Most blockchains were never built with real finance in mind. They were built to be open, transparent, and permissionless. That works great until money starts behaving like money again. Salaries, securities, regulated payments, and institutional capital don’t want every detail permanently exposed on a public ledger.

That’s the gap Dusk Network exists to fill.

Dusk isn’t trying to reinvent finance or outcompete every Layer 1. It’s trying to solve one specific problem: how do you put regulated financial activity on-chain without breaking privacy or compliance? The project has been around since 2018, started by Jelle Pol and Emanuele Francioni, and it’s stayed unusually consistent in what it’s aiming for. No sudden pivots. No trend hopping. Just slow progress toward regulated, private financial infrastructure.

How Dusk Actually Handles Privacy Without Breaking the Rules

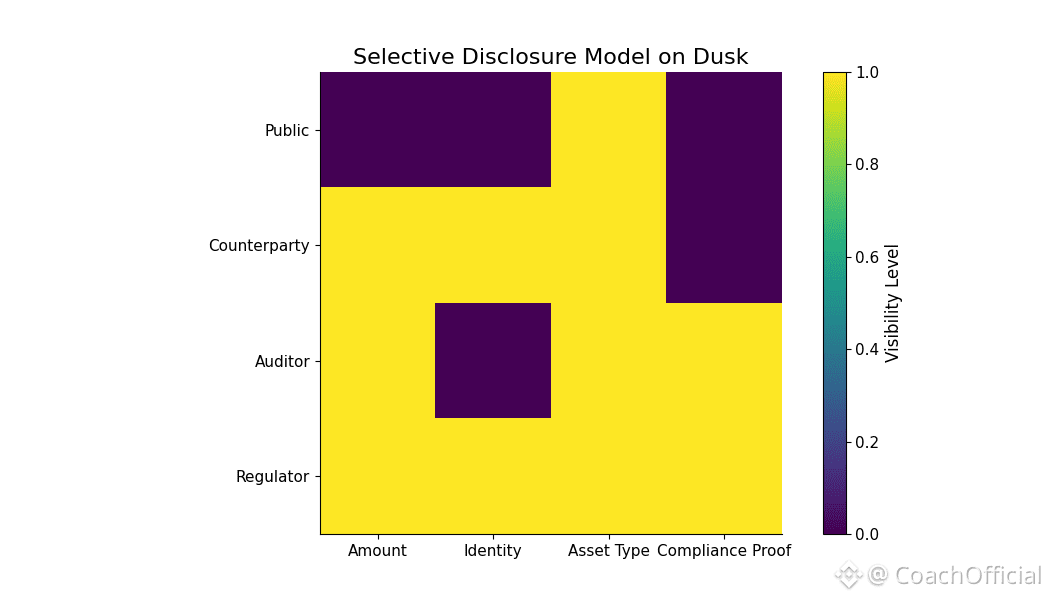

The important thing to understand about Dusk is that it doesn’t treat privacy as secrecy. It treats it as controlled visibility.

Transactions on Dusk are private by default, but they’re not unverifiable. Zero-knowledge proofs are used so something can be proven without showing everything. That distinction matters a lot in finance. Regulators don’t need to see everything. They need to see the right things, at the right time.

The network uses a proof-of-stake based system with succinct attestations. Finality is fast enough to be practical, but the design clearly favors predictability over headline speed numbers. That’s intentional. In regulated systems, knowing when something settles matters more than shaving milliseconds.

With DuskEVM, developers can deploy Ethereum-style smart contracts, but those contracts inherit privacy features at the protocol level. Asset transfers, issuance, and settlement happen on-chain without forcing users into custodial setups or off-chain accounting. Disclosure only happens when it’s explicitly required.

What the DUSK Token Is Actually For

DUSK isn’t a speculative toy token. It’s boring, and that’s kind of the point.

