Understanding these dynamics requires a closer look at the interplay between different types of traders, derivatives and spot market activity, and the broader forces shaping capital flow within the cryptocurrency ecosystem.

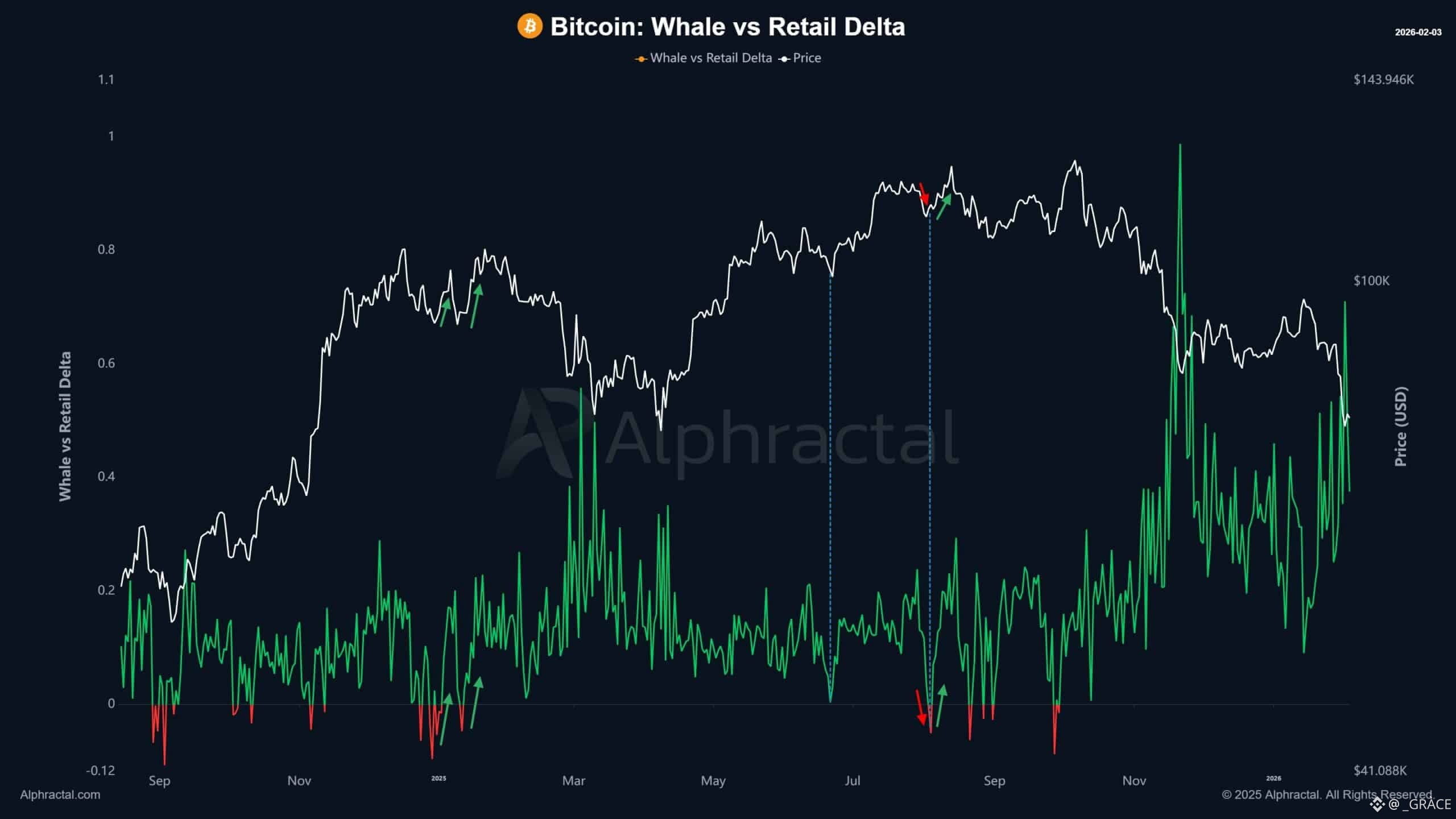

At the forefront of this analysis is the observation that whales have been actively reducing their long exposure in Bitcoin, even as retail participants continue to maintain positions with elevated optimism. These large holders, with access to significant liquidity, are often able to trade with a level of flexibility unavailable to smaller investors. By closing existing longs and occasionally opening short positions, whales can capitalize on short-term volatility while simultaneously managing downside risk.

