Any regular person in the blockchain world understands that markets are cyclic. Periods of enthusiasm, a rapid growth and noisy optimism are followed by quieter periods of doubt, correction and reflection. There are plenty of technologies that flare up when things are good and fade away when the times are bad. Plasma is different. Its value is not as evident in a hype, but in the times of pressure. Once the markets decelerate and the interest wanes, Plasma will keep performing the same silent task it was created to do which is maintaining systems stable and protecting users.

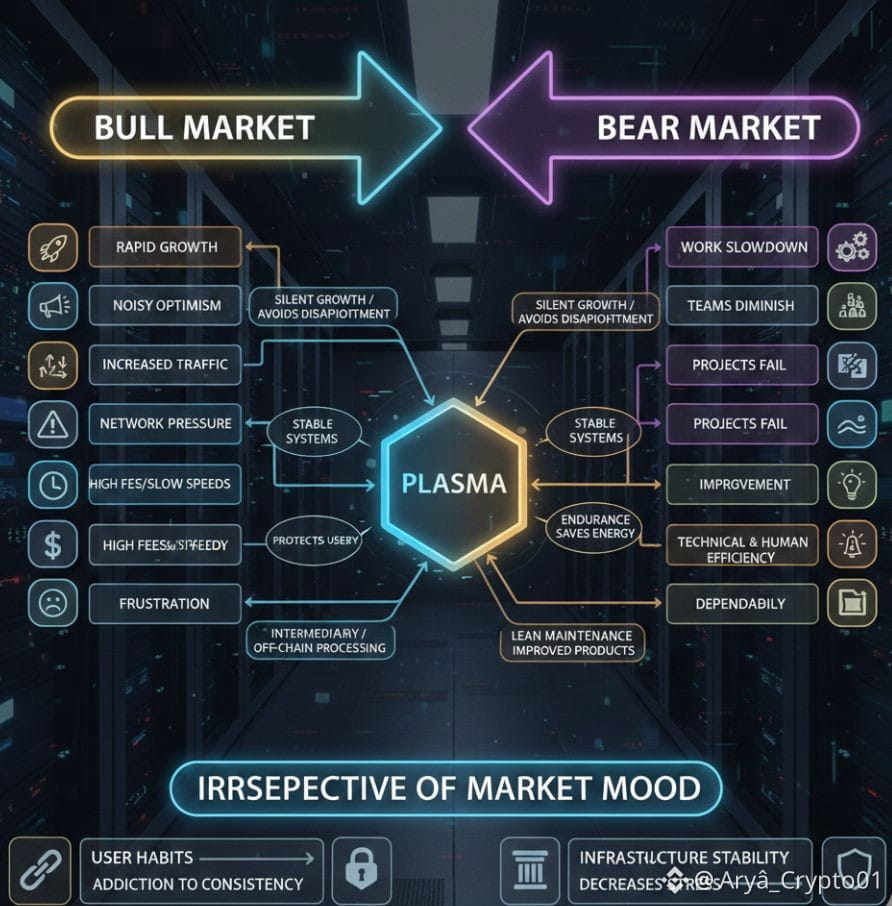

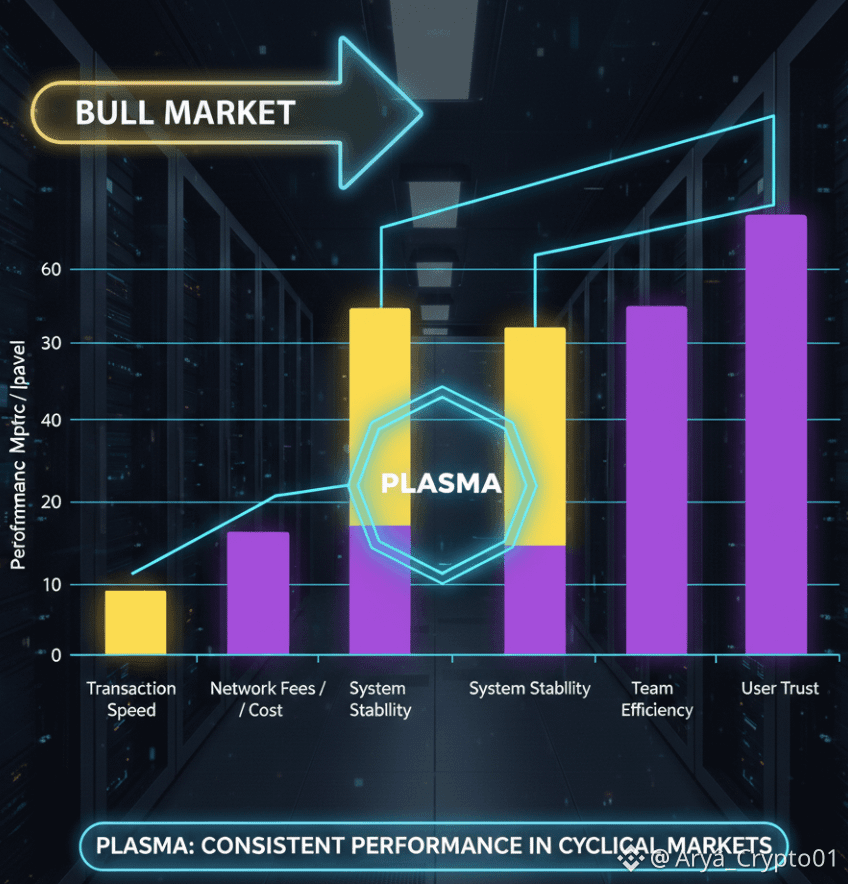

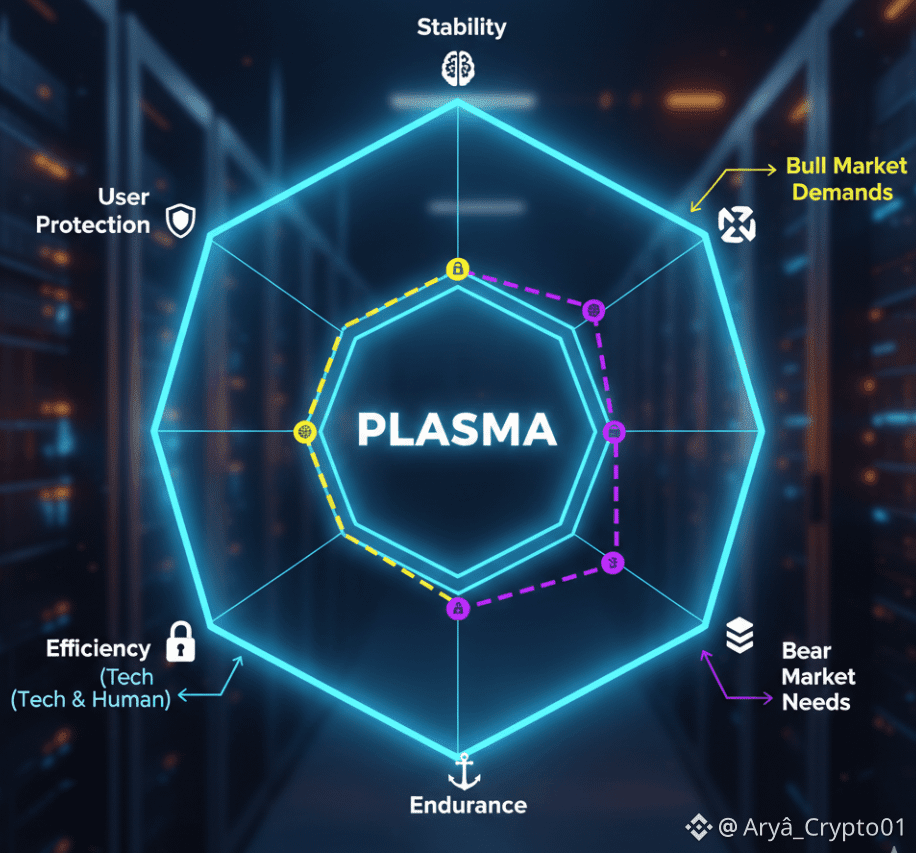

In the bull markets there is rapid increase in the traffic. New visitors come in with a feeling of curiosity and the urgency. The networks are pressured almost instantly. Prices become higher, the waiting time increases and people become frustrated. Plasma comes in as an intermediary in these instances. It takes up the act which would otherwise take up the main chain. When Plasma is working, growth is silent and instead Plasma is working to ensure that growth does not turn into chaos as expressed in the headlines. Instead it does not generate excitement, but it avoids disappointment which is what matters more frequently.

The bear markets tell a different tale. The work slowdown, the teams diminish, and a great number of projects cannot survive. Here the design philosophy of Plasma comes out strong. Stable structured systems are less difficult to maintain through lean periods. Reduced pressure in operation means that the teams do not have to struggle to fix continuous failures, but rather they are able to keep on improving products. Plasma assists projects in saving on energy technical and human in cases where resources are scarce.

