My journey into the world of crypto has been a whirlwind of hype, hope, and disappointment. I chased rumors, scrutinized charts, and tried to decipher the next big thing, often ending up with a pile of tokens only good for speculation. Everything changed when I discovered Plasma XPL. Instead of finding another groundbreaking project, I found calm and profound clarity.

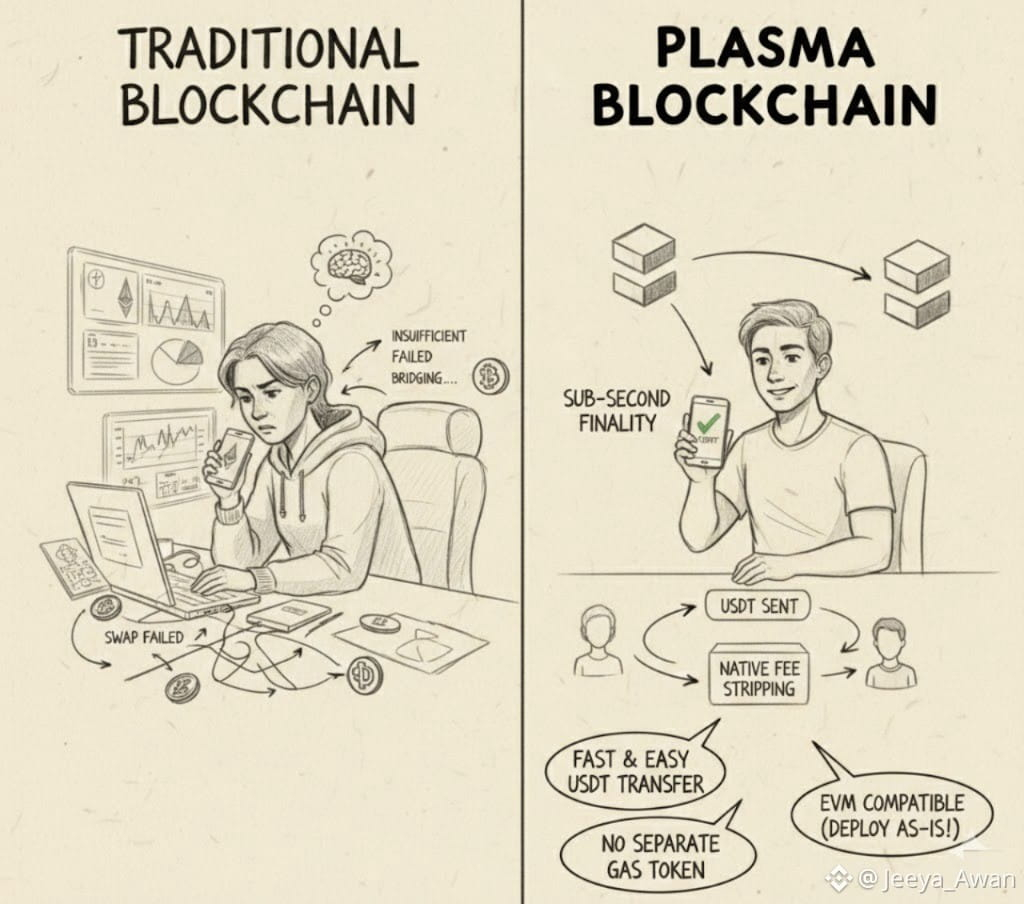

My sole reason for choosing Plasma is that it doesn't try to be "all-powerful." It builds a practical financial infrastructure, and in my experience, it works remarkably well. Most blockchains require ordinary users to learn about cryptocurrency—handling gas tokens, swaps, and complex confirmation processes—before sending stablecoins, which feels like an obligation. @Plasma takes a different approach. It makes stablecoin transfers feel like ordinary payments: fast, predictable, and seamless. For the first time, I was able to easily send USDT to a friend without spending 15 minutes figuring out bridging and transaction fees. In short, the whole process was a success.

This convenience has been incredibly meaningful to me personally. As someone who has tried to introduce cryptocurrency to others, I know firsthand that difficulty is the biggest obstacle. Plasma eliminates these difficulties. Even better, as a developer, I didn't have to relearn everything. Its full compatibility with the Ethereum Virtual Machine (EVM) allowed me to deploy existing smart contracts without rewriting them, while focusing on optimizing the settlement of the blockchain itself, rather than promotion.

I was impressed by Plasma's architecture.Sub-second finality via PlasmaBFT, I no longer need to anxiously stare at the block explorer. Transaction settlement—the true final settlement—takes less than a page refresh. The native transaction fee stripping feature for stablecoins is even more impressive—I don't need to create a separate wallet containing the native token to trade USDT. This isn't just a feature; it's a qualitative leap in usability, aligning with how people actually use their funds.

