Stablecoins are no longer just another crypto utility. They’ve quietly turned into the most practical form of on-chain money people actually use. Payments, transfers, settlements — real movement, not theory. Plasma was built with that reality in mind from the beginning. Not adjusted later. Not patched onto an older design. From day one, this chain assumes stablecoins are the point.

Plasma isn’t “just another Layer-1.” It exists for one clear reason: make USD₮ payments feel simple, fast, and usable across borders. No friction. No ceremony. That’s still something most general-purpose chains struggle to get right, even today.

What Makes Plasma Different

Most blockchains started with smart contracts, DeFi mechanics, or NFTs as the core idea. Stablecoin transfers came later, almost as an afterthought. Plasma flips that order completely. Here, moving stable value comes first.

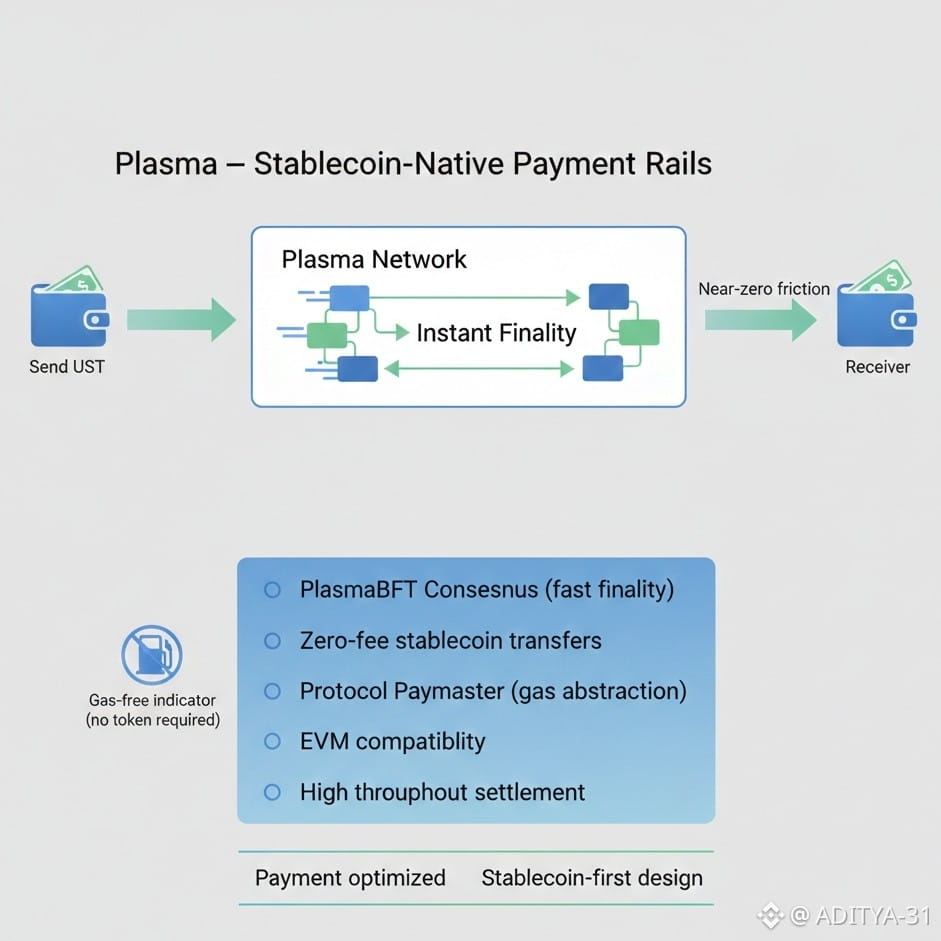

Zero-fee stablecoin transfers, especially USDT, remove a lot of the friction people have simply learned to tolerate elsewhere. PlasmaBFT consensus keeps finality tight, so payments don’t feel uncertain or delayed when activity picks up. The built-in paymaster and flexible gas model mean users don’t have to juggle a volatile token just to send dollars — fees can be handled in stablecoins or even BTC. This isn’t marketing language. It’s design. On Plasma, sending money feels closer to sending a message than running a transaction.

