@Plasma isn’t just another attempt to push blockchain throughput higher. It tackles a more fundamental question: how do you scale stablecoin payments without dragging in the chaos that comes with general-purpose blockchains? That’s not a small shift. If you look at how people actually use blockchains these days, it’s less about speculation and more about payments payments that need to be consistent, dependable, and smooth, not just fast.

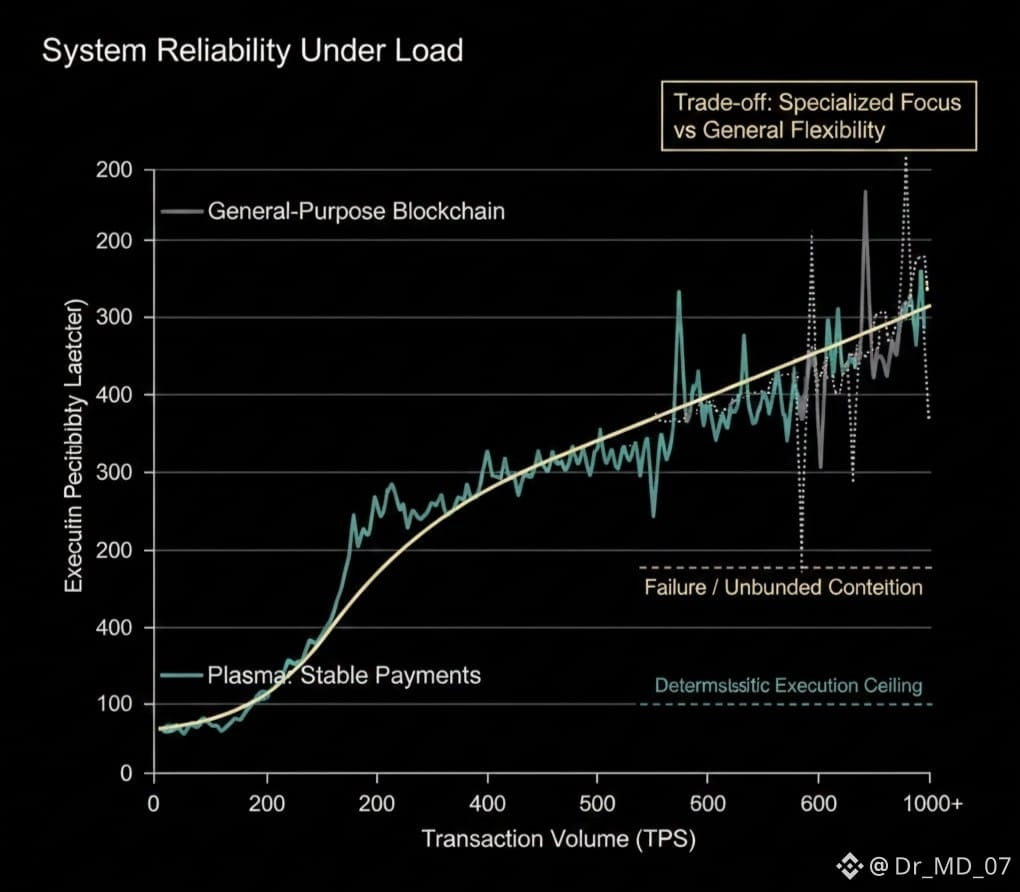

For years, the crypto world treated scalability as a race for transactions per second. More transactions meant a better chain, or so people thought. But Plasma points out that the real killer isn’t just congestion it’s contention. Picture stablecoin transfers, DeFi trades, governance votes, and whatever new smart contract experiment is trending, all fighting for the same resources. That’s when execution turns unreliable. Plasma sidesteps this by carving out stablecoin payments from that noisy, contested environment.

