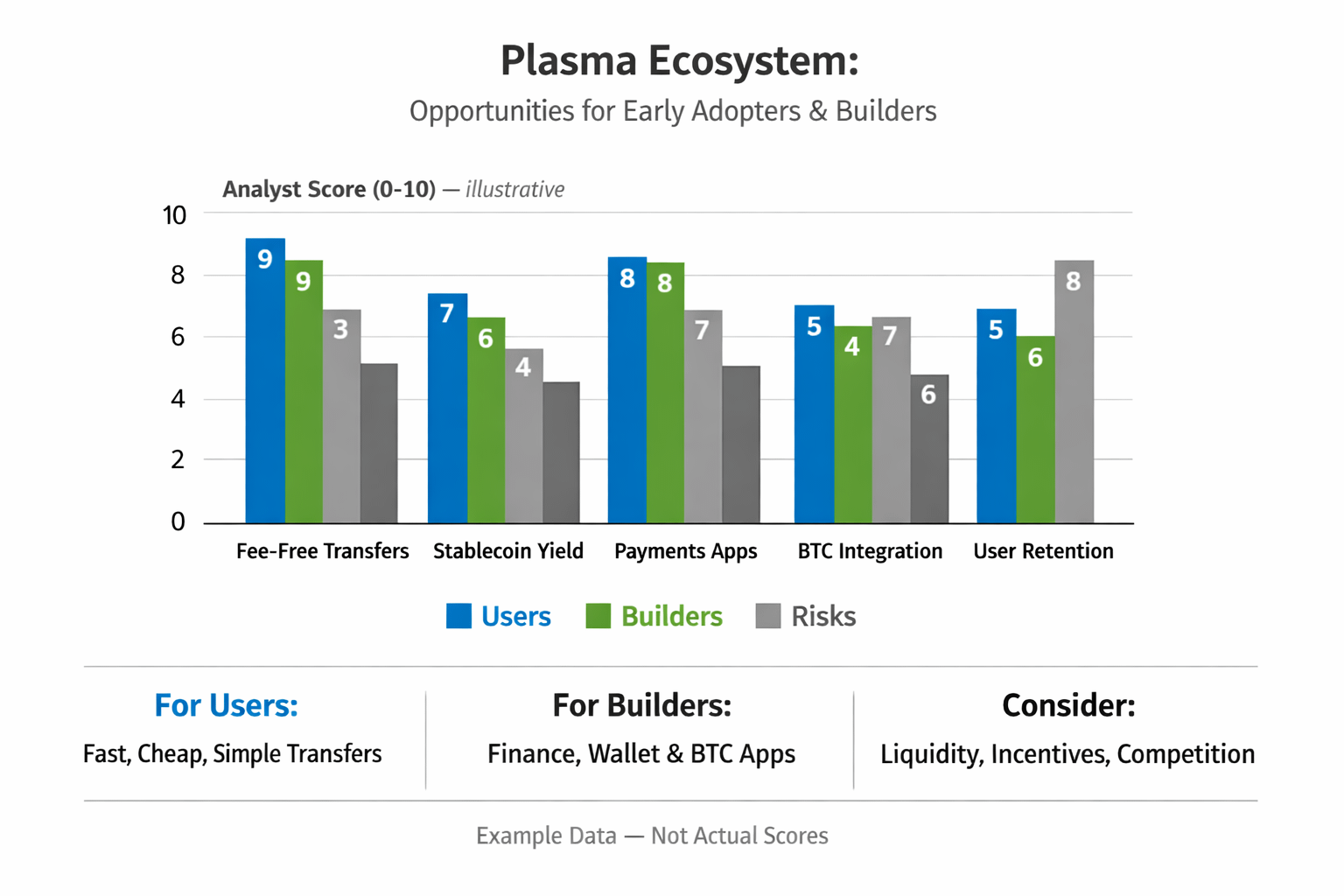

I keep coming back to one awkward truth. Most crypto “adoption” is just people moving stablecoins around… and paying weird tolls to do it. You send USDT, but you still need gas. You bridge, you wait, you pray the tx doesn’t fail, then you pay again. I watched a normal user hit that wall, I felt secondhand stress. Like watching someone try to tap a metro card and the gate screams at them. Plasma (XPL) is basically built to stop that noise. It’s a Layer 1 aimed at stablecoin flow, not a “do everything” chain. The pitch is simple: near instant transfers, and even zero-fee USDT sends, while still keeping EVM support so apps can be built with the usual tools. That focus matters. Payments don’t need ten new toys. They need to work every time, fast, and with costs that don’t surprise you mid-click. Plasma also leans into account abstraction, which is a fancy way to say: your wallet can behave like an app account. It can batch steps, sponsor fees, recover access, and hide the “gas token” headache. Less ritual. More “it just went through.” Now the real question: where’s the edge for early adopters and builders? Early adopters usually chase two things. Better UX and better positioning. Plasma’s UX angle is clear: if stablecoin transfers are the core action, you remove friction right at the center. The positioning part is more subtle. In a stablecoin-first world, the winners aren’t always the flashiest apps. They’re the rails and the boring glue. Wallets that feel like fintech. On-ramps that don’t break. Merchant flows that settle clean. Simple yield paths that don’t require a tutorial and a prayer. If Plasma keeps fees low and finality tight, you can get a new behavior loop: people keep balances on-chain because moving them is painless. That sounds small, but it changes how users act. They stop treating chains like highways they only touch to “cross.” They start treating them like a checking account. And when users sit somewhere, liquidity and app activity tend to follow. There’s also the “gas abstraction” piece. Plasma talks about a protocol-run paymaster that can let approved tokens pay for gas instead of forcing XPL for every action. Apps can make fees invisible, or at least predictable. For early adopters, that means fewer stuck moments. For builders, it means you can design flows that feel normal. Like paying a bill. Like