The surprising part wasn’t that the transaction worked.

It was that nothing relaxed afterward.

In most systems, once a real-world asset settles, attention drains out of the process. The record exists. The transfer is complete enough to reference later. Whatever risk remains is assumed to belong to someone else, somewhere downstream. Settlement acts like a release valve.

That assumption doesn’t survive long inside Dusk Foundation and the wider Dusk Network, especially once tokenized securities start behaving like they belong in a regulated environment instead of a sandbox.

I noticed it during a routine review of tokenized instruments that had already moved on-chain. No alerts. No disputes. No inconsistencies. The ledger reflected the outcome precisely. And yet the workflow stayed tense, as if the system refused to treat completion as an excuse to forget.

Nothing failed.

Nothing stalled.

Nothing asked for permission.

But responsibility remained fully intact.

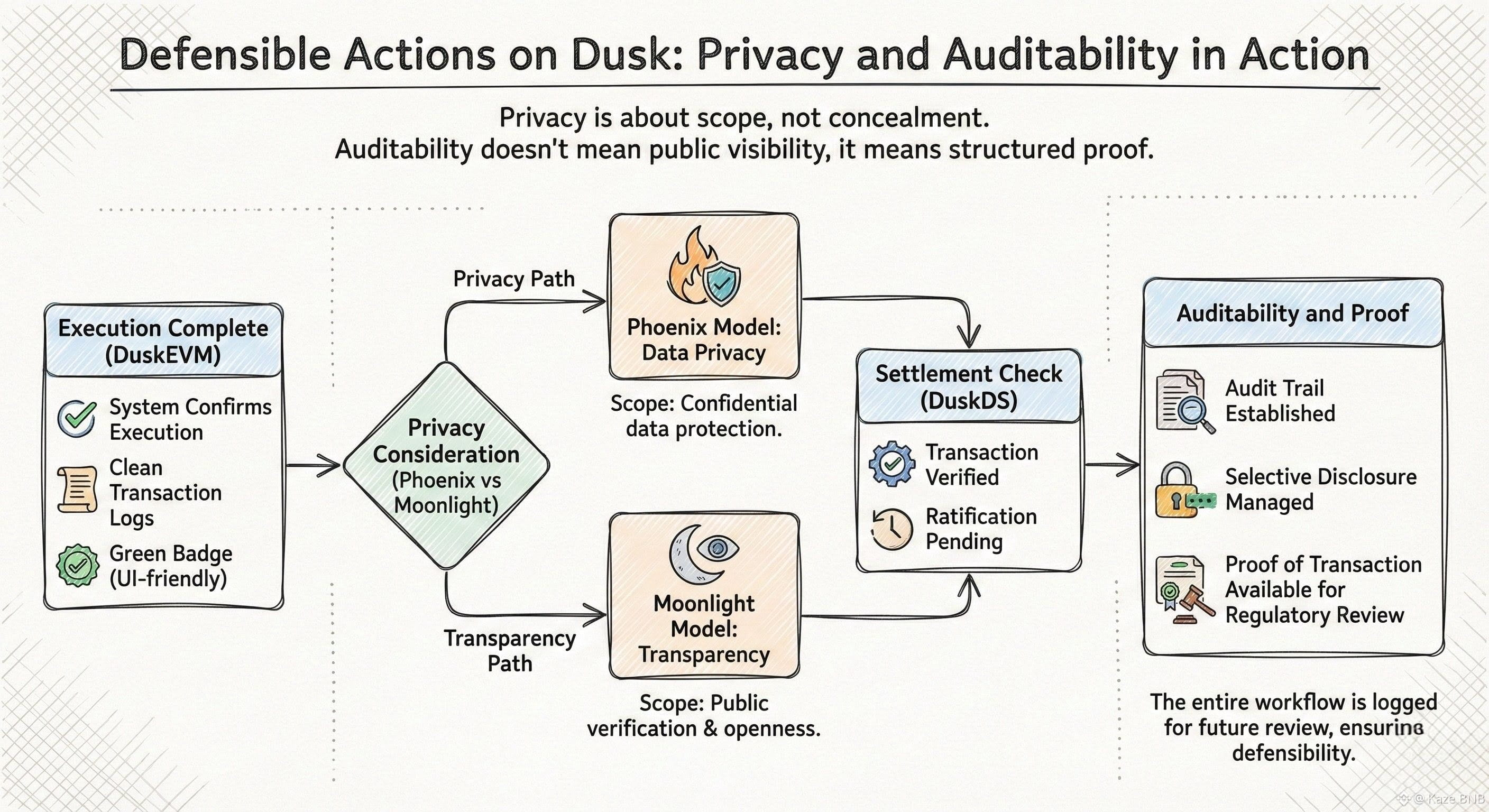

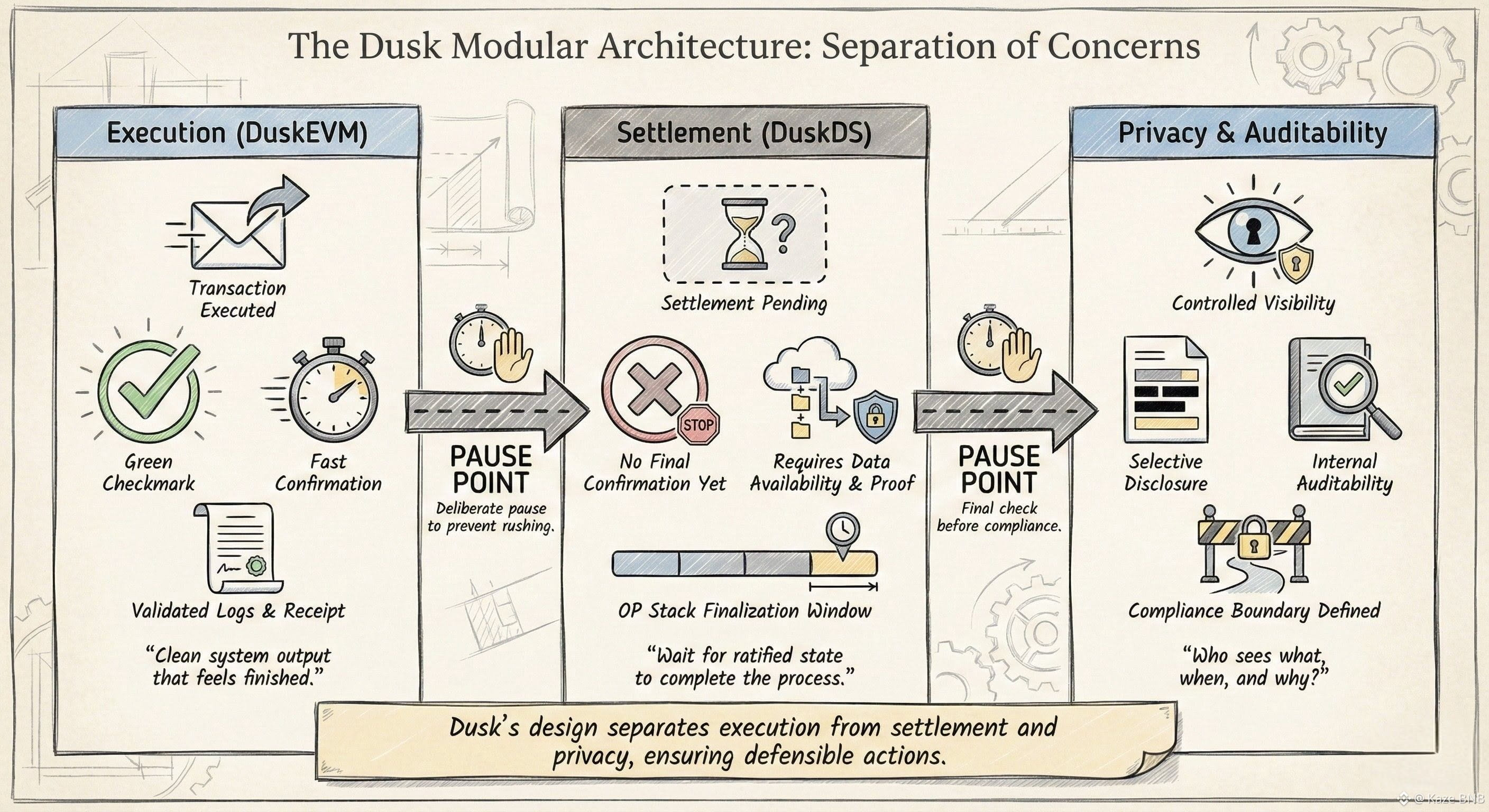

That’s the first real difference I saw Dusk introduce when real-world assets cross into a regulated privacy surface. Execution is not the climax. It’s just the point where future accountability becomes unavoidable. The asset moves quickly, but the system behaves as if it knows someone will ask hard questions later and plans accordingly.

On Dusk, regulated settlement doesn’t close a chapter. It keeps one open.