The Token: XPL’s Role and Distribution

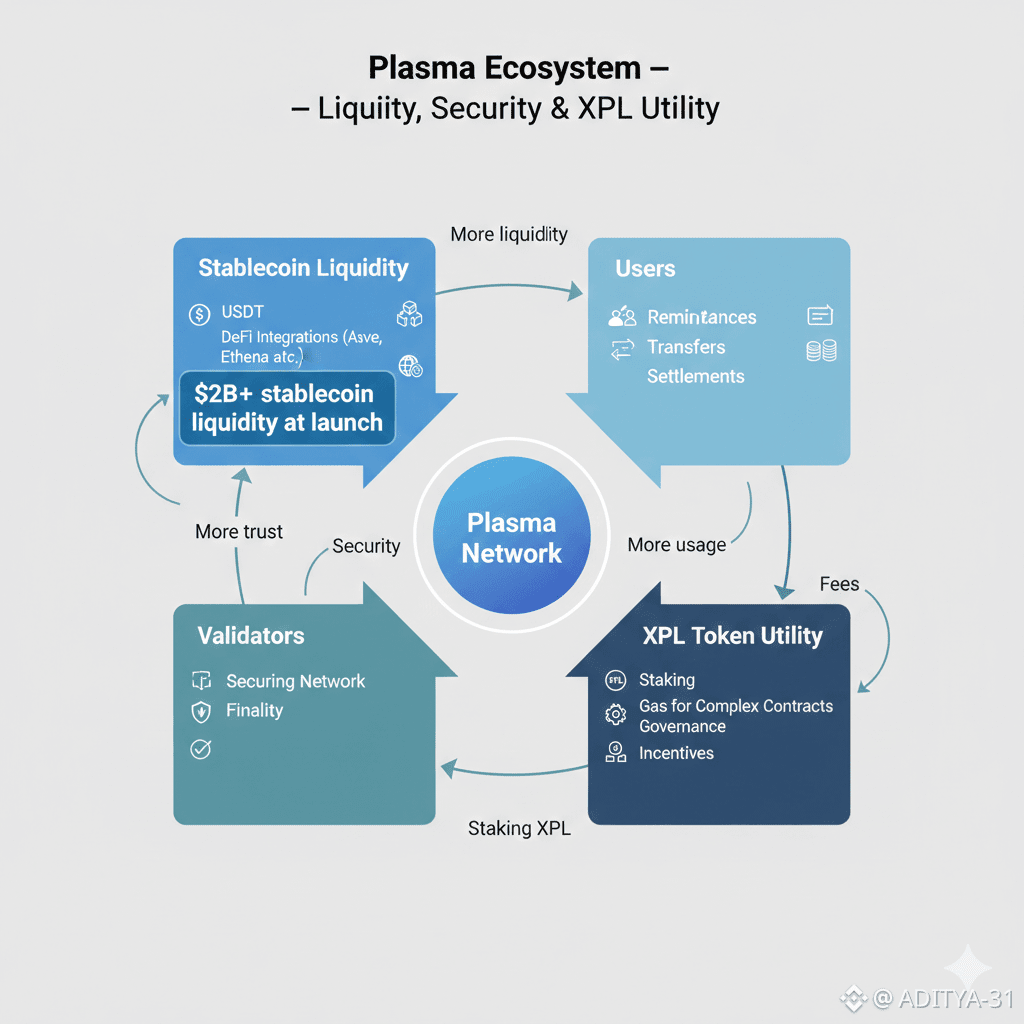

$XPL isn’t positioned as something users must constantly interact with. Its job is quieter than that. It secures the network through staking, supports more complex execution, and aligns validators and long-term ecosystem incentives. That’s it.

The tokenomics reflect this mindset. A 10-billion supply with heavy allocation toward validators and ecosystem growth points to long-term usage, not short-term spectacle. It’s not built to force attention. It’s built to sit underneath everything else and keep the system working.

What’s Happened Since Launch

Plasma didn’t arrive quietly. When the mainnet beta launched in late 2025, stablecoin liquidity crossed the $2-billion mark almost immediately. That’s not common. Early integrations with DeFi platforms like Aave and Ethena helped activity ramp up, and Binance’s HODLer program brought visibility and early participation.

That said, the path hasn’t been smooth. After the initial phase, price action cooled. Network usage didn’t instantly live up to the most optimistic expectations. That tends to happen with infrastructure-first projects. Utility rarely moves in a straight line, especially when speculation fades faster than usage grows.

Short-Term Pressure vs Long-Term Utility

Infrastructure almost always underperforms in the short term. Token unlocks increase circulating supply. Vesting schedules add pressure. Markets react quickly to that. None of this is unusual.

What matters more is whether the need for stablecoin-native rails keeps growing. So far, that demand hasn’t gone away. If anything, it keeps showing up in quieter, more persistent ways.

What Comes Next: BTC Bridge & Cross-Chain Liquidity

One development worth watching is Plasma’s trust-minimized Bitcoin bridge, often referred to as pBTC. The idea is simple: allow BTC to enter the Plasma ecosystem as collateral or liquidity, not just sit outside it. That brings non-stablecoin capital into the system without changing Plasma’s core focus. If executed properly, it broadens XPL’s role beyond payments into deeper liquidity and DeFi use cases.

Why Plasma Still Matters

Stablecoins are no longer experimental. They’re infrastructure. And infrastructure eventually demands specialization. Many chains struggle with stablecoin UX because fees swing, users need extra tokens just to function, and throughput wasn’t designed for payment-heavy flows. Plasma removes those issues by design.

That choice has trade-offs. Speculative momentum can be slower. Adoption can feel gradual. But when usage becomes consistent instead of cyclical, specialized systems are usually the hardest to replace.

Final Thought

Stablecoins aren’t a passing trend. They’re becoming digital money rails. Plasma isn’t chasing attention around that shift. It’s building quietly for how people already behave. If stablecoin payments, remittances, and programmable finance keep expanding, Plasma benefits not through hype, but by solving problems most chains accepted as normal.