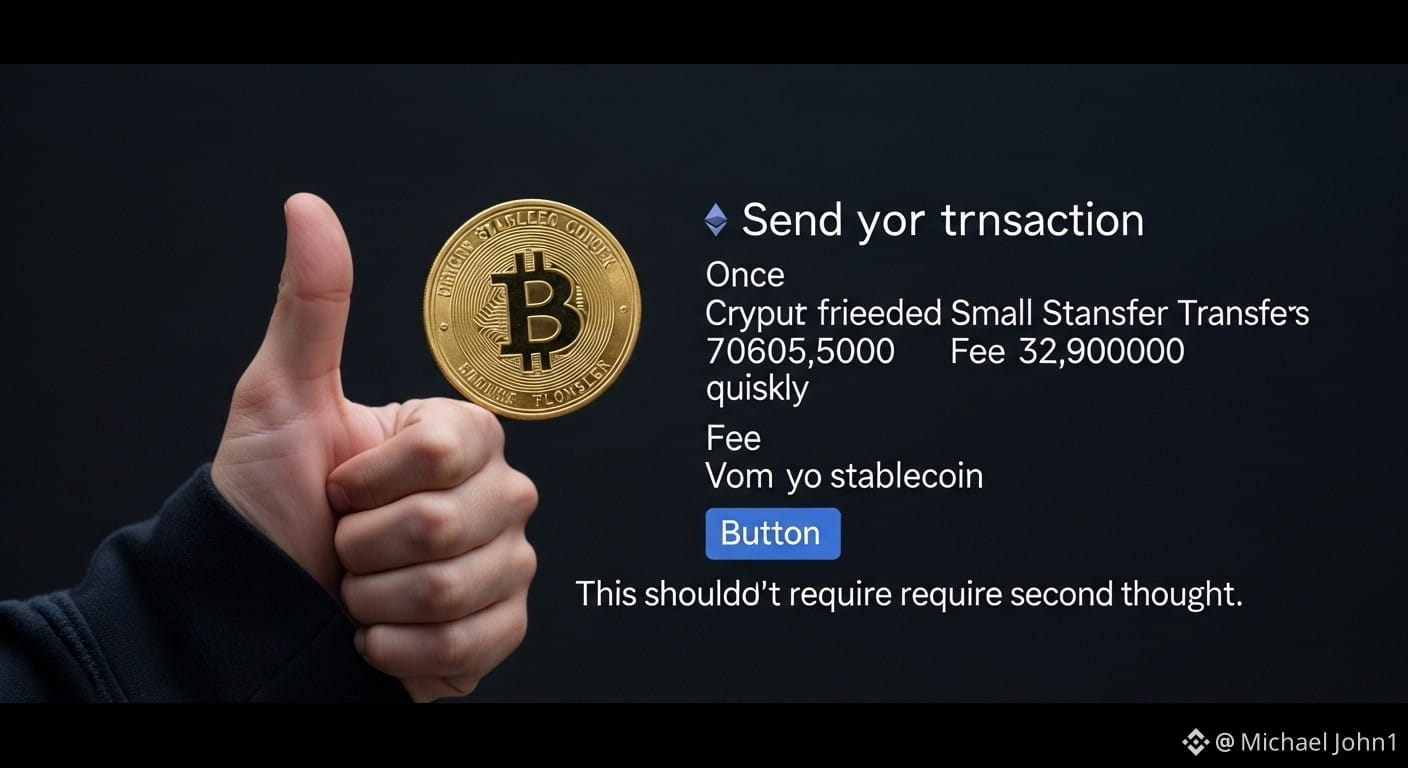

There’s a very specific feeling you get when you’re about to send a crypto transaction and your thumb pauses over the button. It’s not fear exactly, and it’s not confusion either. It’s hesitation. I’ve felt it more times than I can count. Once, it was during a volatile market week when a friend needed a small stablecoin transfer quickly. Nothing dramatic, nothing speculative. Just money moving from one person to another. The fee popped up, and I stopped. I remember thinking, this shouldn’t require a second thought. That moment has stayed with me, and every time conversations turn to scaling, Plasma quietly re-enters my mind.

Plasma doesn’t feel like a breakthrough anymore, at least not by today’s standards. It doesn’t arrive with hype cycles or bold promises. In fact, it’s often mentioned in the past tense, like a chapter crypto has already moved on from. But the more time I spend actually using blockchain systems rather than just reading about them, the more Plasma feels less like an outdated idea and more like an honest one.

