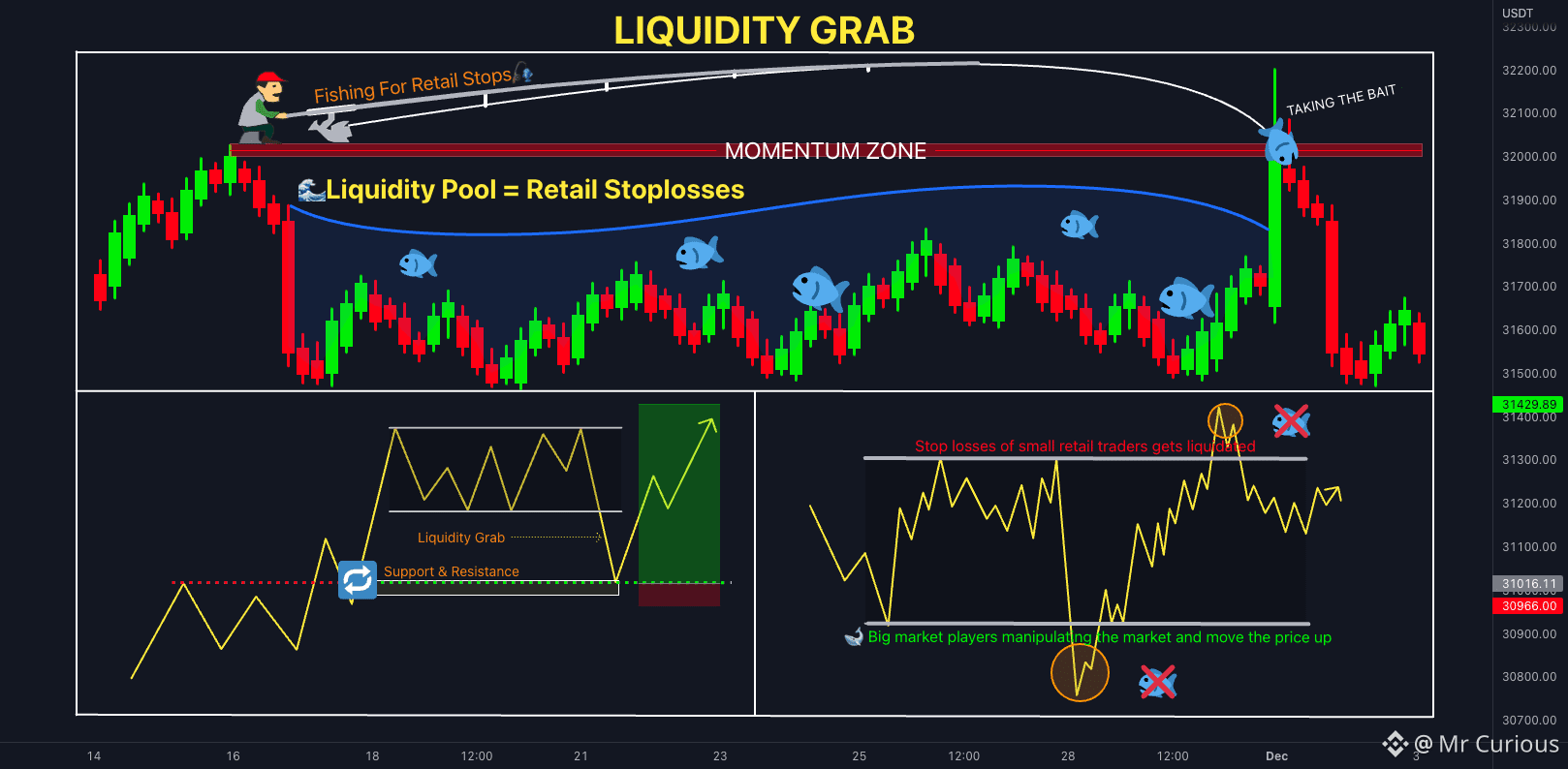

One of the most common phrases traders use after a loss is:

“The market is manipulated.”