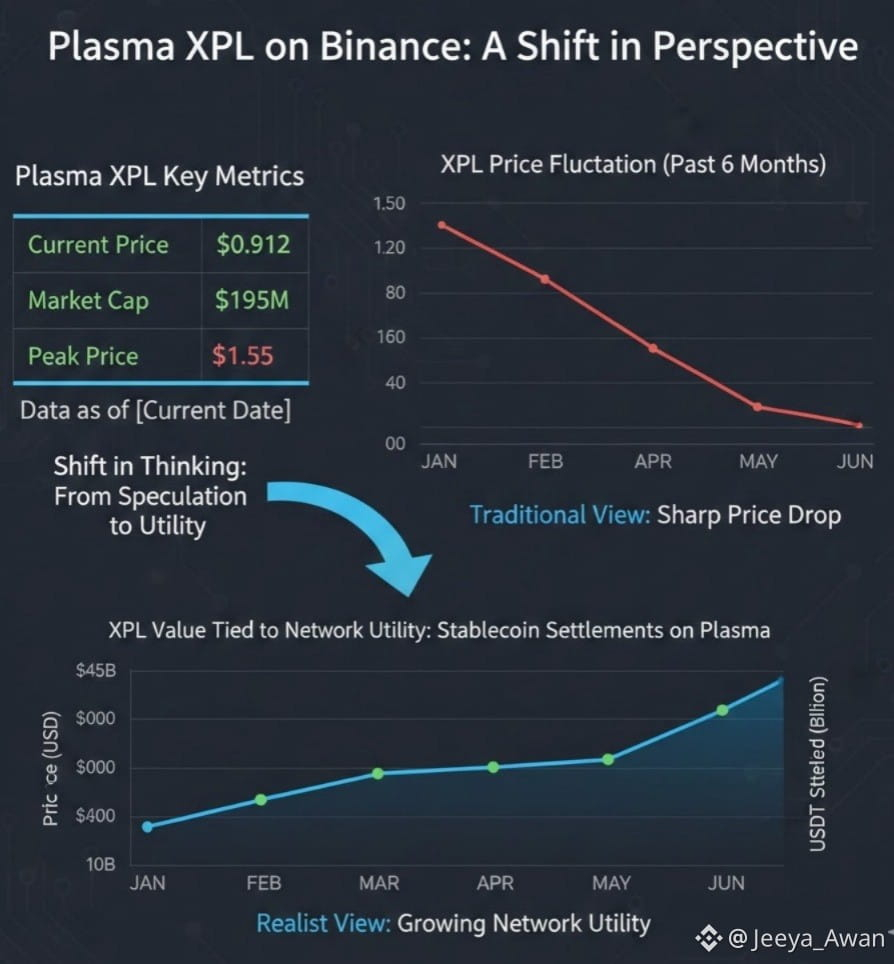

But my real shift in thinking began when I stopped projecting speculative desires onto $XPL. I had to let go of my obsession with media-driven price fluctuations. I checked the data: the price has fallen sharply from its peak and is currently trading at around $0.0912, with a market capitalization of approximately $195 million. Traditional crypto investors see a sharp drop on the charts. Realists, however, see a completely different picture.

I began to view $XPL as a mechanism, not a speculative asset, closely tied to a key part of the infrastructure. Its value is inextricably linked to the network's utility—the amount of stablecoins settled on the blockchain. The token's significance became clear when I used Plasma to realize its intended use—smooth, fee-free USDT transfers. It wasn't designed to be "hyped" based on rumors; it was designed to support and secure a system capable of transferring real value. This ease didn't stem from enthusiasm, but from the calm that comes from not imposing any narrative on something that didn't need one.

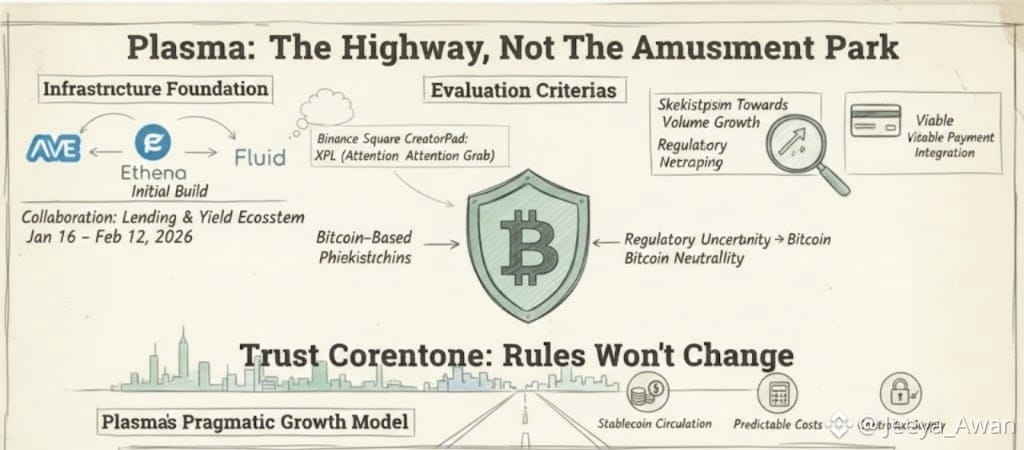

This project's collaboration with Aave, Ethena, and Fluid is more than just a press release; it represents the initial infrastructure for a comprehensive lending and yield ecosystem. The Binance Square CreatorPad event (from January 16th to February 12th, 2026, with a total reward of 3.5 million XPL) cleverly captured attention, but my criteria for evaluating Plasma differ: continued growth in cross-chain settlement volume and truly viable payment integration.

Plasma's Bitcoin-based security philosophy aligns with my growing skepticism towards narrative-driven, flexible blockchains. In a world rife with regulatory uncertainty, upholding Bitcoin's neutrality is a powerful statement, ensuring the rules won't change as circumstances worsen. For settlement infrastructure, this isn't a user experience issue, but a cornerstone of trust.

My ultimate conclusion is that Plasma is building a highway, not an amusement park. Its pragmatic, usage-based growth model—focused on stablecoin circulation, predictable costs, and controlled supply—may seem mundane compared to overhyped cryptocurrencies. But in the long run, what truly endures is stable and reliable infrastructure. XPL is key to that infrastructure. It's not betting on a particular story, but on a system that allows digital currency to circulate in the way it should. After years of hype, I can understand and firmly support this decision.