I realized how broken most stablecoin workflows are on a Tuesday afternoon because nothing went wrong.

I was moving USDT as part of a routine payment flow. Not a test. Not a demo. Just one of those repetitive transfers where you already know the rhythm: send, wait, double-check gas, keep an eye on finality, explain timing to someone downstream.

That rhythm never kicked in.

The transfer settled, balances updated, and the next system in line behaved as if the payment had always been inevitable. No pause. No coordination. No one pinged me asking if it was “safe” to proceed.

That silence was unsettling.

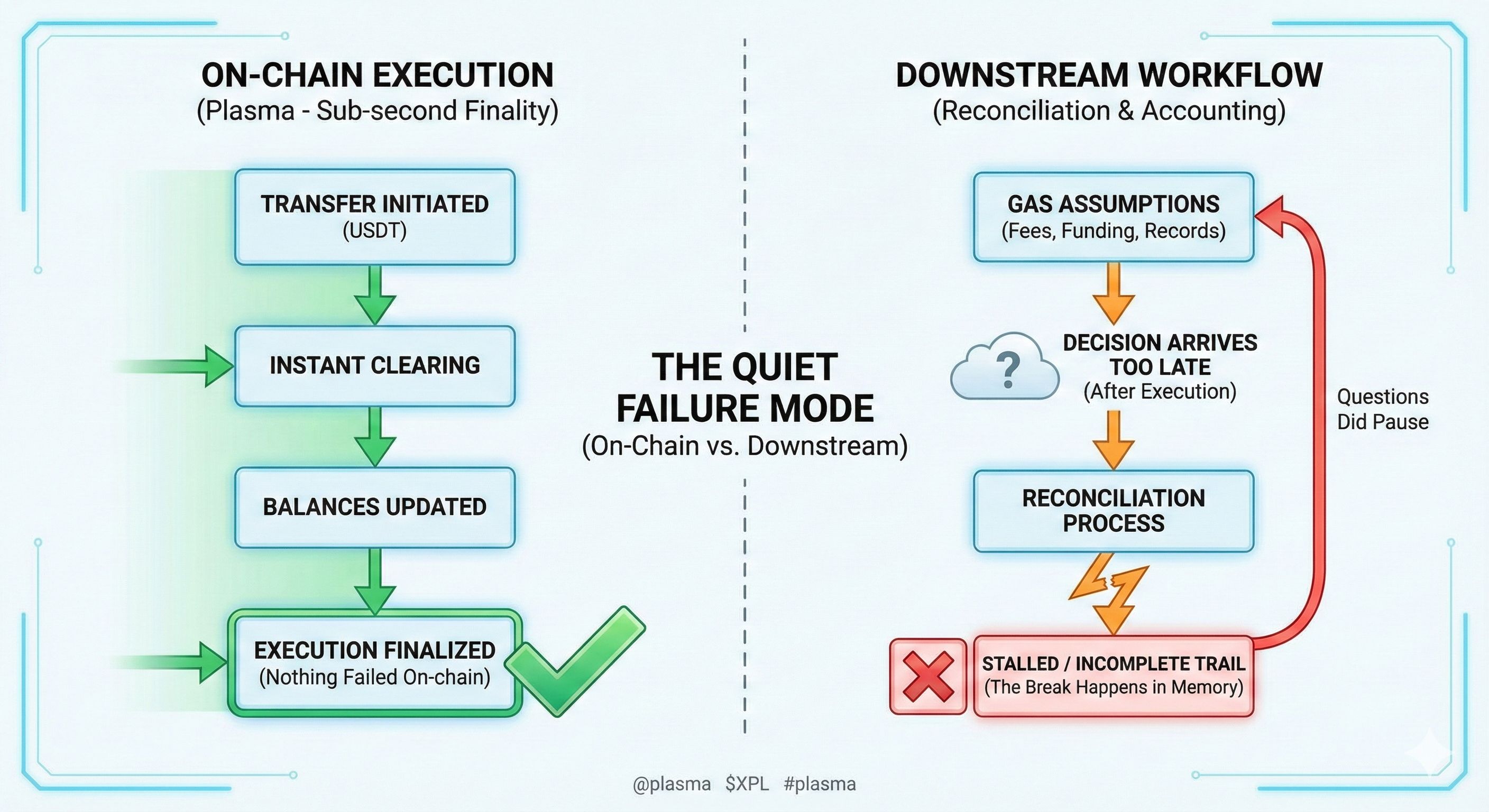

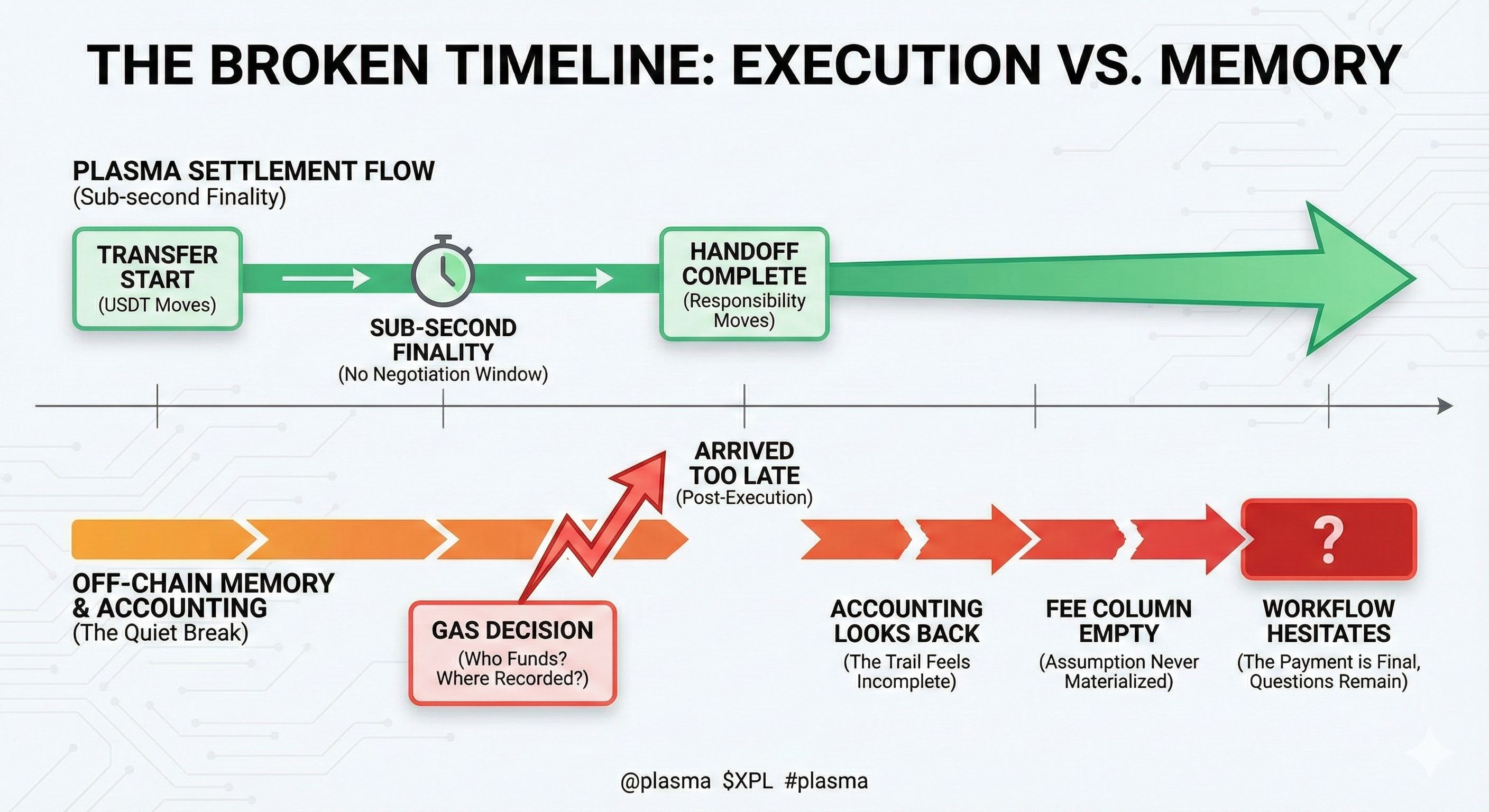

In most systems, even when stablecoins move fast, humans still do the slowing. Gas choices create hesitation. Confirmation windows turn into social buffers. Teams wait not because value hasn’t moved, but because responsibility hasn’t caught up yet.

This time, responsibility arrived immediately.

I checked the clock out of habit. Sub-second. That was the data point that stayed with me, not the speed itself, but what it erased. There was no second state to reconcile. No room for someone to ask for screenshots or hashes. The workflow didn’t bend around human reassurance.

That’s when Plasma (@Plasma ) started to make sense to me.

Plasma doesn’t treat stablecoins like guests on a smart contract chain. It treats them like the reason the chain exists. Gasless USDT transfers remove the side conversation that usually fractures payment intent. Stablecoin-first gas means the fee logic doesn’t pull attention away from settlement. And PlasmaBFT finality collapses waiting into a single, decisive moment.

What surprised me most was how little explanation followed.

Full EVM compatibility through Reth meant nothing felt unfamiliar while executing. Bitcoin-anchored security meant there was no discretionary ordering to debate afterward. The payment just… held. Downstream systems trusted it because there was nothing ambiguous left to question.

That’s a big shift if you’ve spent years designing workflows around delay.

Retail users in high-adoption markets feel this as smoother motion. Institutions feel it as fewer reconciliation loops. But the deeper change is behavioral: people stop hovering. They stop padding time. They stop pretending uncertainty is safety.

Plasma doesn’t remove pressure, it moves it forward.

Once I noticed that, I realized why the flow felt different. The system wasn’t waiting for me to feel comfortable. It assumed settlement should be trusted the moment it exists.

And after that, every other payment flow started to feel louder than it needed to be.