When I look at the current state of blockchain today, especially after watching several cycles rise and fall, one thought keeps returning to me: most networks are still trying too hard to impress instead of quietly trying to work. We measure success with loud numbers, bold claims, and fast narratives, but real-world adoption rarely fails because people reject decentralization as an idea. It fails because systems feel fragile in practice. They break under real usage, behave inconsistently, and force users to care about mechanics that should stay hidden. This is why Plasma has stayed in my mind—not as a trend, not as a trade, but as an infrastructure direction worth observing carefully.

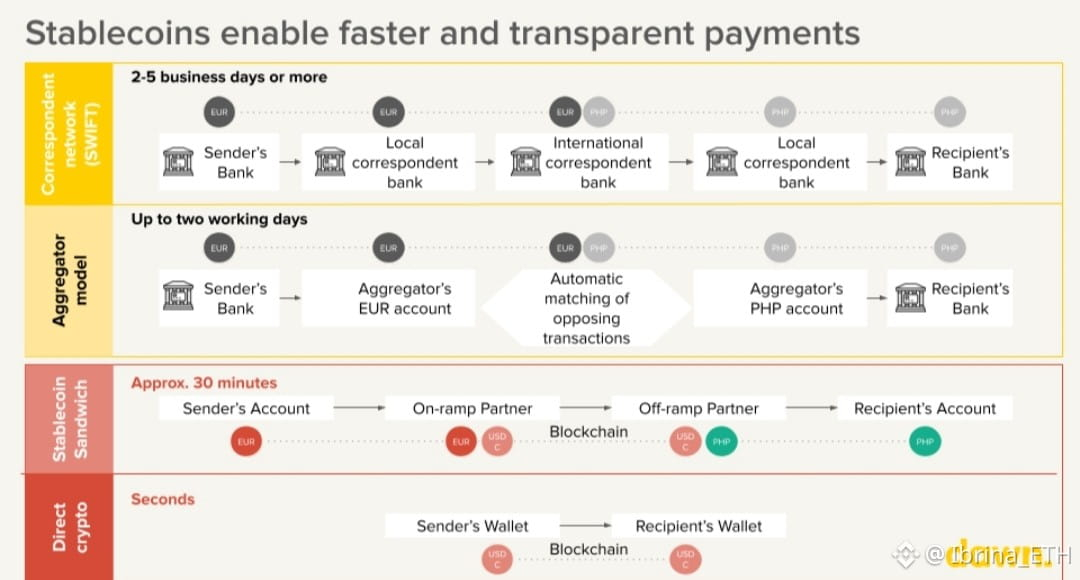

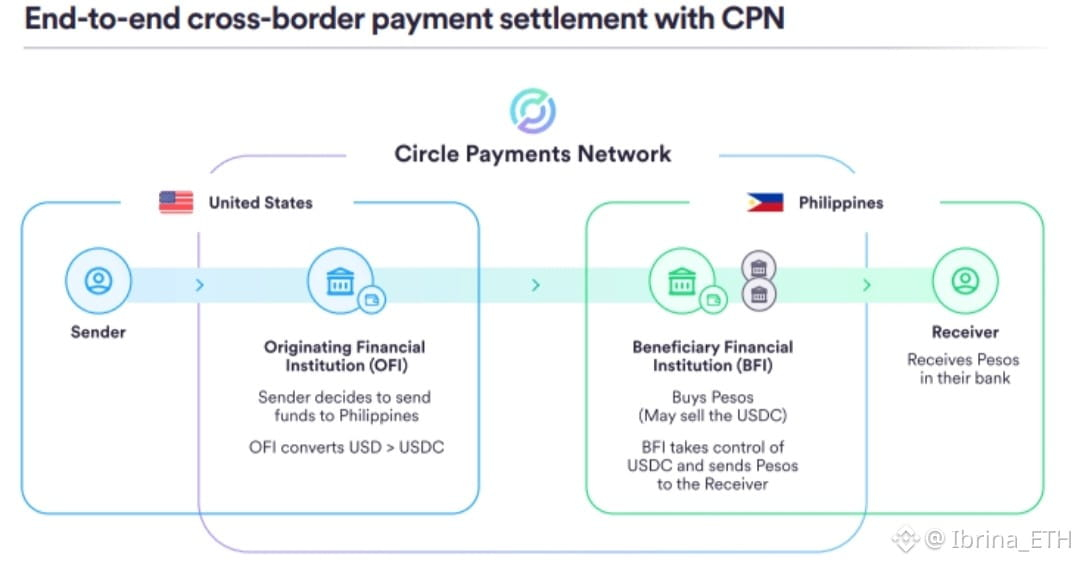

What draws me in is not that Plasma claims to be faster or cheaper than everything else. Many chains make those claims. What feels different is that Plasma appears to accept a hard truth early on: stablecoins are already the most used product in crypto, yet the infrastructure supporting them still feels incomplete. People use stablecoins to move value when banks are slow, expensive, or unavailable, but the experience still feels like “doing crypto” instead of “moving money.” You need gas tokens. Fees fluctuate. Transactions feel uncertain at the worst moments. Plasma’s entire philosophy seems built around removing those frictions rather than layering new features on top of them.

