Here’s a **future-focused overview of the two biggest stablecoins: USDT (Tether) and USDC (USD Coin)** — what they are, how they differ, and where they might be headed. (This is informational and *not* financial advice.)

---

## 🪙 What Are USDT and USDC?

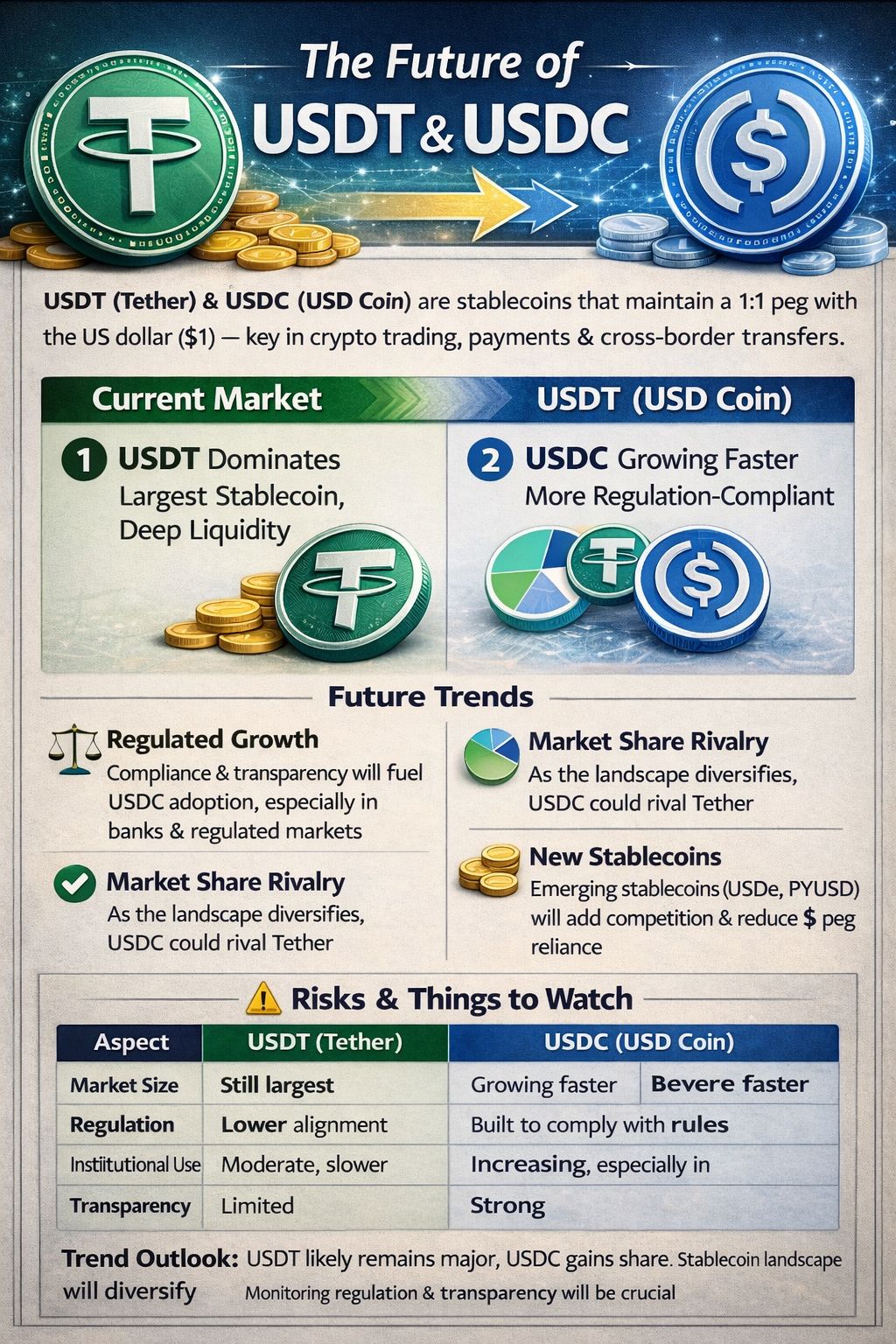

**USDT (Tether)** and **USDC (USD Coin)** are *stablecoins* — cryptocurrencies designed to stay pegged 1:1 with the US dollar. They’re widely used in crypto trading, DeFi, payments, and cross-border transfers because they combine *crypto speed* with *dollar price stability*. ([Cointelegraph][1])

---

## 📊 Current Market Position

* **USDT (Tether)**: Still the largest stablecoin by far, with a significantly higher market cap and trading volume. It’s the go-to for many traders because of its *deep liquidity* and broad global support. ([Cointelegraph][1])

* **USDC (USD Coin)**: The No.2 stablecoin, growing faster percentage-wise due to *stronger regulatory compliance* and institutional interest. ([bitcompare.net][2])

Together, they represent the vast majority of the stablecoin market — though that dominance is slowly being nudged down by newcomers. ([Cointelegraph][1])

---

## 📈 Future Trends & What Could Happen

### 🟢 1. **Regulation Will Shape the Future**

* USDC is fully compliant with major global regulations (like EU **MiCA**), which makes it more attractive to **banks, institutions, and regulated markets**. ([bitcompare.net][2])

* USDT has faced transparency and reserve-reporting criticisms. Even S&P Global downgraded Tether’s stablecoin assessment recently for lack of detailed disclosures. ([Reuters][3])

👉 As regulation grows tighter, **more transparent stablecoins like USDC may gain market share**, especially with institutional use and in regulated regions like Europe and the U.S.

