I didn’t notice the problem while watching a transaction.

I noticed it afterward, when everything that should have moved… didn’t.

The stablecoin transfer was already done.

USDT had landed. Balances reflected it. Nothing was pending in the obvious places. And yet the next step in the workflow stayed frozen, as if the payment were still a rumor instead of a fact.

That gap, between settlement and permission to proceed, is where stablecoins quietly lose their edge.

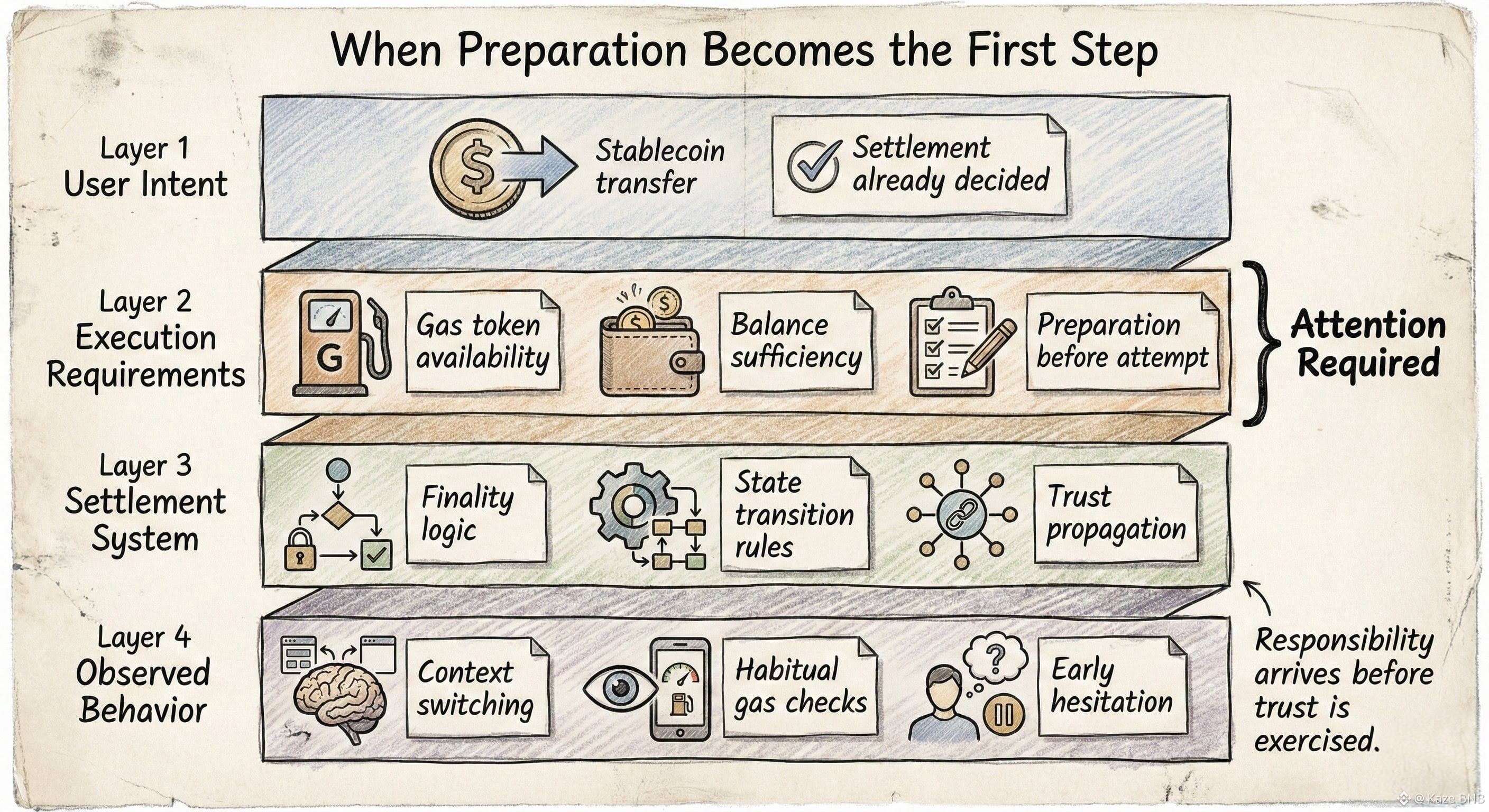

Anyone who moves stablecoins at volume has seen this pattern. The chain confirms, but people don’t. Someone asks for another check. Another system waits for a status update that never quite arrives in the right shape. The money is there, but responsibility hasn’t shifted yet.