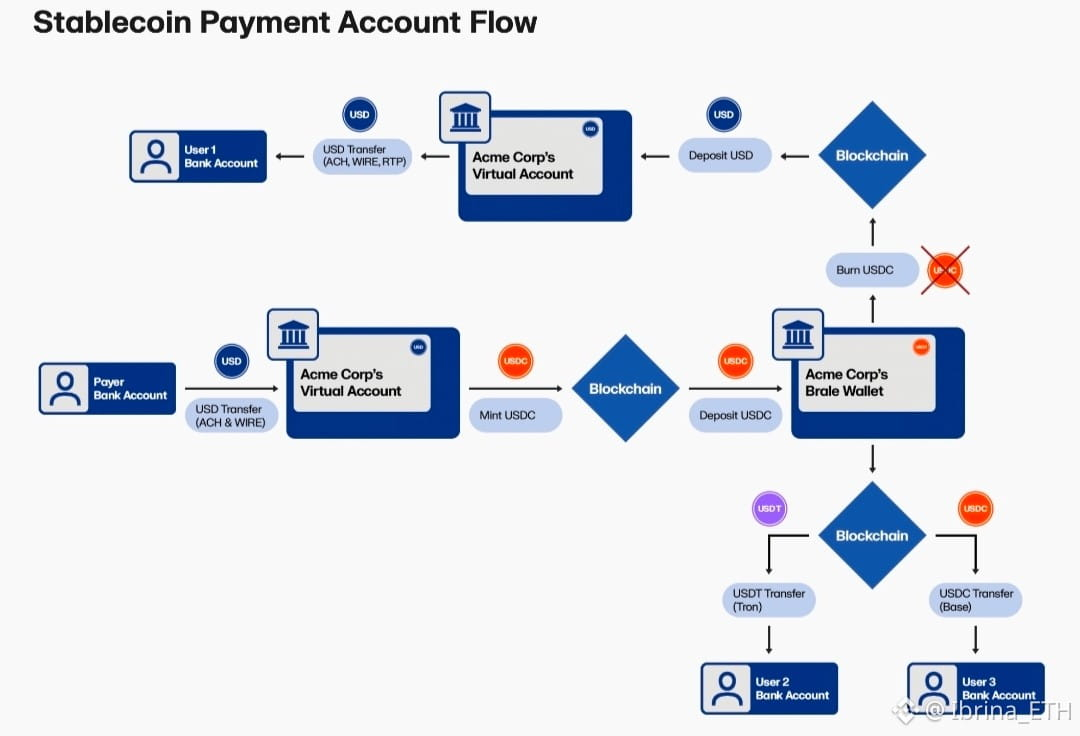

I find it important that Plasma does not try to be everything. It does not present itself as a universal chain for all experiments. Instead, it narrows its focus toward settlement, especially stablecoin settlement. That decision may sound limiting, but in reality it creates clarity. When a network knows exactly what problem it is solving, every design choice becomes more coherent. Stablecoin transfers are not treated as just another token action. They are treated as a first-class operation at the protocol level. This single choice reshapes how the chain behaves under load, how users interact with it, and how developers think about building on top of it.

