It’s been a while since we’ve seen such a clear two-leg structure in $ETH options flow.

Total size ~ $97M notional (Feb 27 ~ $69M | Mar 26 ~ $28M).

The objective is not pure directional betting, but risk hedging + volatility farming.

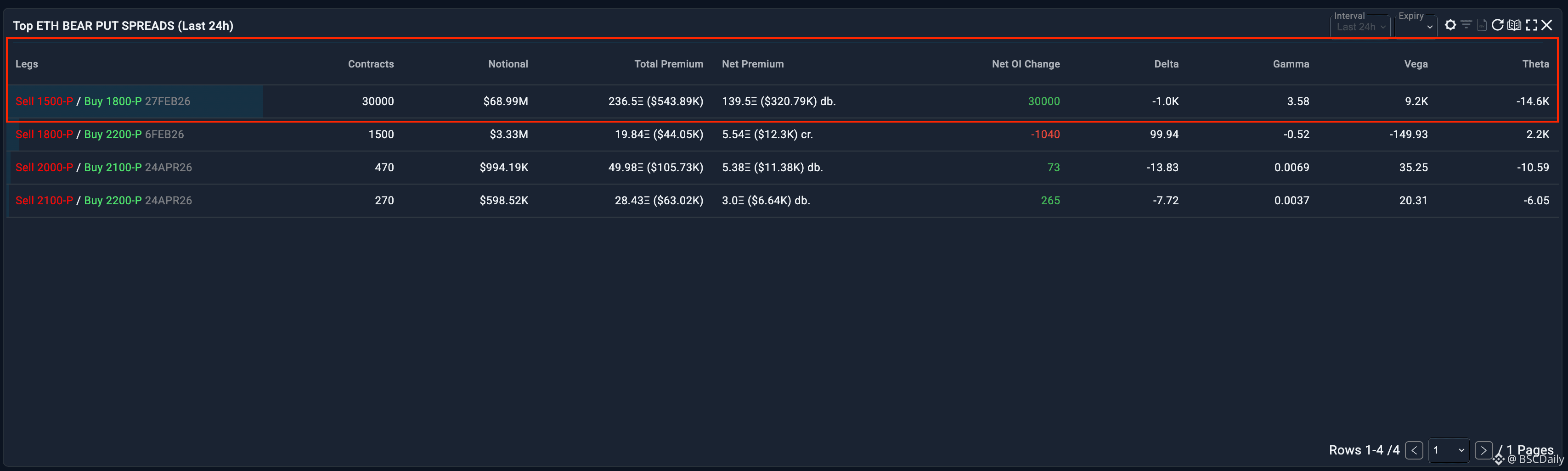

1/ Feb 27 Leg – Downside Hedge (1800 → 1500)

- Notional: ~$69M | Net premium: -$300K

- Payoff: Starts making money if ETH < 1800, max profit at 1500

→ For the near term, the trader is preparing for a bearish scenario on ETH. If ETH continues to drop toward the 1.5k area, the Feb 27 leg serves as a cheap hedge for spot exposure.

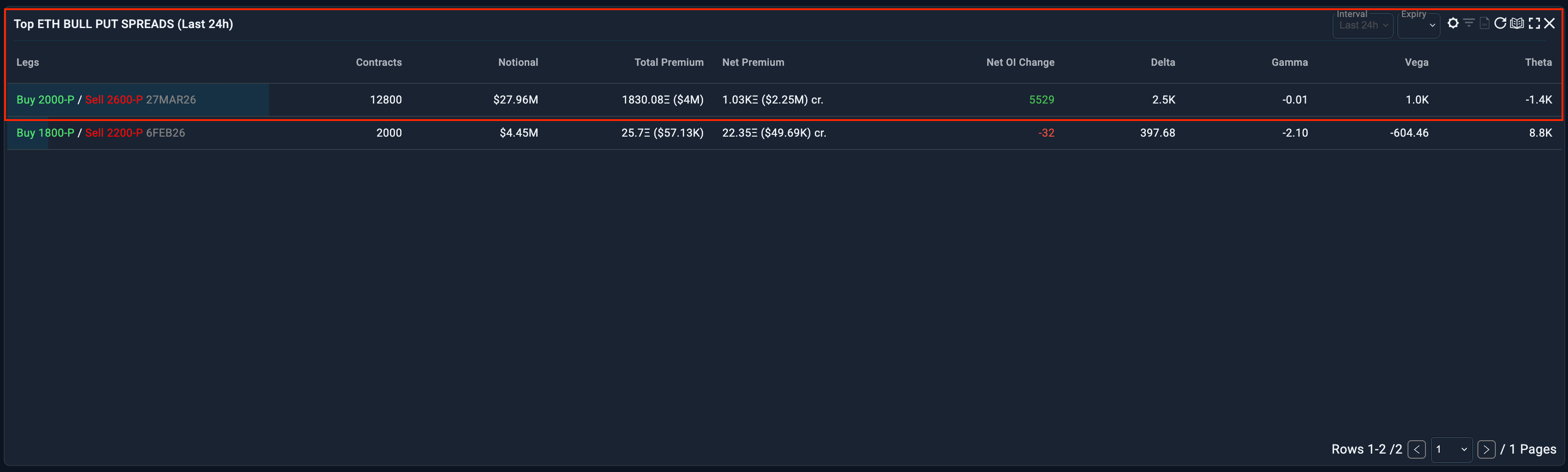

2/ Mar 26 Leg – Theta Farming / Rebound Play (2000 → 2600)

- Notional: ~$28M | Net premium: +$2.25M

- Payoff: Profitable as long as ETH > 2000, max profit if it holds above 2600

→ This leg is ~1 month out, with strikes not too far from spot, suggesting the trader is harvesting premium while leaving room for a post-selloff rebound. The $2.25M premium collected is used to offset the ~$300K hedging cost paid in the Feb 27 leg.

📊Sum Up

Short-term downside hedging + medium-term vol selling to finance the insurance cost — not a one-way directional bet on ETH.

Join our trading group for FREE signals, education, 1-1 support from our experienced traders: https://t.me/ +HWa2akmNUJo5OWQ1 (remove space), or follow us on X: TKR_Trading.