The implications of this behavior are multifaceted. Historically, periods when whales reduce exposure or unwind positions have preceded notable price corrections. Such actions can act as a catalyst, triggering broader market adjustments that often ripple through both derivatives and spot markets. For instance, an unwinding of positions by whales may lead to increased selling pressure, which could push Bitcoin toward critical support levels, such as the lower $70,000 range.

Retail investors, by contrast, tend to exhibit more persistent behavior in their holdings. Relying on shorter time horizons and more limited capital, they may remain in long positions even as broader market signals suggest caution. This optimism can sometimes create an artificial support layer in the market; however, it also exposes retail participants to potential volatility if whale-driven moves accelerate. The gap between retail optimism and whale prudence highlights a key tension that currently defines Bitcoin trading dynamics.

Beyond individual trader behavior, the derivatives market offers important signals about sentiment and potential future trends. One such indicator is the Funding Rate, which measures the relative cost of holding long versus short positions. A positive Funding Rate, even if marginal, suggests that longs still maintain some control over the market, with short traders paying to remain in their positions. While this could indicate a temporary stabilization of price, it does not negate the underlying bearish pressures, particularly if selling momentum builds in the near term.

Short-volume dominance in Bitcoin’s perpetual futures further emphasizes the market’s cautious stance. Taker sell orders have maintained a consistent presence, signaling that aggressive selling activity is not yet subsiding. This dominance of short positions reflects a broader sentiment of risk aversion among participants who anticipate that current bullish behavior may not be sustainable without renewed liquidity or a shift in market conditions.

Spot markets provide a complementary lens through which to view the market. Several indicators point to weakening demand, particularly among U.S.-based investors. For example, a decline in the Coinbase Premium Index, which measures the relative price of Bitcoin on Coinbase compared to Binance, suggests that buying interest is deteriorating. Similarly, institutional investment products such as ETFs and trusts have shown negative premiums relative to spot Bitcoin, indicating subdued interest from professional investors. These trends collectively underscore a market that is cautious, liquidity-constrained, and increasingly sensitive to whale activity.

One of the most significant factors influencing Bitcoin’s near-term outlook is the contraction in trading volume and stablecoin liquidity. Spot trading activity has declined sharply over the past few months, with hundreds of billions of dollars exiting the market since late 2025. This reduction in active capital limits the market’s ability to absorb shocks, creating a scenario where large trades by whales or institutions can disproportionately influence price.

The reduction in stablecoin market capitalization is another key element to consider. Stablecoins often act as the primary vehicle for deploying capital into cryptocurrencies, allowing investors to quickly respond to market opportunities. A $10 billion contraction in stablecoin supply signals hesitancy among investors to commit new capital, further constraining liquidity and amplifying potential price swings. Historically, Bitcoin has tended to absorb returning liquidity first, meaning that any restoration of stablecoin supply could have an outsized impact on near-term price movements.

In this environment, market participants must weigh both opportunities and risks. For whales, the current divergence between retail optimism and declining institutional interest may present a chance to strategically reposition. Opportunistic traders can leverage periods of volatility to open positions with calculated exposure, knowing that smaller participants may react more slowly or emotionally to price swings. Conversely, retail traders must remain mindful of the broader liquidity and volume trends, as persistent optimism alone is insufficient to support sustained upward momentum in the absence of capital inflows.

The dynamics between retail and whale activity also intersect with technical and behavioral market patterns. When whales reduce long exposure, the resulting liquidity vacuum can lead to consolidation phases, where price moves sideways before committing to a clear direction. Alternatively, these periods can precede sharper corrections, particularly if retail optimism sustains temporary support that eventually gives way under mounting selling pressure. Traders who recognize these patterns can better position themselves for both short-term opportunities and longer-term trend shifts.