The part that keeps surprising me is where the delay actually shows up. Not on the explorer. Not in the mempool. It shows up in the handoff: the place where a payment is supposed to become an input, and instead becomes a question. Someone wants a timestamp in a screenshot. Someone wants the same hash pasted into a different tool. Someone waits for a status message that was never designed to be authoritative. The transfer is complete, but the workflow behaves like it’s still negotiating whether it’s allowed to treat that completion as real.

That’s the context in which Plasma and the Plasma Network started to feel less like another chain and more like a correction for me.

Plasma is framed around a narrower, more uncomfortable question: when can a payment stop being discussed and start being relied on as actual stablecoin settlement?

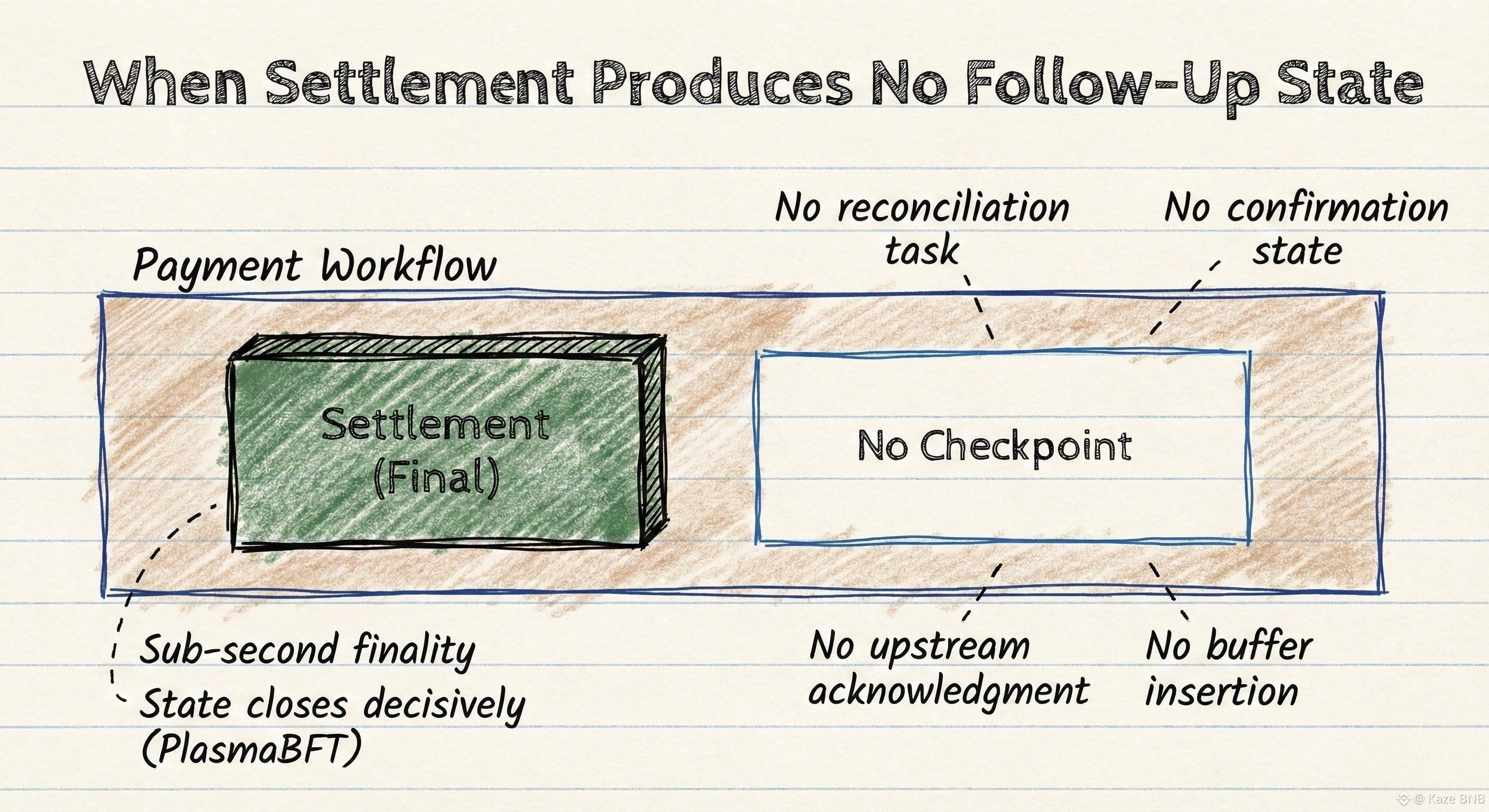

The first place I felt that difference wasn’t in a speed test. It was in the absence of follow-up choreography. In other environments, the moment after a USDT transfer is when the workflow grows extra limbs: “confirm again,” “wait a bit,” “ping me when it’s safe,” “don’t proceed until we see it twice.” Those steps rarely look like fear. They look like “being careful.” Over time they become default.

Plasma’s stablecoin-first design pushes against that. Gasless USDT transfers, stablecoin-denominated gas, and a stablecoin-centric posture reduce the number of reasons a workflow needs to pause before it even begins. The pre-flight ritual, top up gas, check balances, re-check timing, doesn’t get as much room to expand. The payment path becomes closer to what people actually think they’re doing: moving dollars, not managing a second volatile dependency just to move stable value.

In practice, that’s where many “fast” payments slow down. Not on-chain, but in coordination. Someone needs to top up gas. Someone else needs approval. The payment waits while the process catches up.

On Plasma mainnet, that dependency is reduced, which changes how workflows get designed upstream. When gas stops being a separate concern, stablecoin transfers stop behaving like special cases and start behaving like infrastructure.

