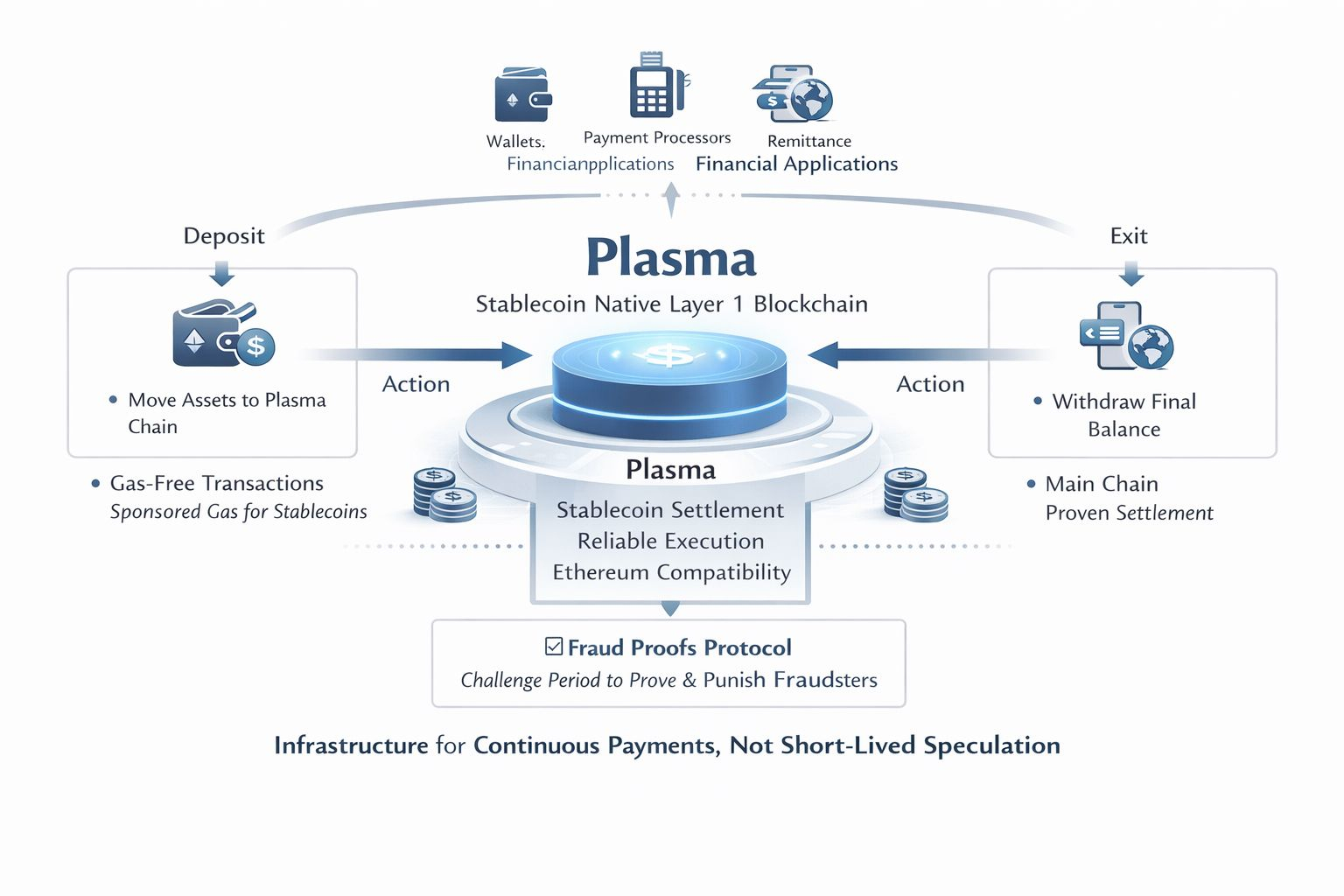

Plasma is a stablecoin native Layer 1 blockchain engineered specifically for payments and value transfer, not as a general purpose smart contract platform. Its design prioritizes stablecoin settlement, predictable execution, low operational friction, and compatibility with existing Ethereum tooling. The intended users are wallets, payment processors, remittance providers, and financial applications that care more about reliability and cost certainty than experimental features. In simple terms, Plasma is built to move money continuously and quietly. It is infrastructure for settlement, not a playground for short-lived speculation.

Most crypto tokens trade on narratives. Plasma’s token should be viewed differently, as a representation of infrastructure demand rather than a pure speculative asset. At present, the token trades in the low teens cent range, with circulating supply in the low billions and a market capitalization in the low hundreds of millions of dollars. Daily volume fluctuates significantly with broader market conditions. Transactions that happen every day because real businesses rely on them. Payroll runs monthly. Remittances move weekly. Automated settlement systems operate continuously. These flows do not care about hype cycles, but they do care about uptime, predictability, and cost.

