Microtransactions have always sounded great in crypto. Small payments for games, creator tips, loyalty rewards, and app actions feel like the natural future of digital economies. But in reality, most of these ideas failed early not because people didn’t want them, but because the numbers never worked.

Anyone who has traded or used crypto during busy network periods knows the problem. Fees don’t just go up they become unpredictable. A transaction that costs a few cents today can suddenly cost dollars tomorrow. When that happens, even a simple $0.05 action turns into a bad decision.

This is why microtransactions quietly disappeared from many projects. The vision was right, but the infrastructure wasn’t ready.

The Real Problem Wasn’t High Fees It Was Uncertainty

Most blockchains talk about “low fees,” but low compared to what? Compared to yesterday? Compared to Ethereum during congestion? The issue isn’t only how cheap a transaction is it’s whether you can trust the cost to stay stable.

For consumer apps, games, and platforms with frequent user actions, unpredictability kills planning. Developers can’t price features properly. Users hesitate before clicking. Every interaction starts to feel like a financial risk instead of a simple action.

That’s where a different approach to fees starts to matter.

How Fixed Fees Change User Behavior

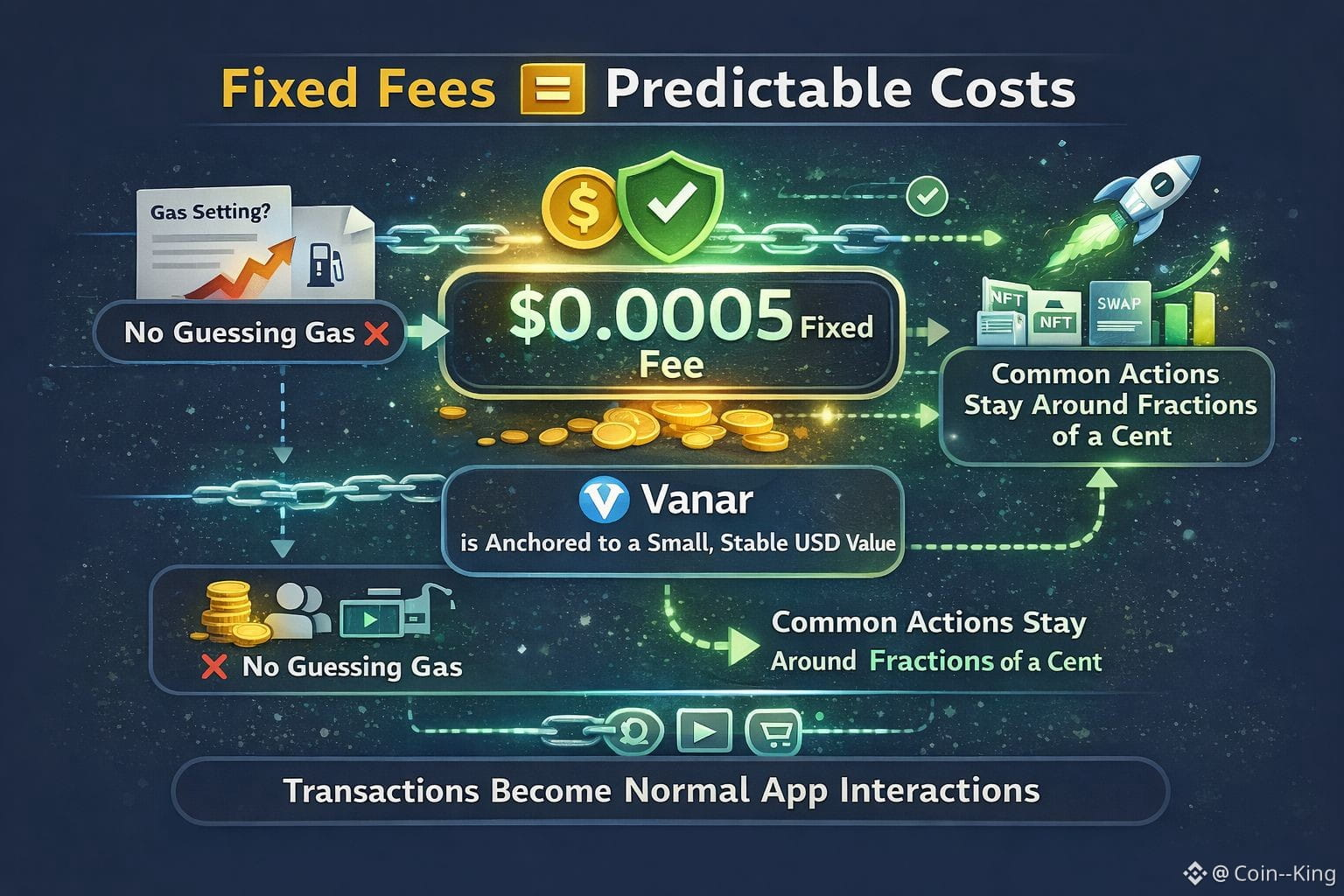

Vanar takes a quieter but more practical path. Instead of letting transaction costs float freely with token prices and network conditions, it aims to anchor fees to a fixed USD value.

