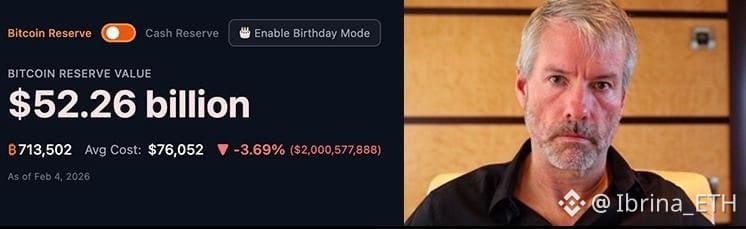

Michael Saylor Strategy is now down roughly $2 billion on its Bitcoin holdings. At first glance, that sounds like a disaster. Headlines scream losses, timelines panic, and critics feel validated. But if you pause for a second, this situation actually teaches something most people still don’t understand about long-term conviction investing.

Here’s the key part many miss Strategy didn’t buy Bitcoin to trade it. They didn’t buy tops to sell bottoms. They treated Bitcoin like a long-term treasury reserve, similar to how companies once treated gold. In that framework, short-term drawdowns are not a failure, they are a feature of volatility. Bitcoin has fallen 50–70% multiple times in its history, and every cycle, those same drawdowns later looked like noise on a much bigger chart.

Here’s the key part many miss Strategy didn’t buy Bitcoin to trade it. They didn’t buy tops to sell bottoms. They treated Bitcoin like a long-term treasury reserve, similar to how companies once treated gold. In that framework, short-term drawdowns are not a failure, they are a feature of volatility. Bitcoin has fallen 50–70% multiple times in its history, and every cycle, those same drawdowns later looked like noise on a much bigger chart.

Think of it like buying land in a growing city. The price can drop during a recession, but the investor who understands why they bought doesn’t panic every time the market sneezes. Saylor’s bet is simple: fiat currencies lose purchasing power over time, while scarce assets don’t. If that thesis plays out, a $2B paper loss today could look irrelevant years from now.

The real lesson for readers isn’t about copying Michael Saylor. It’s about understanding your own time horizon and risk tolerance. Most people lose money not because they choose bad assets, but because they enter with short-term expectations into long-term ideas. When volatility hits, they sell fear instead of reviewing their thesis.

So the question isn’t “Is Strategy down $2B?”

The better question is: Do you actually understand what you’re investing in before volatility tests you?

Curious to hear your take

Is this reckless leverage on belief, or disciplined conviction in a broken monetary system?