sending money to a friend. No “buy this token first” detour. But don’t romanticize it. Early-stage ecosystems can be messy. Incentives pull users in, then fade. Liquidity can be thin. Spreads can sting. Bridges become choke points. So the early adopter “opportunity” is real, but it’s paired with a job: be picky. Watch what actually gets usage. Track what stays alive after rewards cool down. Most people don’t do that. They just chase shiny numbers. Builders have a cleaner playbook here, and it’s not about launching the 400th swap site. If Plasma is a stablecoin chain, the best apps will look like finance tools, not crypto toys. Think flows that assume the user only cares about dollars moving. Payroll. Cross-border pay. Merchant checkout. B2B invoices. Treasury dashboards. Also the hidden plumbing: account abstraction infra, bundlers, paymasters, smart wallets, compliance-friendly reporting. This stuff isn’t glamorous. It’s where ecosystems harden. EVM compatibility helps because teams don’t need to relearn everything. They can ship fast, port contracts, reuse audits, keep their dev muscle memory. Plasma also points to Bitcoin connectivity through a trust-minimized bridge design and a BTC-derived asset used in smart contracts (often described as pBTC). If that bridge holds up in the real world, it expands the “builder surface.” You get BTC liquidity meeting stablecoin payments on the same execution layer. That’s a real design space: BTC-backed lending with stablecoin settlement, hedged yield, vaults that don’t depend on ten hops. Still, the verdict has to stay neutral. A stablecoin-focused L1 is not magic. It’s a try on one use case being dominant enough to justify a chain shaped around it. It’s also a bet on stablecoin issuers, liquidity partners, and wallet teams actually showing up. And yes, if the core promise is “zero-fee USDT,” you’re tying a lot of the story to USDT demand and USDT rails. That’s a strength and a risk. Strength because USDT is everywhere. Risk because concentration cuts both ways. Plasma’s ecosystem opportunity is most real where it’s most boring. Build the rails, the wallets, the fee-less flows, the settlement tools. Early adopters should watch behavior, not hype. If Plasma becomes the place people keep stable dollars because it’s simple, builders win. If it turns into another chain chasing activity with rewards, it’ll feel loud fast.