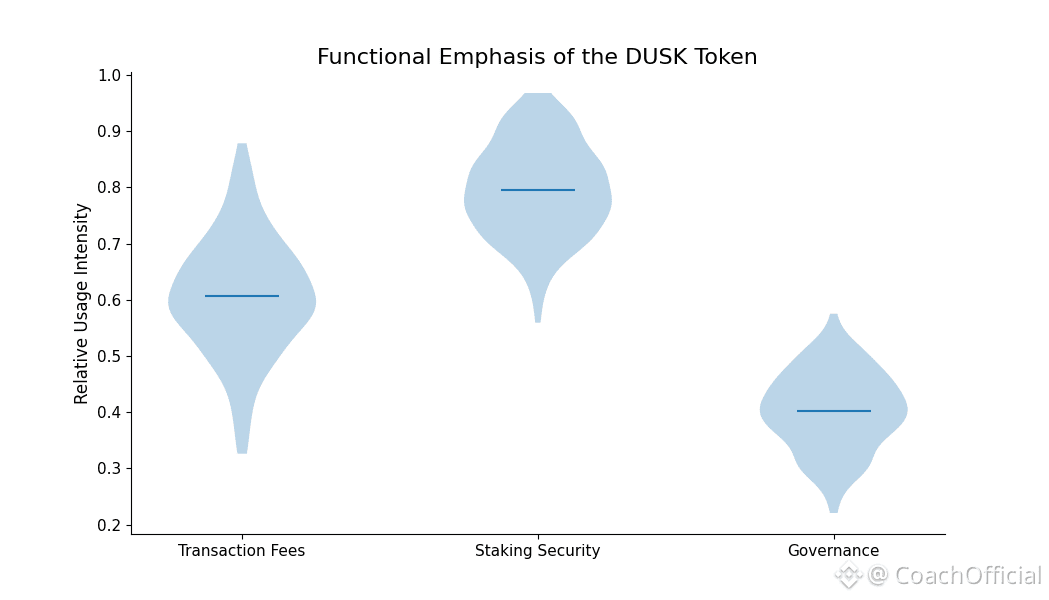

It’s used for transaction fees, staking, and governance. Validators stake DUSK to secure the network and earn rewards over time. Emissions are spread across decades, not front-loaded, and the total supply caps at one billion. About half of that is already circulating, which removes a lot of long-term unlock anxiety.

Governance is tied to participation. If you stake and help secure the chain, you have a say. If you don’t, you don’t. That’s it. No complicated narratives.

Value accrual is tied to usage. More regulated activity means more relevance. There’s no expectation that hype alone drives price.

Why Institutions Are Even Looking at Dusk

Dusk hasn’t grown because it’s loud. It’s grown because it fits where other chains don’t.

Chainlink integration matters here because regulated assets need reliable external data. The partnership with NPEX matters because it shows the chain being used in actual securities workflows, not demos. Backers like Bitfinex and Blockwall didn’t show up for memes. They showed up because the infrastructure makes sense for compliance-heavy environments.

Most of these integrations don’t look exciting on social media. That’s usually a sign they’re real.

What’s Being Built on Top of It

The tooling reflects the audience. Confidential asset issuance. Private yet auditable payments. Compliance-aware smart contracts.

Zedger exists so securities can be issued and managed without exposing shareholder data. Dusk Pay focuses on regulated payments that don’t leak transaction histories. APIs exist for audits, not for flashy dashboards.

This isn’t a playground chain. It’s closer to plumbing.

Growth Without Drama

Dusk hasn’t escaped market cycles. The token peaked years ago, cooled off, and settled into infrastructure territory. That didn’t stop development. Since mainnet, work has focused on EVM compatibility, bridge security, and validator participation.

There’s no rush to decentralize everything overnight. That would be irresponsible in regulated finance. The network is expanding carefully, adjusting incentives as usage grows instead of guessing future demand.

Why This Matters Long-Term

If regulated finance doesn’t move on-chain, Dusk probably stays niche. If it does, privacy-first compliant chains become critical.

Dusk treats privacy as a default requirement, not a feature. Compliance isn’t bolted on. It’s built into the design. That puts it in a very small category of blockchains.

This isn’t a chain built to impress. It’s built to keep working.

@Dusk #Dusk $DUSK