My first encounter with Plasma didn’t come through a polished announcement or a viral thread. It surfaced while revisiting a structural issue that has quietly followed crypto for years. Stablecoins have become some of the most widely used instruments in the ecosystem, yet the infrastructure supporting them was never designed with their actual role in mind. As I examined Plasma’s architecture and the thinking behind it, what stood out wasn’t novelty, but restraint. The system feels shaped by a team more concerned with how value moves in practice than with how loudly a product can be introduced.

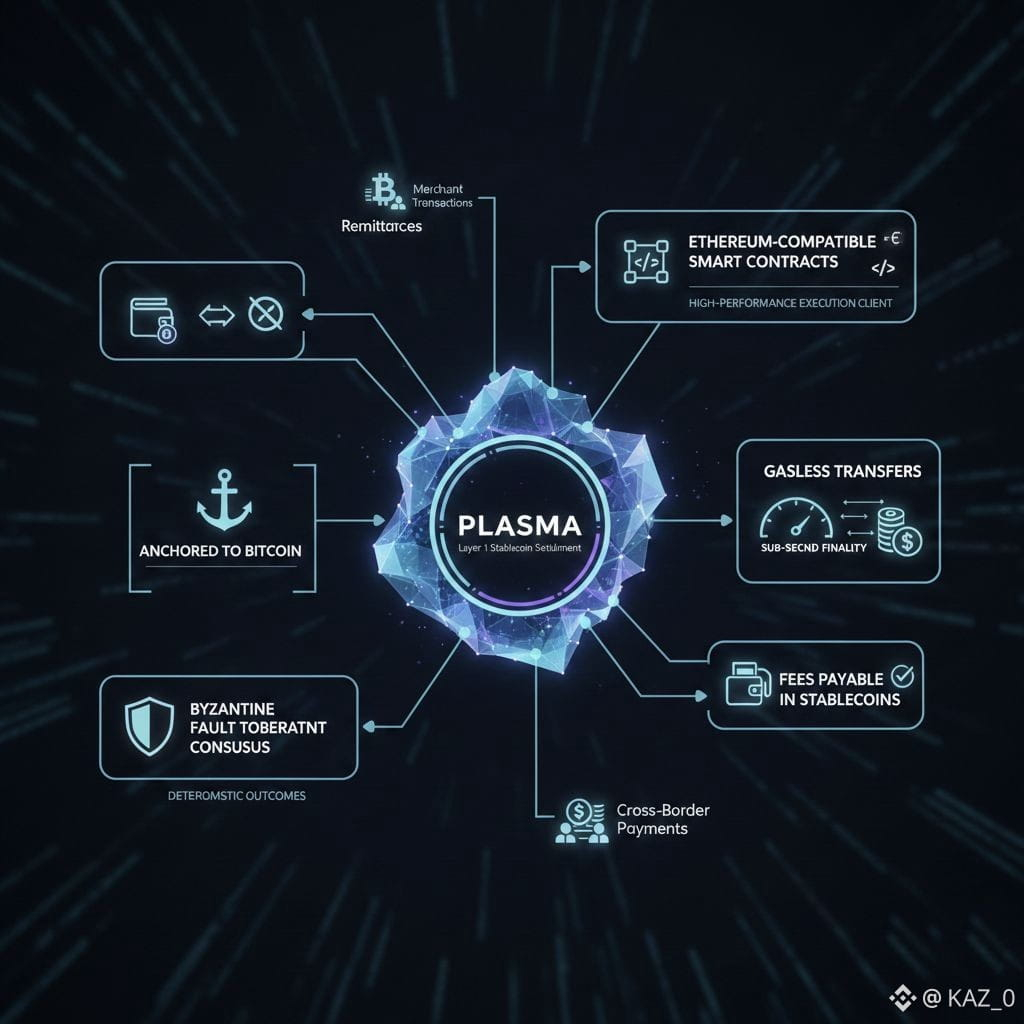

At its core, Plasma is a Layer 1 blockchain purpose-built for stablecoin settlement. That focus may appear narrow at first, but it directly addresses a growing mismatch in the market. Stablecoins now underpin remittances, payroll, merchant transactions, treasury flows, and cross-border payments. These activities demand fast settlement, predictable costs, and operational clarity. Most blockchains, however, treat stablecoins as peripheral assets, forcing them into environments optimized for speculation, variable fees, and congestion. Plasma begins from a different assumption: the network exists primarily to move stable value efficiently.

The problem Plasma targets is not theoretical. In real financial systems, payments need to be reliable, timely, and inexpensive. A transaction that eventually clears but introduces delays, complexity, or exposure to volatile assets fails the test of everyday utility. Plasma responds by embedding stablecoins directly into the protocol. Gasless transfers are not presented as a feature for marketing, but as a design necessity. Someone sending stable value shouldn’t need to manage a separate fuel asset. The network absorbs that complexity so the experience resembles a payment, not an experiment.

This philosophy carries into Plasma’s execution environment. By supporting Ethereum-compatible smart contracts, the network allows existing tools and applications to migrate with minimal friction. More importantly, the choice of a high-performance execution client reveals a deeper priority. Plasma is optimized for consistent, fast transaction processing, delivering sub-second finality that aligns with expectations from payment infrastructure rather than exploratory platforms. When settlement must be trusted immediately, finality becomes foundational.

Consensus design reinforces this focus. Plasma uses a Byzantine fault tolerant model that emphasizes deterministic outcomes and rapid confirmation. The objective isn’t to publish eye-catching throughput metrics, but to ensure that once value is transferred, the result is final. For institutions and payment operators, ambiguity and reversibility are risks. Plasma’s consensus choices reflect a clear understanding of that reality.

Security decisions further underline the network’s intent. By anchoring state to Bitcoin, Plasma relies on the most battle-tested ledger in the crypto space. This isn’t about association, but about neutrality and resistance to historical manipulation. For a system settling stable value at scale, the ability to demonstrate that past transactions cannot be quietly altered is a core requirement, not an optional safeguard.

Another practical design choice is the ability to pay transaction fees directly in stablecoins. While simple on the surface, this resolves a long-standing disconnect between user expectations and blockchain mechanics. Holding stable value should not require exposure to a separate asset just to move it. Allowing fees to be paid in the same unit reduces friction while maintaining a coherent economic model for the network.

Recent developments suggest Plasma is progressing deliberately. The rollout of its execution and consensus components marks a shift from conceptual design to operational reality. Early attention to liquidity and stablecoin availability indicates an understanding that adoption is driven by usefulness, not timelines or slogans. Rather than positioning itself as a universal platform, Plasma appears focused on proving that stablecoin settlement can be cheaper, faster, and more predictable than existing alternatives.

What makes Plasma compelling is not the introduction of unfamiliar ideas, but the disciplined application of known ones. It doesn’t frame itself as a cultural movement or a platform for everything. Instead, it treats stablecoins as serious financial instruments that deserve infrastructure comparable to traditional payment rails, without the intermediaries and delays those systems impose. In doing so, it subtly challenges assumptions about what a Layer 1 blockchain should prioritize.

After reviewing Plasma’s design and trajectory, the overall impression is one of coherence and intentionality. It doesn’t promise to reshape the entire ecosystem overnight. Instead, it proposes infrastructure tailored to a role that already exists at scale, with fewer compromises than current solutions. If stablecoins continue to bridge digital systems and real-world value, networks like Plasma feel less like experiments and more like overdue corrections.