---

### 🟡 2. **Market Share Competition**

Although USDT still leads in sheer size, the combined market share of USDT and USDC has been declining slightly as *new stablecoins and alternatives emerge*. ([Cointelegraph][1])

Analysts note a gradual shift where USDC is *growing faster* — and if trends continue, it could rival USDT more closely in the coming years. ([bitcompare.net][2])

---

### 🧭 3. **New Stablecoins & Innovation**

There are newer stablecoins (like Ethena’s USDe or PayPal’s PYUSD) and even **non-dollar stablecoins** being developed. These could diversify the ecosystem and reduce reliance on USDT/USDC dominance. ([Cointelegraph][1])

In Europe, regulators are encouraging *euro-based* stablecoins to reduce dollar dependency — another trend that shapes the future of global stablecoins. ([Cinco Días][4])

---

### 🏦 4. **Institutional Adoption**

USDC, backed by Circle (now a public company), has strong institutional backing and may continue to benefit from mainstream financial adoption. ([Barron's][5])

Long-term, this could make USDC more integrated into financial systems like digital payments, custody solutions, and regulated finance infrastructure.

---

## 🔍 Risks & Things to Watch

**Stablecoins aren’t risk-free.**

* Their value depends on *trust in the issuer* and *reserve backing*.

* If reserves become insufficient or illiquid in a stress event, even stablecoins can *depeg* from $1 — as seen in past stablecoin stress events. ([Tom's Hardware][6])

* Regulatory crackdowns or compliance struggles could affect where and how these coins are used or even listed on exchanges.

---

## 📍 So What Might the Future Look Like?

Here’s a simple breakdown of likely scenarios:

| Aspect | USDT (Tether) | USDC (USD Coin) |

| ----------------- | -------------------------------------- | ------------------------------------------- |

| Market Size | Still largest but gradually challenged | Growing faster in regulated environments |

| Regulation | Less regulatory alignment | Built to comply with financial rules |

| Institutional Use | Moderate, slower to adopt | Increasing, especially in regulated finance |

| Transparency | Criticized for limited disclosure | Stronger audit and reporting standards |

| Adoption | Widely used in crypto trading | Growing in DeFi & payments |

**Trend Outlook:**

✔ USDT likely to remain a major liquidity driver

✔ USDC likely to gain share in regulated markets

✔ Stablecoin landscape will diversify over the next few years ([Cointelegraph][1])

---

### 🧠 Quick Summary

* **USDT and USDC play key roles in crypto’s future as stable, dollar-linked assets.**

* **Regulation and transparency will be major forces shaping their growth.**

* **New stablecoins and regulatory frameworks are emerging, which could change market dynamics over the next 3–5 years.**

---

If you want, I can also explain **how stablecoins like USDT and USDC work under the hood** and why they matter in crypto DeFi, trading, and payments.

[1]: https://cointelegraph.com/news/stablecoin-duopoly-ends-usdt-usdc-dominance-decline-analyst?utm_source=chatgpt.com "USDT, USDC Dominance Falls To 82% Amid Rising Competition"

[2]: https://bitcompare.net/post/usdt-vs-usdc?utm_source=chatgpt.com "USDT vs USDC: Which Stablecoin Should You Choose in 2026? | Bitcompare"

[3]: https://www.reuters.com/business/finance/tethers-stablecoin-downgraded-weak-sp-assessment-2025-11-26/?utm_source=chatgpt.com "Tether's stablecoin downgraded to 'weak' in S&P assessment"

[4]: https://cincodias.elpais.com/criptoactivos/2026-02-03/la-cnmv-ve-necesaria-una-mayor-presencia-de-stablecoins-en-euro-y-ensalza-las-que-estan-preparando-los-bancos.html?utm_source=chatgpt.com "La CNMV ve necesaria una mayor presencia de 'stablecoins' en euros y ensalza las que están preparando los bancos"

[5]: https://www.barrons.com/articles/circle-internet-group-ipo-price-ec932f81?utm_source=chatgpt.com "Circle Boosts IPO Range and Targets Valuation of $7.2 Billion"

[6]: https://www.tomshardware.com/tech-industry/usd40-billion-plus-crypto-fraud-scheme-results-in-15-year-prison-sentence-for-its-creator-nine-criminal-counts-include-wire-fraud-and-money-laundering?utm_source=chatgpt.com "$40 billion-plus crypto fraud scheme results in 15-year

prison sentence for its creator - nine criminal counts include wire fraud and money laundering”