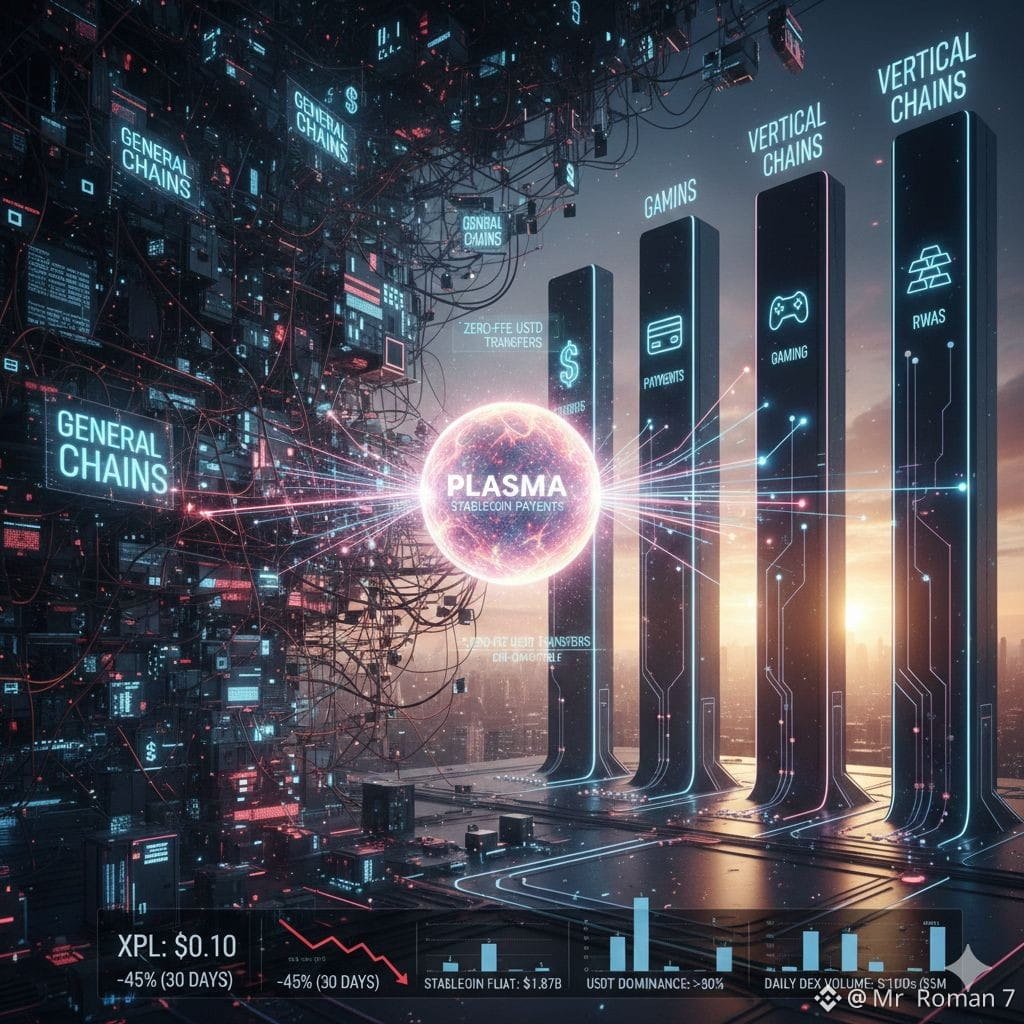

The blockchain landscape is evolving rapidly. Gone are the days when general‑purpose Layer‑1 networks captured all the attention. Today, specialization is winning. Users, liquidity providers, and developers are gravitating toward purpose‑built ecosystems that excel at one core function — whether that’s payments, gaming, perpetuals, or real‑world asset tokenization.

At the heart of this shift are vertical blockchains: chains designed to dominate a specific loop, rather than attempt to be everything to everyone. These chains are not merely experiments — they reflect a maturing market that values real utility, predictable performance, and frictionless user experiences.