I watched a bond token change hands with no visible friction. Selective disclosure held. Disclosure scope remained tight. No sensitive details surfaced unnecessarily. At the same time, the transaction carried a quiet readiness, the posture of something built to withstand inspection long after the moment had passed. Auditability by design doesn’t announce itself here. It just sits alongside execution, waiting, while proofs generate, validations occur, and the ledger updates without asking for attention.

That posture changes how institutions interact with the system.

Teams don’t rush simply because they can. They slow, not out of doubt, but because compliance rectification is assumed to be real work, not a theoretical safeguard. Committee attestation isn’t triggered on every move, yet its possibility shapes behavior immediately. The system doesn’t demand explanations now. It makes sure explanations will still be possible later, the same way I’ve seen settlement reconciliation and validator coordination show up as quiet background obligations rather than visible steps.

This creates a different kind of pressure.

Not the pressure of speed, but the pressure of memory.

I noticed it again while observing simulated transfers between regulated entities. The exchange was clean. Validators coordinated without surfacing themselves. Proofs resolved without ceremony. Everything behaved exactly as expected. And still, there was a pause, not technical, not procedural, but institutional. A moment where participants recognized that the asset hadn’t just moved value. It had carried obligation forward with it.

That’s where Dusk’s identity becomes unmistakable.

Privacy here doesn’t mean obscurity. It means confidentiality with oversight. Visibility is not eliminated; it’s deferred, governed, scoped. When disclosure eventually becomes mandatory, the system won’t scramble to reconstruct intent. It already knows how to answer. That confidence doesn’t come from speed. It comes from protocol-level accountability embedded before anything ever moves.