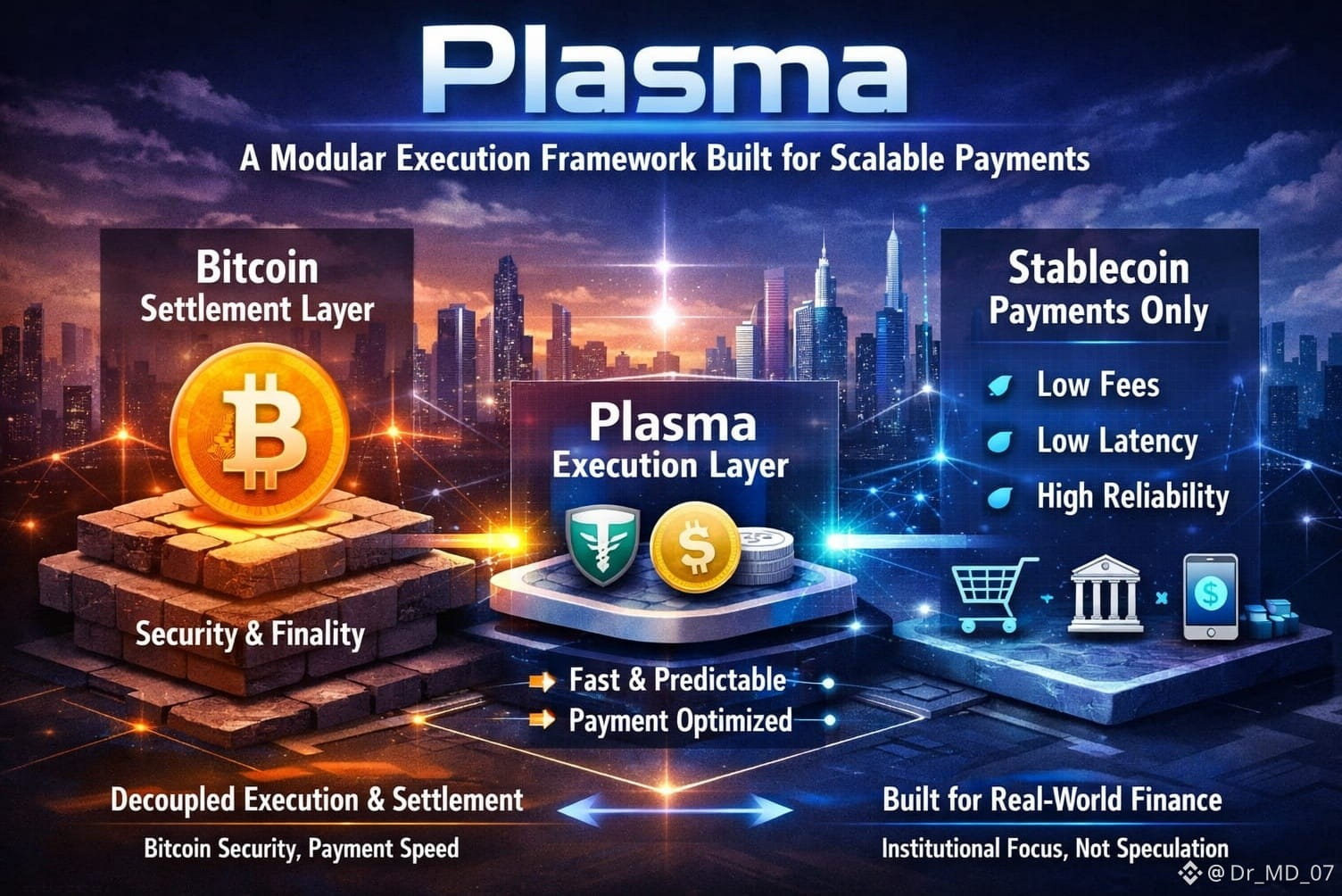

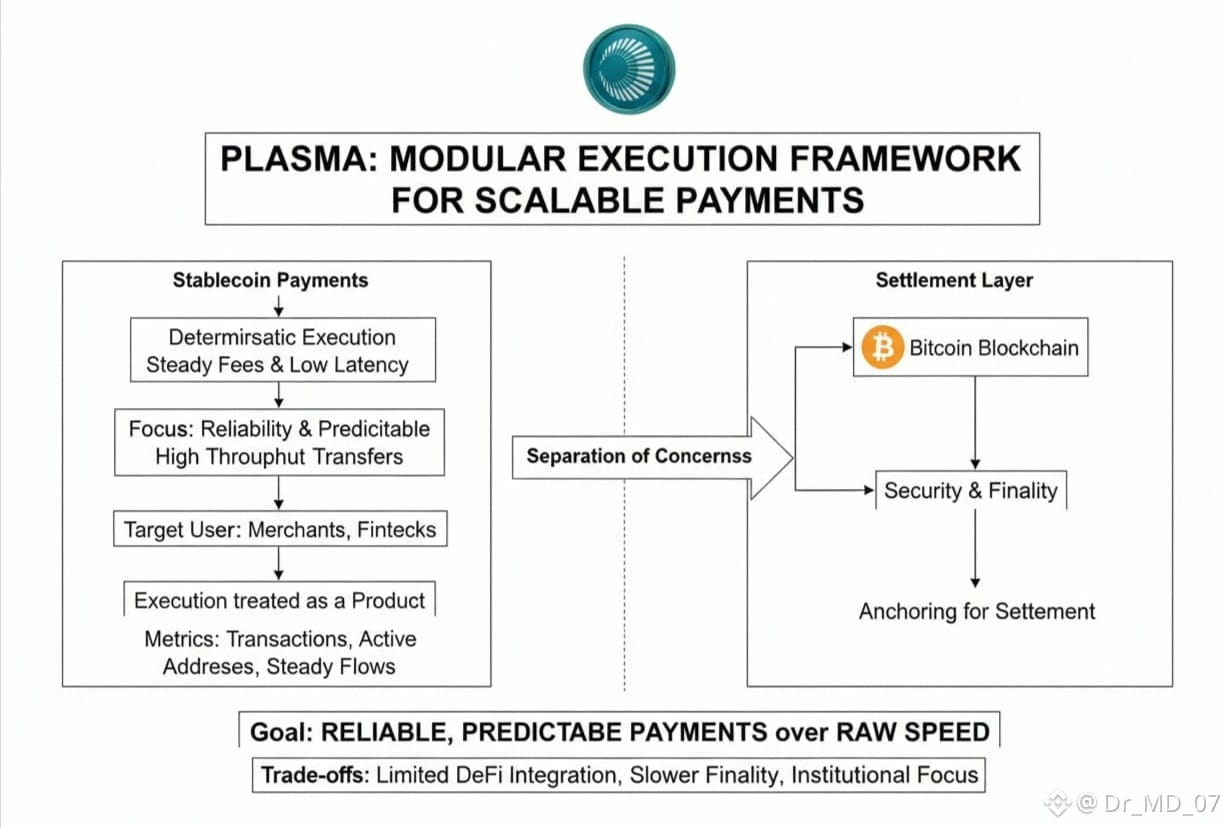

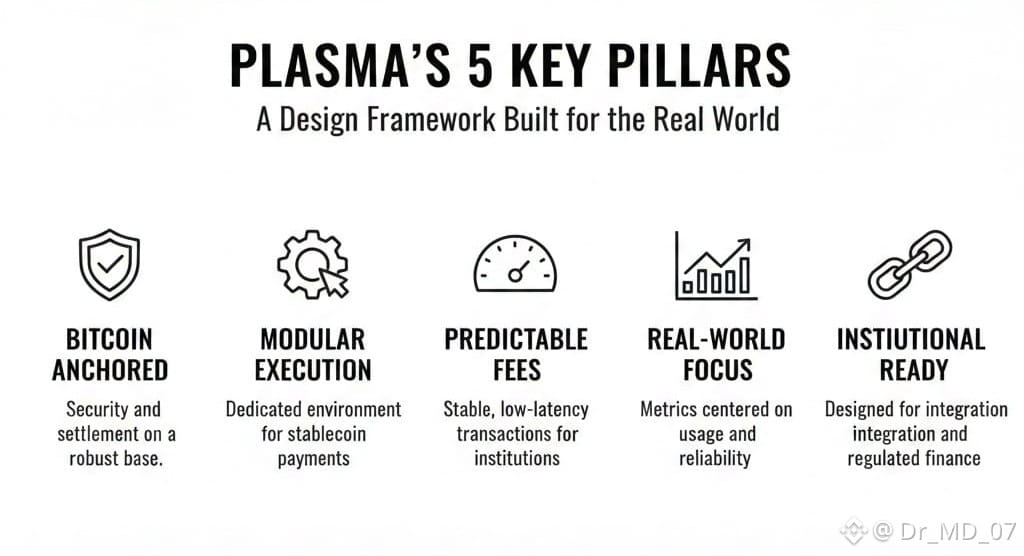

The heart of Plasma is its split between execution and settlement. Settlement and security are anchored to Bitcoin, but execution happens in a space built just for payments. This setup lets Plasma stand on Bitcoin’s security shoulders while ditching its bottlenecks. Even more important, Plasma can actually design how execution works, instead of letting it get tossed around by gas wars and unpredictable blockspace demand.

Stablecoin payments come with their own set of non-negotiables: deterministic execution, steady fees, low latency, and the ability to handle endless simple transfers. General-purpose blockchains struggle with this because they have to juggle all sorts of complex activity. Plasma sticks to payments it doesn’t try to be everything at once. That focus means execution stays reliable, even as usage grows.

The most interesting thing about Plasma is how it treats execution like a product. It doesn’t chase flashy metrics or speculative spikes. Instead, Plasma zeroes in on real usage: how many transactions, how