As blockchain adoption grows, performance stops being a theory and starts being a numbers game. When real users show up, networks either hold up or they crack. We have seen this play out again and again across public chains, and the data is clear. Scalability problems are not abstract. They show up in fees, delays, and failed transactions.

This is where @Plasma takes a different path. Instead of promising ideal conditions, Plasma looks at what actually breaks under pressure and designs around that.

What the data shows during high demand.

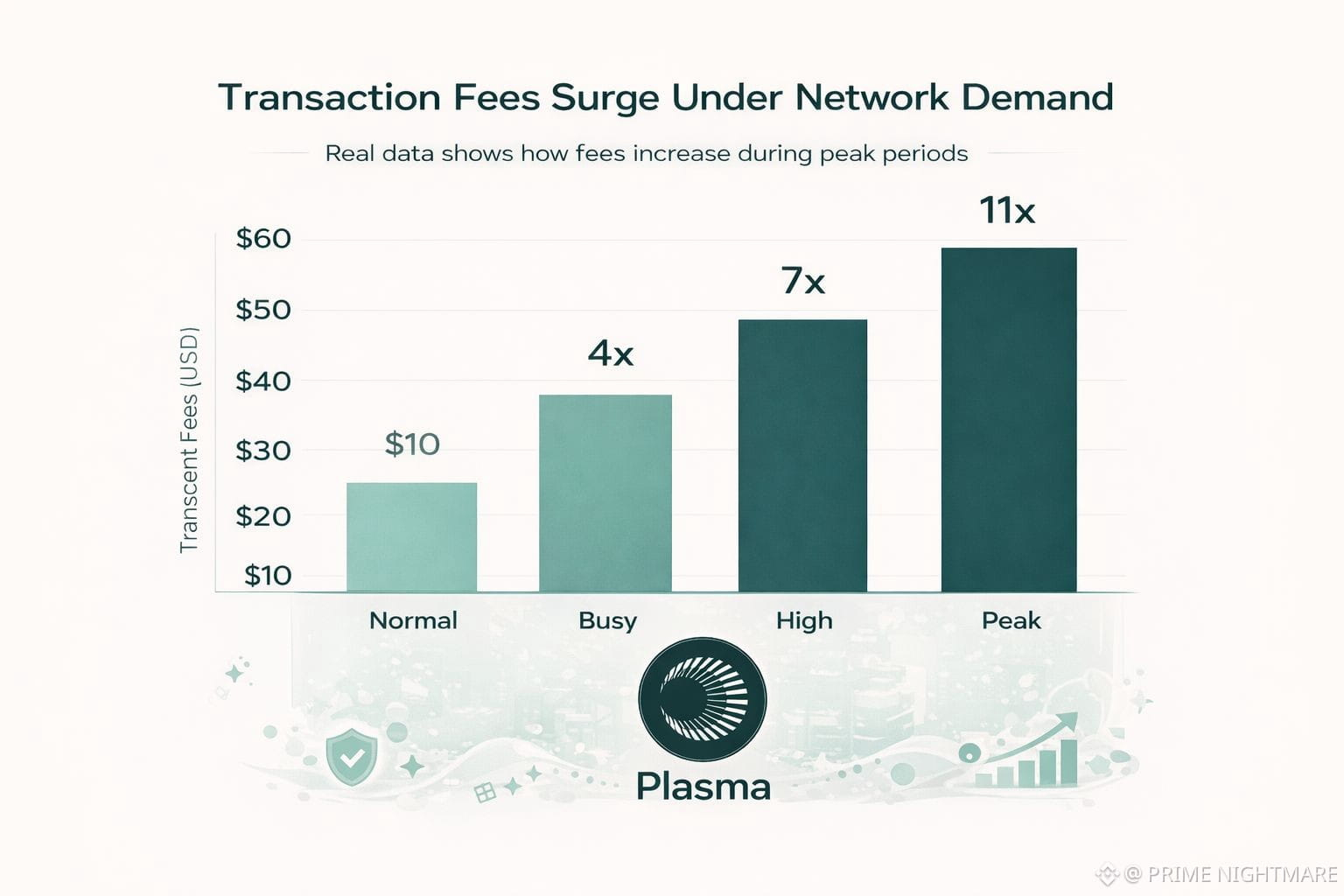

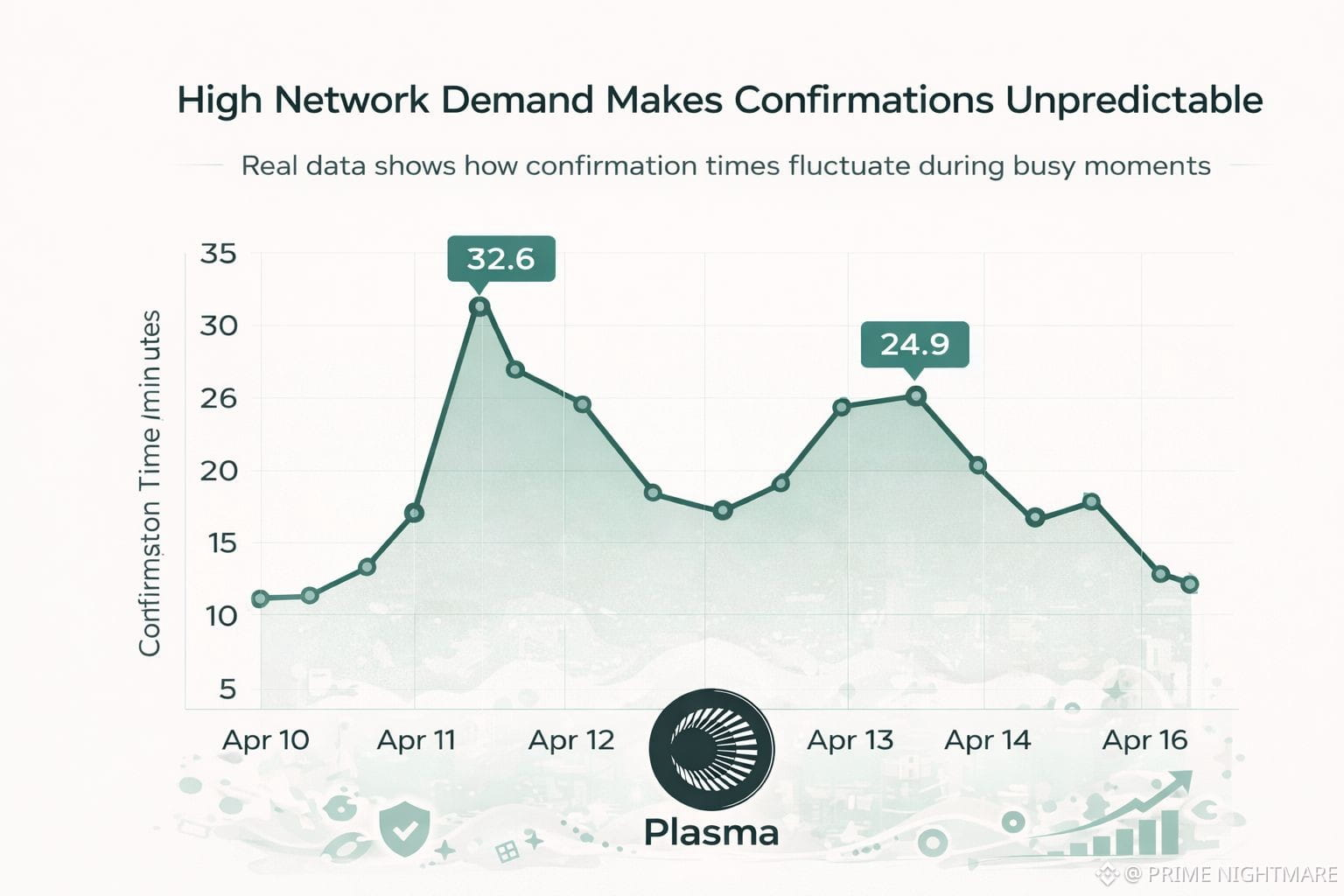

If you look at on chain data from major networks during busy periods, the same issues keep appearing.

• Transaction fees jump anywhere from four times to more than ten times

• Confirmation times become unpredictable

• Failed transactions increase as congestion builds

These spikes usually happen during real events. NFT launches. Market volatility. At those moments, users often end up paying fees that are higher than the value they are trying to move. That kind of experience pushes people away fast.

Plasma is built with this reality in mind. The goal is not to survive short bursts of activity but to stay usable when demand is steady and high.