In simple terms, this means users don’t have to guess what gas settings mean or worry about sudden spikes. Common actions like transfers, staking, NFT minting, swaps, and even many contract deployments are designed to stay within a tiny, predictable cost range often fractions of a cent.

This predictability changes how people behave. When users know an action will always cost roughly the same, they stop overthinking. Transactions become normal app interactions instead of trading decisions.

Cheap Doesn’t Mean Uncontrolled

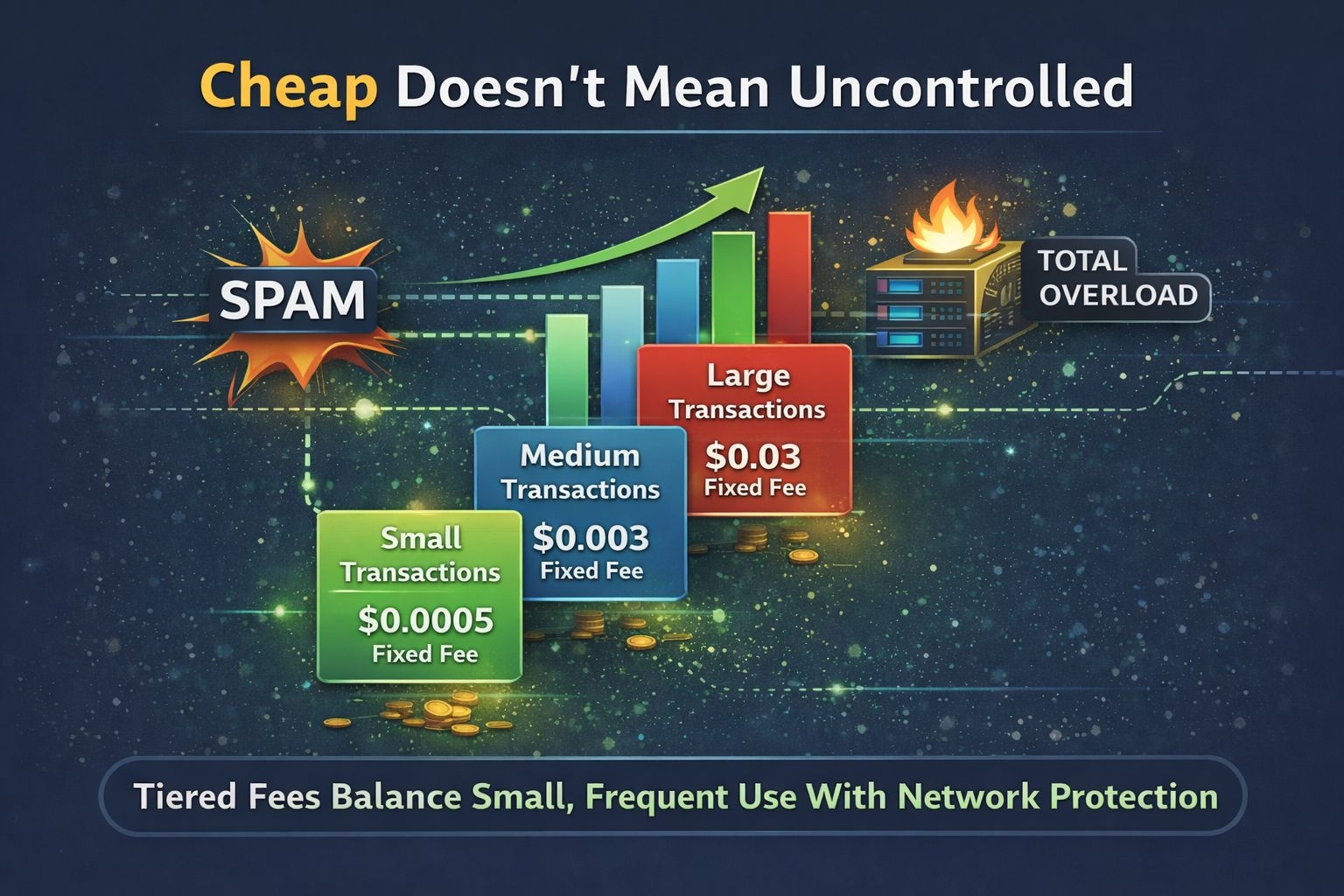

A fair concern with very low fees is abuse. If transactions are almost free, what stops spam?

Vanar’s model acknowledges this risk instead of ignoring it. The network uses tiered fixed fees, where different transaction sizes fall into different pricing levels. Smaller actions remain cheap, while heavier usage carries higher costs.

This approach respects an important reality: blockspace still has value. The goal isn’t unlimited free transactions it’s making small, frequent actions practical without opening the door to network overload.

Why This Matters More in 2026 Than Before

The market has changed. Crypto is no longer focused only on single “killer dApps.” Today’s growth comes from ecosystems where users perform many small actions game moves, creator rewards, in app purchases, AI agent interactions, and loyalty systems.

All of these rely on high frequency, low value transactions. And just as important, teams building these products need cost stability. Businesses can’t scale on networks where fees behave like a lottery.