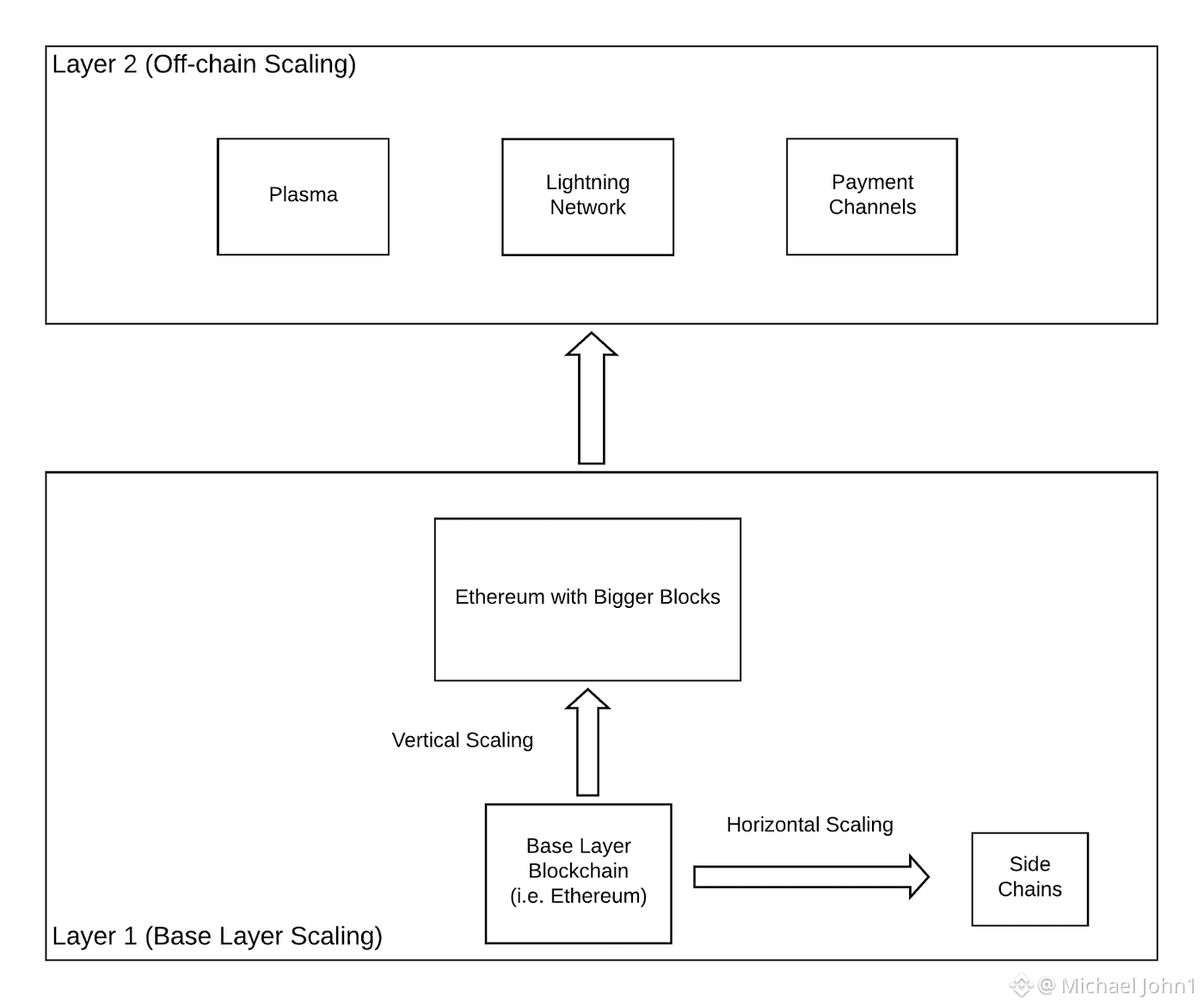

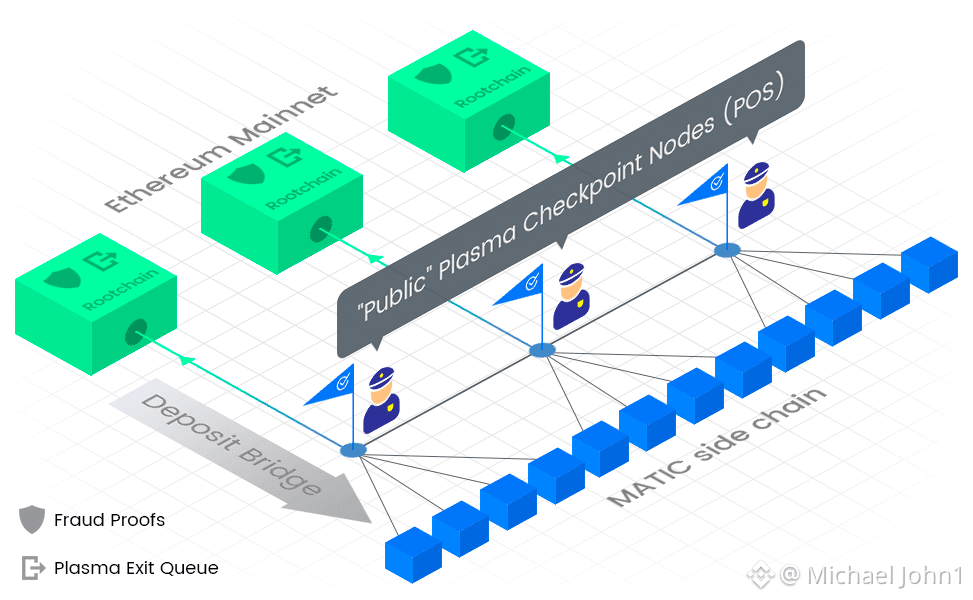

At its core, Plasma was built around a simple observation: not every transaction needs the full weight of a global blockchain behind it. Most transfers are small, routine, and uncontroversial. Forcing all of them onto a single, congested main chain is like routing every local errand through an international airport. Plasma suggested something different. Let everyday activity happen on connected chains where speed and cost make sense, and let the main chain act as a security anchor rather than a constant bottleneck.

What I’ve always liked about this idea is how intuitive it feels when you step outside crypto culture. In real life, we don’t verify every interaction at the highest possible level of authority. We trust local systems until there’s a reason not to. You don’t involve a court for every agreement, but it matters that the court exists. Plasma mirrors that logic. Most of the time, things just work. When they don’t, there’s a path to resolution.

This becomes especially important when you think about where crypto adoption is actually happening. In many emerging markets, crypto isn’t a hobby or a high-risk experiment. It’s infrastructure. People use stablecoins to protect savings, freelancers rely on cross-border payments, and families send support across countries. These users aren’t optimizing for maximum decentralization. They’re optimizing for reliability, affordability, and predictability. Plasma’s approach aligns naturally with those needs.

From my own experience, the biggest barrier to everyday crypto use isn’t education or trust, it’s friction. High fees create emotional resistance. Slow confirmations create anxiety. Complex interfaces create mistakes. Plasma doesn’t solve all of that on its own, but it reduces pressure at the exact point where most users feel it: the moment they try to do something small and simple.

That said, Plasma was never perfect, and pretending otherwise would be dishonest. Early designs placed a lot of responsibility on users. You were expected to monitor the system, to stay alert, to act if something suspicious happened. For people deeply embedded in crypto, that felt reasonable. For everyone else, it was unrealistic. Withdrawals could take time, which felt especially painful during market volatility. These issues slowed adoption and, for many, defined Plasma’s reputation.

