Vanar comes across like a blockchain team that started from the part most projects leave for later: how do you make this usable for normal people? Not “crypto people,” but players clicking through a game, fans collecting a digital item, or a brand running a campaign that has to work the same way every time. If you build for that audience, you can’t hand-wave away things like random fee spikes, slow confirmations, or confusing wallet moments. Those aren’t minor inconveniences in consumer products—they’re the reasons people bounce.

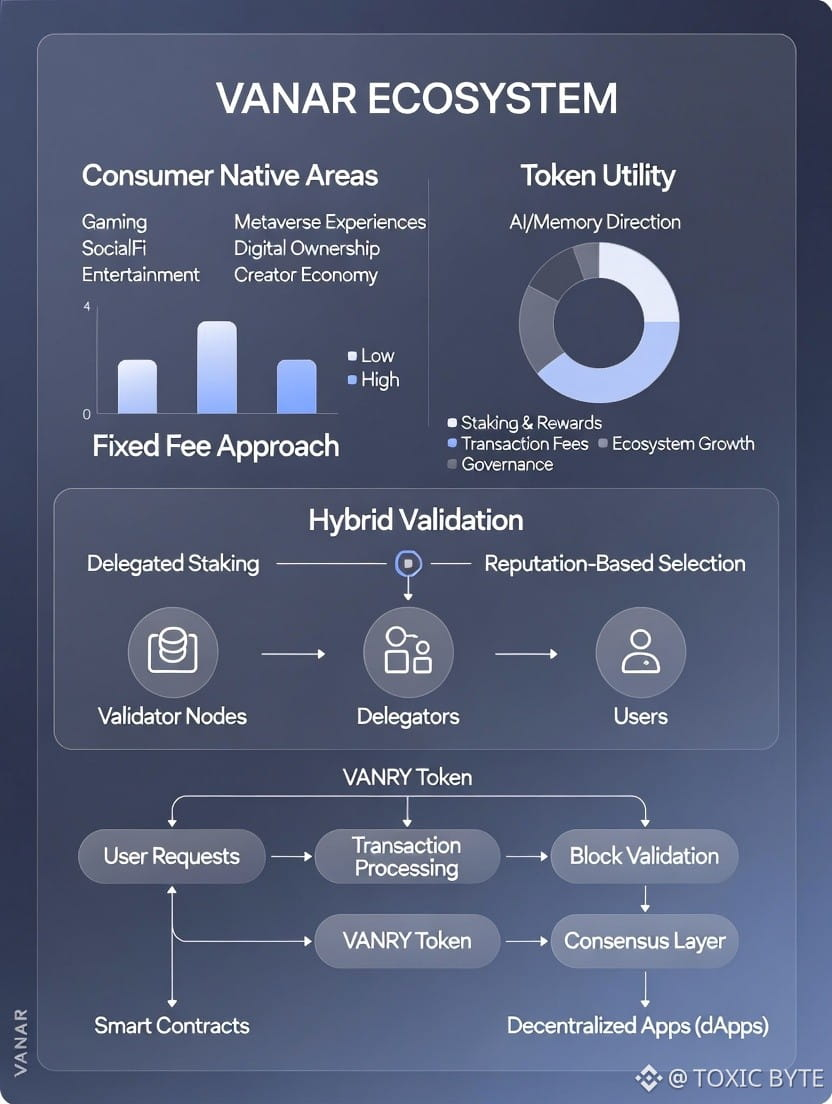

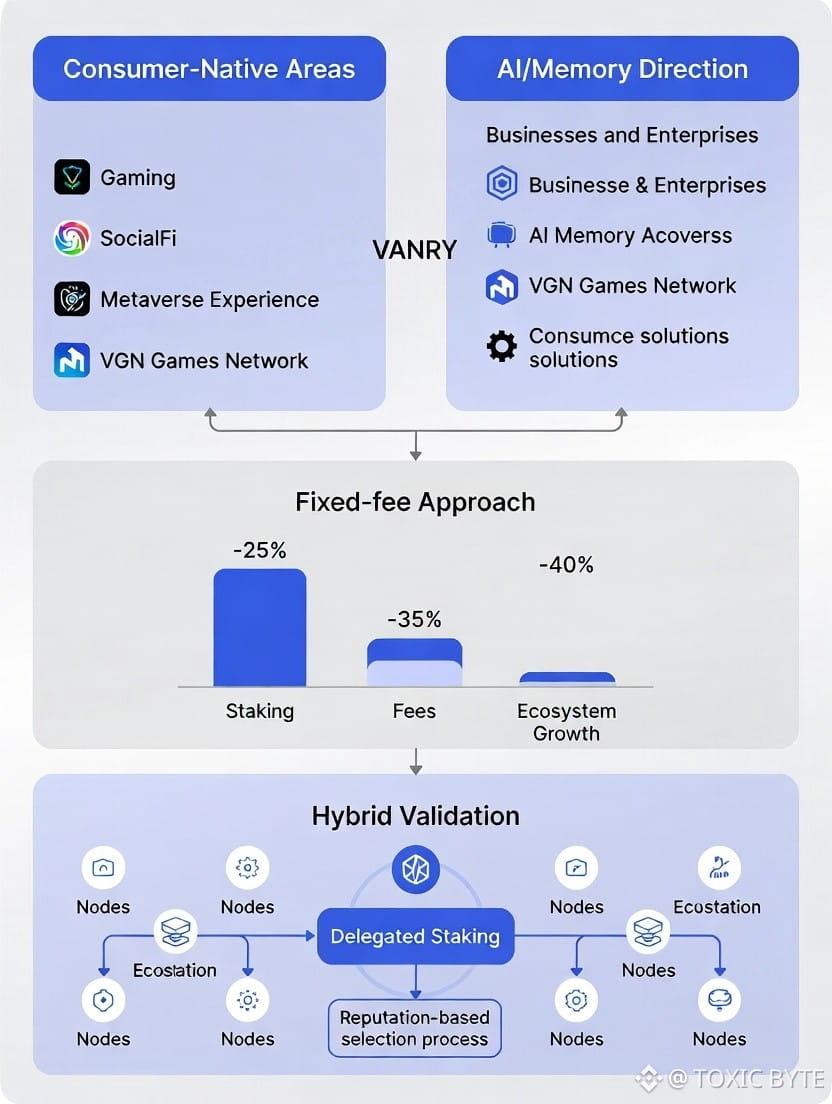

That mindset is easiest to see in how Vanar talks about costs. Instead of treating fees like a chaotic variable the market will sort out, Vanar leans into a fixed-fee approach meant to keep everyday actions consistently cheap. The project even anchors a target cost per transaction around a fraction of a cent and describes a system for managing fees based on token value checks and multiple price references. The point isn’t the exact number—it’s the promise behind it: builders should be able to design experiences without worrying that the price of “tap a button” will suddenly turn into “pay a dollar.”

Under the hood, Vanar doesn’t try to reinvent everything. It’s EVM-compatible, meaning it’s built to speak the same language as Ethereum-style apps and smart contracts. That choice is practical. Developers already know how to write Solidity contracts, audit them, and deploy them with familiar tools. Vanar’s approach is basically: don’t make teams relearn the fundamentals just to ship on your chain. For a project that wants real-world adoption, shortening the distance between “idea” and “live product” is a big deal.

Where things get more interesting is the way Vanar structures its network and roadmap. On validation and security, Vanar’s docs describe a hybrid setup that mixes delegated staking with authority and reputation-based selection. In plain terms, it’s not the most “wild and permissionless” model you’ll see in crypto. It looks more curated, with a foundation-guided validator set and the community delegating stake to support validators and earn rewards. Some people will love that because it can mean reliability and accountability—two things brands and studios actually care about. Others will see it as a tradeoff, because decentralization is not only about technology; it’s also about who gets to participate and how decisions get made. The direction Vanar takes here—how open it becomes over time, and how transparent validator selection is—will shape how the wider market judges its credibility.