Another layer of complexity arises from the interplay between derivatives and spot market trends. While derivative data may suggest marginal long control, declining spot demand points to a broader risk-off sentiment. This duality creates a market scenario where price action may remain range-bound in the short term but is vulnerable to sudden shifts if liquidity imbalances intensify. Investors must navigate this landscape with careful attention to both types of markets, as ignoring either could lead to misjudging overall risk exposure.

Institutional sentiment, or the lack thereof, adds further nuance. Negative premiums in fund-based products indicate subdued institutional participation, reinforcing a broader market trend toward caution. In contrast, retail persistence reflects an optimism that is increasingly decoupled from professional strategies. This divergence is critical, as retail-driven support may hold only temporarily in the face of renewed selling pressure from better-capitalized market players. Understanding this imbalance can inform strategies for managing risk and capital allocation in an environment of heightened uncertainty.

Liquidity and volume constraints are particularly relevant in light of Bitcoin’s historical price behavior. Reduced trading activity tends to amplify volatility, with even modest transactions capable of triggering significant price swings. The combination of declining stablecoin supply, low spot demand, and concentrated whale activity creates conditions in which the market is highly sensitive to shifts in sentiment or capital flow. Traders and investors alike must account for this heightened sensitivity, as the usual stabilizing mechanisms may be insufficient to mitigate sudden market shocks.

Looking ahead, several potential scenarios emerge. One possibility is that Bitcoin enters a consolidation phase, with price moving sideways as market participants digest recent volatility and recalibrate positions. Such a scenario could persist until sufficient liquidity returns or until whales signal renewed conviction through increased exposure. Alternatively, selling pressure may accelerate, driving prices below key support levels and potentially triggering a broader correction. The interplay between retail optimism, declining institutional participation, and active whale repositioning will likely determine which path the market follows.

The divergence between whales and retail participants also highlights the importance of behavioral dynamics in cryptocurrency markets. Whales, with access to deep liquidity, can act opportunistically, exploiting volatility to optimize returns. Retail investors, driven by shorter-term horizons and psychological factors, often maintain positions despite shifting market conditions. This contrast not only shapes price movements but also underscores the need for sophisticated risk management strategies that account for the varying behaviors of market participants.

Analyzing these patterns further, it becomes clear that derivatives and spot markets are mutually influential but distinct in their signals. Positive funding rates may indicate temporary long control, but declining spot volume and weakening premiums suggest that underlying demand is fragile. Effective market analysis requires synthesizing these signals to form a cohesive understanding of potential price trajectories. Traders who can integrate both derivatives and spot insights may be better positioned to anticipate market shifts and respond strategically.

Moreover, the broader macroeconomic context cannot be ignored. Cryptocurrency markets do not operate in isolation; changes in investor sentiment, liquidity conditions, and capital allocation across global markets can have significant ripple effects on Bitcoin. A decline in spot demand or stablecoin liquidity, for instance, may reflect not only market-specific factors but also broader investor caution driven by macroeconomic uncertainty. Recognizing these connections adds an essential layer to understanding market dynamics and potential outcomes.

Ultimately, the current Bitcoin environment exemplifies the challenges and opportunities inherent in cryptocurrency trading. Divergent behavior between whales and retail, coupled with liquidity constraints and declining institutional interest, creates a market that is both volatile and nuanced. Investors must navigate these dynamics with a combination of market awareness, risk management, and strategic positioning. The ability to read signals from both derivatives and spot markets, while understanding the psychological and behavioral tendencies of different participant groups, is key to successfully navigating the current landscape.

In conclusion, Bitcoin’s market dynamics underscore the importance of understanding the interplay between trader behavior, liquidity, and volume. Whales are actively reducing exposure at a time when retail traders remain optimistic, creating a divergence with significant implications for price action. While derivatives data may suggest marginal control by longs, declining spot demand and negative fund premiums highlight a cautious, risk-off market environment. Liquidity constraints, particularly in stablecoins, further amplify potential volatility.

Navigating this complex landscape requires a holistic approach, integrating insights from whale behavior, retail sentiment, derivatives and spot market trends, and macroeconomic context. By doing so, investors can better anticipate potential price trajectories, identify opportunities, and manage risk in a market defined by divergence, liquidity constraints, and shifting sentiment. The current environment may be challenging, but it also presents a window for informed participants to strategically position themselves for future movements in Bitcoin’s evolving market.