Crypto has become fluent in speed, but awkward in the moments that require discretion. In conversation, everything is motion: faster blocks, bigger throughput, more composability. In real life, the moments that matter tend to be quieter. A transfer that needs discretion. A balance that should not become a broadcast. A trade that has to leave a clean footprint without exposing the entire room.

The popular narrative says regulated finance will come on-chain once the technology looks more like a high-performance exchange. More speed, more liquidity, more integrations, more everything.

What’s actually missing is not motion. It’s meaning.

Because regulated finance isn’t allergic to blockchains. It’s allergic to accidental disclosure.

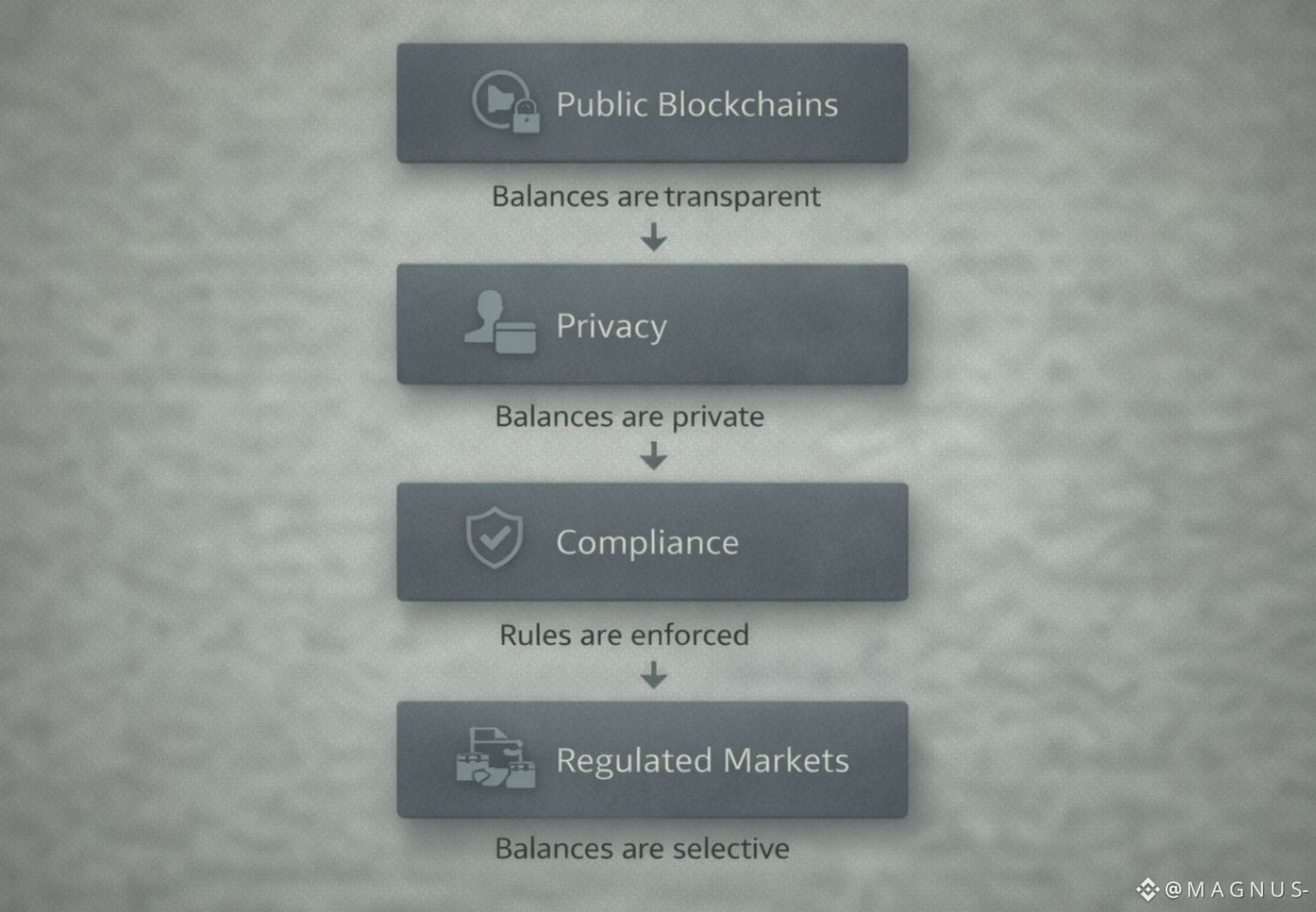

The core problem is simple: public ledgers turn normal financial behavior into public theater. Balances become a glass wallet. Transfers become a trail anyone can follow. For a retail user, that can be uncomfortable. For an institution, it can be unworkable. A lot of compliance is about knowing who did what, when, and why, but not turning every detail into an open dossier.