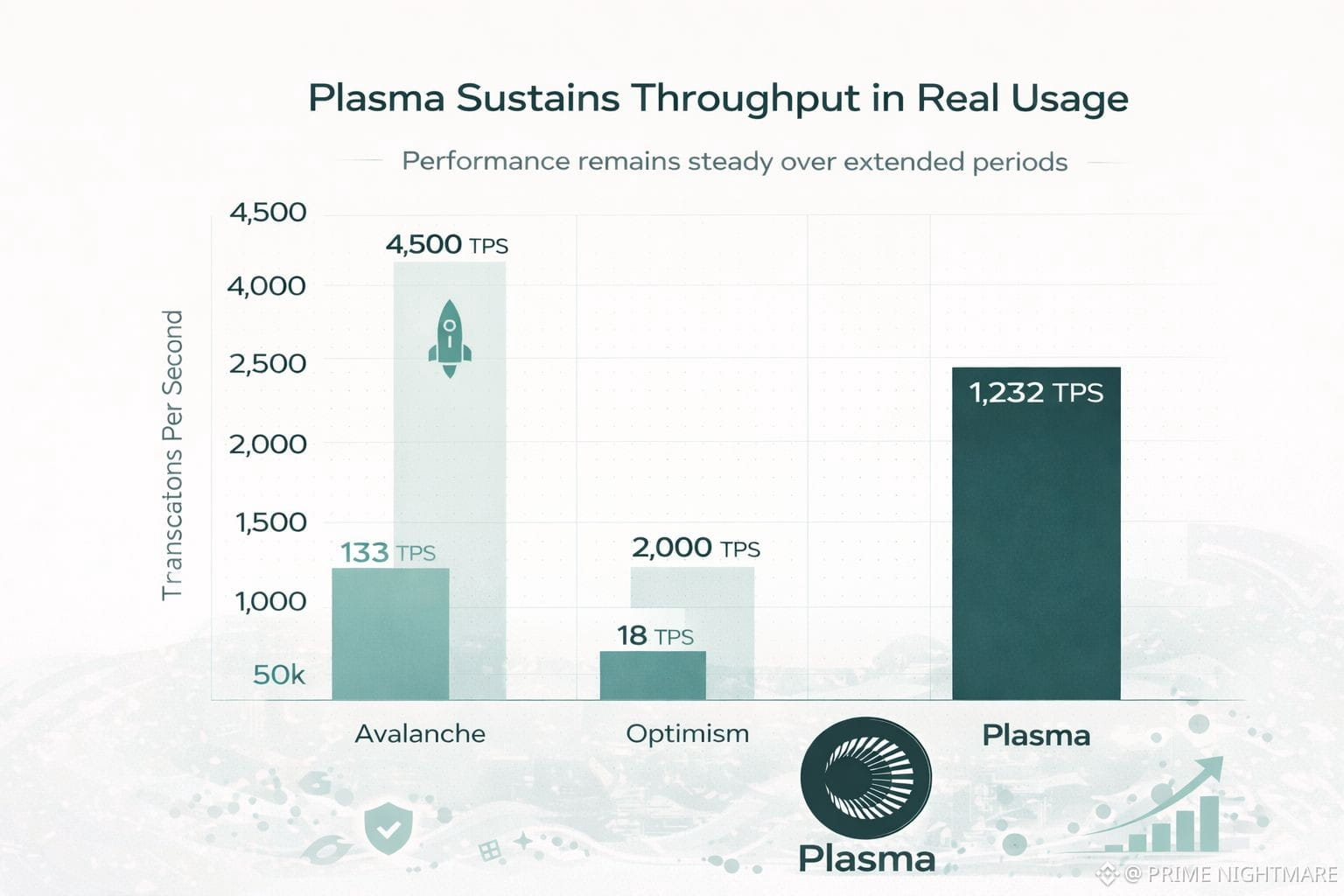

Sustained performance matters more than peak claims.