many active addresses, how steady are the flows? That’s what matters if you’re building payment infrastructure. It’s about showing up every day, not just making headlines during a bull run. Merchants and fintechs want reliability, not drama.

By pulling execution and settlement apart, Plasma gets to fine-tune block production, state changes, and fee models just for stablecoin transfers. Suddenly, payment providers and banks can actually predict their costs and latency something that’s still a headache on most blockchains. If you want to plug blockchain into real-world finance, this kind of predictability isn’t just nice it’s mandatory.

Plasma’s timing is sharp. Stablecoins are now moving money around the world at volumes that rival the major payment networks. Regulators are finally starting to draw clearer lines, and fintech companies want blockchain tech that doesn’t dump them into the wild swings of crypto markets. Plasma fits right into this moment, especially as Bitcoin steps up as a global settlement layer, not an execution playground.

Of course, Plasma’s focused approach comes with trade-offs. It won’t plug easily into DeFi-heavy ecosystems, and tying settlement to Bitcoin means there’s a natural cap on finality speed. So, don’t expect a retail frenzy. Plasma’s growth hinges more on institutions and integration than hype cycles. That might slow adoption, but it builds a sturdier foundation one that won’t evaporate with the next market swing.

What stands out most to me is Plasma’s restraint. It doesn’t try to be a universal chain or chase every new feature. Stablecoin payments are infrastructure they should be reliable, maybe even a little boring, and invisible to end users. In finance, invisible usually means things are working.

Looking forward, I think Plasma should double down on transparency around execution guarantees. Publish real latency distributions, not just averages. Focus on predictable fees, not just the lowest possible. Present Bitcoin settlement as risk management, not an ideological stance. Institutions want systems they can map and trust, and Plasma’s architecture is tailor-made for that.

In the end, Plasma doesn’t try to win the old scalability contest. It reframes the challenge: reliability beats raw speed. That’s what makes it matter.