There's a metric Wall Street uses that crypto completely ignores.

Dollar-days.

It measures not just how much money flows through a system, but how long it stays there.

A billion dollars passing through in 24 hours? That's one billion dollar-days.

A billion dollars sitting for 30 days? That's thirty billion dollar-days.

The difference isn't just accounting. It's the difference between a highway rest stop and a city.

And when I look at Plasma's numbers, I'm watching a city being built in real time while everyone else is counting cars on the highway.

The $1.1 Billion Question

Syrup Finance has 1.1 billion USDT parked in yield protocols on Plasma.

Most people read that headline and think: "Cool, high TVL."

Wrong question.

The right question is: Why isn't that money leaving?

Because here's the thing about stablecoins. They're supposed to move. That's the entire point. You hold USDT to pay for something, settle a trade, move between exchanges, or park temporarily before your next move.

But 1.1 billion dollars isn't parking temporarily.

That's capital that looked at every other option Ethereum, Tron, Solana, Arbitrum, centralized exchanges and decided Plasma offered the best risk-adjusted return plus the best friction profile for when it does eventually move.

This is the moat forming in real time, and it's almost invisible in traditional blockchain metrics.

The Liquidity Gravity Well

Once money reaches a certain density in one place, physics changes.

It's not about yield anymore. It's about optionality.

When institutional capital parks on Plasma, it's betting that when it needs to move for payment settlement, cross-border transfer, collateral rebalancing, or merchant processing, the infrastructure will already be optimized for exactly that operation.

This is why Aave's Plasma deployment became one of the largest almost immediately.

Not because the yield was marginally higher, though it is competitive.

Because the smart money recognized: if you're going to hold stablecoins, hold them where moving them is frictionless.

Gasless USDT transfers aren't a feature. They're the difference between capital that can react in seconds versus capital that needs to plan gas budgets, monitor fee spikes, and maintain volatile token balances.

When volatility hits and you need to move $50 million in under a minute, that difference isn't theoretical.

The ConfirmoPay Signal Everyone Missed

80 million in monthly merchant flow through ConfirmoPay settling on Plasma.

Most people see the number and move on.

Wrong focus.

The signal isn't the volume. It's the merchant retention.

Payment processors don't route transactions through infrastructure that's occasionally cheap or usually fast. They need predictable, reliable, and above all, boring.

ConfirmoPay choosing Plasma means that in live production, under real transaction load, with actual merchant requirements, the infrastructure performed better than the alternatives.

That's not marketing. That's product market fit validated by people who lose money if they're wrong.

