Vanar isn’t trying to win an argument inside crypto. It’s trying to make crypto stop feeling like crypto.

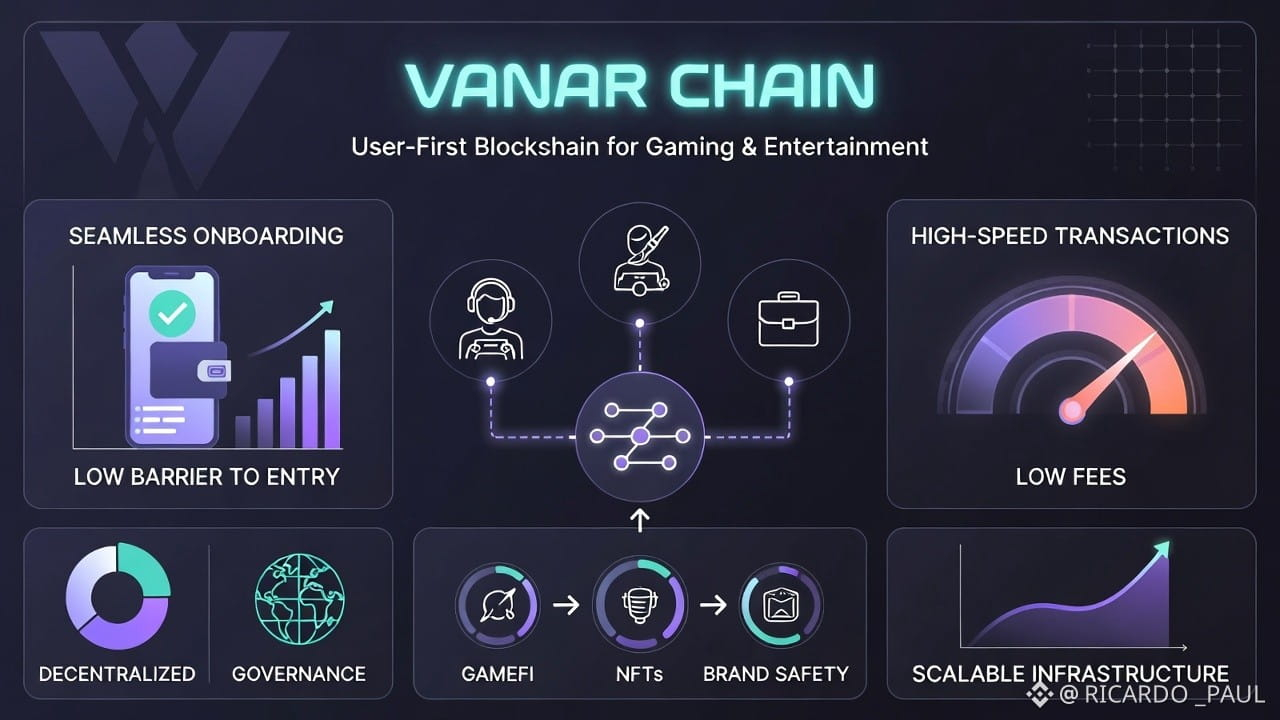

Most blockchains are built by engineers for other engineers. They assume the user will tolerate friction, confusion, and volatility because “that’s just how decentralized systems work.” But real people don’t think like that. A gamer doesn’t care why fees went up. A brand doesn’t care about blockspace theory. A creator doesn’t want to learn five tools just to publish something once.

Vanar starts from that frustration. The idea isn’t to educate the next three billion users about Web3. The idea is to build something they can use without thinking about it at all.

That’s why Vanar positions itself as a Layer-1 designed for real-world adoption. Not as a slogan, but as a design constraint. Predictable behavior matters more than theoretical purity. Consistency matters more than novelty. If an app works today, it should work tomorrow, without surprise costs or broken dependencies. Vanar is built around that expectation.

Under the hood, Vanar doesn’t try to reinvent everything. It leans into EVM compatibility because developers already know how to build there. That’s not exciting, but it’s practical. The goal isn’t to force developers to learn a new paradigm; it’s to remove excuses not to ship. Familiar tooling, fast confirmations, and stable execution are all part of making the chain feel less like an experiment and more like infrastructure.

There is, however, a very real trade-off baked into this approach. Vanar prioritizes performance and reliability early on, which means tighter control over validation and governance in the beginning. This makes the network smoother and easier to manage, but it also means users are trusting the system to open up over time. That promise matters. If decentralization remains theoretical, the trust cost becomes permanent. Vanar’s long-term credibility depends on whether it actually follows through on expanding validator participation and community control.

Where Vanar starts to feel genuinely different is in how it thinks about data. Most blockchains are good at moving tokens but awkward with information. Data usually lives off-chain, scattered across storage systems and APIs that quietly reintroduce centralization. Vanar’s Neutron concept tries to tackle that directly by treating data as something that should be durable, searchable, and verifiable, without giving up privacy.

The more grounded way to understand this isn’t “AI lives on-chain.” That phrase gets thrown around too easily. The more realistic interpretation is that Vanar wants data to stop being fragile. If information can be anchored, compressed, and referenced in a way that applications and AI tools can reliably interact with, you unlock an entirely different class of products. Things like personal AI memory, brand archives, or long-lived consumer data stop depending on centralized servers that can disappear or change the rules.