But I don’t see those limitations as failures. I see them as growing pains. Plasma forced the ecosystem to confront uncomfortable questions about user responsibility, safety, and usability. It made it clear that scaling isn’t just a technical problem, it’s a human one. Who should bear the burden of security? How much complexity is acceptable? Where does trust actually live?

What’s interesting is that many newer solutions quietly reflect the answers Plasma helped surface. Even when people say Plasma is obsolete, its underlying philosophy shows up everywhere. The idea that the main chain shouldn’t do everything. The idea that most transactions don’t need maximum security at maximum cost. The idea that scalability and usability are inseparable. These concepts feel obvious now, but they weren’t always treated that way.

I think crypto sometimes moves so fast that it mistakes novelty for progress. Ideas are labeled “dead” not because they failed, but because they stopped being exciting. Plasma suffers from that perception. It doesn’t spark debates on social media anymore. It doesn’t fuel price speculation. But it still represents a mindset that crypto desperately needs: practicality over spectacle.

There’s also something quietly reassuring about Plasma’s design. It doesn’t assume perfect conditions or perfect actors. It assumes that things can go wrong, and it plans for that without demanding constant attention from the user. That realism feels mature. It feels like infrastructure built by people who’ve seen systems break and decided to design around that reality instead of ignoring it.

When I think about crypto’s future, I don’t imagine everyone debating layer names or scaling models. I imagine people using apps without thinking about what’s underneath. Sending money without pausing. Receiving payments without checking fees first. If crypto ever reaches that point, it won’t be because one flashy solution won. It will be because many ideas, including quieter ones like Plasma, shaped the path.

In a strange way, Plasma reminds me that progress doesn’t always announce itself. Sometimes it fades into the background, doing its job without asking for attention. And maybe that’s the highest compliment infrastructure can receive.

I’m genuinely curious how others see this now. Have you ever stopped mid-transaction because the fee didn’t feel worth it? And when you look at how crypto is evolving, do you think older ideas like Plasma are being unfairly dismissed, or is their influence already baked into the systems we use today?