Scaling this posture is non-trivial.

Handling hundreds of millions in tokenized securities, €300 million and beyond, isn’t about throughput alone. It’s about ensuring that bonds, equities, and funds can circulate without eroding regulatory fidelity. Dusk’s architecture treats this as a baseline condition, not an edge case. Compliance-aware execution isn’t layered on top. It’s native, quiet, and persistent, the kind of posture I’d expect from a system positioning itself as a compliant trading and investment platform for institutions.

What stands out is how little the system tries to reassure you.

There are no banners celebrating compliance. No gestures toward transparency theater. Just behavior that refuses to trade future explainability for present convenience. Transactions don’t feel fragile, they feel deliberate. Heavy, but not slow. Capable, but not casual.

This is why DuskTrade doesn’t feel like a bridge experiment or a sandbox for RWAs. It feels like infrastructure that understands institutional time. Time where regulators and auditors arrive late. Questions surface years after execution. And forgetting is not an acceptable strategy.

As more real-world assets move on-chain, that distinction will matter more than speed ever did.

Systems built to forget struggle when memory is enforced externally. Systems built to remember, quietly, without drama, survive regulation instead of reacting to it.

Dusk doesn’t promise frictionless finance.

It promises that when oversight arrives, nothing will need to be reinvented.

The assets will already know how to stand still under scrutiny.