That’s where Dusk feels different to me. Not louder. Not faster. Heavier. More deliberate.

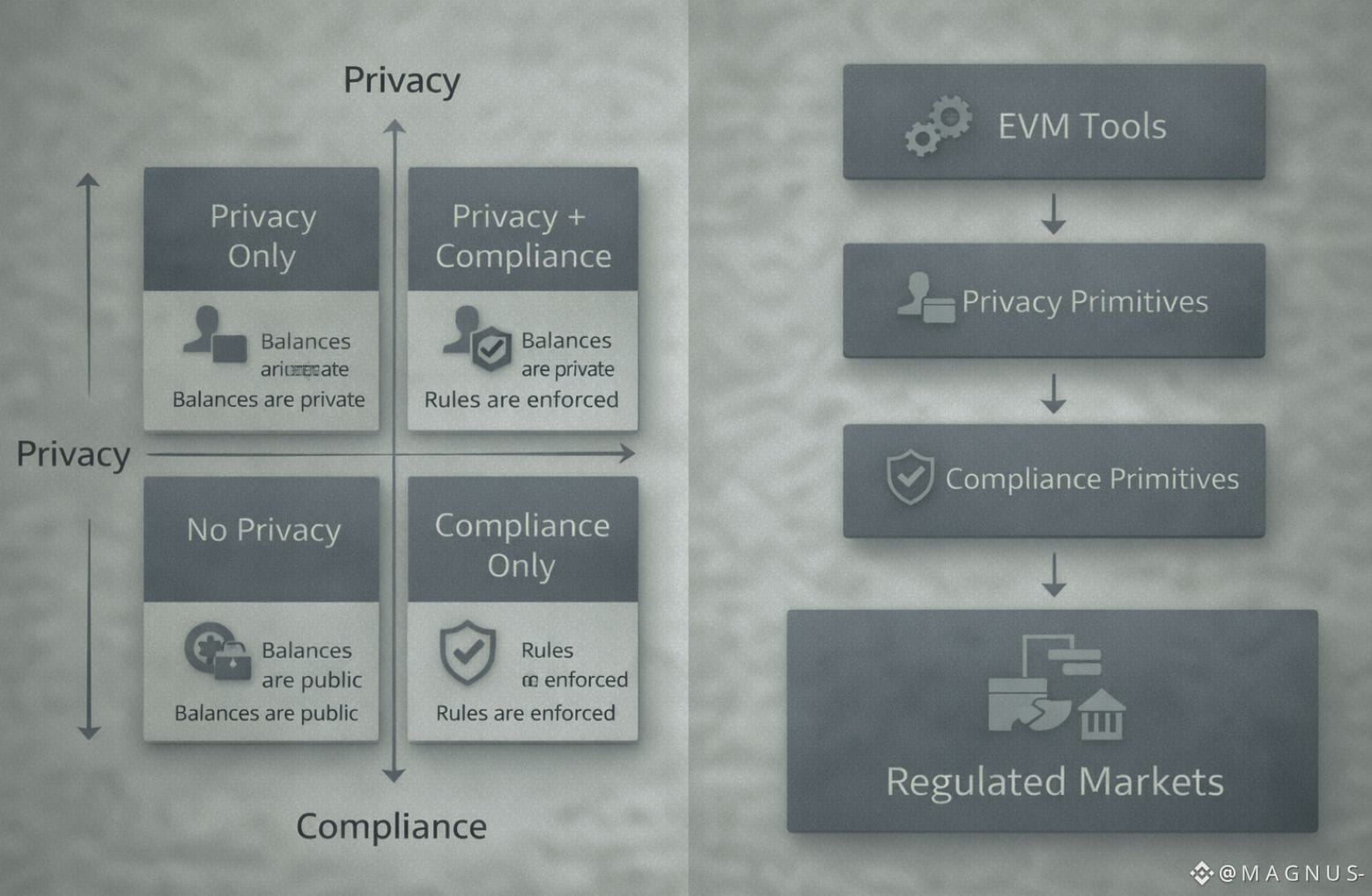

The idea is not “privacy for privacy’s sake.” It’s privacy as a missing component of regulated markets on-chain. Dusk positions itself as a privacy blockchain for regulated finance, meaning you can launch and use markets where institutions can meet real regulatory requirements on-chain, users get confidential balances and transfers instead of full public exposure, and developers can build with familiar EVM tools while gaining native privacy and compliance primitives.

