In a world where blockchain technology is rapidly transforming global finance, one of the most intriguing evolutions is the move toward infrastructure that respects both privacy and regulatory compliance—two demands that have until recently been nearly impossible to balance. Dusk Network, founded in 2018, has emerged at the forefront of this paradigm shift, positioning itself not merely as another Layer‑1 blockchain but as the backbone for institutional‑grade, regulated financial ecosystems where privacy and compliance coexist. As we approach 2026, Dusk’s architecture, technology stack, and strategic traction reflect a platform designed to meet the stringent demands of regulated markets while unlocking the transformative power of decentralized finance (DeFi), real‑world asset (RWA) tokenization, and confidential smart contracts.�

Binance +1

Since its inception, Dusk has pursued a vision that goes beyond crypto speculation—it aims to digitize regulated financial markets, enable confidential transactions, and give financial institutions the infrastructure to issue, trade, and manage digital securities on a public blockchain without exposing sensitive data. This is a niche yet powerful value proposition at the intersection of blockchain privacy, real‑world finance, and global regulatory frameworks.�

CoinMarketCap +1

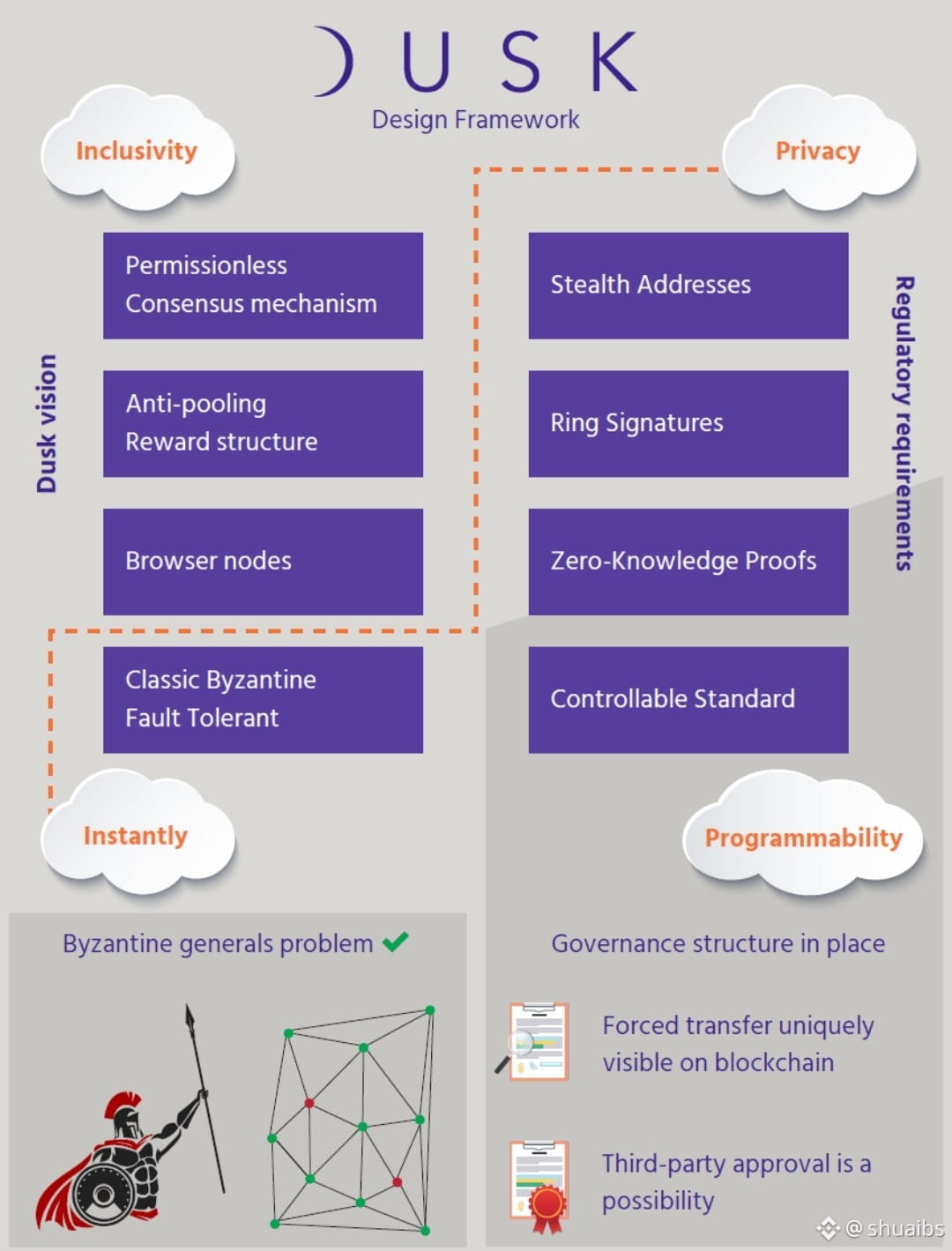

What sets Dusk apart from many Layer‑1 blockchains of its generation is this dual commitment to privacy by design and regulatory compatibility. This is not merely an ideological stance; it has profound practical implications for how financial instruments, from bonds to equities, can be tokenized and traded with confidentiality, auditability, and compliance all embedded within the protocol itself—a world where institutions can go on‑chain with confidence.�

dusk.network

At its core, Dusk is a public, permissionless Layer‑1 blockchain purpose‑built for regulated financial markets and privacy‑centric applications. Its network enables the issuance, trading, and settlement of tokenized real‑world assets in adherence with European regulatory frameworks such as MiFID II, MiCA, and the DLT Pilot Regime. These compliance frameworks are rapidly becoming global standards for digital asset markets, making Dusk’s alignment highly strategic for institutional adoption.�

