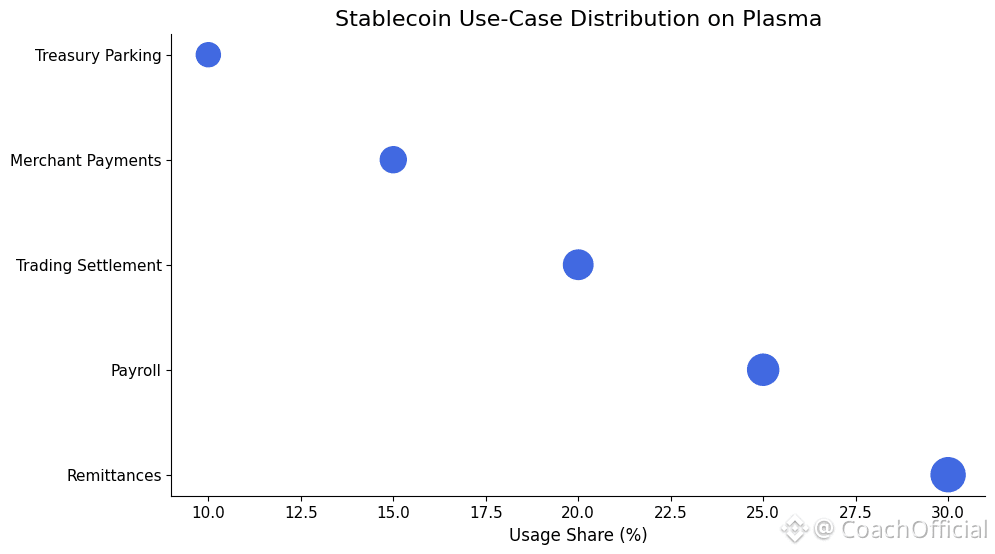

Stablecoins are already doing most of crypto’s real work. Not trading memes, not chasing yields. Just moving money. Paying people. Sending value across borders. Parking funds without worrying about volatility.

The problem is that most blockchains weren’t built for that kind of boring, repetitive, everyday usage. They’re general-purpose systems. When traffic spikes, fees jump. Confirmations slow down. A simple transfer suddenly feels fragile.

Plasma exists because of that mismatch.

It launched in 2025 with a narrow focus: stablecoins and payments. Not NFTs. Not gaming. Not “everything for everyone.” Just making sure digital dollars move quickly, cheaply, and predictably. That focus is why billions in stablecoins moved onto the network early. Plasma didn’t win attention by being loud. It won usage by removing friction.

A Network Built Around Settlement, Not Spectacle

Plasma’s design choices are easy to miss if you’re looking for flashy metrics. What actually matters is how boring it feels when it works.

Blocks finalize in under a second. Throughput clears well over a thousand transactions per second. That’s not about bragging rights. It’s about confidence. When someone sends money, especially across borders, waiting creates doubt. Plasma reduces that gap to almost nothing.

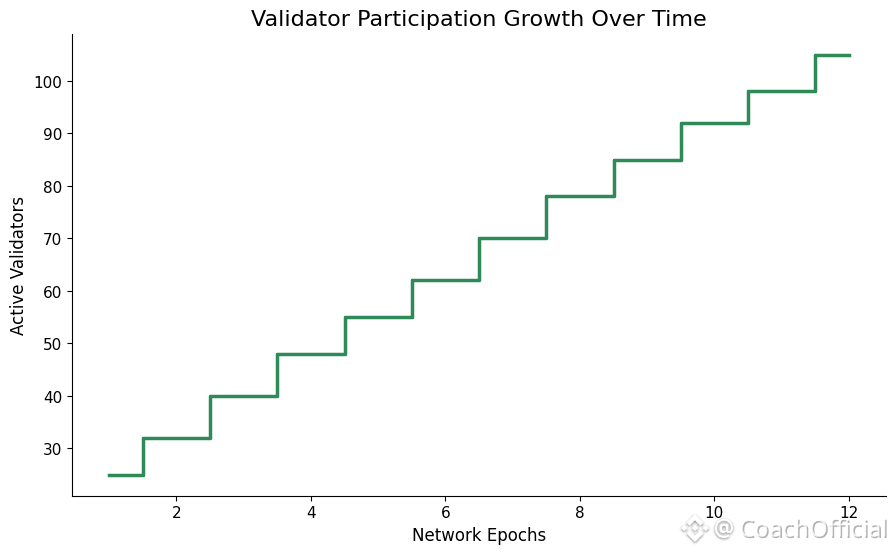

It stays EVM-compatible for a reason. Developers don’t need to relearn tooling or rewrite contracts just to move payments over. That lowers resistance. It also spreads validation across participants instead of relying on a narrow set of operators, which helps the network stay responsive under load.