If that sounds like a lot, it helps to think of it in two metaphors.

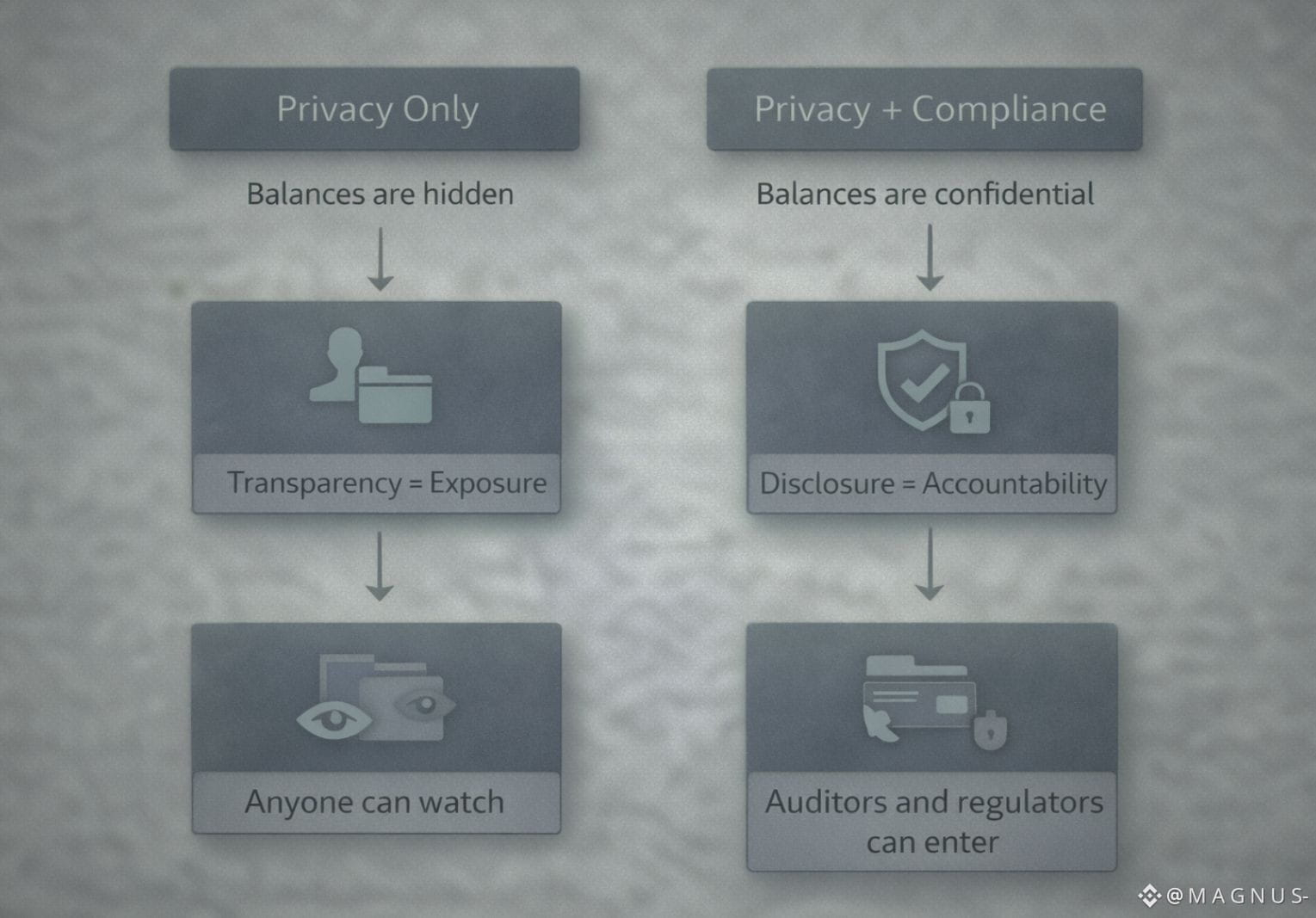

First: public blockchains are like working in a glass office. The work may be legitimate, but the walls are transparent. Everyone can watch your meetings, see your clients, and estimate what you’re doing by who walks in and out. You can try to “behave differently” inside that office, but you’re still exposed.