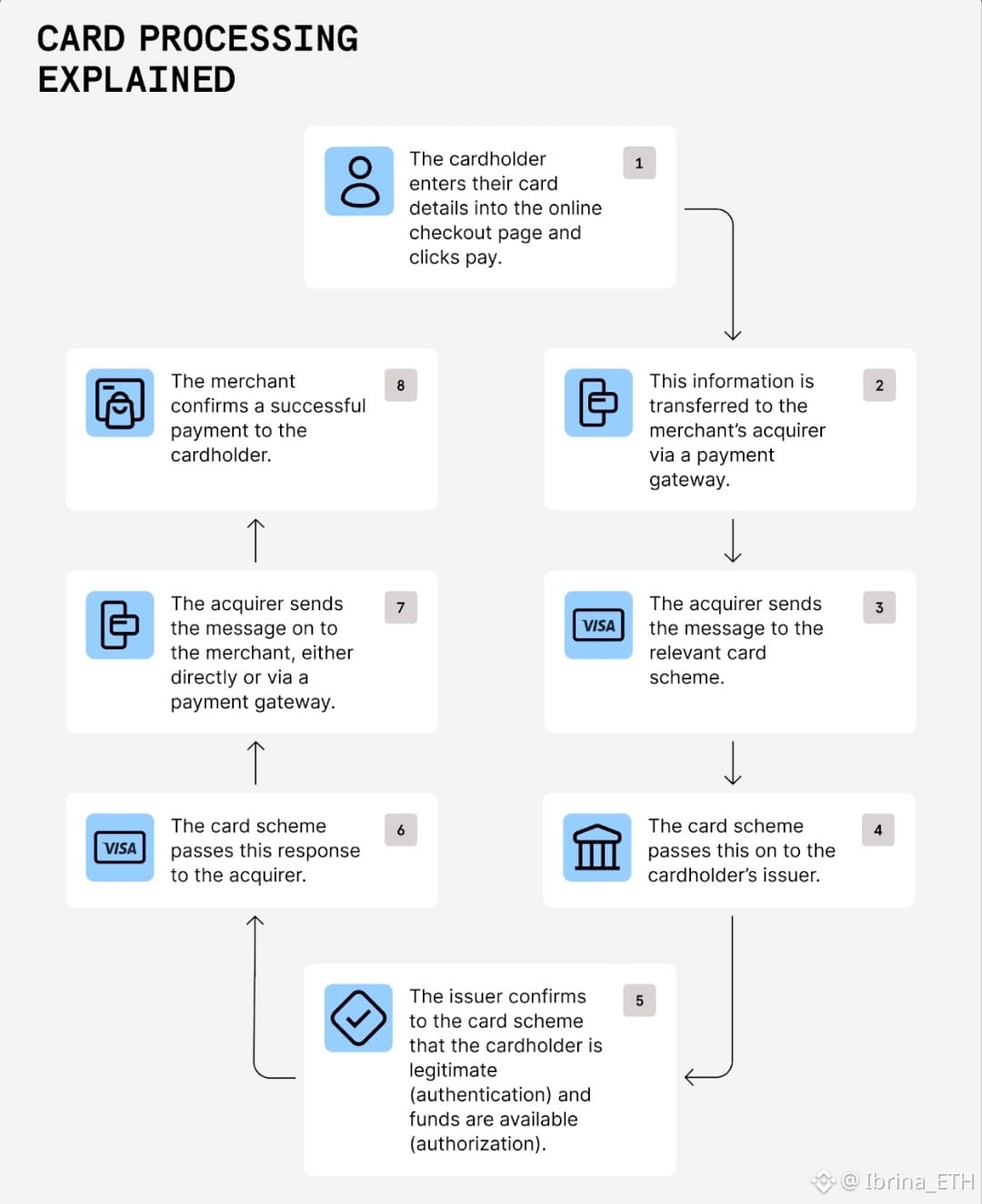

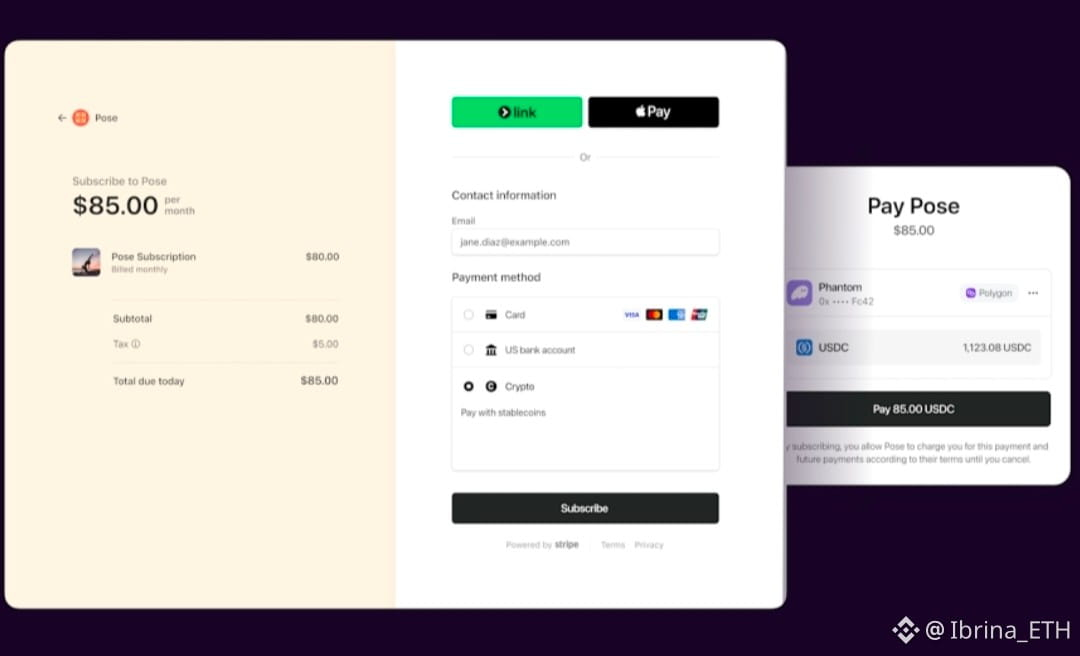

The idea of zero-fee or gas-abstracted transfers often triggers skepticism, and rightly so. Nothing in finance is truly free. Costs always exist somewhere. But what matters is who experiences those costs directly. In most blockchain systems today, the end user absorbs the complexity. They must understand gas, fees, timing, and failure modes. Plasma flips this around. The user experience becomes simple, while the complexity is handled at the system or sponsor level. This mirrors how modern financial products work in the real world. When someone swipes a card, they don’t calculate interchange fees or settlement layers. They just pay. That psychological simplicity is not a gimmick; it is a requirement for scale.