The bigger swing Vanar is taking now is above the base chain. The project increasingly describes itself as a full stack, not just an L1: Vanar Chain as the foundation, plus layers like Neutron and Kayon built around “memory” and “reasoning.” Neutron is pitched as a way to compress and structure information into on-chain objects that stay queryable and verifiable, with a bold performance claim about shrinking large files into tiny representations. Kayon is positioned as a reasoning layer—something that can make the stored information actually usable through natural-language queries, with compliance automation often mentioned as a real use case. Even if you treat the headline numbers cautiously until they’re proven at scale, the intention is clear: Vanar wants to be the place where data can live in a form that AI tools and automated systems can reliably work with.

That shift matters because it gives VANRY a more “real” job than just paying gas. Yes, VANRY is meant to cover transactions and smart contract execution, and it’s tied to staking and validator rewards. But Vanar also links the token to product-level utility—like paying for storage and getting better economics in memory-related tools. When a token has meaningful use inside products people actually use, it stops feeling like a toll and starts feeling like a resource. That’s the difference between “I had to buy this token to do anything” and “this token powers the thing I’m here for.”

Vanar’s token history also explains a lot about its economics. The supply structure was shaped by the TVK-to-VANRY transition at a 1:1 swap, and public disclosures describe a capped max supply with a large portion dedicated to validator rewards over time, plus smaller allocations for development and community incentives. The long-tail validator reward design signals a focus on keeping the network secured and maintained for years, not just pumping emissions in the early stage. Market trackers show that most of the max supply is already circulating, which means Vanar can’t rely on distribution hype to carry it. Momentum has to come from real usage: products, integrations, and genuine demand for the network’s services.

When you look at Vanar’s ecosystem identity, you can see the bridge it’s trying to build. On one side are consumer-native areas like gaming and metaverse experiences—where projects like Virtua Metaverse and VGN Games Network act as “proof that this chain can handle real users doing real actions.” On the other side is the newer AI/memory direction, which is about making on-chain data useful and persistent for businesses and automated agents, not just collectible. That’s a smart pairing: entertainment brings volume and users; AI and data tooling brings stickiness and higher-value workflows.

If Vanar gets where it’s trying to go, the win won’t be “we’re another fast chain with low fees.” The win will be subtler and much bigger: builders stop worrying about blockchain mechanics, users stop noticing they’re interacting with a blockchain at all, and VANRY becomes the quiet fuel underneath experiences that feel normal—until you realize the underlying guarantees are stronger than what Web2 could provide. That’s the real finish line: not attention in the L1 race, but being the infrastructure people rely on because it works, it’s predictable, and it makes new kinds of products possible.