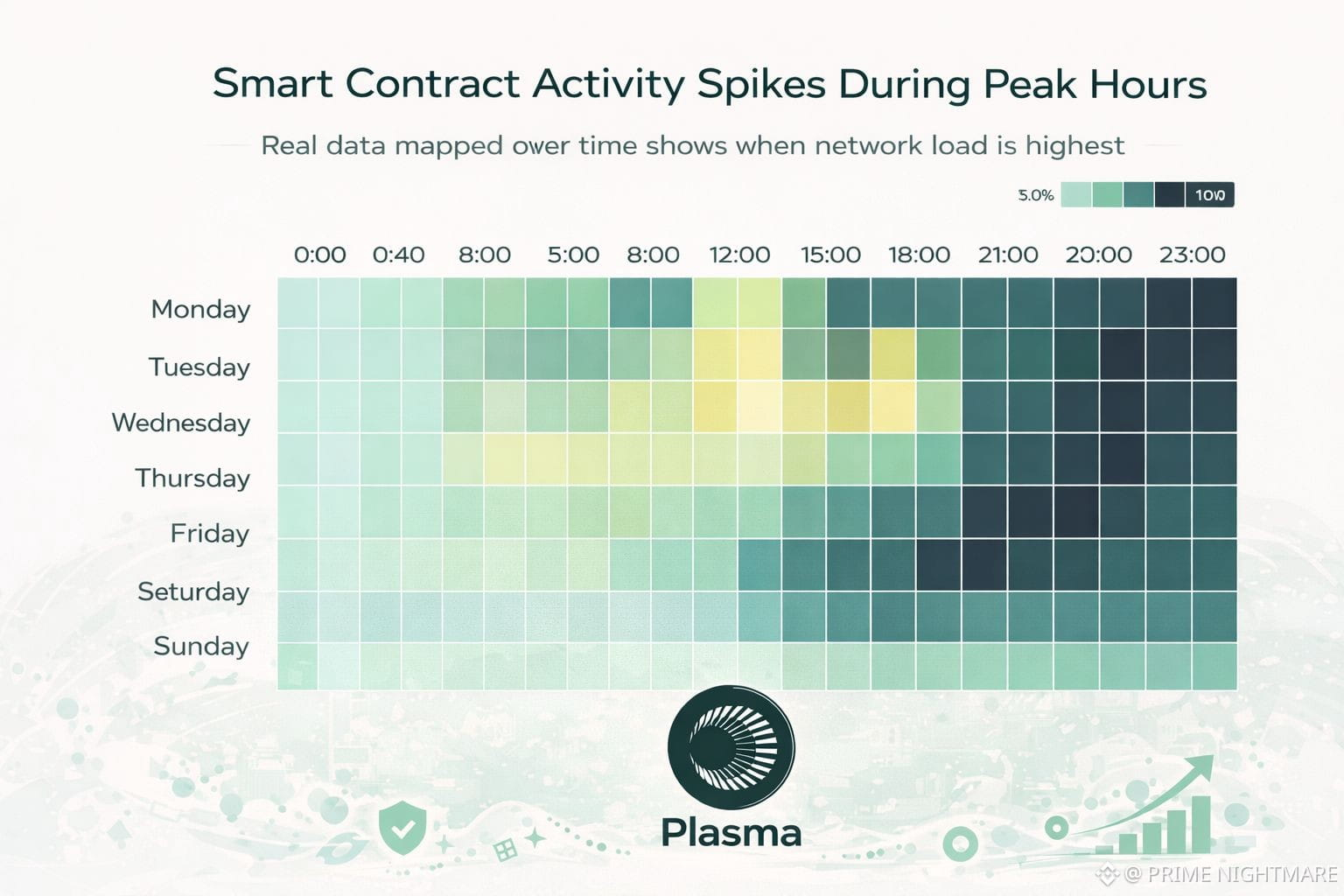

Many networks advertise impressive transactions per second numbers. The problem is that these numbers rarely show up in real use. Independent performance data shows that once smart contracts and real users are involved, sustained throughput often drops to a fraction of the advertised maximum.

Plasma focuses on what can be maintained over time. By reducing execution overhead and allowing transactions to be processed more efficiently in parallel, the network is designed for constant load, not lab tests.

This matters because real applications do not turn on and off. They run every day.

How XPL fits into real usage.

The Plasma network runs on XPL, and the token is tied directly to what happens on the protocol.

$XPL is used for.

• Validator participation and network security

• Governance settlement.

• Economic coordination at the network level.

Looking at past market rotation, infrastructure tokens with clear on chain roles tend to hold up better over time. They show lower volatility and recover faster after downturns compared to assets driven only by hype.

The design of XPL reflects that lesson. Its value comes from use, not stories.

Developers are the early signal.

One of the most consistent indicators of long term network growth is developer activity. Open source contribution data shows that ecosystems with steady developer growth usually attract more users and capital later.

Plasma puts a lot of weight on predictable fees and reliable execution. When developers know what it will cost to run their apps and can trust the network to behave consistently, they stay and build more.That creates a simple loop. Stable infrastructure leads to better apps. Better apps bring more users. More users strengthen the network.

Why this approach matters now.

User expectations have changed. Research across Web3 platforms shows that many users leave after just one or two failed or delayed transactions. Performance is no longer a bonus. It is the baseline.

Plasma is built for a phase where.

• Users expect low fees and fast confirmations.

• Developers expect reliability.

• Investors look for real fundamentals.

Projects that solve these problems quietly tend to be the ones that last.Plasma is not betting on hype. It is betting on measurable results.Follow plasma and watch the infrastructure being built for the next wave of blockchain adoption.#Plasma