Stablecoins did not quietly become important. They became unavoidable. Today, more than 90 percent of onchain transaction volume across public blockchains touches a dollar-denominated token at some point. On peak days, stablecoins move more value than Visa does globally. USDT and USDC alone regularly clear over 60 billion dollars a day onchain. Yet when you look closely at most blockchains, it becomes clear they were never designed for this reality. They were built for generalized computation, open experimentation, and flexible programmability. Payments were assumed to be just another application. Over time, that assumption started to break.

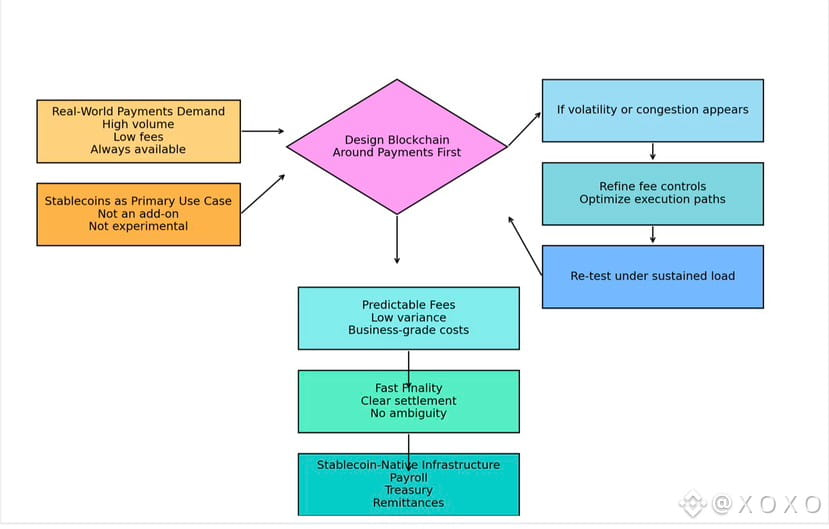

@Plasma starts from a different place. It does not treat stablecoins as a feature that happens to run on top of a chain. It treats them as the reason the chain exists.

Most blockchains inherit their architecture from an era where tokens were volatile assets first and money second. Blocks were sized for experimentation. Fees were allowed to float wildly because speculation could tolerate it. Finality was acceptable at minutes because no one was settling payroll or treasury flows. This worked when onchain activity was dominated by traders and developers. However, stablecoins behave differently. They are used by businesses, remittance corridors, payment processors, and increasingly by institutions that measure risk in basis points, not narratives.

Plasma is designed around that reality. Instead of optimizing for maximum generality, it optimizes for predictable settlement. The chain assumes that transactions will be frequent, values will be stable, and failure tolerance will be extremely low. This shifts every design decision.

Consider fees. On many networks, transaction costs fluctuate by 10x or even 100x within a single day. For a trader, that is annoying. For a business moving 50,000 payments a day, it is operationally impossible. Plasma’s fee model is built for consistency first. Fees remain low not because the chain is empty, but because throughput and execution paths are engineered to absorb volume without congestion. This matters when average payment sizes are small. A 1.20 dollar fee on a 20 dollar payment is not friction. It is a deal breaker.

Speed matters for the same reason, although not in the way marketing pages describe it. Stablecoin users do not need theoretical sub-second block times. They need confidence that settlement will occur when expected and will not reverse. Plasma focuses on fast finality rather than raw speed. When a payment clears, it clears with certainty. For payroll systems, treasury desks, and cross-border merchants, this reliability matters more than chasing millisecond benchmarks.

Another overlooked detail is transaction ordering and congestion behavior. In generalized chains, high-value transactions often crowd out low-value ones during periods of volatility. Gas auctions reward whoever pays more. Plasma flips the priority. The system is tuned so that high-volume payment flows remain stable even when markets become noisy. This ensures that everyday transfers do not get trapped behind speculative activity. That separation is subtle, but it is essential for real money systems.

