Plasma is building something that feels less like a typical blockchain upgrade and more like a new chapter of how digital money will move across the world. When I study Plasma in the current cycle what stands out is how focused and practical the entire design is. It is the opposite of most chains that try to chase every possible narrative. Instead of being a chain for every use case Plasma chose one mission that is becoming more important every day which is to make stablecoin payments instant simple reliable and cheap. This single focus is what makes Plasma different. It is not trying to become another crowded ecosystem. It is trying to solve the part of crypto that millions of people already use but do not fully understand stablecoin based digital money.

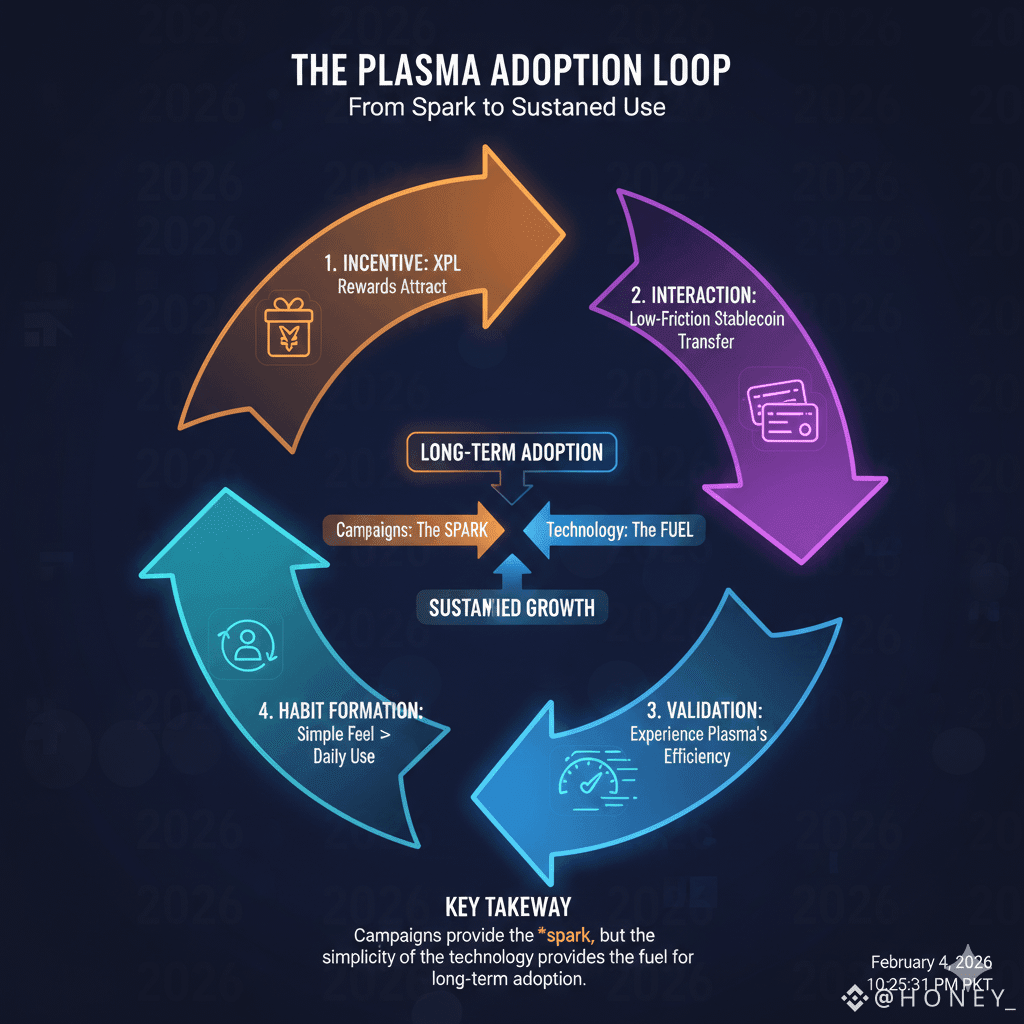

Plasma is built around a stablecoin first architecture where sending USDT feels like sending a message. You do not worry about fee tokens. You do not calculate gas. You do not check network congestion. Plasma separates the cost of running the network from the experience of the user which allows stablecoin transfers to behave like real digital money. This changes everything. It means remittances can move across borders without heavy fees. It means merchants can accept stablecoins without unpredictable costs. It means people can use stablecoins for daily payments without learning blockchain mechanics. It removes friction in a way that most chains have not been able to achieve because they still require users to manage native tokens for the simplest transfers.

