I used to think I was being smart.

Not “smart” in the academic way. Smart in the crypto way. The kind of smart that jumps from chain to chain like a tourist with a spreadsheet, always chasing the highest APY, always convinced the next vault is the real alpha. I told myself I was a liquidity hunter. I told myself that staying on one chain was laziness. I told myself that the people who sit still are the ones paying my yield.

Then I did the math properly.

Not the “headline APY” math. The real math. Gas on entry, gas on exit, bridging fees, swap slippage, the time cost of waiting for confirmations, the stress cost when something gets stuck, the opportunity cost when a chain is slow and your funds are frozen in transit like luggage lost at an airport. After all that, I realized something humiliating.

I didn’t outperform the Plasma crowd. The ones I mocked as “lying flat.” The ones who just stayed put, harvested whatever the system gave them, and carried on with their lives like they were on social welfare. I was the one working overtime, chain-hopping like a gig worker, and they were the ones quietly winning.

That’s when it clicked: Plasma isn’t playing a pure technology game. It’s playing a human behavior game.

Let’s be honest. Uniswap is everywhere. Aave is everywhere. Pendle is everywhere. Ethena is everywhere. If this were about features alone, Plasma wouldn’t have an unfair advantage. You could do the same loop on a dozen other networks, sometimes with better fees, sometimes with better liquidity, sometimes with an APY that looks 3–5% higher on paper.

