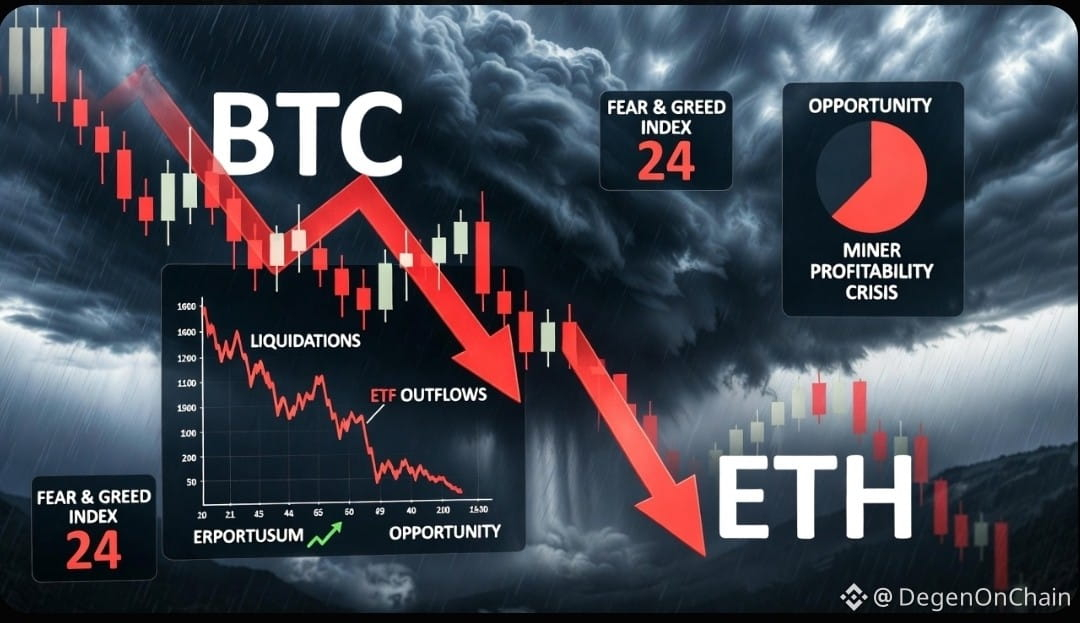

Today's hottest topic in crypto (Feb 4, 2026) is the ongoing market downturn / correction — the whole space is bleeding hard, with massive value wiped out and fear levels spiking.Quick snapshot of the pain:

Global crypto market cap down sharply (erased ~$400–500B in the last week or so, sitting around $2.6T now).

Bitcoin ($BTC ) dipped to lows around $72K–$74K recently before bouncing a bit, now hovering ~$73K–$76K (down 2–3% today, 10–15%+ weekly). It's off highs and erasing post-election gains for some.

Ethereum ($ETH ) taking a bigger hit, down ~5%+ recently, trading ~$2,100–$2,300 (some reports of 25% weekly drop vibes).

Solana ($SOL ) continuing its slide (around $91–$97, down 7–9% today).

Altcoins broadly getting wrecked, with heavy liquidations cascading.

Why the heat / what's driving convos:

Why is crypto down today/this week? — Classic risk-off mode: macro compression, correlation with falling tech stocks / precious metals (gold/silver dip hurting "safe haven" narratives), leveraged positions getting flushed (billions in longs liquidated), outflows from BTC ETFs in spots, and no big catalyst to reverse yet.

Peter Schiff types calling it a prolonged bear for BTC while gold surges.

Analysts like Tom Lee saying bottoms might be close, but sentiment is at 2-month lows (extreme fear territory).

Michael Burry warnings about BTC failing as safe haven and potential knock-on effects.

Other buzzing sub-topics:

Vitalik Buterin dropping takes on Ethereum Layer 2s — fees plummeting so fast that many L2s are losing purpose, forcing them to "grow up" or pivot.

Bitcoin mining profitability crisis: difficulty expected to drop 14% soon, block times spiking — miners hurting bad.

Hyperliquid (perp DEX) bucking the trend with big surges (71%+ in spots) while everything else dumps — people calling it one of the few bright spots.

Tokenization / RWAs still getting mainstream nods, but drowned out by the red charts.

Some privacy narrative chatter (ZK, FHE stuff) as a longer-term play.

On X, it's a mix of capitulation memes ("crypto is a scam" vibes from some), dip-buying calls ("buy when chicken littles squawk"), and farming airdrop/points grinds (Polymarket, Fhenix, etc.) to stay active.Bottom line: Extreme fear + flush-out phase = classic crypto setup where weak hands exit and strong ones accumulate. But short-term, it's brutal risk-off across risk assets. Not FA — markets volatile AF right now. You watching for a bounce or expecting more downside? What's your play in this mess?