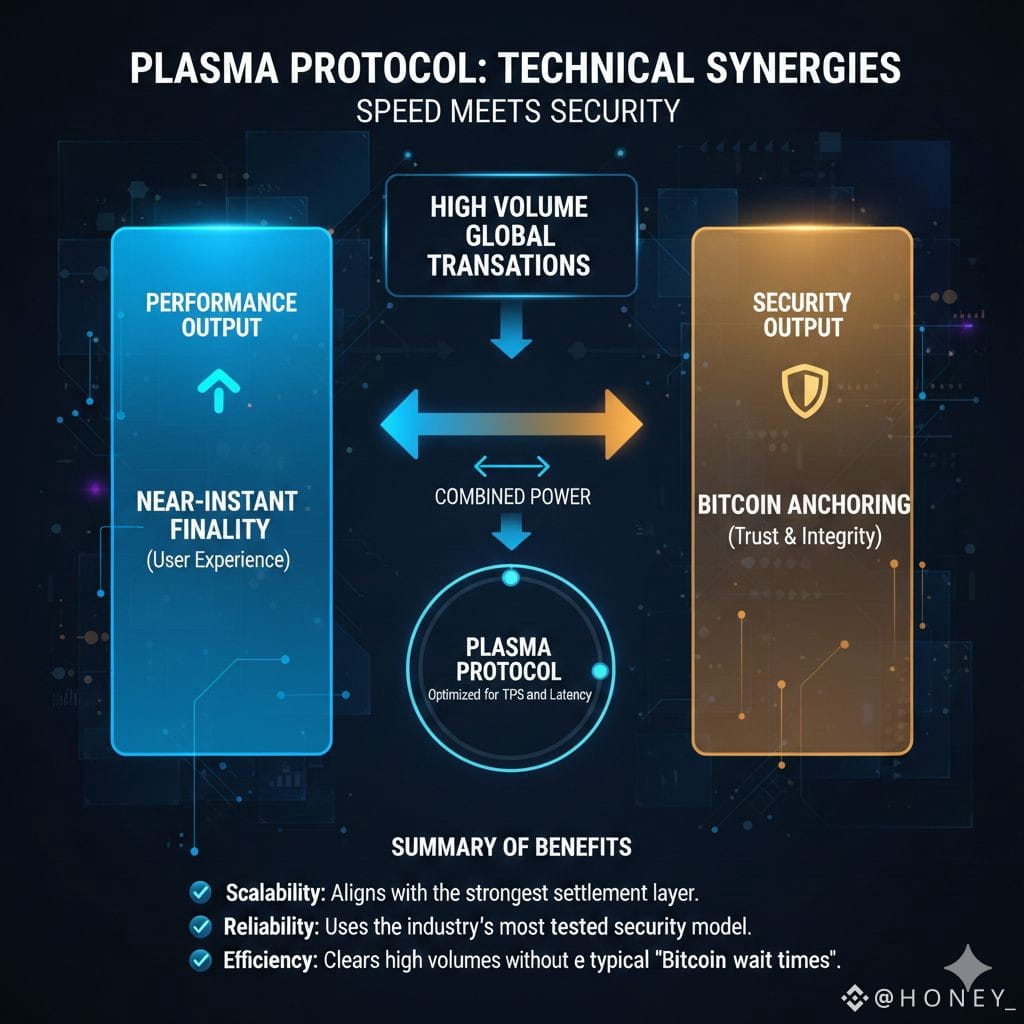

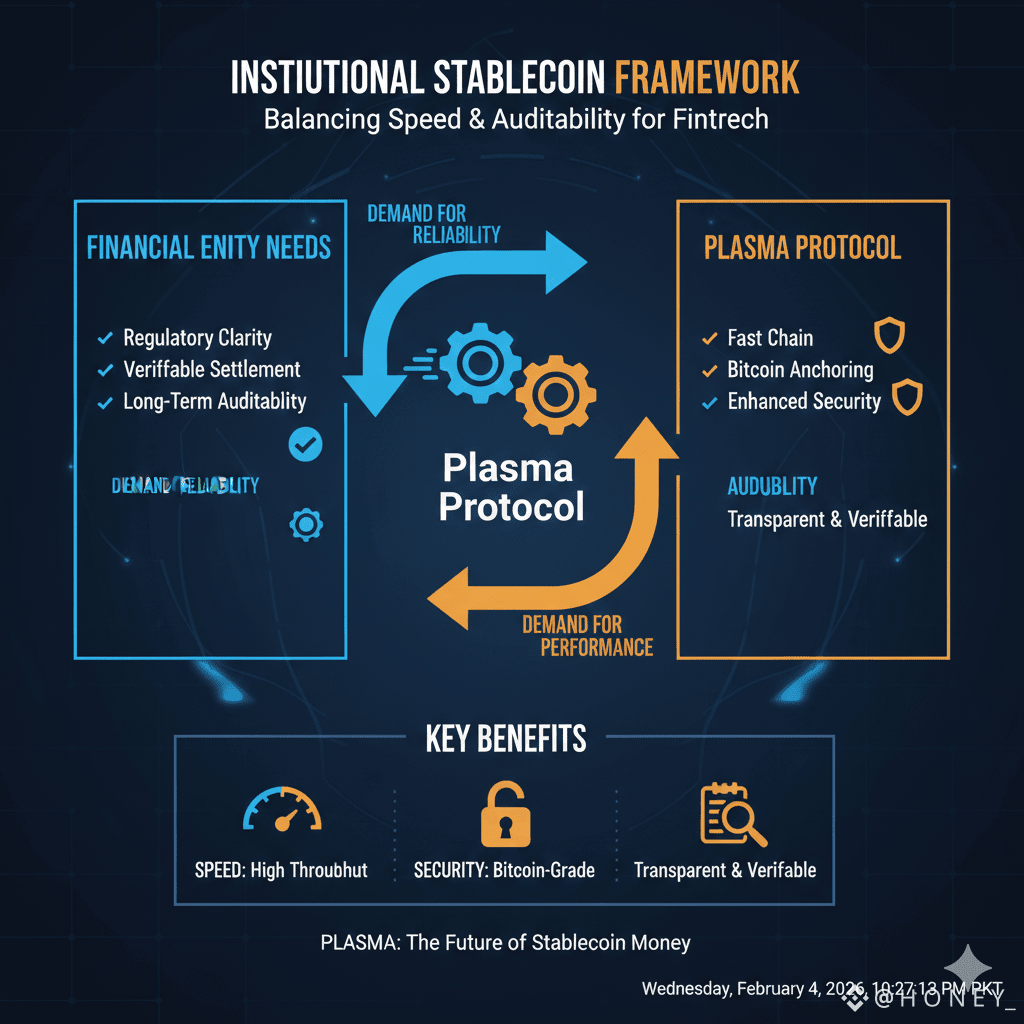

What makes Plasma more powerful is the performance under the hood. Plasma achieves extremely fast settlement and near instant finality allowing high volume global transactions to clear within seconds. This speed is combined with an anchoring structure that connects Plasma to Bitcoin for additional security. That gives Plasma a strong foundation that is rare in the industry because it combines high throughput with the most tested security model ever created. By anchoring to Bitcoin Plasma is able to scale while aligning with the strongest settlement layer available.

