Let me start with a thought that many people in crypto won’t like: the most important asset in this entire industry isn’t Bitcoin or Ethereum. It’s stablecoins.

Not as an investment thesis. Not as hype. Just as a simple reality.

Every leveraged trade, every NFT mint, every cross-border transfer, every escape from a collapsing local currency eventually ends in something stable. USDT, USDC, and similar assets quietly absorb the chaos. They don’t trend on Twitter, but they carry the weight of the system.

And yet, we’ve built a trillion-dollar crypto economy on infrastructure that treats stablecoins like guests, not citizens. That’s the real flaw. It’s like designing a global payments network where the most important component was never meant to be there in the first place.

This is where Plasma stands out not because it’s loud, but because it’s focused.

While most blockchains try to do everything at once, Plasma asks a much simpler question: what if crypto actually worked as a payments system?

For years, we’ve layered speculation on top of chains that were never optimized for everyday value transfer. Plasma flips that logic. It doesn’t start with DeFi or hype apps. It starts with money movement fast, final, predictable money movement.

Think about the real world. A merchant in Argentina. A freelancer in Nigeria. A family sending funds across borders. Today, using stablecoins still feels harder than it should. Gas fees jump. Transactions hang. You need a second volatile token just to move a “stable” one. For non-crypto users, this isn’t freedom it’s friction.

General-purpose blockchains were designed for programmable, volatile assets. Stability was bolted on later. Plasma doesn’t bolt it on. It builds around it.

Calling Plasma a “Layer 1 for stablecoins” almost misses the point. It’s more accurate to think of it as purpose-built financial infrastructure. Every design decision — consensus, fees, finality is optimized for one job: moving stable value cheaply and reliably.

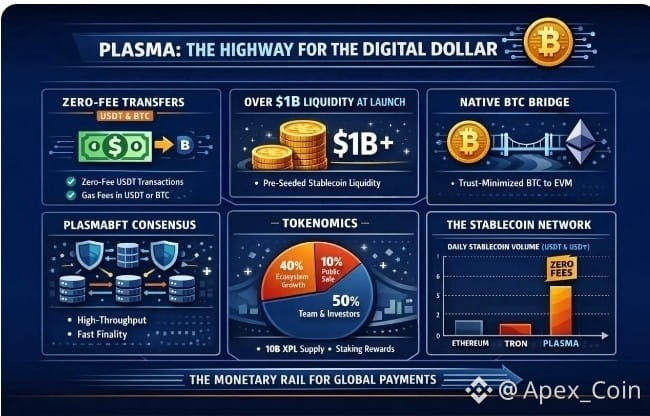

This philosophy is clearest in Plasma’s approach to consensus. PlasmaBFT prioritizes fast, deterministic finality. Yes, this means different trade-offs than Proof-of-Work maximalism. But payments don’t need ideological purity they need certainty. When someone sends $500, they care about speed, cost, and reliability, not abstract decentralization metrics.

That pragmatic mindset shows up again in Plasma’s most important feature: native, feeless USDT.

On most chains, USDT lives inside a smart contract and pays rent in another token. On Plasma, USDT is first-class. There’s no separate gas token for users to worry about. No extra mental overhead. From the user’s perspective, it’s simple: dollars go in, dollars come out. The blockchain fades into the background exactly where infrastructure should be.

Plasma still has a token, XPL, but its role is intentionally unglamorous. XPL isn’t built to fuel speculation. It exists to secure the network, govern it, and align incentives around long-term usage. Its value is meant to reflect network security and utility, not narrative cycles. That alone puts Plasma in a different psychological category than most crypto projects.

What really strengthens this vision is Plasma’s approach to adoption. Plasma Learn isn’t content marketing it’s field research. By studying regions like Nigeria or Russia, Plasma is identifying where stablecoins aren’t just convenient, but necessary. Hyperinflation, capital controls, broken banking rails these are the environments where stable infrastructure matters most.

Plasma isn’t just shipping code. It’s building understanding.

The strategy becomes clear when you look at who Plasma is actually for. First, developers helped by EVM compatibility and familiar tooling. Second, institutions reassured by compliance partnerships like Elliptic, which signal seriousness rather than hype. And finally, everyday users reached through education and real-world use cases, not token promises.

At its core, Plasma isn’t trying to be flashy. It’s trying to be invisible.

The goal isn’t to be the app you talk about. It’s to be the rail everything else runs on. A kind of open, programmable SWIFT layer for the internet era. That’s not a short-term play. That’s a generational ambition.

So measuring Plasma by price misses the point entirely. The real signals are quieter: institutional integrations, transaction consistency, stablecoin velocity, and usage that doesn’t spike and crash with market sentiment.

If Plasma succeeds, XPL won’t move like a meme coin. It will behave like infrastructure boring, steady, and essential.

And maybe that’s the most bullish thing of all.

Because long after the narratives fade and the speculation cools, the world will still need to move money. Plasma isn’t here for the carnival. It’s here to build the plumbing that remains once the noise is gone.