Solana’s journey over the last few years is one of the clearest examples of how narratives drive crypto markets. Many people only focus on the price, but the real story sits behind usage, hype cycles, and how traders behave when excitement fades. Solana’s move from single digits to triple digits was not random, and the pullback that followed was not a failure either.

Back in 2024, Solana became the center of the memecoin explosion. Low fees and fast transactions made it the easiest blockchain for launching and trading new tokens. Almost every trending memecoin was being created and traded on Solana. This pushed organic demand for SOL because users needed it for transactions, swaps, liquidity, and bots. As activity increased, price followed naturally.

That phase pushed Solana from around 8 dollars to nearly 300 dollars. The important thing to understand is that this move was backed by heavy on chain usage. It was not only speculation. Traders were actually using the network every day. When usage explodes, markets often overshoot on the upside, and Solana did exactly that.

When the memecoin hype started cooling down, the same engine that pushed Solana up began slowing. As fewer new tokens launched and trading volume dropped, demand for SOL also reduced. People started taking profits, and price adjusted to a more realistic level. This kind of correction is normal after a parabolic move and has happened to almost every major crypto cycle in the past.

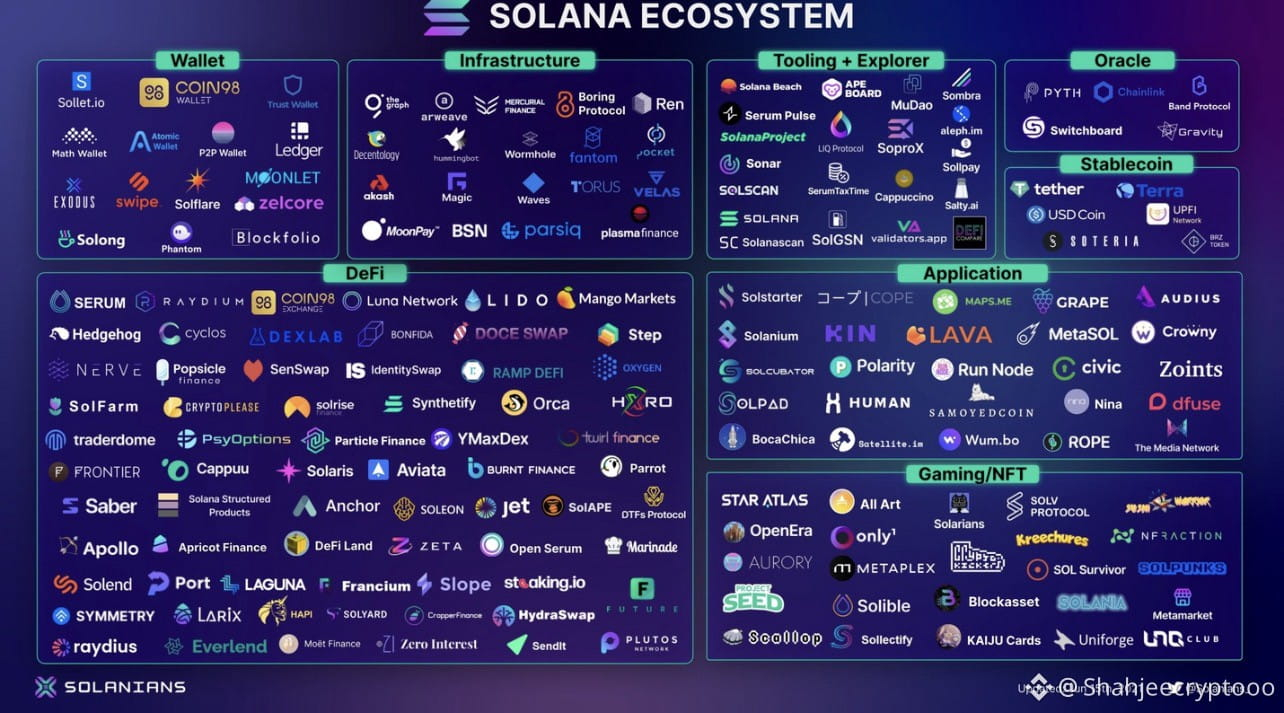

This does not mean Solana lost its position. Even today, Solana still leads the memecoin ecosystem. A large majority of active memecoins are still built on Solana, and no other chain has taken that role away. Beyond memes, Solana continues to grow in payments, NFTs, games, and real applications, even if that growth is quieter now.

Silence in the market often creates doubt, but historically this is where long term foundations are built. When price is no longer moving fast, attention shifts away, and that is usually when serious builders and long term investors step in.

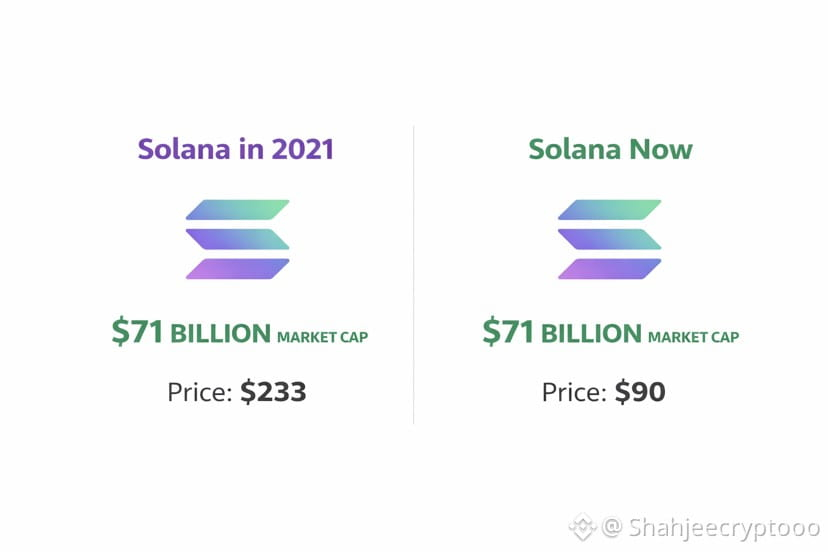

At current levels, the range between 85 and 90 dollars looks like a healthy base. This zone has acted as a balance point where selling pressure is absorbed and panic reduces. In previous cycles, similar ranges on Solana acted as accumulation zones before the next expansion phase began.

The next strong move for Solana will likely not come from blind hype. It will need a fresh trigger. That trigger could be another memecoin wave, a new application category, or wider market liquidity improving. When liquidity returns, capital tends to flow back into chains that already proved they can handle scale, and Solana has already passed that test.

In the bigger picture, Solana’s story is far from finished. The rise was driven by real activity. The correction happened because hype faded. What remains now is infrastructure, users, and an ecosystem that is still one of the most active in crypto.

Markets always move in cycles. Loud phases are followed by quiet phases. And often, the strongest trends begin when most people stop paying attention. Solana today feels closer to preparation than exhaustion.