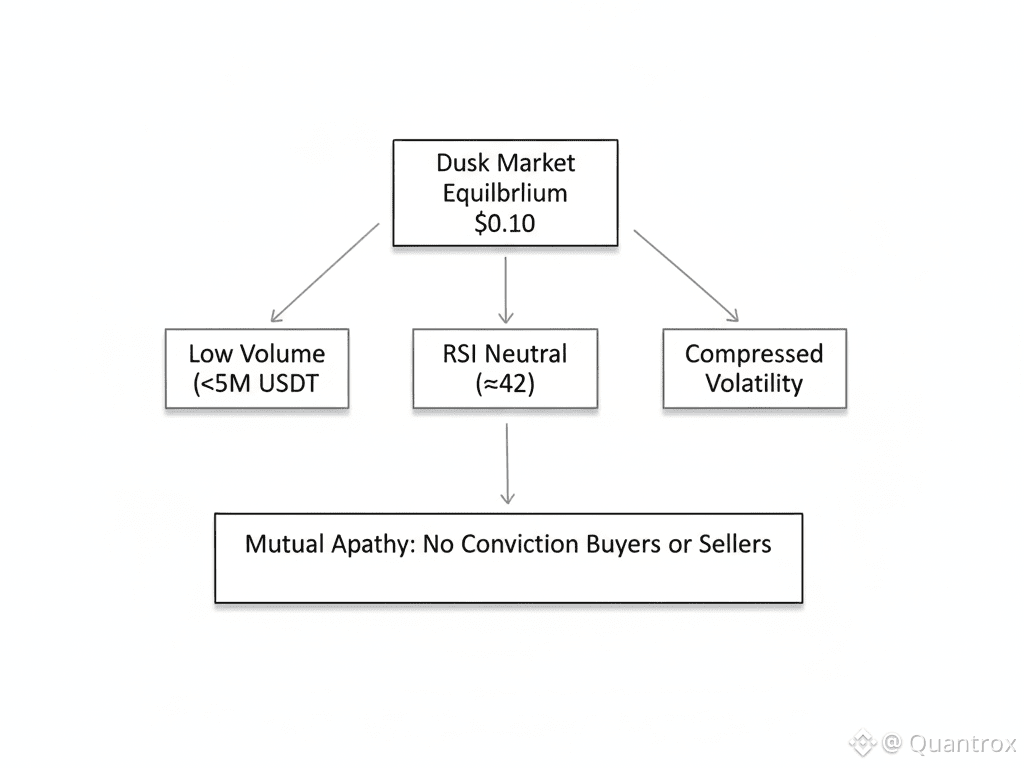

I've traded through enough prolonged downturns to recognize when markets reach equilibrium at levels where neither buyers nor sellers have conviction. Price stops making violent moves, volatility compresses, volume dies to barely anything, and you get this dead zone where nothing happens. The calm feels like stability but it's really just mutual apathy—sellers exhausted themselves, buyers don't believe enough to accumulate and everyone's waiting for something to break the stalemate.

Dusk is grinding around $0.1028 with the 24-hour range from $0.1100 to $0.0986 showing tight consolidation. RSI recovered to 42.32 from yesterday's 31 reading sitting right in neutral territory where momentum could go either direction. Volume of 4.63 million USDT remains pathetic, barely above the 4.21 million lows we saw earlier. What's unusual about this Dusk price action isn't the levels—it's that we're stabilizing at $0.10 during the year when DuskTrade is supposed to launch with NPEX bringing €300 million in tokenized securities on-chain, and absolutely nobody cares enough to participate.