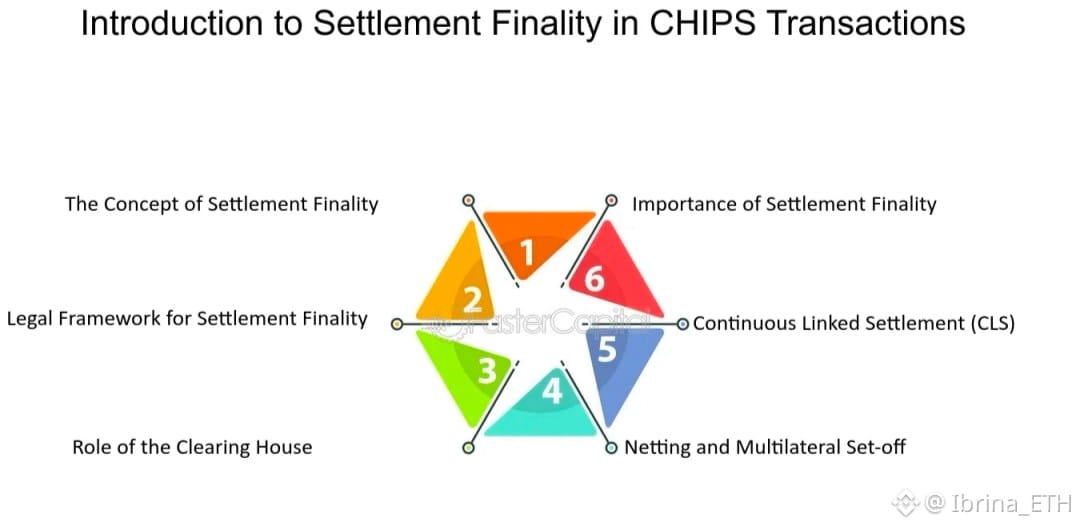

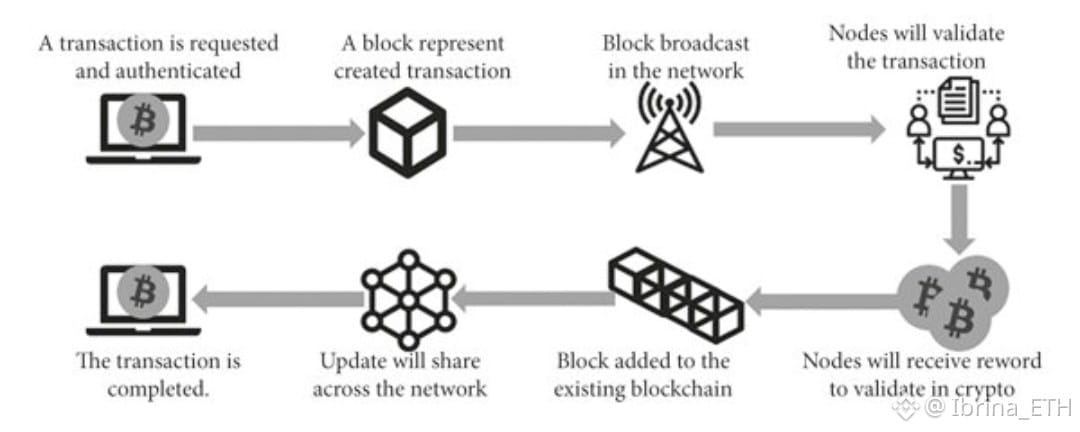

Another aspect I keep thinking about is finality. In speculative environments, speed is often framed as a competition. In payment systems, finality is about trust. When is a transaction truly done? When can a merchant, a business, or a system rely on the balance as settled? Plasma’s emphasis on deterministic finality speaks to a payments-first mindset. This is not about being exciting. It is about being dependable, even when conditions are not ideal. Real financial systems are judged on their worst days, not their best demos.