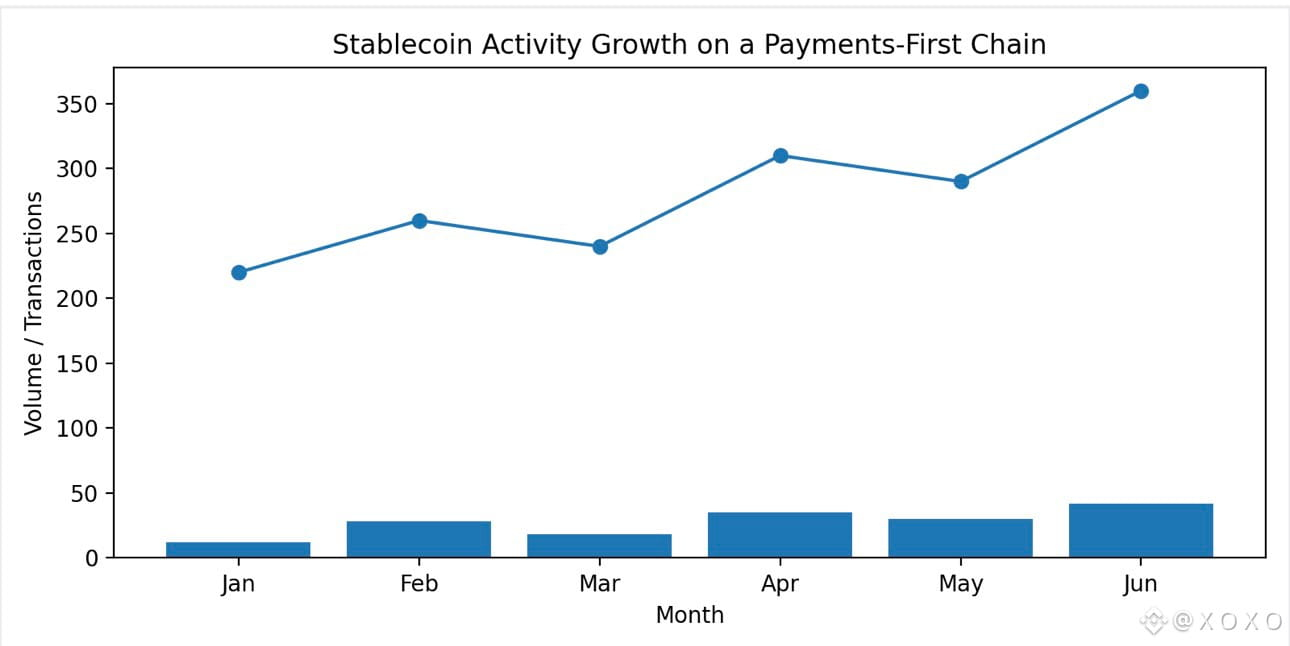

Quantitatively, the difference shows up quickly. A network that can reliably process tens of thousands of stablecoin transfers per second with fees under a few cents changes user behavior. It enables use cases like merchant batching, streaming payments, and continuous settlement that simply cannot function when fees spike unpredictably. Plasma is not chasing peak theoretical throughput. It is chasing sustained, boring, repeatable performance. Ironically, that boredom is exactly what money needs.

Reliability also extends beyond the chain itself. Plasma’s infrastructure assumes that stablecoins are part of a larger financial workflow. Transactions are not isolated events. They are entries in accounting systems, compliance logs, and reconciliation processes. Therefore, the chain is built to integrate cleanly with offchain systems. Deterministic behavior simplifies auditing. Predictable state transitions simplify monitoring. When something goes wrong, the cause can be identified without guesswork.

This matters because stablecoins are no longer niche instruments. In 2024 alone, stablecoin transaction volume exceeded 11 trillion dollars. Emerging markets increasingly use them as working capital rails. Small businesses rely on them to bypass expensive correspondent banking networks. Institutions are experimenting with tokenized cash equivalents for settlement. In all of these cases, users care less about decentralization slogans and more about whether the system behaves like money should.

Plasma’s design implicitly acknowledges this shift. It does not attempt to be everything to everyone. Instead, it narrows its focus and becomes very good at one thing. By doing so, it avoids the architectural compromises that plague multipurpose chains. There is no need to accommodate every possible smart contract pattern. There is no incentive to inflate block space for speculative bursts. The system remains aligned with its core workload.

What makes this approach compelling is that it scales socially as well as technically. When users trust that fees will stay low, they design products that assume low fees. When they trust that finality is reliable, they design workflows that depend on it. Over time, the ecosystem becomes self reinforcing. Plasma does not need to attract activity with incentives. Activity comes because the chain fits the job.