CoinMarketCap

Dusk’s privacy infrastructure is built around advanced cryptographic techniques such as zero‑knowledge proofs (ZKPs), which allow transactions and smart contracts to be validated without revealing confidential details like identities or transaction amounts. This enables institutions to conduct transactions in a manner comparable to private banking systems, yet with the transparency and trust assurances of blockchain technology. Importantly, this privacy is audit‑capable, meaning regulators can access necessary data under permissioned conditions without compromising overall confidentiality.�

XT

Another critical component of Dusk’s technology is its Segregated Byzantine Agreement (SBA) consensus mechanism—a modified proof‑of‑stake protocol engineered to offer both rapid finality and robust decentralization. SBA improves validator selection, enhances security, and supports the privacy‑preserving transaction models that financial markets require. Complementing SBA are confidential smart contracts, known as XSC (Confidential Security Contracts), which are designed to automate compliance logic at the protocol level. For example, tokens can be configured to enforce transfer restrictions automatically, ensuring that only regulated parties can participate in certain transactions.�

XT

The practical advantages of these technologies go beyond theoretical appeal. In traditional finance, intermediaries such as custodians, broker‑dealers, and clearinghouses add layers of cost, friction, and latency. By contrast, Dusk’s architecture seeks to remove expensive intermediaries while preserving regulatory safeguards—effectively streamlining settlement processes and reducing counterparty risk. This has profound implications for the future of capital markets infrastructure, especially as tokenization trends accelerate.�

Medium

2025–2026 marks a significant period of maturation and real‑world deployment for Dusk. After six years of development, the network successfully launched its mainnet in early 2026, transitioning from testnet experimentation to full operational capability. With this milestone, developers can now build and deploy private, compliant applications on a live Layer‑1 network. This unlocks practical use cases such as confidential financing platforms, secure DeFi protocols, and regulated trading venues that were previously constrained by public blockchain transparency or regulatory concerns.�

CoinMarketCap

Dusk’s roadmap for 2026 also includes significant ecosystem expansions like Dusk Pay, a MiCA‑compliant payment solution for businesses, and the introduction of NPEX dApps for regulated trading of tokenized securities on DuskEVM (an Ethereum Virtual Machine compatibile layer). These initiatives extend the blockchain’s value beyond tokenization into everyday finance and enterprise payment systems. Moreover, planned Chainlink integration promises cross‑chain interoperability and live data feeds, which are crucial for asset pricing and decentralized market functionality.�

CoinMarketCap

These developments underscore the real traction Dusk is gaining not just within the crypto sphere but also within regulated financial sectors. Strategic partnerships with established entities—such as NPEX and Cordial Systems—highlight this shift toward institutional relevance. For example, efforts to build a blockchain‑powered stock exchange demonstrate how Dusk’s core assets can be applied to existing regulated infrastructures, reducing operational costs and enhancing trust.�

cordialsystems.com

The emphasis on regulatory compatibility also puts Dusk in a favorable position amidst global regulatory trends. Privacy laws like the GDPR in Europe have established the principle that data protection is non‑negotiable. Meanwhile, financial regulators are crafting frameworks that embrace digital asset markets while demanding robust compliance measures. Dusk’s architectural alignment with these realities—privacy by default, auditability when needed—makes it uniquely suited to serve both regulators and market participants.�

dusk.network

This regulatory alignment is complemented by technical foresight: by introducing confidential smart contracts, Dusk provides a platform where complex financial instruments such as derivatives, structured products, private auctions, and registry services can be executed on‑chain without exposing sensitive logic or data. This brings blockchain into the realm of real‑world financial infrastructure rather than relegating it to speculative or public token markets.�

XT

From an adoption standpoint, the tokenization of RWAs—such as government bonds, corporate debt, and private equity—is one of the most compelling use cases for blockchain technology. Analysts widely regard 2026 as a pivotal year for asset tokenization, which could involve trillions of dollars in institutional capital flowing onto blockchain platforms. Dusk’s privacy‑preserving, compliant architecture directly targets this opportunity, offering a platform where institutional players can finally bridge traditional finance with decentralized ecosystems.�

KuCoin

Dusk’s relevance extends beyond finance into sectors like identity management, where privacy and security are equally paramount. Academic research on models like fully private self‑sovereign identity (SSI) frameworks built on Dusk’s blockchain highlights the network’s potential to support advanced privacy technologies that go beyond financial use cases. While these applications are still emerging, they point to the broader versatility of privacy‑centric blockchain infrastructure.�

arXiv

As with any ambitious blockchain project, Dusk faces challenges—including technical scalability, competitive pressure from other privacy‑focused platforms, and navigating evolving global regulations. However, the fact that it combines privacy with compliance gives it a strategic edge in markets where transparency alone is not enough. Financial institutions are increasingly looking for solutions that don’t compromise client confidentiality while satisfying stringent legal obligations—needs that many public blockchains cannot fulfill.�

Gate.com

In conclusion, Dusk Network stands at the forefront of transforming blockchain into regulated financial infrastructure rather than a speculative playground. Its privacy‑first architecture, coupled with built‑in compliance frameworks, positions it as a foundational platform for confidential DeFi, tokenized securities, and regulated financial services in 2025–2026 and beyond. As the world transitions toward tokenized finance and decentralized markets, Dusk’s model offers a compelling blueprint for how blockchain can serve the real economy—providing privacy, compliance, and innovation in a single, scalable ecosystem that meets the needs of regulators, institutions, and developers alike.�

Binance +1