins without knowing blockchain enables those transactions, the infrastructure succeeds precisely through its transparency.

The selective application of fee sponsorship only for USDT transfers while charging standard gas for complex operations like contract deployment or DeFi interactions demonstrates careful economic design. The protocol cannot sustainably subsidize all computation because validator infrastructure requires compensation to remain operational. The targeting of simple payment transactions where gas costs represent small absolute amounts but create disproportionate friction enables meaningful user experience improvement without unsustainable economics. The validator compensation from complex transactions and XPL staking rewards ensures network security remains properly incentivized even while basic transfers flow freely. The mathematics only work if volume of subsidized transactions remains manageable relative to fee-generating activity, creating natural limit on how much free usage protocol can support before economics force reconsideration.

The future confidential payments module under active research addresses privacy requirements for use cases like payroll and business-to-business settlements where transaction amounts and recipient identities contain commercially sensitive information. The planned implementation using stealth addresses and verifiable proofs aims to shield sensitive data while preserving auditability for compliance purposes. The design goals explicitly include implementation in standard Solidity enabling any developer to integrate privacy features, opt-in nature allowing users choose appropriate privacy level for each transaction, full composability with existing DeFi protocols avoiding fragmentation into isolated privacy pools, and alignment with regulatory needs for demonstrating compliance without exposing unnecessary details. They’re recognizing that privacy and compliance represent competing requirements demanding careful balance rather than absolute maximization of either dimension.

The Execution Layer Enabling Familiar Development Experience

The choice to build execution environment on Reth high-performance Ethereum client written in Rust rather than developing custom virtual machine from scratch reflected pragmatic recognition that Ethereum Virtual Machine compatibility matters more than theoretical performance advantages. The modular architecture means developers deploy contracts using standard Solidity without modifications from Ethereum mainnet, leverage existing tools like Hardhat and Foundry without learning new frameworks, and connect through familiar wallets like MetaMask without custom integrations. The compatibility eliminates switching costs that prevent developers from experimenting with alternative chains even when those chains offer superior technical characteristics. If talented Solidity developers must learn entirely new programming languages and rebuild toolchains to try Plasma, most won’t bother regardless of infrastructure advantages.

The Rust implementation provides memory safety guarantees and performance characteristics that JavaScript or Python-based clients cannot match. The language’s ownership system prevents entire classes of bugs related to memory management, data races, and concurrent access that plague systems written in languages with manual memory control or garbage collection. The performance matters because execution layer must process thousands of transactions per second during peak demand without becoming bottleneck limiting overall system throughput. The modular design means different components can be optimized independently, potentially swapping execution client entirely if better alternatives emerge without disrupting consensus or other layers. We’re seeing maturation toward loosely coupled architectures where improvement in one subsystem doesn’t require coordinating changes across entire codebase.

The pipelining of consensus stages represents sophisticated optimization where new block proposals begin before previous block fully commits, creating continuous stream of work flowing through system rather than sequential processing waiting for each stage to complete before next begins. The parallelization works because different blocks exist at different stages simultaneously with proposals for block N plus two occurring while block N plus one undergoes voting and block N reaches final commitment. The overlap increases throughput dramatically compared to sequential processing where validators sit idle waiting for current stage to complete before starting next. The approach requires careful coordination ensuring blocks don’t reference state that hasn’t finalized yet, but when implemented correctly the throughput gains justify additional complexity.

The deterministic finality achieved through Byzantine Fault Tolerant consensus contrasts sharply with probabilistic finality in proof-of-work chains where transactions gradually become more secure as additional blocks build on top but never achieve absolute irreversibility. The distinction matters enormously for payment applications where merchants need definitive answer about whether transaction succeeded before releasing goods. The probabilistic model forces waiting periods where transactions remain theoretically reversible creating friction in user experience and operational complexity in merchant systems. The deterministic approach provides cryptographic proof that transaction finalized and cannot reverse, enabling instant settlement without waiting periods or risk management processes accounting for potential reversals. If it becomes standard that blockchain payments settle with same finality as cash handoff, the user experience improvements enable adoption scenarios impossible with probabilistic systems.

Reflecting On Architecture Choices Defining Infrastructure Limitations

The engineering decisions underlying Plasma collectively prioritize specific use cases while explicitly accepting limitations in other dimensions. The stablecoin-focused optimization means protocol performs exceptionally for high-volume payment workloads but offers no advantages for general computation or complex smart contract logic compared to Ethereum or other chains. The specialization creates competitive moat for target applications while acknowledging that attempting everything leads to mediocrity everywhere. The strategic discipline of defining what protocol won’t do matters as much as capabilities it provides because limited development resources must focus on delivering excellence in core competencies rather than spreading thin across features that don’t differentiate.

The Bitcoin sidechain architecture brings security benefits but also introduces complexity and trust assumptions absent in independent chains. The verifier network requires maintaining sufficient decentralization to prevent collusion while ensuring operational reliability so bridge doesn’t become unavailable during validator failures. The threshold signature schemes distributing trust across multiple parties protect against individual verifier compromise but create coordination challenges when validators need to rotate keys, upgrade software, or respond to security incidents. The trade-offs involved in bridge security represent ongoing research area where improvements in cryptographic techniques and Bitcoin scripting capabilities may enable stronger trust minimization over time, but current implementation requires accepting specific security model that differs from alternatives like full Bitcoin validation through BitVM.

The protocol-level paymaster enabling zero-fee USDT transfers creates user experience advantage but introduces economic sustainability questions around whether fee structure generates sufficient validator compensation as network scales. The subsidization works when volume of free transactions remains small relative to fee-generating activity, but growth trajectory where free usage dramatically outpaces paid computation could force uncomfortable economic adjustments. The network effects from free transfers may create sufficient lock-in that future fee introduction becomes tolerable to users who already depend on infrastructure, or competition from other chains offering similar subsidies may prevent sustainable economics from ever emerging. The resolution of this tension will determine whether zero-fee transfers represent durable competitive advantage or unsustainable promotional offer that must eventually end.

The future of Plasma depends on technical architecture proving robust at scale while ecosystem development creates applications that leverage unique capabilities rather than treating Plasma as interchangeable alternative to Ethereum or Solana. The consensus optimizations, Bitcoin integration, and paymaster system collectively enable payment applications that cannot operate efficiently on general-purpose chains, but market must validate that specialized infrastructure captures meaningful value rather than marginal improvements over existing solutions. The coming years will reveal whether engineering excellence in targeted niche creates defensible position or whether network effects and developer communities on general-purpose chains outweigh technical advantages of specialization. The answer matters not just for Plasma but for broader question of whether blockchain infrastructure future consists of specialized purpose-built chains or universal platforms attempting to serve all use cases adequately if not optimally.