In reality, what most people call manipulation is simply liquidity doing its job.

What liquidity actually means

Liquidity is where orders exist:

stop-losses

breakout entries

resting limit orders

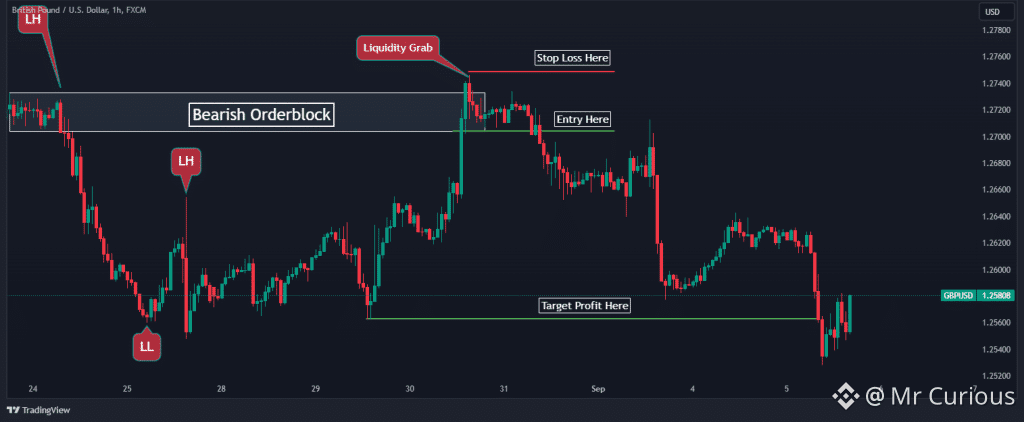

These orders usually sit at obvious levels:

equal highs and lows

previous day’s high/low

clean trendline touches

range highs and lows

When many traders see the same level, liquidity builds there naturally.

Why price moves into those levels

Price doesn’t move randomly, and it doesn’t move emotionally.

It moves to:

fill orders

test commitment

transfer risk from weak hands to strong hands

If price didn’t move toward liquidity, markets would be inefficient.

A move into stops is not an attack — it’s price completing a process.

The real misunderstanding

Retail traders often expect price to:

respect levels perfectly

reverse immediately

reward early entries

But markets don’t reward early confidence.

They reward correct timing and context.