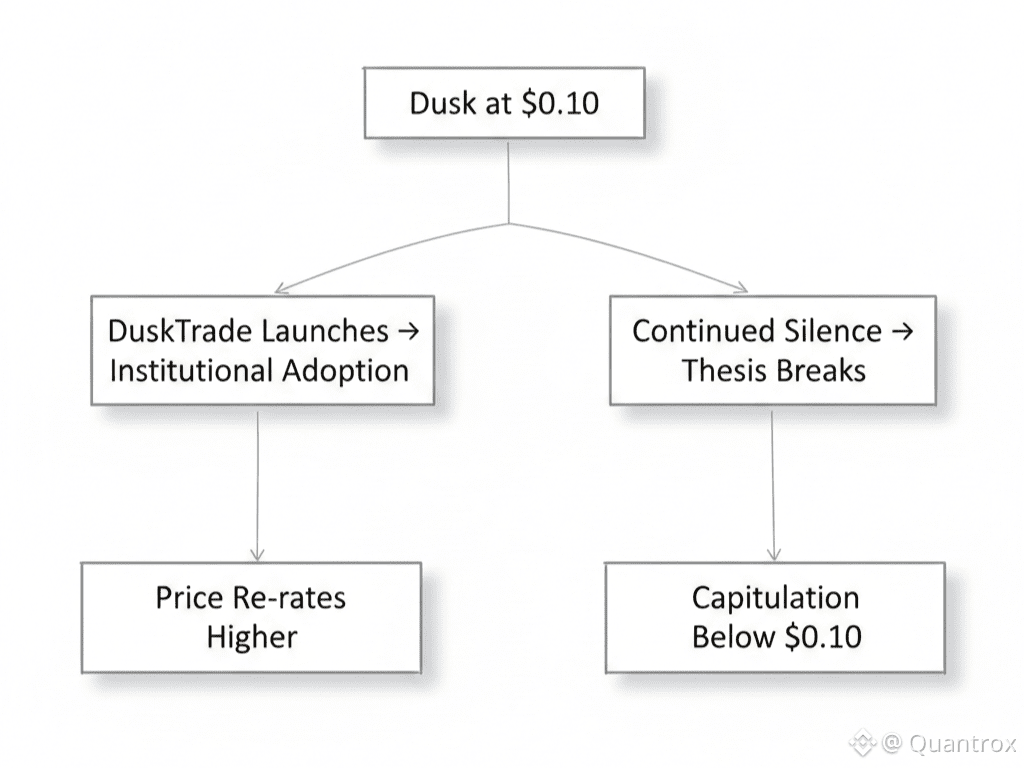

Either this equilibrium at $0.10 is the calm before institutional buyers show up and validate the entire thesis, or it's just dead money grinding sideways while participants wait for confirmation the thesis broke before final capitulation.

Dusk sits at $0.1028 after touching $0.0986 and bouncing to $0.1100, now settling in this tight range. RSI at 42.32 is perfectly neutral—not oversold enough to create bounce urgency, not overbought enough to trigger selling. Volume at 4.63 million USDT shows minimal market participation regardless of whether Dusk is at $0.09 or $0.11. This is equilibrium where the market has priced in its expectation and is just waiting for reality to prove it right or wrong.

What that equilibrium price of $0.10 tells you is what the market currently believes about Dusk's institutional adoption thesis. We're down 70% from the $0.3299 launch, stabilizing at levels that suggest participants think there's maybe 10-20% chance DuskTrade launches with meaningful volume and maybe 80-90% chance it doesn't materialize as announced.

If the market believed NPEX was actually preparing to migrate hundreds of millions in securities onto Dusk infrastructure this year, equilibrium would be much higher. If the market was certain DuskTrade was pure vaporware, Dusk would be grinding toward zero not stabilizing at $0.10. The current price represents the market saying "probably doesn't happen, but small chance we're wrong."

What makes this equilibrium at $0.10 interesting is how it affects both bulls and bears. Bulls who believe in DuskTrade can't accumulate meaningful size at these levels because volume is too low—trying to buy even $50,000 worth would move the market noticeably. Bears who think it's vaporware already exited or are waiting for confirmation before final capitulation. Everyone in the middle is just gone.