Dusk is closer to a real office with doors and access control. Auditors can enter when they need to. Regulators can verify that rules are being followed. But random strangers cannot sit in the hallway with binoculars and map your operations.

Second: most on-chain markets today feel like leaving footprints in wet cement. Every step hardens into a permanent impression that anyone can study later. Dusk aims to change the surface texture. You still leave evidence that you walked through. You just don’t leave your shoe size, your route, and your destination for everyone to trace.

Mechanically, that means two things working together.

One is confidentiality at the user level: balances and transfers that aren’t fully exposed by default. That matters because privacy is not only about hiding. It’s about reducing noise. When everything is public, the chain becomes a place where people trade the metadata of other people’s lives. That is motion without meaning.

The other is compliance at the market level: building regulated logic into how on-chain activity can be verified and governed. Institutions don’t need a system that forgets. They need a system that remembers in the right way. Not gossip. Not surveillance. Just verifiable proof that requirements were met.

This is where the “motion vs meaning” theme really lands. Crypto has always been good at movement. Tokens move, liquidity moves, narratives move. But regulated finance is built on constraints. Not because it loves friction, but because constraint is the price of trust.

In some environments, that trust premium is the difference between experimentation and production.

Here are a few estimates that help ground it.

Roughly, a large portion of institutional hesitation around on-chain settlement is not “can it clear fast enough,” but “can it clear without leaking sensitive positions and counterparties.” You can feel this in how often privacy is raised in serious conversations even when it’s not on the slide deck.

Early signs suggest that when users believe their balances are exposed, their behavior changes. They split activity across wallets, route through extra hops, and hesitate to interact at all. In some environments, that adds friction that can be bigger than fees. Not monetary friction. Cognitive friction. The kind that breaks habit formation.

And in some environments, compliance work itself becomes the hidden tax. The more a system broadcasts, the more expensive it becomes to manage what that broadcast implies. Legal reviews, monitoring, reporting, internal approvals. The chain may be “open,” but your organization becomes closed around it.

Dusk’s bet is that privacy and compliance primitives are not optional features. They are the missing layer that turns blockchain motion into financial meaning.

What I find quietly contrarian here is that it refuses the easy aesthetic of transparency as virtue. In crypto, transparency is often treated as moral. If it’s public, it must be honest.

But transparency is not honesty. Transparency is exposure.

Regulated finance runs on selective disclosure. You disclose to the right parties under the right conditions, with the right audit trail. You don’t disclose to the crowd. You don’t disclose to your competitors. You don’t disclose to data harvesters who can build models around your behavior.

So the real question isn’t “Can regulated finance use blockchains?” It’s “Can blockchains hold a boundary?”

Now, an honest risk.

Privacy systems can make people nervous for valid reasons. If information is hidden, how do you prevent abuse? How do you ensure compliance does not become theater? How do you keep privacy from turning into a black box where bad behavior can hide?

That critique deserves respect. A chain that hides everything is not a market. It’s a rumor.

If Dusk is executed well, is that privacy does not have to mean invisibility. The mature version is confidentiality with verifiability. You keep sensitive details private while maintaining proofs, controls, and auditability where required. That is the difference between “trust me” and “verify me.” It’s the difference between darkness and discretion.

And there’s another risk that is more practical than philosophical: adoption.

Markets don’t migrate just because the architecture is cleaner. They migrate when the tooling is familiar, the compliance story is credible, and the user experience doesn’t feel like walking through sand. Dusk’s approach of pairing EVM familiarity with native privacy and compliance primitives is a strong direction, but it still has to prove itself in production patterns that institutions recognize.

That’s the part people skip when they’re chasing motion. They talk about what a chain can do, not what a market will actually tolerate.

Still, I keep coming back to the same thought: the most important infrastructure is rarely the loudest. It’s the part you only notice when it’s missing.

When privacy is missing, the entire system feels weightless. Everything becomes content. Every action becomes a signal for someone else to trade. Your on-chain life turns into a public dataset.

When privacy and compliance exist as first-class design, the chain gains texture. It starts to feel like a place where serious activity can leave a footprint without leaving a confession.

Maybe that’s the real shift Dusk is pointing at. Not faster motion.