I once interviewed a small development team which survived a lengthy market downturn in large part because of this stability. They could not afford to continually re-architecture infrastructure or even deal with regular network problems. Their application in plasma has enabled them to continue running without much interventions. It worked and that is why users remained. Such silence dependability formed devotion when others lost their communities in a time of plentiful platforms.

To a user, consistency is more important than the price movements. Individuals do not forget that a system fails them in the stressful times. Plasma decreases the possibility of such failures. Users develop habits when they are able to transfer funds, communicate with applications and be confident in the results, irrespective of the mood in a market. Habits outlast trends. The addiction to consistency of core experiences is aided by plasma which maintains consistency.

The markets will always go up and down but infrastructure should be stable. Plasma does not assure insecurity against loss of money or being risked in the market. The protection it offers is against technical failure at emotional times. It is significant that difference. Already not sure about prices, people do not need to guess whether a system will perform or not. Plasma decreases that strata of stress.

With time, technologies that survive more than one cycle get respect. The concepts of plasma have been applied to a range of more recent scaling solutions although it is not generally referred to as plasma. Layered design, user exit and modular responsibility have now become a rule of thumb. This impact did not increase due to hype, rather owing to the fact that Plasma in various conditions proved helpful time and again.

Over time, blockchain will only be successful when it has systems that endure the periods of enthusiasm and quietness. This type of endurance is Plasma. It does not alter its behavior on the sentiment of the market. It is still stability-oriented, safety-oriented, and steady growth. And it might even in a cyclical industry, that silent continuity be its most useful offering.