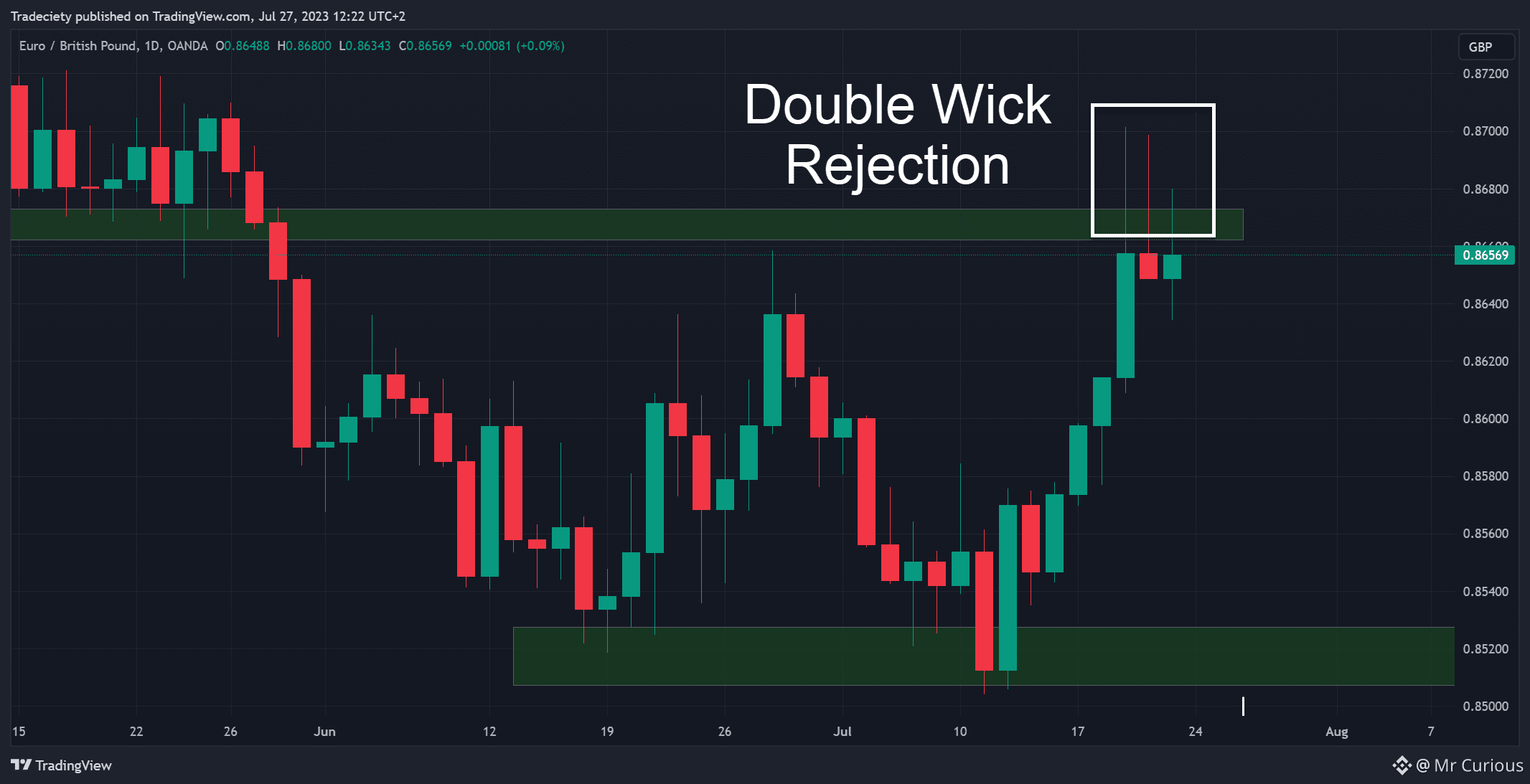

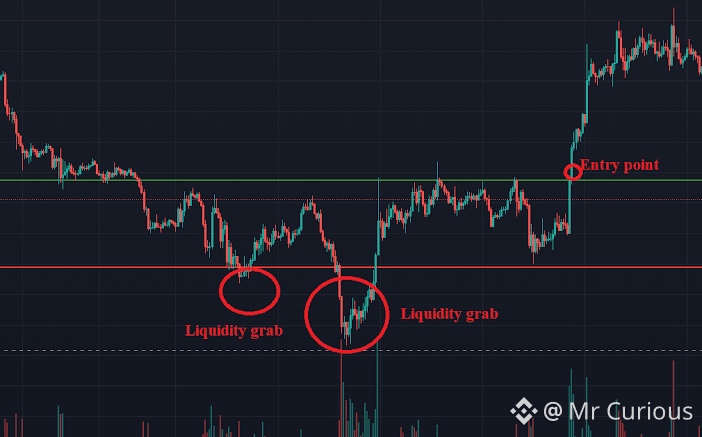

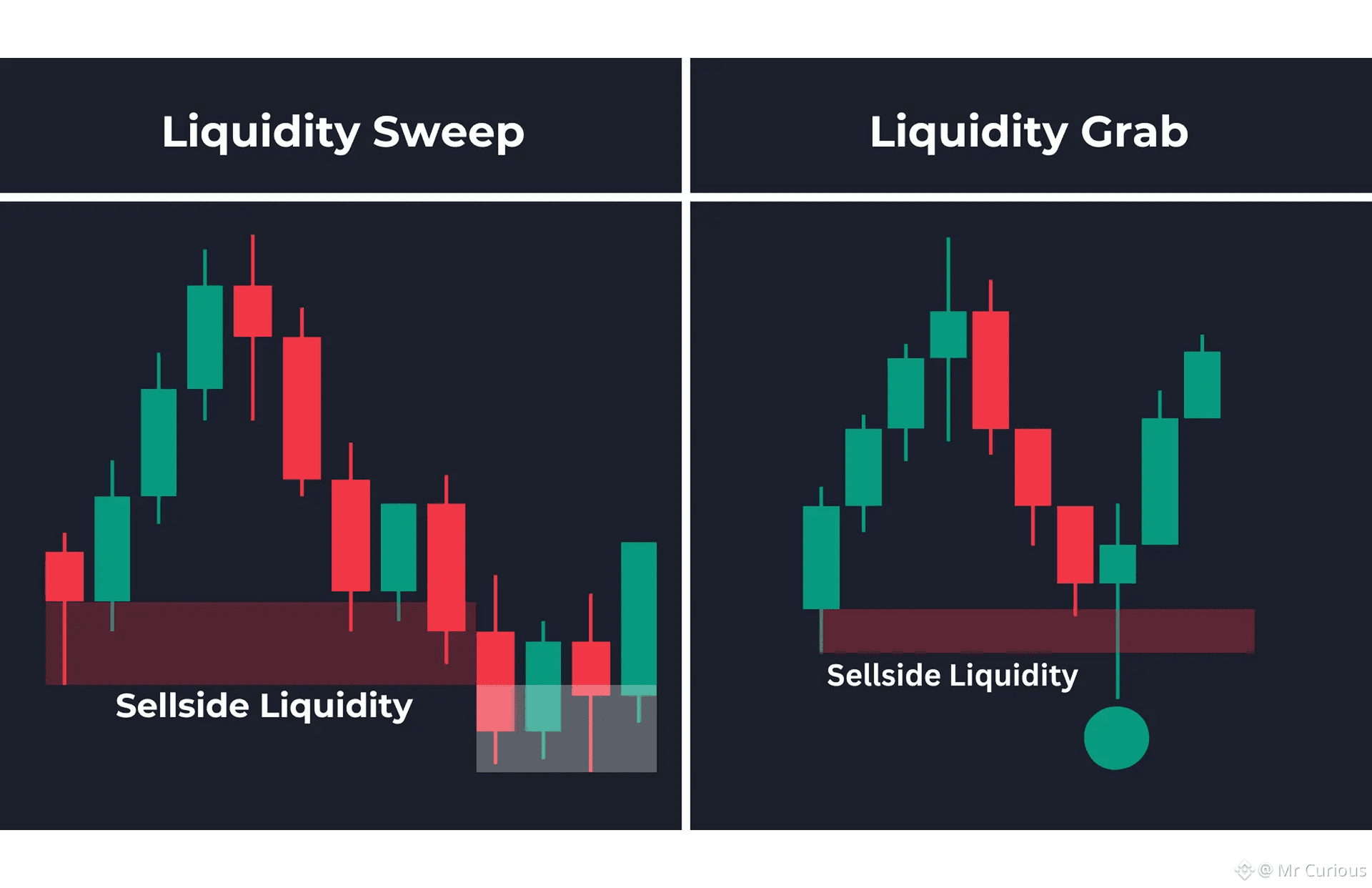

That’s why price often:

sweeps a high before dropping

breaks a support before reversing

looks “wrong” before it looks right

Not because someone is hunting you — but because liquidity must be accessed.

Structure changes everything

Liquidity alone doesn’t define direction.

What matters is:

higher-timeframe structure

acceptance or rejection after the sweep

follow-through, not the sweep itself

A liquidity grab without confirmation is just movement.

A liquidity grab with structure is information.

The main lesson

Instead of asking:

“Why did the market hunt my stop?”

A better question is:

“Where was liquidity, and what did price do after reaching it?”

Understanding liquidity shifts your mindset from victim to observer.

And once you stop fighting liquidity, you start reading the market more clearly.

Do you usually enter before liquidity is taken — or wait to see how price reacts after?