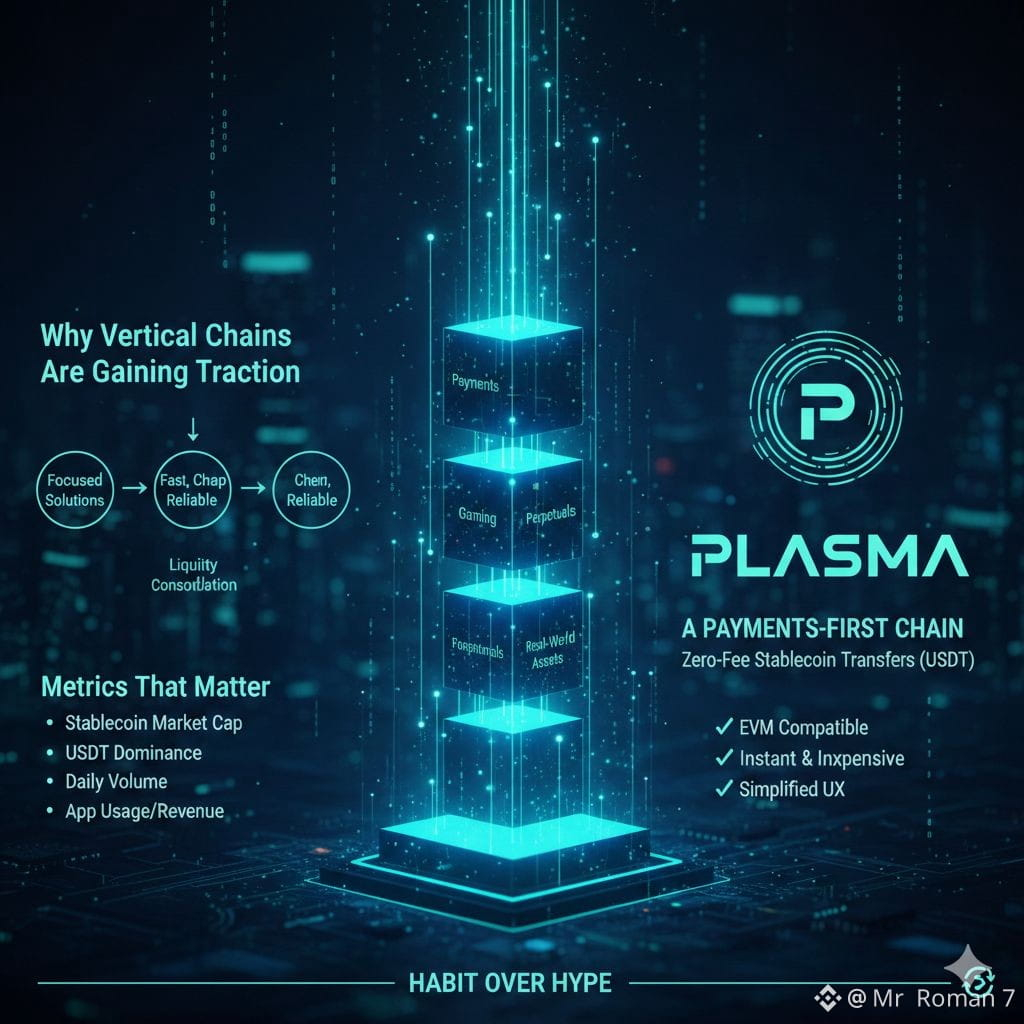

The Rise of Vertical Chains

Vertical chains succeed because they solve real problems with focused solutions. Rather than building broad stacks with sprawling feature sets, they optimize for a single use case and do it exceptionally well. This has several advantages:

User retention improves because core interactions are fast, cheap, and reliable.

Developers keep building without reinventing standard infrastructure.

Liquidity consolidates where it becomes truly productive, instead of splintering across ecosystems that merely promise general compatibility.

This paradigm prioritizes depth over breadth, turning attention toward chains that own their niche.

Enter Plasma — A Payments‑First Chain

Plasma exemplifies the vertical chain philosophy. Its mission is straightforward: become the premier settlement layer for large‑scale stablecoin payments. While many Layer‑1 chains aim to host broad decentralized finance (DeFi) stacks, Plasma’s strategy centers on a singular truth — money in motion must be instant, inexpensive, and reliable.

Plasma achieves this by:

Maintaining EVM compatibility, so existing tooling, wallets, and developer workflows remain unchanged.

Eliminating traditional gas fees for stablecoin transfers, especially for dominant assets like USDT.

Simplifying the user experience so sending money feels intuitive — not like a technical hurdle.

In a market where complexity drives users away faster than brand loyalty can retain them, Plasma’s simplicity becomes a competitive advantage.

Frictionless Stablecoin Flows

Fees are often the invisible friction that undermines adoption. Plasma removes that barrier by enabling zero‑fee stablecoin transfers, particularly for USDT‑style tokens. This aligns with how real users think about payments — dollars should feel like dollars, and moving them shouldn’t feel like a technical transaction.

On‑chain activity reflects this approach. Strong stablecoin circulation, meaningful DEX volume, and minimal transfer costs create an ecosystem where capital isn’t just parked — it moves. For traders and developers alike, this equates to:

Lower costs of entry and experimentation

Faster settlement cycles

Higher throughput without congestion penalties

How Value Accrues in a Vertical Chain

A common critique of zero‑fee systems is: If there are no fees, how does the chain accrue value?

Plasma’s roadmap addresses this head‑on. Instead of monetizing transfers directly, the strategy is to:

Secure stablecoin flows at scale

Layer monetization on top through apps, swaps, and credit services

This mirrors successful vertical ecosystems in other industries: mastery of a core loop first, then expansion outward. Plasma didn’t rely on slow organic adoption alone — it launched with significant stablecoin activity from day one, granting immediate visibility and utility.

Metrics That Matter

For vertical chains to transcend hype and become infrastructure, certain indicators must demonstrate real traction. Traders and analysts should monitor:

On‑chain stablecoin market capitalization

USDT dominance within the ecosystem

Daily transaction and DEX volume

Whether zero‑fee transfers convert into app usage and revenue

These metrics reveal whether a chain is merely busy — or genuinely indispensable.

Risks and Dependencies

No strategy is without risk. Plasma’s heavy reliance on USDT exposes it to external factors beyond its control, including regulatory shifts, issuer policies, and exchange integrations. Additionally, zero‑fee mechanics often depend on relayer networks or sponsorship models, which could introduce centralized permissioning risk.

Metrics like TVL and transaction volume should be interpreted carefully. Incentive‑driven spikes may not reflect sustainable engagement, especially if underlying utility does not grow in tandem.

Conclusion: Habit Over Hype

Vertical chains are succeeding not because of flashy marketing, but because they become habitual platforms — the places users return to again and again because doing the core task feels effortless.

Plasma is not trying to be a catch‑all blockchain. It is focused on making one task — dollar settlement — so seamless that users barely notice the chain at all. If Plasma can stabilize a multi‑billion dollar stablecoin float and grow its ecosystem activity from tens to hundreds of millions daily, it may very well graduate from narrative to measurable infrastructure in the evolving blockchain stack.