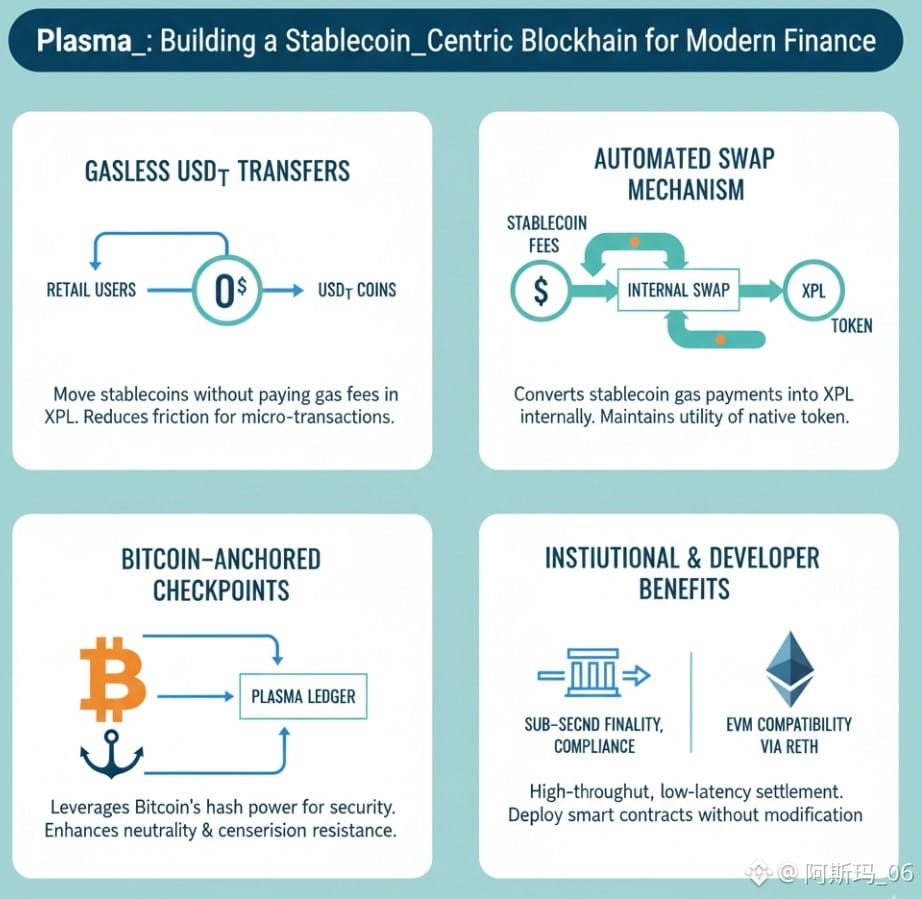

Plasma is a Layer 1 blockchain designed specifically to address the friction points in stablecoin transactions. Its architecture prioritizes usability, speed, and security while remaining fully EVM-compatible. One of the core innovations is the ability to execute gasless USD₮ transfers. By allowing users to move stablecoins without directly paying gas fees in XPL, Plasma reduces the barriers to entry for everyday transactions. This feature is particularly relevant for retail users and payment corridors where micro-transactions are frequent and friction can erode adoption.

The question of network efficiency arises when most fees are denominated in stablecoins rather than the native XPL token. Plasma manages this balance by introducing an automated swap mechanism that converts stablecoin gas payments into XPL internally. This approach maintains the utility of the native token while letting users operate in a familiar currency like USD₮. In practice, it ensures that XPL remains the backbone of network security and economics, even when transaction fees are abstracted away from the end user..

Security is a central concern for any settlement layer, and Plasma addresses this through Bitcoin-anchored checkpoints. By periodically anchoring its state to the Bitcoin blockchain, Plasma leverages the hash power of the most secure network in the world. This enhances neutrality and censorship resistance while maintaining trust-minimized verification. The anchoring process is designed to be low-frequency but cryptographically verifiable, ensuring that network participants can independently confirm the integrity of the Plasma ledger.

Looking ahead, Plasma’s architecture is flexible enough to consider anchoring to other proof-of-work chains as a supplementary security measure. Such an approach could add redundancy without compromising performance or finality. Anchoring to multiple chains would require careful orchestration of checkpoint frequency and data summarization, but the potential for enhanced resilience makes it an area of active research.

For institutional adoption, Plasma is deliberately structured to support high-throughput, low-latency settlement. Payment processors, banks, and fintech firms benefit from sub-second finality and predictable performance. The network’s APIs are designed to integrate directly with institutional systems, enabling real-time monitoring of stablecoin flows and gas usage. Compliance considerations, including transaction auditing and traceability, are built into the protocol to meet regulatory standards without compromising efficiency.

Developers also benefit from Plasma’s design. Full EVM compatibility via Reth ensures that Ethereum smart contracts can be deployed without modification. This allows DeFi protocols, payment applications, and retail-focused wallets to leverage Plasma’s features without extensive rewrites. For developers, the combination of zero-fee USD₮ transfers, stablecoin-first gas, and sub-second finality creates opportunities for building applications that were previously constrained by Ethereum’s high fees and network congestion.

In practice, Plasma represents a convergence of usability, security, and developer accessibility. Gasless transfers make everyday transactions practical. The XPL token maintains network security while accommodating stablecoin-denominated fees. Bitcoin anchoring strengthens trust and neutrality, and the platform’s compatibility with Ethereum tooling ensures broad developer adoption. For institutions and retail users alike, these elements come together to form a stable, efficient, and resilient settlement layer.

Ultimately, Plasma’s innovation lies not in flashy features but in addressing concrete pain points for stablecoin usage. The design choices reflect a pragmatic understanding of transaction friction, token economics, and trust minimization. By focusing on these fundamentals, Plasma positions itself as a serious infrastructure layer for both payments and decentralized finance.