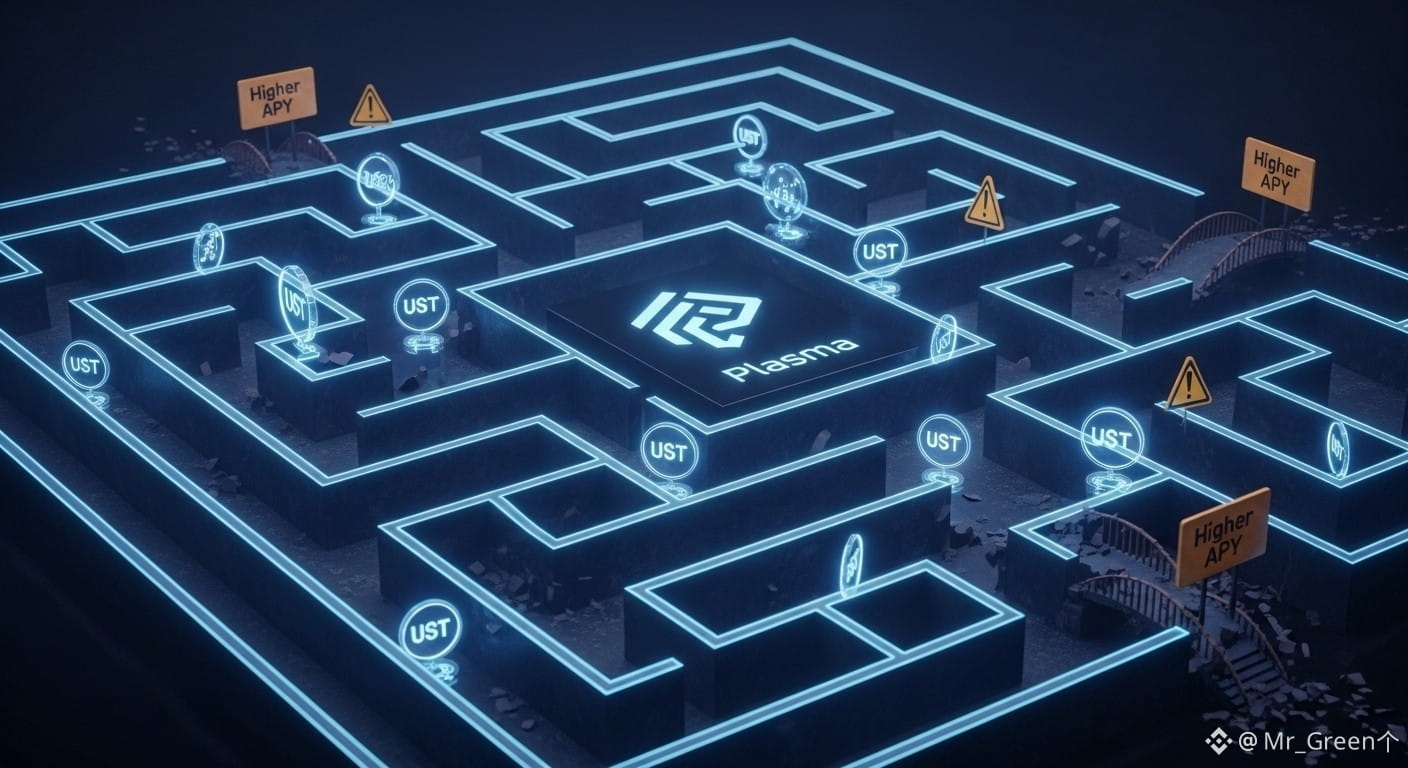

But Plasma’s move is not to invent new Lego pieces. It’s to rearrange the Lego pieces into a maze you don’t want to leave.

The rewards don’t come as one clean incentive. They come as layers. Like onion skins. One wrapped around another, until your portfolio starts feeling less like a liquid position and more like a bundled subscription.

You want yield on your USDT product? Fine. That pulls you into holding USDT on Plasma. You want XPL rewards? Fine. Now your “simple yield” becomes a requirement ladder: you’re nudged into LP, nudged into specific pools, nudged into actions that are individually reasonable but collectively sticky. You want to hedge? Great—tools are right there, one click away, so you don’t have to move anywhere else. You want to rotate strategies? Also there, neatly packaged, so the easiest path is always “stay inside.”

It doesn’t feel like captivity while it’s happening. That’s the genius. Every step feels handy. Every step feels worth it. Every step feels like you’re optimizing. And then one day you look up and realize your capital is trapped in a system that makes leaving feel like a mistake even when the numbers say you could earn more outside.

That’s why the Apple ecosystem analogy hits so hard.

I know Android phones charge faster. I know Windows laptops can be cheaper. I know you can get the same core function elsewhere. But I’m not switching because the photos are in iCloud, the passwords are in Keychain, and the habits are already burned into muscle memory. The switching cost isn’t just money. It’s mental friction. It’s migration anxiety. It’s the fear that something small breaks and you spend your weekend fixing it.

Plasma is doing that same thing on-chain.

It’s building iCloud for capital. It’s building Keychain for yield habits. It’s building “muscle memory DeFi.” Not by locking your funds with a gate, but by wrapping your incentives until you lock yourself.

People like to pretend crypto users are hyper-rational agents. We’re not. We’re exhausted. We’re risk-sensitive in weird ways. We’ll spend hours chasing a 5% APY improvement and then refuse to bridge once because the last time we bridged we lost sleep.

That’s Plasma’s bet: human laziness is more reliable than ideology.

When everything you want to do can be completed inside one ecosystem—earn, LP, hedge, rotate, claim, repeat—then the idea of leaving starts to feel like unnecessary stress. Even if another chain is offering higher APY, you look at it and your brain translates “extra yield” into “extra anxiety.” You start asking yourself whether one cross-chain move is worth the chance of being stuck mid-bridge, or being exposed during a delay, or paying fees twice, or misclicking a route and spending the next two hours in Telegram asking strangers for help.

Most of the time, it isn’t worth it.

And that’s why I find Plasma’s strategy slightly sneaky, but undeniably effective.

It doesn’t need to be the best tech. It needs to be the best default. It needs to be the place where doing nothing feels safer than doing something. It needs to be the chain where the cost of migration feels larger than the benefit of optimizing.

Right now, XPL price action may not look inspiring. It drags. It chops. It doesn’t always reward the story. But I’ve noticed something in my own behavior that’s more honest than any chart.

I hesitate to sell.

Not because I’m suddenly a believer. Not because I think I’ve found religion. But because I can see the stranded capital inside the ecosystem increasing. And stranded capital is a strange thing: it’s not loyal, but it’s stable. It’s not there because of conviction, it’s there because leaving is inconvenient.