My take on this is simple. Stablecoins are not an application trend. They are the financial substrate of crypto. Chains that treat them as secondary will continue to struggle with unpredictability and friction. Plasma feels different because it accepts a hard truth early. If you build for money first, everything else becomes easier. If you build for everything, money never quite fits. Plasma chose the former, and in a world where stablecoins quietly move trillions, that choice feels less like a design preference and more like inevitability.

**Essay Two

When Payments Become Infrastructure: Plasma and the Quiet Discipline of Doing One Thing Well**

There is a moment in every technology cycle when complexity stops being impressive and starts being expensive. Blockchains are reaching that moment now. After years of adding features, layers, and abstractions, many networks have become incredibly capable and strangely fragile at the same time. Stablecoins expose this fragility more clearly than any other use case. Payments are unforgiving. They reveal where systems wobble, where costs leak, and where assumptions break under load.

Plasma approaches this problem by removing ambition rather than adding it. Instead of asking how many things a blockchain can support, it asks how well it can support one thing at scale.

Stablecoin payments are deceptively simple. On the surface, they are just transfers of value. Underneath, they are repetitive, high frequency, and sensitive to delay. A payment rail that handles 5 transactions per second and one that handles 50,000 look similar in a demo. In production, they behave nothing alike. Latency compounds. Fees accumulate. Edge cases multiply.

Most chains were designed when this kind of sustained load was hypothetical. Their architectures assume spiky usage rather than constant flow. Plasma assumes the opposite. It expects continuous pressure. This changes how capacity is planned. The system is designed to remain stable under persistent demand rather than peak demand alone.

One of the most important consequences of this is cost predictability. Businesses care less about absolute fees and more about variance. A system that charges 2 cents consistently is more useful than one that charges 0.1 cents sometimes and 5 dollars other times. Plasma’s infrastructure is optimized to minimize variance. Execution paths are streamlined. Block production remains steady. Fee markets are constrained to prevent runaway pricing.

This predictability unlocks behaviors that general chains discourage. For example, merchants can settle transactions individually instead of batching aggressively. Streaming payments become viable because per transaction cost stays low. Treasury operations can rebalance frequently without worrying about market conditions on the chain. These are small changes, but together they make stablecoins behave like real money rather than speculative tokens.

Speed also plays a different role here. In speculative environments, faster blocks often mean faster trading. In payment environments, faster finality means faster trust. Plasma’s focus is on ensuring that once a transaction is included, it is effectively done. This reduces the operational overhead of waiting, monitoring, and retrying. Over millions of transactions, that reduction compounds into real efficiency.

Numbers help illustrate this. If a business processes 1 million payments per month and each payment requires an additional 30 seconds of monitoring due to uncertain finality, that is over 8,000 hours of operational drag. Reduce that uncertainty, and the savings are immediate. Plasma’s design aims at these quiet efficiencies rather than headline benchmarks.

Another critical aspect is failure handling. Payments systems must assume things will go wrong. Networks congest. Validators fail. External systems lag. Plasma is designed so that when something breaks, it breaks cleanly. Transactions either settle or they do not, without ambiguous intermediate states. This clarity is invaluable for reconciliation and dispute resolution.

Stablecoins also live at the intersection of crypto and traditional finance. That boundary introduces constraints that purely crypto native chains often ignore. Compliance requirements, reporting standards, and auditability matter. Plasma’s deterministic behavior simplifies these requirements. It becomes easier to explain system behavior to external stakeholders. Easier explanations lead to adoption.

This is where Plasma’s philosophy becomes most visible. It does not try to convince the world to change its expectations. It adapts to existing ones. Money expects discipline. Payments expect reliability. Systems that provide these qualities tend to disappear into the background, which is exactly where infrastructure belongs.

Over time, this approach reshapes the ecosystem. Developers stop designing around volatility and start designing around flow. Users stop checking gas trackers and start assuming transfers will work. The chain becomes less visible and more trusted. Ironically, this invisibility is a sign of success.

My take here is shaped by watching payment systems fail quietly and repeatedly in crypto. Not through hacks or outages, but through small frictions that add up until users leave. Plasma’s strength is that it takes those frictions seriously. By designing for stablecoins from the ground up, it treats payments not as an experiment, but as a responsibility. In a space that often celebrates novelty, Plasma’s restraint feels refreshing. Sometimes the most innovative thing a system can do is decide what not to be.