The native token XPL plays an important part in the overall economic model of the network. Even though stablecoin transfers do not require users to pay token based fees the internal mechanics still rely on XPL for validator rewards network security resource allocation and long term governance. The supply of XPL is capped at ten billion with allocations designed for the public sale the ecosystem team incentives investors and continued growth of the network. A considerable amount of XPL is allocated to ecosystem expansion which includes developer grants liquidity support strategic partnerships and infrastructure incentives. This is important because Plasma is building a real payment system and payment systems grow only when builders wallets apps and companies integrate them deeply into their operations.

The latest developments around Plasma show that the ecosystem is expanding rapidly. One of the most important updates is the integration with NEAR Intents which opened Plasma to more than two dozen chains. This gives Plasma a powerful cross chain presence because USDT and XPL can now move across multiple networks without slow bridges or fragmented liquidity. Stablecoin users benefit from this immediately. They want stablecoins that move quickly and easily between chains without frustrations. Plasma is becoming a core part of that experience.

Plasma also gained attention through the Binance Square campaign where millions of XPL were dedicated to creator rewards and user participation. This helped expand awareness and onboard thousands of new users into the Plasma ecosystem. Campaigns like these are not temporary hype. They help people experience stablecoin transfers on Plasma for the first time and once they see how simple it feels they tend to keep using it. This is how long term adoption forms.

Another important update is the ongoing unlock schedule for XPL including the planned unlock in February twenty twenty six for ecosystem growth. Unlock events often create discussions but in Plasma these allocations are designed to support builders and partners who are helping grow real utility. The unlock model follows a predictable structure that encourages responsible distribution while also funding long term development of the network.

Plasma is targeting real world use cases that generate high volume activity. Stablecoin payments are already one of the largest categories in crypto with billions of dollars moving daily across centralized exchanges and on chain transfers. But stablecoins still do not feel like real money for most users because existing blockchains introduce friction costs delays and uncertainty. Plasma solves this problem by turning stablecoin transfers into a smooth digital money experience.

Developers can also build new applications with far more simplicity because Plasma is compatible with the Ethereum Virtual Machine. This means they can deploy contracts using the same tools they already know but with a stablecoin first design. They can create lending markets automated payment applications merchant checkout rails subscription models savings apps remittance platforms on chain payroll systems consumer wallets and much more. Developers have never had a chain where the user experience of stablecoin movement is actually the main priority. Plasma gives them this environment.

The Bitcoin anchoring mechanism is also important for institutions and fintech companies. As stablecoins gain regulatory clarity around the world financial entities want verifiable settlement and long term auditability. Plasma provides a fast chain with additional security linked to Bitcoin which appeals to entities that want reliability alongside performance. The future of stablecoin money will require both speed and security and Plasma aligns directly with this requirement.

Price movement around XPL has shown volatility which is normal for early stage infrastructure networks. Price does not represent the true value of Plasma at this stage. Infrastructure projects must be measured by usage partnerships integrations network growth and stablecoin flow not short term candle movement. As more applications and wallets integrate Plasma and as more stablecoin users begin using its rails the long term strength of the ecosystem will become more visible.

Looking forward Plasma aims to deepen its integrations expand cross chain liquidity attract merchant adoption and accelerate ecosystem incentives. The focus remains on transforming stablecoin usage into a real payment phenomenon that works in daily life not just inside crypto platforms. The world is shifting toward digital dollars as a universal medium of exchange and Plasma is trying to become the network that powers the movement of these digital dollars at global scale.

This is why Plasma matters. If stablecoins are the digital dollars of the internet then Plasma is building the infrastructure that will carry those dollars. Faster than traditional rails. Cheaper than old blockchains. Deeply secure through Bitcoin. More flexible through cross chain connectivity. More accessible for daily use because the user never has to handle gas tokens or complex settings. Plasma is not trying to build a speculative narrative. It is building the everyday financial layer.

Plasma is shaping a world where value moves instantly where stablecoins behave like real money and where blockchain complexity disappears behind smooth user experiences. It is infrastructure for the future of global payments and it has the potential to become one of the most important chains in the stablecoin economy.