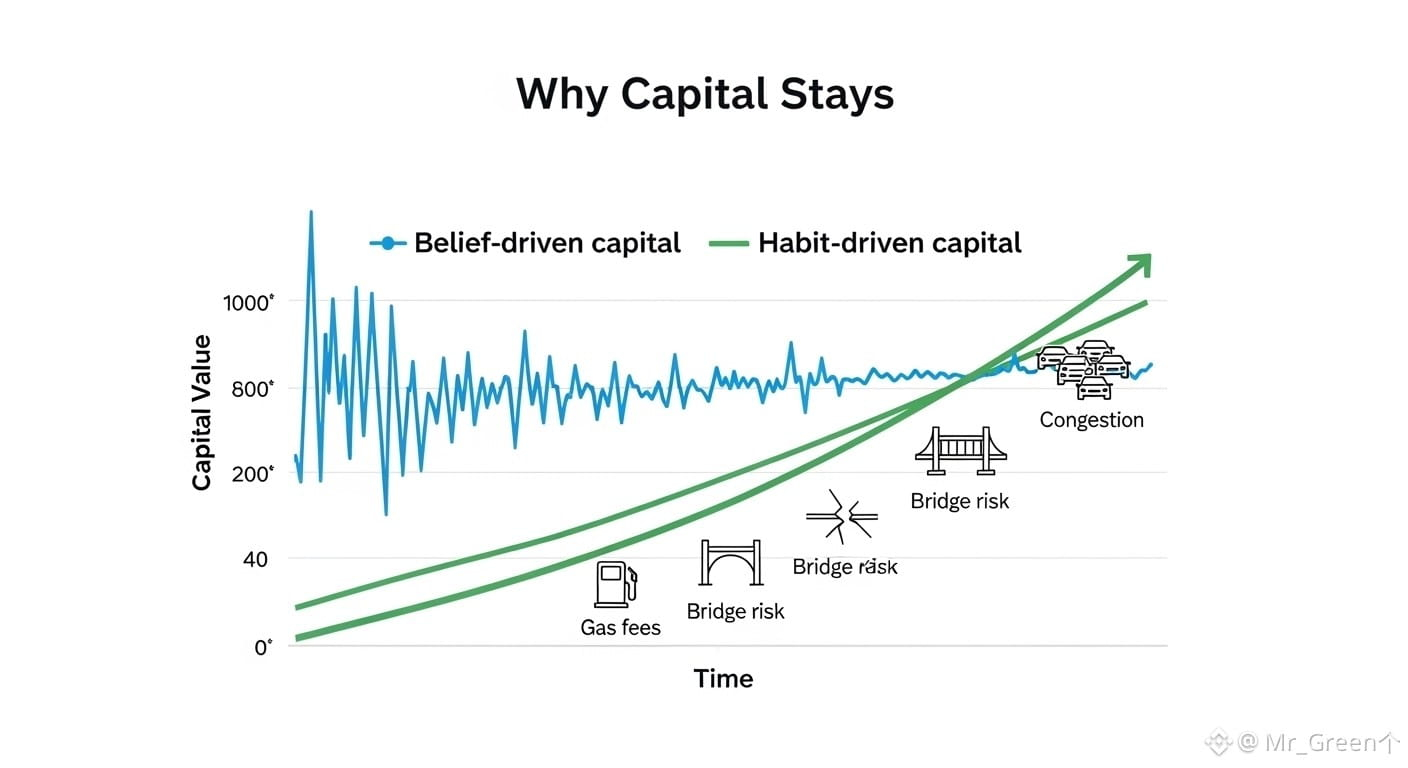

In crypto, money that stays because of belief is the most fragile money. Belief can flip overnight. Belief is allergic to boredom. Belief leaves when narratives change.

Money that stays because of laziness? That’s sticky. That’s durable. That’s the kind of capital that doesn’t panic-sell because it wasn’t emotionally invested in the first place. It’s just comfortable.

That’s the uncomfortable truth: the strongest moat in 2026 might not be a technical barrier. It might be a habit barrier.

Plasma seems to understand that.

If it succeeds, it won’t be because it built the fastest chain, or the cheapest chain, or the loudest chain. It will be because it built the chain that made leaving feel harder than staying. And in a world where every extra step is friction and every bridge is a risk, that might be the most powerful product decision of all.