The same philosophy shows up in Plasma’s execution choices. By maintaining full EVM compatibility via Reth, Plasma avoids turning settlement optimization into a developer tax. Existing Solidity contracts, tooling, and mental models carry over. This isn’t a walled garden. And in real workflows, that isn’t a marketing bullet, it’s survival.

Then the pressure shifts to the part that normally stays hidden: finality as a boundary, not a suggestion.

With PlasmaBFT and sub-second finality, settlement doesn’t stretch into a window. It snaps shut. There’s no long tail where someone can justify waiting “just in case.” The chain stops offering excuses for delay, and that forces the rest of the workflow to confront its own assumptions. If the process still won’t move, it isn’t because the payment is unclear. It’s because the surrounding workflow was built to lean on ambiguity.

That pressure matters more than raw performance.

The final piece that made me take Plasma seriously is its Bitcoin-anchored security angle. Neutrality and censorship resistance sound abstract until you’ve had a transaction delayed or questioned for reasons that had nothing to do with validity. Anchoring security assumptions to Bitcoin isn’t about worshipping BTC; it’s about borrowing the one thing it’s proven better than anything else: credible neutrality over time.

For payment flows and institutional settlement, that neutrality isn’t optional. It’s table stakes.

The real problem Plasma is pressing on isn’t that blockchains are slow. It’s that settlement confidence doesn’t scale with transaction volume. As more money moves, people add safeguards. As safeguards accumulate, speed becomes performative instead of real.

Plasma’s bet is that stablecoin-native economics, EVM parity through Reth, PlasmaBFT finality, and Bitcoin-anchored security can shrink the negotiation layer people keep reintroducing around stablecoin settlement.

What I’m watching now isn’t whether Plasma can move USDT. That part is easy to claim. I’m watching whether Plasma can keep workflows from inventing new reasons to hesitate after the transfer is already done.

Because the moment settlement becomes usable as a handoff, without extra permission, without extra rituals, teams stop building around doubt.

And the next time the workflow freezes, it won’t be the chain asking for time.