What also stands out to me is Plasma’s decision to remain compatible with existing developer tooling. This might not sound revolutionary, but it is deeply practical. Asking developers to abandon familiar environments in order to adopt a new chain often slows adoption rather than accelerating it. Plasma seems to understand that infrastructure succeeds when it reduces cognitive load, not when it demands reinvention. By keeping the development surface familiar, the chain lowers the cost of experimentation and migration, which matters far more than theoretical elegance.

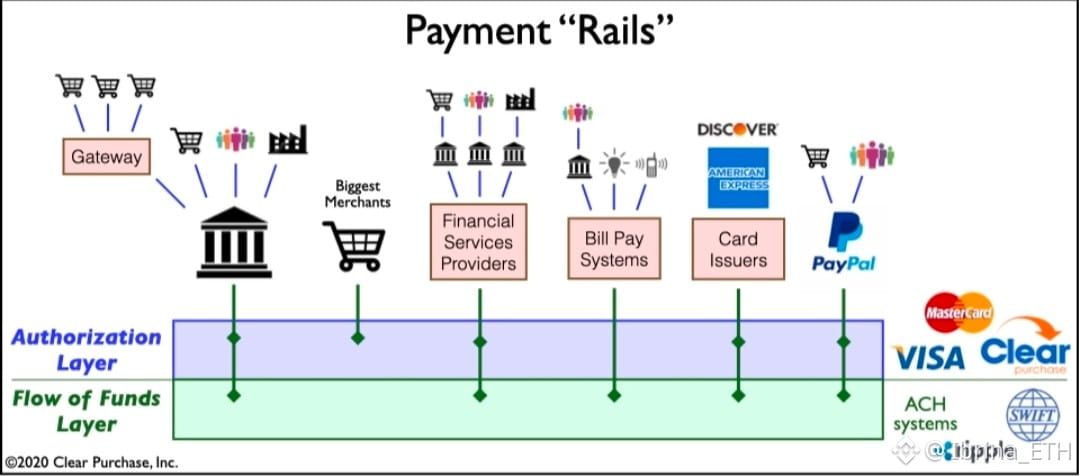

From a broader perspective, Plasma feels less like an entertainment product and more like plumbing. And in finance, plumbing is what actually matters. Payment rails, settlement layers, and clearing systems rarely get applause, but everything depends on them working quietly and consistently. If stablecoins are becoming the digital representation of value movement, then the chains that support them must prioritize boring reliability over flashy features.

I also think it is important to stay grounded about what Plasma can and cannot do. No technology can override macroeconomic reality. No chain can save overleveraged speculation or protect users from poor risk decisions. But infrastructure can provide a foundation that survives cycles. When hype fades and liquidity tightens, the systems that continue to move value efficiently tend to remain relevant. In that sense, Plasma’s focus on stablecoin settlement feels aligned with how real usage behaves during stress, not just during optimism.

What I personally watch most closely is not announcements or narratives, but habits forming on-chain. Are stablecoin balances growing? Are transactions consistent rather than spiky? Are developers building tools that look boring but necessary, like wallets, payout systems, and settlement integrations? These are not exciting metrics, but they are honest ones. They are harder to fake and easier to sustain.

From an educational standpoint, Plasma represents a useful case study in focus. It shows that not every chain needs to chase the same vision. Sometimes the strongest move is to narrow the problem space and solve one thing well. Stablecoins do not need more ideology. They need infrastructure that feels invisible, predictable, and safe. If Plasma succeeds, it may never be celebrated loudly. Instead, it will simply be used, and that is the highest compliment any infrastructure can receive.

My overall takeaway is not a prediction, but an observation in progress. Plasma is not trying to win attention. It is trying to win habit. If stablecoin transfers become simple, predictable, and boring on this network, then the chain itself will fade into the background. And if blockchain is going to matter to everyday users, that invisibility is not a failure it is success.

That is why Plasma continues to hold my attention. Not because it promises the future, but because it is quietly trying to make the present work better.