The 270+ validators still running Dusk nodes through this equilibrium at $0.10 represents the strongest signal that maybe the institutional story has some truth. Those operators are maintaining infrastructure through 70% drawdown and stabilization at levels where they're probably operating at losses. If DuskTrade was obviously not happening, wouldn't at least some validators quit to stop bleeding money?

My read is validators are in the same position as everyone else—waiting for confirmation one way or the other. They committed to Dusk expecting 2026 adoption. Now in 2026 watching price stabilize at $0.10, they're stuck. Shutting down requires admitting they were wrong. Staying operational means accepting ongoing losses while hoping DuskTrade materializes. Most are probably choosing to wait rather than make the definitive call that the thesis failed.

The RSI at 42.32 perfectly captures this equilibrium. Not bullish, not bearish, just neutral waiting. Technical indicators in the 40-45 range can stay there indefinitely during dead markets where nothing happens. Dusk could grind around $0.10 with RSI at 42 for weeks or months until some catalyst forces resolution.

What would that catalyst be? For Dusk specifically, it has to come from NPEX. Either they announce concrete DuskTrade launch details—specific date, regulatory approvals completed initial securities lined up—or enough time passes that even bulls lose patience. We're already into late January 2026 with no major updates about imminent securities trading on Dusk infrastructure. Each week of silence makes the bearish case stronger.

The volume of 4.63 million USDT during this equilibrium shows almost nobody is participating in Dusk markets. The few transactions happening are probably arbitrage and market making, not directional positions being built. Real conviction on either side would show up as volume, but we're getting nothing.

What bothers me about this equilibrium at $0.10 is the opportunity cost for anyone holding through it. Every day Dusk grinds sideways at $0.10 is a day that capital could be deployed elsewhere in assets actually doing something. The only justification for holding through this dead period is belief that DuskTrade announcement is imminent and will send Dusk significantly higher. But "imminent" keeps getting pushed further out as 2026 progresses without updates.

For Dusk bulls the counterargument is that equilibrium at $0.10 creates asymmetric opportunity. If you're wrong and DuskTrade doesn't launch, you lose another 50-70% maybe down to $0.03-$0.05. If you're right and it does launch with real volume, you probably 3-5x from current levels. That risk-reward makes sense if you assign meaningful probability to the bull case.

But that logic only works if DuskTrade is a real possibility. If it's 95% certain not to happen, then "asymmetric opportunity" is just catching a falling knife. And the market stabilizing at $0.10, down 70% during the supposed launch year, suggests most participants lean toward the latter interpretation.

The infrastructure keeps operating through all this. DuskEVM processes contracts at $0.1028 just like it did at $0.3299. Hedger handles confidential transactions. Validators maintain consensus. All the technology works, which is what makes the market's apathy so striking. The capability exists for privacy-preserving securities settlement with regulatory compliance. The market at $0.10 is saying capability doesn't matter if nobody uses it.

That's the brutal reality of Dusk's current equilibrium. Everything needed for institutional adoption exists except the institutions. And every day of stabilizing at $0.10 without NPEX announcements makes it more likely the institutions never show up.

Either this equilibrium breaks with DuskTrade announcement that sends Dusk significantly higher, or it breaks with continued silence that eventually triggers final capitulation below $0.10 as remaining bulls give up. The RSI at 42.32 and volume at 4.63 million USDT says the market is perfectly balanced between those outcomes, waiting for reality to tip one direction.

For anyone deciding whether to hold Dusk through this equilibrium, the question is simple: how long are you willing to wait for DuskTrade confirmation before concluding it's not happening? We're already in the launch year with price stabilized at 70% drawdowns. If nothing materializes by March or April, does the thesis officially break? Or do you keep waiting through all of 2026 hoping announcements come eventually?

The validators staying operational suggest some participants are willing to wait indefinitely. The market stabilizing at $0.10 suggests most participants think waiting is futile. One group has to be catastrophically wrong. The equilibrium continues until we find out which.