One of the most practical decisions is fee handling. Stablecoin transfers can be sponsored or paid directly in stables. Users don’t need to juggle extra tokens just to send money. That sounds small, but it changes behavior. People stop thinking about the transaction and just send it. That’s what payments are supposed to feel like.

Optional privacy layers add flexibility for businesses that need discretion without breaking auditability. Again, not flashy. Just useful.

What XPL Is Actually There For

XPL isn’t positioned as a speculative centerpiece. It’s there to coordinate incentives.

Validators stake it to secure the network. Participants earn rewards based on real activity, not inflated emissions. Governance uses it to adjust parameters when things change in the real world, not just on paper.

The supply is capped at 10 billion, with a bit over 2 billion circulating. Distribution has been paced slowly, which matters more than people admit. Sudden unlocks break trust. Plasma avoided that.

Holding XPL isn’t about guessing the next narrative. It’s about backing infrastructure that benefits from consistent usage. As stablecoin volume grows, incentives naturally strengthen. No theatrics required.

Why Partnerships Matter More Than Marketing

Plasma didn’t grow by shouting. It grew by plugging into places where money already moves.

Integrations with major stablecoin issuers made zero-fee transfers possible. Support across more than 100 countries turned it from a crypto experiment into something payment-like.

Cross-chain work has been especially important. Settlement times between Plasma and Ethereum were cut in half. That matters for institutions that don’t live on one chain. Assets need to move without friction, or they won’t move at all.

Most partnerships are boring in the best way. Liquidity. Compliance. Settlement. Things that don’t trend, but compound.

The Ecosystem That Forms When Payments Are Reliable

Once transfers stop being painful, other things start to work better.

Wallets feel instant. Remittance tools stop leaking value to fees. Lending protocols can rely on stable collateral without worrying about congestion wiping out margins.

Developers have built automated payouts, stable yield products, and settlement tools that depend on Plasma’s predictability. Enterprise teams care less about ideology and more about whether the system behaves the same tomorrow as it did today. Plasma leans into that.

The ecosystem isn’t loud, but it’s functional. And that’s usually a good sign.

Stress, Volatility, and Staying Boring

Plasma didn’t avoid volatility. Early price swings were sharp, like most new networks. What mattered was that usage didn’t disappear when excitement cooled.

Development kept moving. Liquidity stayed. Stablecoin volume didn’t evaporate.

Recent upgrades, like faster cross-chain settlement, weren’t cosmetic. They fixed real bottlenecks. The network keeps adjusting based on how people actually use it, not how a roadmap says they should.

Validator participation continues expanding. Economic parameters shift as the system matures. Nothing feels frozen.

Why This Matters Long Term

Zero-fee stablecoin transfers matter most where margins are thin. Remittances. Small businesses. People moving money because they need to, not because it’s interesting.

As fiat gateways expand, Plasma increasingly sits between crypto and everyday finance instead of trying to replace either. Education and tooling make it easier for non-crypto users to onboard without intermediaries doing everything for them.

Market signals aren’t explosive, but they’re consistent. That’s usually how infrastructure grows.

Where Plasma Actually Sits

Recent milestones show the pattern. Faster bridges. Compliance-ready integrations in Europe. Billions in stablecoin flow. Community-driven upgrades that focus on usability instead of hype.

Price is down from early highs. That’s normal. Infrastructure rarely matures in straight lines.

What matters is that Plasma keeps doing the job it set out to do: move stable value quickly, cheaply, and without drama.

Final Thought

Plasma isn’t trying to redefine money. It’s trying to stop getting in its way.

If stablecoins continue becoming the backbone of digital finance, the chains built specifically for them will matter more than general-purpose platforms stretched too thin. Plasma is positioning itself as one of those quiet rails underneath the system.