The Two-Sided Liquidity Trap In a Good Way

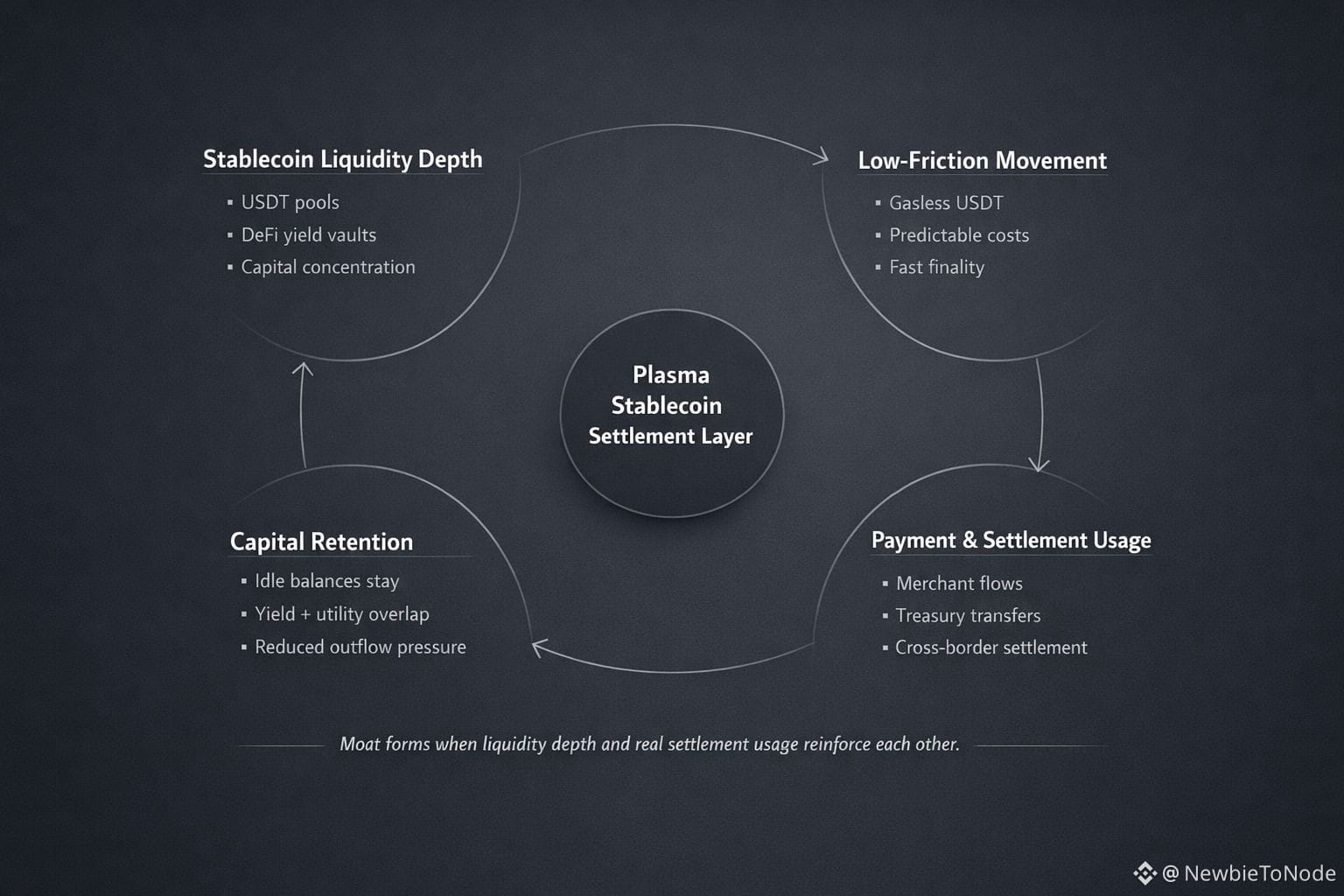

Plasma is simultaneously building two network effects that reinforce each other:

Side 1: Depth

DeFi, yield, liquidity pools. High capital concentration makes moving large amounts efficient. Slippage disappears. Market makers arrive.

Side 2: Breadth

Payments, settlements, merchant flow. High transaction volume makes infrastructure more valuable. More integrations happen. User familiarity grows.

Most chains choose. DeFi focused or payment focused.

Plasma's bet: stablecoin infrastructure does not have to choose.

A merchant needs deep liquidity to convert payments without slippage.

A DeFi protocol needs payment volume so yields stay competitive and capital stays productive.

When both exist on the same infrastructure, each side makes the other more valuable.

The moat is the liquidity times usage compound effect.

What the Market Value Is Completely Missing

$200 million market cap.

For context, that's less than most DeFi protocols with a fraction of the TVL and no actual payment integration.

The market is pricing Plasma like a speculative Layer 1 racing for mindshare.

It should be pricing it like clearing infrastructure approaching critical liquidity mass.

When AWS crossed the threshold where building on AWS became cheaper than building your own infrastructure, revenue exploded.

When Visa became so ubiquitous that merchants could not afford not to accept it, transaction volume compounded.

Plasma is approaching that threshold for stablecoin settlement.

Once enough liquidity sits here and once enough payment volume routes here, the infrastructure becomes self-reinforcing.

New protocols integrate because that's where the liquidity is.

New merchants accept it because that's where the volume is.

New capital parks here because that's where the infrastructure is.

The market will reprice this when it realizes it's not valuing a blockchain. It's valuing a clearing house that happens to use blockchain architecture.

The Diagnostic Question

Forget integrations. Forget partnerships. Forget announcements.

There is one question that determines whether Plasma becomes essential infrastructure or just another efficient blockchain:

Is capital that earns yield on chain actually flowing into real world payment settlement, or just recycling through DeFi?

If it's recycling, if those billions just farm yield and exit elsewhere, then Plasma is a great DeFi chain with a payments story.

If it's flowing, if treasury departments use Syrup yields to optimize working capital while settling vendor payments gaslessly through merchant rails, then Plasma is infrastructure that connects DeFi efficiency with real world utility.

If stablecoin liquidity remains circular inside DeFi and does not increasingly intersect with merchant settlement, Plasma remains a capital-efficient DeFi venue, not systemic infrastructure.

The data is starting to suggest the latter.

But the next phase of growth will make that distinction undeniable.

The Strategy

One foot on DeFi depth. One foot on payment breadth.

This is not confused product strategy.

It's the only way to build a two-sided network for stablecoins.

You need depth so whales and institutions trust the liquidity.

You need breadth so the infrastructure becomes unavoidable for real transactions.

When both reach critical mass simultaneously, you do not have a blockchain competing with others.

You have the default settlement layer for digital dollars.

My Read

This is not a race for attention. It's a race for inevitability.

Plasma is positioning itself as the default settlement layer for dollar-denominated digital value through architecture that makes alternatives feel inefficient.

The market is still pricing it as a blockchain project. Smart money is starting to price it as financial infrastructure.

That gap will not stay open forever.