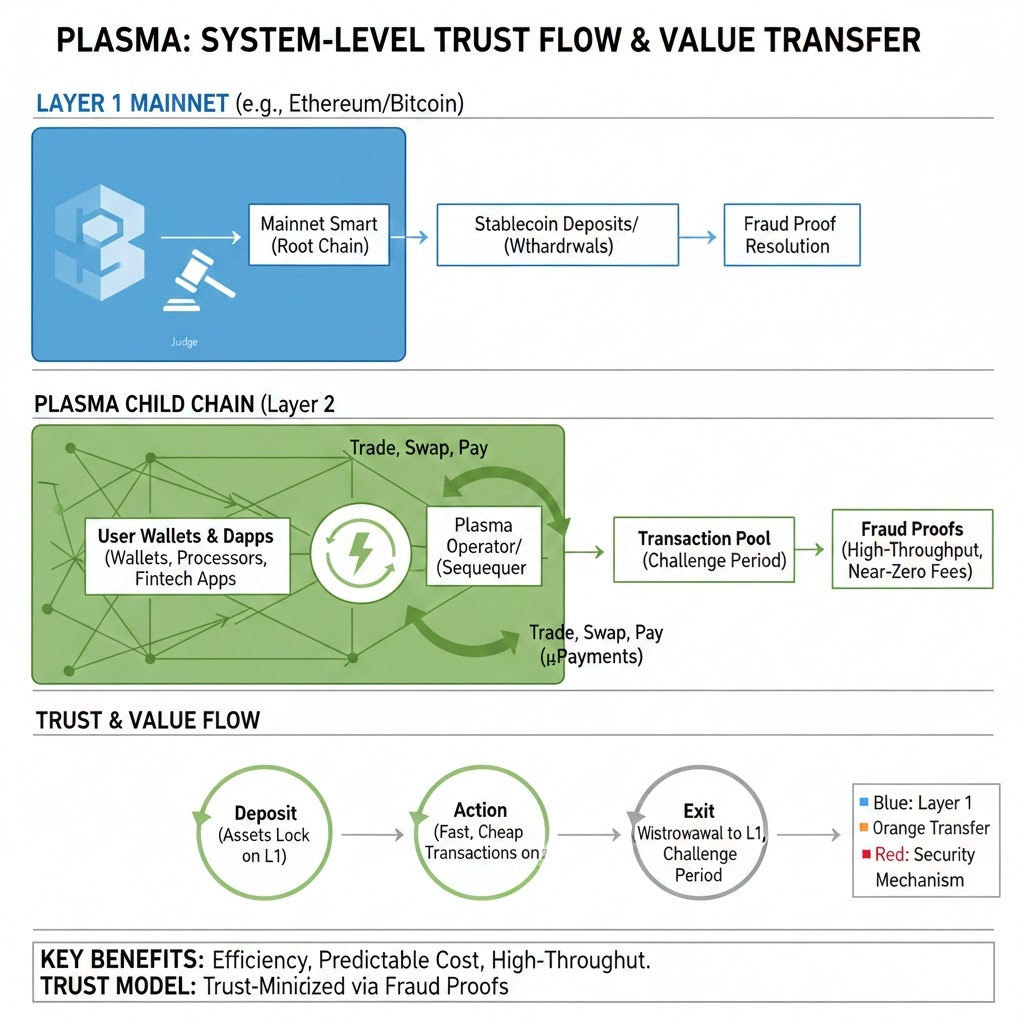

The process usually happens in three steps. First is the deposit, where you move your assets from the main network into the Plasma chain. Next is the action, where you trade, swap, or pay at lightning speed. These transactions do not clog up the main network. Finally, there is the exit. When you are done, you withdraw your final balance. The Plasma chain submits a summary to the main chain to prove what you own.

You might wonder what happens if the person running the Plasma chain tries to steal your money. Plasma uses Fraud Proofs. If someone tries to submit a fake transaction, there is a challenge period where anyone can provide evidence of the cheat. If the cheat is caught, the dishonest actor is punished, and your funds stay safe. This is why Plasma is often called trust minimized because you do not have to trust the operator, just the math.

While newer tech like Roll ups gets a lot of hype today, the Plasma infrastructure offers specific perks. It provides zero or near zero fees. Many modern Plasma networks use a system that sponsors gas for stablecoins, meaning you can send money without even owning the network's native token. It offers high throughput, handling thousands of transactions per second, which is perfect for high frequency trading. It also has security anchoring. Unlike a sidechain, which is its own isolated island, Plasma is tethered to a major chain. If the Plasma chain fails, the rules allow you to exit your money back to the main safety net.

Plasma’s price action so far mostly reflects macro liquidity, risk on or risk off sentiment, and positioning. That is normal for an early stage infrastructure asset. Payments infrastructure does not win by attracting attention, it wins by becoming invisible. If usage grows steadily while price remains volatile or flat, that divergence is not necessarily bearish. It may simply reflect that the market is slower to price infrastructure than narratives.

Stablecoin usage continues to grow as a settlement layer for cross border payments and on chain finance. Even modest penetration into real payment flows can generate large transaction counts. Plasma’s design lowers friction enough that wallets and applications can route payments through it by default, rather than as an optional path. If transaction volumes grow consistently month over month, value accrues structurally, not episodically. Repeated usage compounds. A merchant settling once per day is more valuable than a speculator trading once per cycle. If thousands of such actors exist, the network becomes durable. None of this requires explosive growth. Low single digit percentage increases in real transaction volume, sustained over time, are enough to justify a long term infrastructure thesis.

Adoption risk is real. Payments infrastructure only works if businesses integrate it, and those sales cycles are slow. If Plasma fails to become the default rail for any meaningful category of users, activity may remain thin. Liquidity structure is another risk. That can discourage serious participants. Competition is persistent. Other chains also optimize for stablecoin settlement. Without clear operational advantages or distribution, Plasma may struggle to stand out. Finally, regulatory realities matter.

The bottom line is that Plasma is not just about speed, it is about efficiency. It means more of your profit stays in your wallet instead of being eaten by gas fees.