This shift is why predictable, low cost chains are getting renewed attention. Vanar’s positioning as an EVM compatible Layer 1 built for high activity fits this new demand, especially as consumer and AI-driven applications continue to grow.

A Trader’s View: Utility Comes Before Price

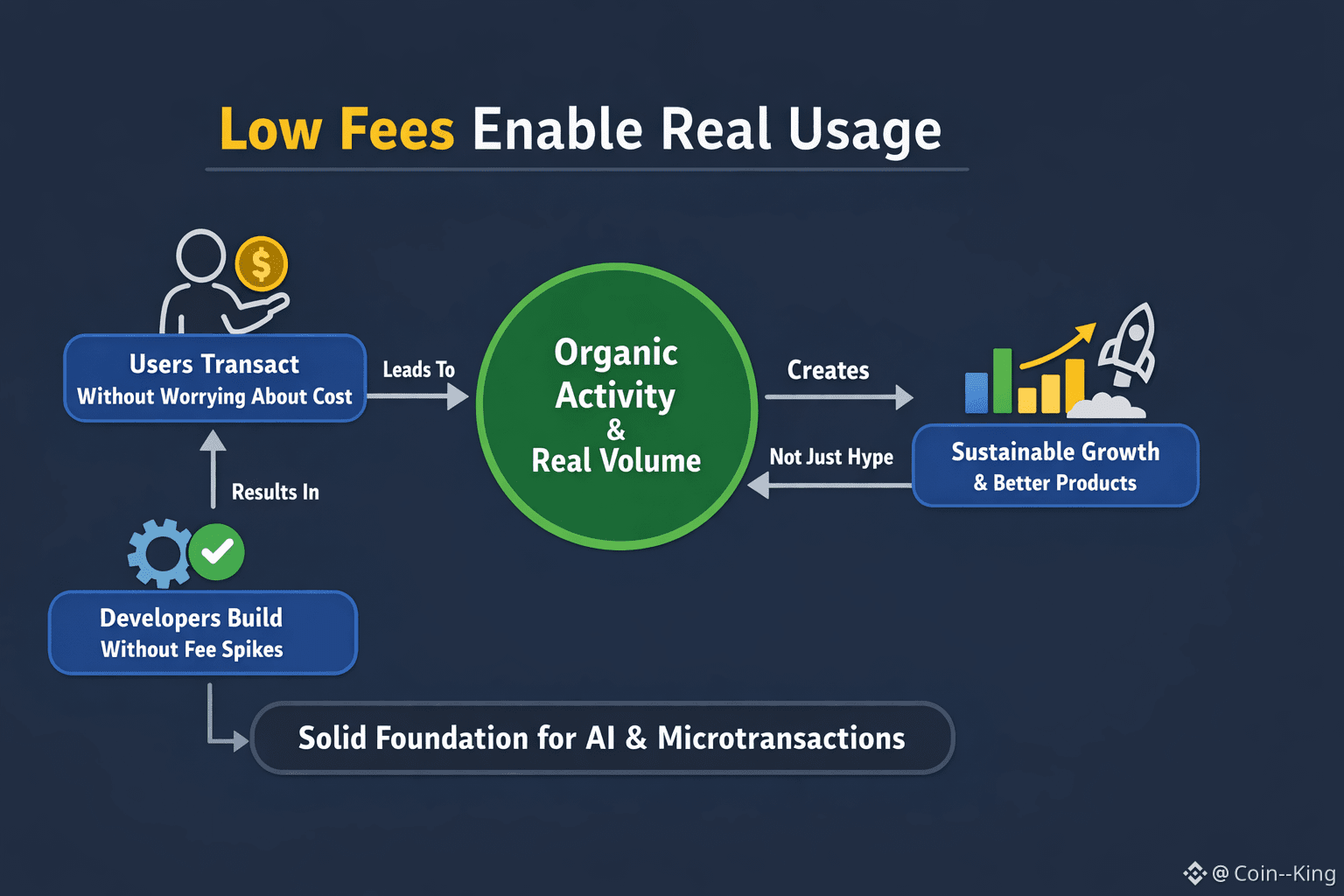

Low fees alone don’t move markets. But they enable something more important real usage.

When users transact without worrying about cost, activity becomes organic. When developers don’t need to redesign systems around fee spikes, products improve faster. Over time, this creates genuine volume, not short lived hype driven by incentives.

Vanar’s broader roadmap talks about AI native infrastructure and ecosystem expansion, but none of that works without a solid fee foundation. Microtransactions only matter if people actually use them.

Final Thought: Boring Can Be Powerful

Low fee networks should always be evaluated carefully. Cheap transactions can hide weak demand. They can attract noise. Not every low cost chain succeeds.

But when low fees are combined with predictability, structure, and practical guardrails, something valuable emerges reliability.

And in crypto, reliability doesn’t make headlines. It quietly attracts builders, users, and long-term activity. If Vanar’s fixed fee model continues to perform under real world usage, microtransactions won’t be a buzzword anymore. They’ll simply become part of everyday on chain behavior.

Sometimes, the chains that win aren’t the loudest they’re the ones that just work.