This matters because real adoption doesn’t come from DeFi dashboards alone. It comes from tools people use because they solve a problem in their daily lives. If Vanar can make data storage and interaction feel boringly reliable, it becomes useful in ways most chains never touch.

The VANRY token sits underneath all of this, and its role is more nuanced than just “pay gas.” Yes, it’s used for transactions and staking, and yes, it supports validator incentives and governance. That’s table stakes for an L1. What really determines whether VANRY matters long-term is whether it becomes economically tied to actual usage.

If people and applications use Vanar products, and VANRY is the most efficient way to access those products, then demand becomes organic. Discounts, access rights, or revenue-linked mechanisms only matter if the underlying services are genuinely valuable. Tokens don’t create demand by themselves; products do.

One subtle but important point is that Vanar deliberately tries to shield users from token volatility by stabilizing fees. That’s great for adoption, but it also means token value capture doesn’t automatically scale with usage the way it might on other chains. VANRY’s success depends more on staking demand, network security needs, and product-driven consumption than on simple fee pressure. That’s a harder path, but also a more honest one.

Zooming out, Vanar’s biggest strength and biggest risk are the same thing. It’s trying to be usable first and ideological later. That can unlock mainstream adoption, but it also requires discipline, transparency, and follow-through. Infrastructure projects don’t earn trust through hype cycles; they earn it through consistency over years.

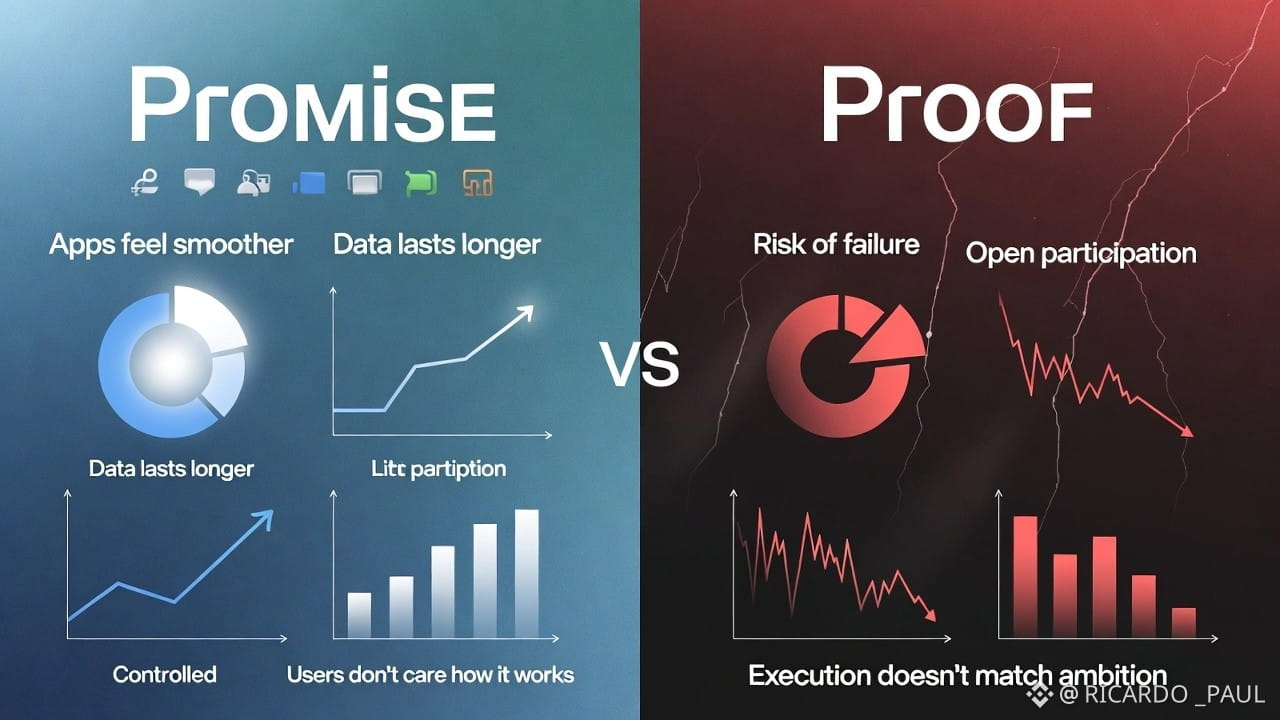

If Vanar succeeds, it won’t be because it shouted the loudest. It will be because apps built on it feel smoother, data lasts longer, and users don’t have to care how the system works underneath. In that world, VANRY isn’t a speculative symbol; it’s just part of how things function.

If Vanar fails, it won’t be because the idea was wrong. It will be because execution didn’t match ambition, or because the network never fully crossed the bridge from controlled performance to open participation.

Right now, Vanar sits in that uncomfortable middle space between promise and proof. The thesis makes sense. The direction is clear. What remains is the hard part: turning all of this into something people rely on without thinking about it.

That’s what real adoption looks like.